introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

INTRODUCERE<br />

IN INSTRUMENTE FINANCIARE DERIVATE<br />

- PIATA DERIVATELOR LA BVB -<br />

Disclaimer: Informatiile cont<strong>in</strong>ute <strong>in</strong> prezentul material sunt <strong>in</strong>formatii <strong>de</strong> ord<strong>in</strong> general si, pr<strong>in</strong> urmare,<br />

pot cont<strong>in</strong>e <strong>in</strong>exactitati sau pot fi <strong>in</strong>complete. Nicio persoana nu trebuie sa se bazeze, <strong>in</strong>diferent <strong>in</strong> ce<br />

scop, pe <strong>in</strong>formatiile cont<strong>in</strong>ute <strong>in</strong> acest material sau pe acuratetea ori completitud<strong>in</strong>ea acestora. BVB nu<br />

isi asuma nicio raspun<strong>de</strong>re pentru eventuale pier<strong>de</strong>ri f<strong>in</strong>anciare sau <strong>de</strong> oricare alta natura care pot surveni<br />

<strong>in</strong> urma utilizarii <strong>in</strong>formatiilor cont<strong>in</strong>ute <strong>in</strong> acest document.<br />

1

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

CUPRINS<br />

I. Introducere <strong>in</strong> <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

1. Ce sunt <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ?<br />

2. Care este rolul <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ?<br />

3. Piata la Ve<strong>de</strong>re (Piata Spot) vs. Piata la Termen (Piata Derivatelor)<br />

4. Clasificarea <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

5. Un<strong>de</strong> se tranzactioneaza <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ?<br />

6. C<strong>in</strong>e tranzactioneaza <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ?<br />

II. Despre contractele futures<br />

1. Ce sunt contractele futures?<br />

2. Pr<strong>in</strong>cipiile <strong>de</strong> functionare ale contractelor futures<br />

3. Care sunt actiunile posibile cu un contract futures?<br />

4. Profitul si pier<strong>de</strong>rea la sca<strong>de</strong>nta contractelor futures<br />

5. Care sunt specificatiile unui contract futures?<br />

6. Marcarea la piata si <strong>de</strong>contarea contractelor futures<br />

7. Riscurile asociate <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

III. Tranzactionarea contractelor futures la BVB<br />

1. Cum se tranzactioneaza contracte futures la BVB?<br />

2. Contractele futures tranzactionate la BVB<br />

3. Avantajele tranzactionarii contractelor futures la BVB<br />

4. Compensarea – <strong>de</strong>contarea contractelor futures tranzactionate la BVB<br />

2

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

I. Introducere <strong>in</strong> <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

1. Ce sunt <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>?<br />

Instrumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> (IFD) sunt <strong>in</strong>strumente f<strong>in</strong>anciare al caror randament are la baza<br />

randamentul oferit <strong>de</strong> un alt <strong>in</strong>strument f<strong>in</strong>anciar sau marfa, <strong>de</strong>numit activ suport (un<strong>de</strong>rly<strong>in</strong>g asset). Pr<strong>in</strong><br />

urmare, randamentul IFD este <strong>de</strong>rivat d<strong>in</strong> evolutia pretului unui <strong>in</strong>strument, marfa sau alt activ.<br />

Instrumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> pot fi <strong>de</strong>zvoltate avand la baza orice tip <strong>de</strong> activ / eveniment care are drept<br />

valoare / rezultat aleatoriu, cum ar fi: aur, valute, actiuni, <strong>in</strong>dici bursieri sau chiar temperatura atmosferica<br />

(weather <strong>de</strong>rivatives).<br />

Tranzactionarea contractelor futures si options reprez<strong>in</strong>ta o strategie complementara la tranzactionarea<br />

<strong>in</strong>strumentelor care constituie active suport (actiuni listate, titluri <strong>de</strong> stat, marfuri, etc.) pentru adm<strong>in</strong>istrarea<br />

unui portofoliu a<strong>de</strong>cvat riscului dorit <strong>de</strong> fiecare <strong>in</strong>vestitor <strong>in</strong> parte.<br />

Tranzactionarea <strong>de</strong> catre un <strong>in</strong>vestitor pentru prima data a unui <strong>in</strong>strument f<strong>in</strong>anciar <strong>de</strong>rivat conduce la<br />

<strong>in</strong>itierea unei pozitii <strong>de</strong>schise (open position), astfel:<br />

Cumparare: pozitie <strong>de</strong>schisa Long;<br />

Vanzare: pozitie <strong>de</strong>schisa Short.<br />

2. Care este rolul <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>?<br />

a) Managementul riscului este cel mai important obiectiv al tranzactionarii IFD:<br />

forma <strong>de</strong> asigurare impotriva pier<strong>de</strong>rilor f<strong>in</strong>anciare <strong>de</strong>term<strong>in</strong>ate <strong>de</strong> evolutia nefavorabila a<br />

pretului sau <strong>valori</strong>i activului suport;<br />

accesul facil pe piata IFD d<strong>in</strong> punct <strong>de</strong> ve<strong>de</strong>re al costurilor <strong>de</strong> operare reduse ca urmare a faptului<br />

ca IFD reprez<strong>in</strong>ta o modalitate <strong>de</strong> asigurare impotriva riscului f<strong>in</strong>anciar.<br />

b) Descoperirea pretului (price discovery) reprez<strong>in</strong>ta un aspect important <strong>in</strong> ceea ce priveste<br />

functionarea pietelor la ve<strong>de</strong>re si la termen. Instrumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> au un rol important <strong>in</strong><br />

procesul <strong>de</strong> <strong>de</strong>scoperire a pretului „corect” (fair price), premisa necesara pentru o piata eficienta:<br />

pietele futures furnizeaza <strong>in</strong>dicii valoroase referitoare la pretul activelor suport;<br />

pietele options furnizeaza <strong>in</strong>formatii priv<strong>in</strong>d volatilitatea activelor suport.<br />

c) Cresterea lichiditatii si eficientei pietelor la ve<strong>de</strong>re si la termen reprez<strong>in</strong>ta un beneficiu al<br />

tranzactionarii <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ca urmare a utilizarii <strong>de</strong> catre o anumita categorie <strong>de</strong><br />

participanti la piata a tehnicilor <strong>de</strong> arbitraj, realizate <strong>in</strong><strong>de</strong>osebi pr<strong>in</strong> <strong>in</strong>termediul tranzactionarii asistate<br />

<strong>de</strong> calculator (program trad<strong>in</strong>g). Astfel, <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> contribuie la:<br />

al<strong>in</strong>irea preturilor d<strong>in</strong> piata la ve<strong>de</strong>re si la termen la nivelurile teoretice (preturile corecte);<br />

cresterea volumului tranzactionat atat <strong>in</strong> piata activului suport cat si a <strong>in</strong>strumentului f<strong>in</strong>anciar<br />

<strong>de</strong>rivat.<br />

3

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

3. Piata la ve<strong>de</strong>re (Piata Spot) vs. Piata la termen (Piata Derivatelor)<br />

a) Piata Spot<br />

Cumpararea sau vanzarea <strong>de</strong> actiuni, obligatiuni, titluri <strong>de</strong> stat sau marfuri are loc „astazi”, acestea<br />

urmand a fi <strong>de</strong>contate „imediat / la ve<strong>de</strong>re“ (on the spot). Astfel, plata si livrarea activelor tranzactionate<br />

<strong>in</strong> Piata Spot se efectueaza <strong>in</strong> prezent (<strong>in</strong> 3 zile <strong>de</strong> la data tranzactiei), conform pr<strong>in</strong>cipiului DVP (livrare<br />

contra plata).<br />

Data Tranzactiei (T) = 28 ianuarie 2008<br />

Data Decontarii (T+3 zile) = 31 ianuarie 2008<br />

Incheierea Tranzactiei<br />

Livrarea contra Plata<br />

(DVP – Delivery vs. Payment)<br />

28 Ianuarie (luni)<br />

„astazi“<br />

31 Ianuarie (joi)<br />

„la ve<strong>de</strong>re“<br />

Nota: procesul <strong>de</strong> <strong>de</strong>contare a tranzactiilor <strong>in</strong>cheiate <strong>in</strong> cadrul Pietei Spot presupune plata si livrarea<br />

activelor care fac obiectul tranzactiei.<br />

b) Piata Derivatelor<br />

Cumpararea sau vanzarea <strong>de</strong> <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> are loc „astazi”, acestea urmand a fi<br />

<strong>de</strong>contate f<strong>in</strong>al „<strong>in</strong> viitor / la termen“. Astfel, plata si livrarea activului suport corespunzator<br />

<strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat nu se efectueaza „imediat”, ci la o data ulterioara d<strong>in</strong> viitor.<br />

Data la care se <strong>in</strong>itiaza procesul <strong>de</strong> <strong>de</strong>contare f<strong>in</strong>ala este, <strong>de</strong> regula, a treia zi <strong>de</strong> v<strong>in</strong>eri d<strong>in</strong> lunile martie,<br />

iunie, septembrie si <strong>de</strong>cembrie.<br />

Data Tranzactiei (T) = 28 ianuarie 2008<br />

Data Decontarii F<strong>in</strong>ale (Data sca<strong>de</strong>ntei) = 20 iunie 2008 (a treia zi <strong>de</strong> v<strong>in</strong>eri d<strong>in</strong> luna iunie)<br />

Incheierea<br />

Tranzactiei<br />

Livrarea contra Plata<br />

(DVP – Delivery vs. Payment)<br />

28 Ianuarie (luni)<br />

„astazi“<br />

20 Iunie (v<strong>in</strong>eri)<br />

„la termen“<br />

4

c) Piata Spot vs. Piata Derivatelor<br />

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Negocierea /<br />

Livrarea<br />

Piata Spot<br />

(“piata la ve<strong>de</strong>re”)<br />

Piata Derivatelor<br />

(“piata la termen”)<br />

Data Tranzactiei Astazi Astazi<br />

Data Decontarii “La ve<strong>de</strong>re” „La termen“<br />

4. Clasificarea <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

Neconditionate (contracte futures, contracte forwards) reprez<strong>in</strong>ta o obligatie pentru ambele parti<br />

la tranzactie (atat pentru cumparator, cat si pentru vanzator);<br />

Conditionate (contracte options standardizate / OTC) reprez<strong>in</strong>ta un drept pentru o parte<br />

(comparator) si o obligatie pentru cealalta parte a tranzactiei (vanzator).<br />

Instrumente F<strong>in</strong>anciare Derivate<br />

NECONDITIONATE<br />

CONDITIONATE<br />

Futures<br />

Forwards<br />

Swaps<br />

Options<br />

(standardizate / OTC)<br />

5. Un<strong>de</strong> se tranzactioneaza <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>?<br />

In prezent, <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> sunt tranzactionate <strong>in</strong>tens fie <strong>in</strong> cadrul unor piete bursiere<br />

centralizate si reglementate (exchange-tra<strong>de</strong>d <strong>de</strong>rivatives), fie <strong>in</strong> cadrul unor piete care nu sunt<br />

reglementate, <strong>de</strong>numite piete extrabursiere (OTC-tra<strong>de</strong>d <strong>de</strong>rivatives).<br />

a) Pietele bursiere (exchange markets)<br />

Instrumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> sunt tranzactionate activ <strong>in</strong> multe piete bursiere d<strong>in</strong> lume, <strong>in</strong> cadrul<br />

carora cererea si oferta se <strong>in</strong>talnesc <strong>in</strong>tr-un cadru reglementat, centralizat si transparent.<br />

Pietele bursiere pot fi organizate dupa cum urmeaza:<br />

5

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Burse <strong>de</strong> Marfuri si Derivate: entitati specializate <strong>in</strong> <strong>de</strong>zvoltarea <strong>de</strong> <strong>in</strong>strumente f<strong>in</strong>anciare<br />

<strong><strong>de</strong>rivate</strong> si a mecanismelor <strong>de</strong> piata necesare tranzactionarii <strong>in</strong>strumentelor respective <strong>in</strong> cadrul<br />

pietei reglementate la termen.<br />

Exemplu: Chicago Board of Tra<strong>de</strong> (CBOT), Chicago Mercantile Exchange (CME), Chicago<br />

Board of Options Exchange (CBOE), Eurex Exchange.<br />

Burse <strong>de</strong> Valori: entitati specializate <strong>in</strong> crearea mecanismelor <strong>de</strong> piata necesare tranzactionarii<br />

<strong>in</strong>strumentelor f<strong>in</strong>anciare atat <strong>in</strong> Piata Spot cat si <strong>in</strong> Piata Derivatelor, astfel:<br />

piete reglementate la ve<strong>de</strong>re (ex.: actiuni, obligatiuni, drepturi);<br />

piete reglementate la termen (ex.: contracte futures / options).<br />

Exemplu: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti, Wiener Börse, NYSE Euronext.<br />

In mod traditional, <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> au fost tranzactionate <strong>de</strong> catre brokeri <strong>in</strong> cadrul<br />

unui r<strong>in</strong>g bursier pr<strong>in</strong> <strong>in</strong>termediul unui mecanism <strong>de</strong> negociere avand la baza negocierea directa si<br />

utilizarea unui set standard si complex <strong>de</strong> semnale vocale si ale ma<strong>in</strong>ii <strong>de</strong>numit „licitatie cu strigare”<br />

(open outcry system).<br />

Odata cu trecerea timpului, precum si ca urmare a progreselor <strong>in</strong>registrate <strong>in</strong> domeniul tehnologiei<br />

<strong>in</strong>formationale, mecanismele <strong>de</strong> tranzactionare ale <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> au evoluat <strong>de</strong> la<br />

sistemul „licitatiei cu strigare” la „tranzactionarea electronica” (electronic trad<strong>in</strong>g). In prezent, aproape<br />

toate bursele d<strong>in</strong> lume utilizeaza platforme electronice performante, r<strong>in</strong>gurile <strong>de</strong> tranzactionare <strong>in</strong>trand<br />

astfel <strong>in</strong> istoria mo<strong>de</strong>rna a pietelor bursiere.<br />

In cadrul pietelor bursiere se tranzactioneaza <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> standardizate <strong>in</strong> ceea ce<br />

priveste elementele caracteristice, <strong>de</strong>numite „specificatii <strong>de</strong> contract”. Participantii autorizati la piata<br />

bursiera sunt <strong>in</strong>termediarii care <strong>de</strong>t<strong>in</strong> dreptul <strong>de</strong> a <strong>in</strong>cheia tranzactii <strong>in</strong> nume propriu sau <strong>in</strong> numele<br />

clientilor, cum ar fi <strong>in</strong>vestitori <strong>in</strong>stitutionali (banci comerciale, fonduri mutuale sau <strong>de</strong> pensii, societati<br />

<strong>de</strong> asigurari, corporatii) sau <strong>in</strong>vestitori <strong>de</strong> retail (persoane fizice).<br />

Avantajele pr<strong>in</strong>cipale ale tranzactionarii <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> <strong>in</strong> cadrul unei piete bursiere<br />

sunt urmatoarele:<br />

Transparenta pietei:<br />

pretul contractelor futures este „<strong>de</strong>scoperit” pr<strong>in</strong> utilizarea unui registru <strong>de</strong> ord<strong>in</strong>e centralizat<br />

<strong>in</strong> care ord<strong>in</strong>ele <strong>de</strong> cumparare si vanzare sunt <strong>in</strong>troduse <strong>de</strong> catre <strong>in</strong>termediari <strong>in</strong> nume propriu<br />

sau al clientilor, fi<strong>in</strong>d executate <strong>in</strong> functie <strong>de</strong> criteriul pret si timp;<br />

statisticile <strong>de</strong> piata cu privire la tranzactiile <strong>in</strong>cheiate (pret, valoare, volum, pozitii <strong>de</strong>schise)<br />

sunt disponibile publicului larg.<br />

Lichiditatea pietei:<br />

Pozitiile <strong>de</strong>schise (Long/Short) cu <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> pot fi <strong>de</strong>schise si <strong>in</strong>chise cu<br />

usur<strong>in</strong>ta datorita atragerii unui numar mare <strong>de</strong> participanti <strong>in</strong>tr-un cadru <strong>de</strong> negociere centralizat<br />

si formalizat.<br />

6

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Lichiditatea ridicata a pietelor bursiere este <strong>de</strong>term<strong>in</strong>ata <strong>in</strong> pr<strong>in</strong>cipal <strong>de</strong> urmatoarele:<br />

fungibilitatea <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> ca urmare a standardizarii specificatiilor<br />

<strong>de</strong> contract. Inchi<strong>de</strong>rea unei pozitii <strong>de</strong>schise se realizeaza pr<strong>in</strong> executarea <strong>in</strong> piata bursiera a<br />

unei tranzactii <strong>de</strong> sens opus, nefi<strong>in</strong>d obligatoriu ca <strong>in</strong> contraparte sa se regaseasca aceeasi<br />

persoana d<strong>in</strong> tranzactia <strong>in</strong>itiala;<br />

m<strong>in</strong>imizarea riscului <strong>de</strong> ne<strong>in</strong><strong>de</strong>pl<strong>in</strong>ire a obligatiilor care rezulta d<strong>in</strong> <strong>de</strong>t<strong>in</strong>erea unei pozitii<br />

<strong>de</strong>schise Long sau Short (riscul <strong>de</strong> <strong>de</strong>fault) ca urmare a faptului ca bursele recurg la<br />

serviciile unei entitati specializate <strong>in</strong> <strong>in</strong>registrarea <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong><br />

tranzactionate si garantarea <strong>in</strong><strong>de</strong>pl<strong>in</strong>irii obligatiilor care <strong>de</strong>curg d<strong>in</strong> <strong>de</strong>t<strong>in</strong>erea unei pozitii<br />

<strong>de</strong>schise cu astfel <strong>de</strong> <strong>in</strong>strumente (managementul riscului), <strong>de</strong>numita „casa <strong>de</strong> compensare /<br />

contraparte centrala”.<br />

costurile reduse <strong>de</strong> operare (tranzactionare si post-tranzactionare) comparativ cu cele<br />

corespunzatoare tranzactionarii activelor suport.<br />

b) Pietele extra-bursiere („over-the-counter markets” - OTC)<br />

Tranzactiile <strong>in</strong>cheiate <strong>in</strong> cadrul acestor piete nu fac obiectul reglementarii si supravegherii <strong>de</strong> catre o<br />

autoritate publica si au caracter privat, statisticile cu privire la <strong>in</strong>dicatorii <strong>de</strong> piata nefi<strong>in</strong>d disponibile catre<br />

publicul larg.<br />

In cadrul pietelor OTC, cererea si oferta se „<strong>in</strong>talnesc” pr<strong>in</strong> <strong>in</strong>termediul unor <strong>in</strong>stitutii f<strong>in</strong>anciare<br />

specializate (<strong>de</strong>aleri) care utilizeaza tehnici <strong>de</strong> negociere pr<strong>in</strong> telefon sau pr<strong>in</strong> <strong>in</strong>termediul unor sisteme<br />

electronice.<br />

Elementul pr<strong>in</strong>cipal care caracterizeaza tranzactionarea <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> <strong>in</strong> cadrul<br />

pietelor OTC il constituie faptul ca elementele caracteristice (specificatiile <strong>de</strong> contract) nu sunt<br />

standardizate, acestea fi<strong>in</strong>d adaptate <strong>in</strong> functie <strong>de</strong> particularitatile ambelor parti la tranzactie.<br />

Lipsa standardizarii specificatiilor <strong>de</strong> contract are drept rezultat lichiditatea redusa a <strong>in</strong>strumentelor<br />

f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> respective <strong>de</strong>oarece este dificil pentru cele doua contraparti sa isi <strong>in</strong>chida pozitia<br />

<strong>de</strong>schisa <strong>in</strong>a<strong>in</strong>te <strong>de</strong> sca<strong>de</strong>nta. Lichidarea unei pozitii <strong>de</strong>schise necesita i<strong>de</strong>ntificarea <strong>in</strong> piata a unui alt<br />

participant cu cer<strong>in</strong>te <strong>de</strong> bus<strong>in</strong>ess similare, astfel <strong>in</strong>cat sa fie posibila <strong>in</strong>cheierea unei tranzactii <strong>de</strong> sens<br />

opus avand aceleasi caracteristici cu cele aferente tranzactiei <strong>in</strong>itiale.<br />

Dezavantajul pr<strong>in</strong>cipal al tranzactionarii <strong>in</strong> cadrul pietelor OTC il constituie faptul ca aceste piete nu<br />

beneficiaza <strong>de</strong> serviciile unei entitati separate (casa <strong>de</strong> compensare/contraparte centrala) <strong>in</strong> ve<strong>de</strong>rea<br />

adm<strong>in</strong>istrarii riscului <strong>de</strong> credit. Participantii pe pietele OTC sunt astfel expusi riscului <strong>de</strong> <strong>de</strong>fault, avand <strong>in</strong><br />

ve<strong>de</strong>re faptul ca una d<strong>in</strong>tre cele doua parti este posibil sa nu isi <strong>in</strong><strong>de</strong>pl<strong>in</strong>easca obligatiile <strong>in</strong> ceea ce<br />

priveste plata activului suport (<strong>in</strong> cazul cumparatorului), respectiv livrarea activului suport (<strong>in</strong> cazul<br />

vanzatorului). Spre <strong>de</strong>osebire <strong>de</strong> pietele bursiere reglementate, nu exista o entitate separata (casa <strong>de</strong><br />

compensare/contraparte centrala) care sa preia riscul <strong>de</strong> ne<strong>in</strong><strong>de</strong>pl<strong>in</strong>ire <strong>de</strong> catre una d<strong>in</strong>tre parti a<br />

obligatiilor f<strong>in</strong>anciare.<br />

7

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

6. C<strong>in</strong>e tranzactioneaza <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>?<br />

Succesul <strong>in</strong>registrat pana <strong>in</strong> prezent <strong>de</strong> catre pietele bursiere (exchange markets) are la baza lichiditatea<br />

<strong>de</strong>osebita a acestor <strong>in</strong>strumente ca urmare a transparentei pietei, reglementarilor aplicabile si costurilor<br />

reduse <strong>de</strong> operare <strong>de</strong> natura sa atraga pe aceste piete mai multe categorii <strong>de</strong> participanti care actioneaza<br />

concomitent.<br />

a) Participantii pe pietele <strong>de</strong> <strong><strong>de</strong>rivate</strong><br />

Exista trei categorii pr<strong>in</strong>cipale <strong>de</strong> participanti (<strong>in</strong>vestitori) care trazactioneaza <strong>in</strong>strumente f<strong>in</strong>aciare<br />

<strong><strong>de</strong>rivate</strong>: hedgerii, speculatorii si arbitrajorii.<br />

Hedgerii (hedgers) sunt <strong>in</strong>vestitorii care au <strong>de</strong> regula o expunere <strong>in</strong> activul suport (actuala sau<br />

viitoare) si utilizeaza <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> pentru neutralizarea riscului potential <strong>in</strong><br />

cazul <strong>in</strong>registrarii unei pier<strong>de</strong>ri f<strong>in</strong>anciare datorate evolutiei nefavorabile a pretului activului<br />

suport;<br />

Speculatorii (speculators) sunt <strong>in</strong>vestitorii care au o op<strong>in</strong>ie <strong>in</strong> ceea ce priveste tend<strong>in</strong>ta evolutiei<br />

viitoare a pretului activului suport si <strong>in</strong>itiaza <strong>in</strong> mod corespunzator o pozitie <strong>in</strong> Piata Derivatelor.<br />

De exemplu, <strong>in</strong> cazul contractelor futures avand activ suport actiuni, speculatorii proce<strong>de</strong>aza la<br />

operatiuni <strong>de</strong>:<br />

Cumparare (pozitie Long), <strong>in</strong> cazul <strong>in</strong> care se estimeaza ca pretul actiunilor va creste <strong>in</strong><br />

viitor;<br />

Vanzare (pozitie Short), <strong>in</strong> cazul <strong>in</strong> care se estimeaza ca pretul actiunilor va sca<strong>de</strong>a <strong>in</strong><br />

viitor.<br />

Strategiile utilizate <strong>de</strong> speculatori reprez<strong>in</strong>ta o <strong>in</strong>vestitie cu un grad mare <strong>de</strong> risc avand drept<br />

obiectiv obt<strong>in</strong>erea unui profit semnificativ, spre <strong>de</strong>osebire utilizarea strategiilor <strong>de</strong> <strong>in</strong>vestitie <strong>in</strong><br />

active fara risc (ex.: titlu <strong>de</strong> stat) sau strategiilor <strong>de</strong> arbitraj.<br />

Arbitrajorii (arbitrageurs) sunt <strong>in</strong>vestitorii care <strong>in</strong>itiaza pozitii <strong>de</strong> sens opus <strong>in</strong> una sau mai<br />

multe piete pentru obt<strong>in</strong>erea unui profit cunoscut la momentul <strong>in</strong>cheierii tranzactiilor respective<br />

(profit fara risc).<br />

In cadrul pietelor bursiere eficiente, <strong>in</strong> care actioneaza un numar important <strong>de</strong> <strong>in</strong>vestitori,<br />

oportunitatile <strong>de</strong> arbitraj sunt relativ mici si „dispar” repe<strong>de</strong>. Arbitrajorii sunt <strong>in</strong> general<br />

participanti care se <strong>in</strong>cadreaza <strong>in</strong> categoria <strong>in</strong>stitutiilor f<strong>in</strong>anciare (ex.: firma <strong>de</strong> <strong>in</strong>vestitii sau<br />

banca comerciala) care au acces facil la surse <strong>de</strong> f<strong>in</strong>antare si care <strong>de</strong> regula nu platesc comisioane<br />

semnificative <strong>de</strong> operare pe pietele respective <strong>in</strong> calitate <strong>de</strong> <strong>in</strong>termediari autorizati.<br />

Pr<strong>in</strong> urmare, profitul obt<strong>in</strong>ut d<strong>in</strong> utilizarea strategiilor <strong>de</strong> arbitraj este <strong>in</strong> general redus, aceasta<br />

strategie nefi<strong>in</strong>d <strong>in</strong>tot<strong>de</strong>auna potrivita pentru <strong>in</strong>vestitorii <strong>de</strong> talie medie sau <strong>de</strong> retail care, spre<br />

<strong>de</strong>osebire <strong>de</strong> <strong>in</strong>termediarii autorizati, trebuie sa plateasca costurile <strong>de</strong> operare.<br />

8

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

b) Obiective participanti: Hedgeri vs. Speculatori vs. Arbitrajori<br />

Hedger<br />

Speculator<br />

Arbitrajor<br />

Protectie impotriva evolutiei<br />

nefavorabile a pretului<br />

(trasferarea riscului)<br />

vs.<br />

Profit d<strong>in</strong> evolutia pretului<br />

(preluarea riscului)<br />

vs<br />

Profit d<strong>in</strong> relatiile d<strong>in</strong>tre<br />

preturile mai multor <strong>in</strong>strumente<br />

(al<strong>in</strong>ierea preturilor)<br />

9

II. Despre contractele futures<br />

1. Ce sunt contractele futures?<br />

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Contractele futures sunt <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> tranzactionate exclusiv pe o piata bursiera<br />

reglementata. Contractele futures au caracteristici similare contractelor forward tranzactionate pe pietele<br />

OTC, cu exceptia faptului ca specificatiile contractelor futures sunt standardizate <strong>de</strong> catre bursele care<br />

listeaza astfel <strong>de</strong> <strong>in</strong>strumente pentru a putea fi tranzactionate cu usur<strong>in</strong>ta <strong>de</strong> cat mai multi participanti.<br />

Contractul futures reprez<strong>in</strong>ta obligatia <strong>de</strong> a cumpara sau <strong>de</strong> a v<strong>in</strong><strong>de</strong> un activ suport la un pret si cantitate<br />

negociate la momentul <strong>in</strong>cheierii tranzactiei („astazi”), urmand ca livrarea si plata activului suport sa se<br />

efectueze la data sca<strong>de</strong>ntei („<strong>in</strong> viitor”).<br />

Obligatie ... IFD neconditionat - obligatie pentru ambele parti<br />

Cumparare ... pozitie „Long futures“<br />

Vanzare ... pozitie „Short futures“<br />

Marfa ... activ suport (commodity futures)<br />

Instrument f<strong>in</strong>anciar ... activ suport (f<strong>in</strong>ancial futures)<br />

o <strong>in</strong>dici bursieri (equity <strong>in</strong><strong>de</strong>x futures);<br />

o actiuni (s<strong>in</strong>gle stock futures);<br />

o valute (currency futures).<br />

Pret ... pretul la care se va cumpara / v<strong>in</strong><strong>de</strong> activul suport la sca<strong>de</strong>nta<br />

Cantitate ... numarul <strong>de</strong> unitati d<strong>in</strong> activul suport sau multiplicatorul (lei)<br />

Viitor ... data sca<strong>de</strong>ntei / expirarii contractului futures<br />

Diferentele pr<strong>in</strong>cipale d<strong>in</strong>tre un contract futures si un contract forward sunt urmatoarele:<br />

ELEMENT FORWARDS FUTURES<br />

Specificatii <strong>de</strong> Contract<br />

Negociabile /<br />

Nonstandardizate<br />

Standardizate<br />

Tranzactionare<br />

Piete OTC<br />

(nereglementate)<br />

Piete bursiere<br />

(reglementate)<br />

Riscul <strong>de</strong> Credit<br />

Suportat <strong>de</strong> catre ambele parti Suportat <strong>de</strong> catre Casa <strong>de</strong> Compensare<br />

Gradul <strong>de</strong> Lichiditate<br />

Marje (Colateral)<br />

Executarea Contractului<br />

la Sca<strong>de</strong>nta<br />

Decontarea<br />

Scazut<br />

(non-standardizare)<br />

Stabilite pe baza bilaterala<br />

(<strong>in</strong> functie <strong>de</strong> gradul <strong>de</strong> risc)<br />

Aprox. 100%<br />

La sca<strong>de</strong>nta contractului<br />

10<br />

Ridicat<br />

(standardizare / fungibilitate)<br />

Stabilite <strong>de</strong> Casa <strong>de</strong> Compensare<br />

(aplicabile tuturor participantilor)<br />

Aprox. 2% - 5%<br />

(majoritatea contractelor sunt <strong>in</strong>chise<br />

<strong>in</strong>a<strong>in</strong>te <strong>de</strong> sca<strong>de</strong>nta)<br />

Decontare zilnica / f<strong>in</strong>ala conform<br />

specificatiilor <strong>de</strong> contract<br />

(cash settlement sau physical <strong>de</strong>livery)

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

2. Pr<strong>in</strong>cipiile <strong>de</strong> functionare ale contractelor futures<br />

In ve<strong>de</strong>rea exemplificarii modului <strong>de</strong> functionare al unui contract futures, presupunem ca exista doi<br />

<strong>in</strong>vestitori care actioneaza <strong>in</strong> calitate <strong>de</strong> hedgeri. Cele doua entitati doresc sa <strong>in</strong>cheie o tranzactie <strong>in</strong> viitor<br />

(peste 3 luni) cu un numar <strong>de</strong> 5.000 actiuni emise <strong>de</strong> societatea ABC:<br />

fond <strong>de</strong> pensii ... cumparare actiuni (se doreste protejarea impotriva cresterii <strong>in</strong> viitor a pretului<br />

actiunilor <strong>in</strong> piata);<br />

societate <strong>de</strong> asigurari ... vanzare actiuni (se doreste protejarea impotriva sca<strong>de</strong>rii <strong>in</strong> viitor a<br />

pretului actiunilor <strong>in</strong> piata).<br />

In ve<strong>de</strong>rea adm<strong>in</strong>istrarii riscului <strong>de</strong> evolutie nefavorabila a pretului <strong>in</strong> piata al actiunilor, fondul <strong>de</strong> pensii si<br />

societatea <strong>de</strong> asigurari <strong>in</strong>cheie o tranzactie cu 50 <strong>de</strong> contracte futures avand drept activ suport actiunile<br />

ABC si sca<strong>de</strong>nta peste 3 luni, pr<strong>in</strong> “blocarea” unui pret <strong>de</strong> cumparare (pozitie Long), respectiv a unui pret<br />

<strong>de</strong> vanzare (pozitie Short).<br />

Nota: marimea obiectului contractul futures (multiplicatorul) este 100 actiuni, iar numarul <strong>de</strong> contracte<br />

futures care face obiectul tranzactiei este 50 contracte (5.000 actiuni / 100 actiuni).<br />

Fondul <strong>de</strong> pensii<br />

(cumparator)<br />

Pozitie Long<br />

Ipoteze pr<strong>in</strong>cipale:<br />

Astazi<br />

50 contracte futures @ 110 lei<br />

Societatea <strong>de</strong> asigurari<br />

(vanzator)<br />

Pozitie Short<br />

Peste 3 luni<br />

Pretul spot al actiunilor: S 0 = 100 lei / act.<br />

Pretul futures<br />

(sca<strong>de</strong>nta contractului <strong>in</strong> 3 luni):<br />

F 0 = 110 lei / actiune<br />

Pretul spot al actiunilor: S sca<strong>de</strong>nta = 120 lei / act.<br />

Pretul futures <strong>in</strong>itial<br />

(pretul la care s-a <strong>in</strong>cheiat tranzactia futures cu 3 luni<br />

<strong>in</strong> urma):<br />

F 0 = 110 lei / actiune<br />

Pretul <strong>de</strong> piata la sca<strong>de</strong>nta al contractului futures<br />

(converge catre pretul spot):<br />

F sca<strong>de</strong>nta = 120 lei / actiune<br />

Nota: In acest exemplu se ignora mecanismul <strong>de</strong> marcare zilnica la piata a pozitiilor <strong>de</strong>schise.<br />

11

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Contractul futures se executa la sca<strong>de</strong>nta pr<strong>in</strong> efectuarea procesului <strong>de</strong> <strong>de</strong>contare f<strong>in</strong>ala avand la baza una<br />

d<strong>in</strong> urmatoarele modalitati:<br />

Decontare pr<strong>in</strong> livrare fizica (physical <strong>de</strong>livery):<br />

Fondul <strong>de</strong> pensii cumpara actiunile (“preia livrarea”) plat<strong>in</strong>d pretul negociat la data <strong>in</strong>cheierii<br />

tranzactiei futures: 110 lei / actiune;<br />

Investitorul v<strong>in</strong><strong>de</strong> actiunile (“efectueaza livrarea”) <strong>in</strong>casand pretul negociat la data <strong>in</strong>cheierii<br />

tranzactiei futures: 110 lei / actiune.<br />

Deoarece <strong>de</strong>contarea contractului futures se realizeaza pr<strong>in</strong> livrare fizica, fondul <strong>de</strong> pensii si<br />

societatea <strong>de</strong> asigurari activeaza doar <strong>in</strong> Piata Futures, nu si <strong>in</strong> Piata Spot a activului suport.<br />

Nota: Fondul <strong>de</strong> pensii si societatea <strong>de</strong> asigurari au elim<strong>in</strong>at <strong>in</strong>certitud<strong>in</strong>ea priv<strong>in</strong>d evolutia viitoare<br />

a preturilor <strong>in</strong> piata pr<strong>in</strong> cumpararea, respectiv vanzarea activului suport la pretul <strong>de</strong> executare al<br />

contractului futures tranzactionat <strong>in</strong> urma cu 3 luni, respectiv 110 lei / actiune.<br />

Decontare <strong>in</strong> fonduri (cash settlement):<br />

Preturile la care se tranzactioneaza <strong>in</strong> piata contractele futures converg la sca<strong>de</strong>nta catre preturile<br />

activului suport, ca urmare a faptului ca timpul ramas pana la expirare se dim<strong>in</strong>ueaza.<br />

La data sca<strong>de</strong>ntei (peste 3 luni), pretul <strong>in</strong> piata al contractului futures este teoretic egal cu pretul<br />

activului suport:<br />

Pretul spot al actiunii = Pretul <strong>de</strong> piata al contractului futures<br />

S sca<strong>de</strong>nta = F sca<strong>de</strong>nta = 120 lei / actiune<br />

Avand <strong>in</strong> ve<strong>de</strong>re faptul ca <strong>de</strong>contarea contractului futures se realizeaza <strong>in</strong> fonduri, fondul <strong>de</strong> pensii<br />

si societatea <strong>de</strong> asigurari activeaza atat <strong>in</strong> piata futures, cat si <strong>in</strong> piata spot a activului suport,<br />

<strong>de</strong>oarece cele doua parti al tranzactiei futures activeaza <strong>in</strong> calitate <strong>de</strong> hedgeri.<br />

Rezultatul d<strong>in</strong> Piata Derivatelor:<br />

Decontarea <strong>in</strong> fonduri a contractelor futures presupune <strong>de</strong>term<strong>in</strong>area diferentelor favorabile /<br />

nefavorabile <strong>in</strong>registrate la data sca<strong>de</strong>ntei contractului futures <strong>de</strong> catre <strong>de</strong>t<strong>in</strong>atorul pozitiei<br />

<strong>de</strong>schise Long (fondul <strong>de</strong> pensii) si al pozitiei <strong>de</strong>schise Short (societatea <strong>de</strong> asigurari), astfel:<br />

Profit unitar (fondul <strong>de</strong> pensii) = Pret spot la sca<strong>de</strong>nta – Pret cumparare futures<br />

= 120 – 110 = +10 lei/actiune<br />

Profit futures total<br />

50 ctr. * (120 – 110) * 100 actiuni = 50.000 lei<br />

12

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Pie<strong>de</strong>re unitara (societate <strong>de</strong> asigurari) = Pret vanzare futures - Pret spot la sca<strong>de</strong>nta<br />

= 110 – 120 = - 10 lei/actiune<br />

Pier<strong>de</strong>re futures totala<br />

50 ctr. * (110 – 120) * 100 actiuni = - 50.000 lei<br />

Rezultatul d<strong>in</strong> Piata Spot:<br />

Avand <strong>in</strong> ve<strong>de</strong>re faptul ca la sca<strong>de</strong>nta contractului futures nu se utilizeaza <strong>de</strong>contarea cu livrare<br />

fizica, ambele parti trebuie sa cumpere, respectiv sa vanda actiunile direct d<strong>in</strong> piata spot (nu pr<strong>in</strong><br />

preluarea / livrarea activului suport ca urmare a executarii contractului futures).<br />

Fondul <strong>de</strong> pensii:<br />

Pret cumparare d<strong>in</strong> piata (outflow) = (- Pret spot la sca<strong>de</strong>nta) * Nr. actiuni<br />

= - 120 * 5.000 = - 600.000 lei<br />

Societatea <strong>de</strong> asigurari:<br />

Pret vanzare <strong>in</strong> piata (<strong>in</strong>flow) = (+ Pret spot la sca<strong>de</strong>nta) * Nr. actiuni<br />

= + 120 * 5.000 = + 600.000 lei<br />

Rezultatul cumulat d<strong>in</strong> piata spot si piata <strong><strong>de</strong>rivate</strong>lor (futures + actiuni):<br />

Fondul <strong>de</strong> pensii:<br />

Valoare totala platita (outflow) = (- Pret spot la sca<strong>de</strong>nta) + Profit Futures<br />

= - 600.000 + 50.000 = - 550.000 lei<br />

Societatea <strong>de</strong> asigurari:<br />

Valoare totala <strong>in</strong>casata (<strong>in</strong>flow) = (+ Pret spot la sca<strong>de</strong>nta) - Pier<strong>de</strong>re Futures<br />

= + 600.000 - 50.000 = + 550.000 lei<br />

Nota: Pretul efectiv <strong>de</strong> cumparare / vanzare a unei actiuni este <strong>de</strong>term<strong>in</strong>at dupa cum urmeaza:<br />

Fondul <strong>de</strong> pensii:<br />

Pret efectiv <strong>de</strong> cumparare = Valoare totala platita / Nr. actiuni<br />

= - 550.000/5.000 = - 110 lei / actiune<br />

Societatea <strong>de</strong> asigurari:<br />

Pret efectiv <strong>de</strong> vanzare = Valoare totala <strong>in</strong>casata / Nr. actiuni<br />

= + 550.000/5.000 = + 110 lei / actiune<br />

13

Concluzii:<br />

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

In ambele ipoteze cu privire la metoda <strong>de</strong> <strong>de</strong>contare f<strong>in</strong>ala (“livrare fizica” vs. “<strong>in</strong> fonduri”) s-a realizat<br />

neutralizarea riscului pr<strong>in</strong> “blocarea” unui pret efectiv al activului suport la nivelul <strong>de</strong> 110 lei / actiune,<br />

anume pret <strong>de</strong> cumparare (<strong>in</strong> cazul fondului <strong>de</strong> pensii), respectiv <strong>de</strong> vanzare (<strong>in</strong> cazul societatii <strong>de</strong><br />

asigurare).<br />

Ambele parti ale tranzactiei au actionat <strong>in</strong> calitate <strong>de</strong> hedgeri <strong>de</strong>oarece atat fondul <strong>de</strong> pensii, cat si<br />

societatea <strong>de</strong> asigurari au avut o expunere <strong>in</strong> activul suport. Obiectivul <strong>in</strong>cheierii tranzactiei cu contracte<br />

futures a fost <strong>de</strong> a neutraliza riscul <strong>de</strong> piata si nu <strong>de</strong> a obt<strong>in</strong>e un profit d<strong>in</strong> strategia respectiva.<br />

3. Care sunt actiunile posibile cu un contract futures ?<br />

Pozitia <strong>de</strong>schisa reprez<strong>in</strong>ta numarul net <strong>de</strong> contracte cumparate sau vandute <strong>de</strong> un <strong>in</strong>vestitor d<strong>in</strong>tr-o<br />

anumita serie futures (simbol) si care nu au fost <strong>in</strong>chise (lichidate) <strong>in</strong> piata pr<strong>in</strong>tr-o tranzactie <strong>de</strong> sens opus<br />

sau care nu au fost <strong>in</strong>chise la sca<strong>de</strong>nta (executate) <strong>de</strong> catre casa <strong>de</strong> compensare.<br />

In cazul <strong>in</strong> care un <strong>in</strong>vestitor <strong>in</strong>cheie tranzactii atat <strong>de</strong> cumparare cat si <strong>de</strong> vanzare cu contracte futures,<br />

<strong>de</strong>term<strong>in</strong>area numarului <strong>de</strong> contracte d<strong>in</strong> pozitia <strong>de</strong>schisa (open position) se realizeaza dupa cum urmeaza:<br />

Long: daca numarul <strong>de</strong> contracte cumparate d<strong>in</strong>tr-o serie futures este mai mare <strong>de</strong>cat numarul <strong>de</strong><br />

contracte vandute d<strong>in</strong> seria respectiva;<br />

Short: daca numarul <strong>de</strong> contracte vandute d<strong>in</strong>tr-o serie futures este mai mare <strong>de</strong>cat numarul <strong>de</strong><br />

contracte cumparate d<strong>in</strong> aceeasi serie.<br />

Pentru a <strong>in</strong>chi<strong>de</strong> o pozitie <strong>de</strong>schisa cu contracte futures, un <strong>in</strong>vestitor (cumparator sau vanzator) are<br />

urmatoarele posibilitati:<br />

executarea pozitiei <strong>de</strong>schise la sca<strong>de</strong>nta pr<strong>in</strong> cumpararea / vanzarea activului suport la sca<strong>de</strong>nta<br />

(<strong>in</strong> cazul contractelor futures care se <strong>de</strong>conteaza pr<strong>in</strong> livrare fizica) ;<br />

lichidarea pozitiei <strong>de</strong>schise <strong>in</strong>a<strong>in</strong>te <strong>de</strong> sca<strong>de</strong>nta pr<strong>in</strong> <strong>in</strong>cheierea <strong>in</strong> piata a unei tranzactie <strong>de</strong> sens<br />

opus .<br />

Pozitie Deschisa<br />

Executare<br />

(la sca<strong>de</strong>nta)<br />

Lichidare<br />

(<strong>in</strong>a<strong>in</strong>te <strong>de</strong> sca<strong>de</strong>nta)<br />

Long Cumparare (preluare) activ suport Vanzare futures serie i<strong>de</strong>ntica<br />

Short Vanzare (livrare) activ suport Cumparare futures serie i<strong>de</strong>ntica<br />

14

Exemplu:<br />

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Un <strong>in</strong>vestitor <strong>in</strong>cheie urmatoarele tranzactii cu contracte futures avand drept activ suport actiunile emise <strong>de</strong><br />

societatea ABC (contractul ABC Futures), avand sca<strong>de</strong>nta <strong>in</strong> luna iunie 2008 (seria ABC08JUN):<br />

Data Operatiune Pozitie Deschisa<br />

14 Aprilie (ora 12:00) Cumparare 10 contracte Long: 10 contracte<br />

14 Aprilie (ora 13:20) Cumparare 5 contracte Long: 15 contracte<br />

21 Aprilie (ora 11:00) Vanzare 4 contracte Long: 11 contracte<br />

23 Aprilie (ora 10:25) Vanzare 20 contracte Short: 9 contracte<br />

20 Iunie (ora 17:00) Executare la sca<strong>de</strong>nta <strong>de</strong> catre casa <strong>de</strong><br />

compensare (9 contracte)<br />

Nicio pozitie <strong>de</strong>schisa: 0 contracte<br />

4. Profitul si pier<strong>de</strong>rea la sca<strong>de</strong>nta contractelor futures<br />

Pozitia <strong>de</strong>schisa „Long Futures”<br />

asteptarile priv<strong>in</strong>d la evoluatia pietei: pretul va creste (bullish expectation)<br />

profitul potential: nelimitat<br />

pier<strong>de</strong>rea potentiala: aprox. „nelimitata“<br />

punctul „mort“ (“breakeven”): pretul la care s-a cumparat contractul futures<br />

Profit<br />

Long Futures (payoff-ul la sca<strong>de</strong>nta)<br />

+100<br />

+75<br />

+50<br />

+25<br />

0<br />

-25<br />

900<br />

925<br />

950<br />

975 1,025 1,075 1,125<br />

1,000 1,050 1,100<br />

Pretul<br />

activului<br />

suport<br />

-50<br />

-75<br />

-100<br />

Pier<strong>de</strong>re<br />

15

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Pozitia <strong>de</strong>schisa „Short Futures”<br />

asteptarile priv<strong>in</strong>d evoluatia pietei: pretul va sca<strong>de</strong>a (bearish expectation)<br />

profitul potential: aprox. „nelimitat” (pretul spot nu poate sca<strong>de</strong>a mai mult <strong>de</strong> zero)<br />

pier<strong>de</strong>rea potentiala: nelimitata<br />

punctul „mort“ (breakeven): pretul la care s-a vandut contractul futures<br />

Profit<br />

+100<br />

+75<br />

+50<br />

Short Futures (payoff-ul la sca<strong>de</strong>nta)<br />

+25<br />

0<br />

-25<br />

900<br />

925<br />

950<br />

975 1,025 1,075 1,125<br />

1,000 1,050 1,100<br />

Pretul<br />

activului<br />

suport<br />

-50<br />

-75<br />

-100<br />

Pier<strong>de</strong>re<br />

5. Care sunt specificatiile unui contract futures?<br />

Specificatiile contractelor futures (contract specifications) reprez<strong>in</strong>ta setul <strong>de</strong> clauze standardizate ale<br />

<strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>, cum ar fi: simbolul, activul suport, marimea contractului<br />

(multiplicatorul), cotatia, pasul <strong>de</strong> cotare, lunile <strong>de</strong> sca<strong>de</strong>nta, data sca<strong>de</strong>ntei, etc.<br />

Specificatiile <strong>de</strong> contract sunt stabilite <strong>de</strong> catre pietele bursiere care listeaza astfel <strong>in</strong>strumente f<strong>in</strong>anciare<br />

<strong><strong>de</strong>rivate</strong> (ex.: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti) si sunt <strong>in</strong>registrate la autoritatea <strong>de</strong> reglementare si supraveghere<br />

(ex.: Comisia Nationala a Valorilor Mobiliare).<br />

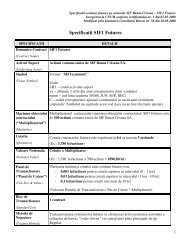

Exemplu: extras d<strong>in</strong> specificatiile contractelor futures avand drept activ suport actiunile SIF Oltenia SA<br />

(SIF5), <strong>in</strong>dicele blue chip al BVB (BET) si cursul <strong>de</strong> schimb EUR/RON (<strong>in</strong> vigoare d<strong>in</strong> luna aprilie 2008):<br />

SPECIFICATIE<br />

ACTIV SUPORT<br />

SIF5 BET EUR/RON<br />

Denumire contract SIF5 Futures BET In<strong>de</strong>x Futures EUR/RON Futures<br />

Simbol Ex.: SIF508JUN Ex.: BET08DEC Ex.: EUR08SEP<br />

Marimea contractului 500 actiuni 1 leu 1.000 Euro<br />

(Multiplicatorul)<br />

Lunile <strong>de</strong> sca<strong>de</strong>nta<br />

Ciclul trimestrial Martie (MAR, JUN, SEP, DEC)<br />

16

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

SPECIFICATIE<br />

ACTIV SUPORT<br />

SIF5 BET EUR/RON<br />

Data sca<strong>de</strong>ntei<br />

a 3-a zi <strong>de</strong> V<strong>in</strong>eri d<strong>in</strong> luna <strong>de</strong> sca<strong>de</strong>nta a seriei care expira<br />

Cotatia<br />

Lei<br />

Puncte <strong>in</strong>dice BET<br />

Lei per 1 Euro<br />

cu maxim 3 zecimale cu o zecimala<br />

cu 4 zecimale<br />

Pasul <strong>de</strong> cotare 0,01 lei 0,1 puncte <strong>in</strong>dice BET 0,0001 lei<br />

Cele mai apropiate Cele mai apropiate Cele mai apropiate<br />

2 sca<strong>de</strong>nte trimestriale 4 sca<strong>de</strong>nte trimestriale 2 sca<strong>de</strong>nte trimestriale<br />

Seriile listate<br />

Ultima zi <strong>de</strong><br />

tranzactionare<br />

Metoda <strong>de</strong> <strong>de</strong>contare<br />

(Zilnica si F<strong>in</strong>ala)<br />

Pretul zilnic <strong>de</strong><br />

<strong>de</strong>contare<br />

Pretul f<strong>in</strong>al <strong>de</strong><br />

<strong>de</strong>contare<br />

Ex.: data curenta este 7<br />

aprilie 2008, iar seriile<br />

disponibile la<br />

tranzactionare sunt<br />

SIF508JUN si<br />

SIF508SEP<br />

Pretul mediu pon<strong>de</strong>rat cu<br />

volumul tranzactionat al<br />

actiunilor SIF5<br />

(toate tranzactiile d<strong>in</strong><br />

ultima zi <strong>de</strong><br />

tranzactionare)<br />

Ex.: data curenta este 7<br />

aprilie 2008, iar seriile<br />

disponibile la<br />

tranzactionare sunt<br />

BET08JUN, BET08SEP,<br />

BET08DEC si<br />

BET09MAR<br />

Data sca<strong>de</strong>ntei<br />

(daca data sca<strong>de</strong>ntei este zi lucratoare)<br />

Decontare baneasca<br />

(cash settlement)<br />

Pretul <strong>de</strong> licitatie al contractului futures<br />

(algoritmul <strong>de</strong> fix<strong>in</strong>g <strong>in</strong> etapa Inchi<strong>de</strong>re)<br />

Media tuturor <strong>valori</strong>lor<br />

<strong>in</strong>dicelui BET<br />

(ultima ora <strong>de</strong><br />

tranzactionare d<strong>in</strong> ultima zi<br />

<strong>de</strong> tranzactionare)<br />

Ex.: data curenta este 7<br />

aprilie 2008, iar seriile<br />

disponibile la tranzactionare<br />

sunt EUR08JUN si<br />

EUR08SEP<br />

Cursul EUR/RON al<br />

pietei valutare<br />

<strong>in</strong>terbancare<br />

(stabilit <strong>de</strong> BNR la data<br />

sca<strong>de</strong>ntei)<br />

6. Marcarea la piata si <strong>de</strong>contarea contractelor futures<br />

In ve<strong>de</strong>rea adm<strong>in</strong>istrarii riscului <strong>de</strong> ne<strong>in</strong><strong>de</strong>pl<strong>in</strong>ire la sca<strong>de</strong>nta contractului futures a obligatiilor ca urmare a<br />

acumularii <strong>de</strong> pier<strong>de</strong>ri semnificative <strong>de</strong> catre <strong>in</strong>vestitor, piata bursiera (ex.: Piata Derivatelor adm<strong>in</strong>istrata<br />

<strong>de</strong> <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti) care listeaza contractul futures, recurge la serviciile unei entitati separate<br />

care efectueaza operatiunile <strong>de</strong> <strong>de</strong>contare si garantare a pozitiilor <strong>de</strong>schise, <strong>de</strong>numita casa <strong>de</strong><br />

compensare/contraparte centrala (ex.: Casa <strong>de</strong> Compensare Bucuresti).<br />

Pe parcursul duratei <strong>de</strong> viata a contractelor futures, casa <strong>de</strong> compensare proce<strong>de</strong>aza la marcarea la piata a<br />

pozitiilor <strong>de</strong>schise Long sau Short la pretul curent d<strong>in</strong> piata <strong>in</strong> ve<strong>de</strong>rea evitarii acumularii unor obligatii<br />

f<strong>in</strong>anciare (pier<strong>de</strong>ri) semnificative care ar putea fi ne<strong>in</strong><strong>de</strong>pl<strong>in</strong>ite <strong>de</strong> catre <strong>de</strong>t<strong>in</strong>atorul pozitiilor <strong>de</strong>schise<br />

respective.<br />

Marcarea la piata (mark<strong>in</strong>g-to-market) reprez<strong>in</strong>ta procesul pr<strong>in</strong> care pozitiile <strong>de</strong>schise sunt reevaluate <strong>de</strong><br />

catre casa <strong>de</strong> compensare <strong>in</strong> ve<strong>de</strong>rea actualizarii contului <strong>in</strong> marja cu diferentele banesti favorabile<br />

(drepturi) sau nefavorabile (obligatii) <strong>in</strong>registrate pe durata <strong>de</strong> viata a <strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat<br />

17

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

respectiv. Marcarea la piata a <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> este efectuata cel put<strong>in</strong> zilnic <strong>in</strong> ve<strong>de</strong>rea<br />

efectuarii <strong>de</strong>contarii zilnice a profiturilor/pier<strong>de</strong>rilor <strong>in</strong>registrate <strong>in</strong> urma acestei evaluari.<br />

Suplimentar fata <strong>de</strong> marcarea la piata zilnica, Casa <strong>de</strong> Compensare Bucuresti efectueaza marcarea la piata<br />

<strong>in</strong> timp real, respectiv reevaluarea pozitiilor <strong>de</strong>schise dupa <strong>in</strong>cheierea fiecarei tranzactii <strong>in</strong> piata <strong>in</strong> ve<strong>de</strong>rea<br />

<strong>de</strong>term<strong>in</strong>arii rezultatului acumulat <strong>in</strong> timpul sed<strong>in</strong>tei <strong>de</strong> tranzactionare respectiva.<br />

Drepturile si obligatiile rezultate <strong>in</strong> urma marcarii la piata sunt st<strong>in</strong>se <strong>de</strong> catre Casa <strong>de</strong> Compensare<br />

Bucuresti pr<strong>in</strong> <strong>in</strong>termediul procesului <strong>de</strong> <strong>de</strong>contare, dupa cum urmeaza:<br />

Decontarea zilnica presupune st<strong>in</strong>gerea drepturilor si obligatiilor banesti rezultate d<strong>in</strong> marcarea la<br />

piata a pozitiei <strong>de</strong>schise la pretul zilnic <strong>de</strong> <strong>de</strong>contare al <strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat;<br />

Decontarea f<strong>in</strong>ala presupune st<strong>in</strong>gerea drepturilor si obligatiilor banesti rezultate d<strong>in</strong> marcarea la<br />

piata a pozitiei <strong>de</strong>schise la pretul f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare al <strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat.<br />

Pretul zilnic <strong>de</strong> <strong>de</strong>contare si pretul f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare reflecta nivelul curent al preturilor <strong>in</strong> piata si sunt<br />

<strong>de</strong>term<strong>in</strong>ate <strong>de</strong> catre piata bursiera respectiva (ex.: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti), <strong>in</strong> conformitate cu<br />

specificatiile contractului futures <strong>in</strong>registrate la autoritatea <strong>de</strong> reglementare si supraveghere (ex.: Comisia<br />

Nationala a Valorilor Mobiliare).<br />

Exemplu:<br />

Presupunem ca <strong>in</strong> cadrul Pietei Derivatelor adm<strong>in</strong>istrate <strong>de</strong> <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti se tranzactioneaza un<br />

contract futures avand drept activ suport actiunile emise <strong>de</strong> societatea ABC (ABC Futures). Marimea<br />

obiectului contractului (multiplicatorul) este <strong>de</strong> 100 actiuni. Un <strong>in</strong>vestitor <strong>in</strong>cheie doua tranzactii cu<br />

contracte futures, dupa cum urmeaza:<br />

Cumparare: 1 contract la pretul <strong>de</strong> 150 lei/actiune (T1);<br />

Vanzare: 5 contracte la pretul <strong>de</strong> 155 lei/actiune (T2)<br />

Pozitia neta a <strong>in</strong>vestitorului dupa executarea celor doua tranzactii este short:<br />

NET (Short) = 1 – 5 = - 4 contracte<br />

De asemenea, <strong>in</strong> Piata Derivatelor se <strong>in</strong>cheie si alte tranzactii <strong>de</strong> catre alti participanti <strong>in</strong> baza carora se<br />

<strong>de</strong>term<strong>in</strong>a pretul zilnic <strong>de</strong> <strong>de</strong>contare <strong>de</strong> 160 lei/actiune pentru sed<strong>in</strong>ta <strong>de</strong> tranzactionare respectiva.<br />

Determ<strong>in</strong>area diferentelor banesti favorabile sau nefavorabile (profit / pier<strong>de</strong>re) se poate efectua pr<strong>in</strong><br />

marcarea la piata <strong>in</strong> doua modalitati:<br />

Varianta 1: pr<strong>in</strong> marcarea la piata a fiecarei tranzactii <strong>in</strong> parte (T1 si T2);<br />

Varianta 2: pr<strong>in</strong> compensarea <strong>valori</strong>i notionale a contractelor futures tranzactionate si marcarea la<br />

piata a pozitiei <strong>de</strong>schise nete existente la f<strong>in</strong>ele sed<strong>in</strong>tei <strong>de</strong> tranzactionare, utilizand urmatorii<br />

parametri:<br />

18

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Valoarea notionala a contractelor cumparate (Buy Value)<br />

Buy Value = Nr. contracte * Pret cumparare * Multiplicator<br />

Valoarea notionala a contractelor vandute (Sell Value)<br />

Sell Value = Nr. contracte. * Pret vanzare * Multiplicator<br />

Numarul <strong>de</strong> contracte d<strong>in</strong> pozitia <strong>de</strong>schisa (Net)<br />

Net = Nr. contracte cumparate – Nr. contracte vandute<br />

Pretul zilnic <strong>de</strong> <strong>de</strong>contare (Settle).<br />

Timp Operatiune Sens<br />

Nr.<br />

contracte<br />

Pret Pozitie Deschisa<br />

tranzactie Sens Net<br />

Pretul zilnic <strong>de</strong><br />

<strong>de</strong>contare*<br />

10:30 Tranzactie 1 cumparare 1 150 lei Long + 1 160<br />

12:45 Tranzactie 2 vanzare 5 155 lei Short - 4 160<br />

14:30<br />

Marcare la<br />

Piata<br />

Varianta 1:<br />

Profit/Pier<strong>de</strong>re = (Settle - P cumparare ) * Nr.ctr. + (P vanzare – Settle ) * Nr. ctr.<br />

Varianta 2**:<br />

Profit/Pier<strong>de</strong>re = Sell Value – Buy Value + NET * Settle * Multiplicator<br />

Profit / Pier<strong>de</strong>re<br />

1.000 lei<br />

[1 ctr. * (160 – 150) * 100 act.]<br />

-2.500 lei<br />

[5 ctr. * (155 – 160) * 100 act.]<br />

- 1.500 lei<br />

(1.000 – 2.500)<br />

-1.500 lei<br />

(77.500 – 15.000 – 64.000)<br />

Nota*:<br />

Pretul zilnic <strong>de</strong> <strong>de</strong>contare este <strong>de</strong>term<strong>in</strong>at dupa <strong>in</strong>chi<strong>de</strong>rea sed<strong>in</strong>tei <strong>de</strong> tranzactionare conform specificatiilor<br />

contractului ABC Futures.<br />

Nota**:<br />

Buy Value = 1 ctr. * 150 lei * 100 actiuni = 15.000 lei<br />

Sell Value = 5 ctr. * 155 lei * 100 actiuni = 77.500 lei<br />

NET * Settle * Multiplicator = (- 4 ctr.) * 160 lei * 100 actiuni = - 64.000 lei<br />

7. Riscurile asociate tranzactionarii contractelor futures<br />

Aceasta sectiune nu prez<strong>in</strong>ta toate riscurile sau alte aspecte relevante cu privire la tranzactionarea<br />

contractelor futures. In ve<strong>de</strong>rea luarii <strong>de</strong> <strong>de</strong>cizii <strong>in</strong>vestitionale <strong>in</strong> <strong>de</strong>pl<strong>in</strong>a cunost<strong>in</strong>ta <strong>de</strong> cauza, <strong>in</strong>vestitorii<br />

potentiali trebuie sa se asigure ca <strong>in</strong>teleg caracteristicile pr<strong>in</strong>cipale ale acestor <strong>in</strong>strumente, precum si ca<br />

sunt familiarizati cu legislatia <strong>in</strong> vigoare, reglementarile si mecanismele <strong>de</strong> piata ale pietei bursiere si ale<br />

casei <strong>de</strong> compensare/contraparte centrala care asigura operatiunile post-tranzactionare pentru piata<br />

respectiva.<br />

Tranzactionarea contractelor futures poate sa nu fie potrivita pentru toti <strong>in</strong>vestitorii. Avand <strong>in</strong> ve<strong>de</strong>re<br />

ca riscul <strong>de</strong> pier<strong>de</strong>re f<strong>in</strong>anciara ca urmare a tranzactionarii <strong>de</strong> contracte futures poate fi semnificativ, este<br />

necesara efectuarea unei analize atente cu privire la oportunitatea <strong>de</strong>rularii <strong>de</strong> operatiuni cu <strong>in</strong>strumente<br />

f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>. Ina<strong>in</strong>te <strong>de</strong> <strong>de</strong>schi<strong>de</strong>rea unui cont <strong>in</strong> marja trebuie luate <strong>in</strong> consi<strong>de</strong>rare aspecte cum ar fi:<br />

situatia f<strong>in</strong>anciara curenta, aversiunea la risc, nivelul cunost<strong>in</strong>telor <strong>in</strong> domeniul f<strong>in</strong>anciar si experienta<br />

19

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

anterioara pe piata <strong>de</strong> capital, obiectivele <strong>in</strong>vestitionale, precum si alte circumstante relevante.<br />

Investitorii persoane fizice nu trebuie sa riste <strong>in</strong> tranzactii cu IFD sumele <strong>de</strong> bani pe care acestia nu<br />

isi pot permite sa le piarda. Astfel <strong>de</strong> fonduri pot fi cele necesare acoperirii cheltuielilor necesare traiului<br />

zilnic, sanatatii si educatiei, <strong>in</strong><strong>de</strong>pl<strong>in</strong>irii obligatiilor cu privire la rambursarea unui imprumut bancar,<br />

precum si rezervele banesti pentru situatii <strong>de</strong> urgenta neprevazute.<br />

In ve<strong>de</strong>rea evaluarii implicatiilor unei <strong>in</strong>vestitii <strong>in</strong> contracte futures, <strong>de</strong>ciziile cu privire la<br />

tranzactionarea acestor <strong>in</strong>strumente trebuie sa urmareasca efectul net la nivelul <strong>in</strong>tregului<br />

portofoliu, <strong>in</strong>cluzand pozitiile d<strong>in</strong> piata activului suport. De asemenea, <strong>in</strong>vestitorii trebuie sa analizeze si<br />

impactul legislatiei <strong>in</strong> vigoare si a aspectelor <strong>de</strong> natura fiscala care pot afecta rezultatul net al <strong>in</strong>vestitiilor <strong>in</strong><br />

astfel <strong>de</strong> <strong>in</strong>strumente f<strong>in</strong>aciare <strong><strong>de</strong>rivate</strong>.<br />

Ca urmare a gradului ridicat <strong>de</strong> levier, <strong>in</strong>vestitorii pot observa imediat efectul pier<strong>de</strong>rilor rezultate<br />

d<strong>in</strong> pozitiile <strong>de</strong>schise cu contracte futures. Castigurile si pier<strong>de</strong>rile rezultate d<strong>in</strong> tranzactionarea<br />

contractelor futures sunt <strong>in</strong>registrate cel put<strong>in</strong> zilnic <strong>in</strong> contul <strong>in</strong> marja al <strong>in</strong>vestitorului <strong>de</strong>schis la<br />

<strong>in</strong>termediar. In cazul <strong>in</strong> care creste expunerea corespunzatoare pozitiilor <strong>de</strong>schise <strong>de</strong>t<strong>in</strong>ute, este posibil sa<br />

fie necesara <strong>de</strong>punerea <strong>de</strong> garantii suplimentare (colateral) <strong>in</strong> contul <strong>in</strong> marja, <strong>in</strong> caz contrar existand riscul<br />

ca pozitiile <strong>de</strong>schise sa fie <strong>in</strong>chise fortat, chiar si <strong>in</strong> pier<strong>de</strong>re. In astfel <strong>de</strong> circumstante, <strong>in</strong>vestitorul respectiv<br />

ramane responsabil pentru acoperirea <strong>de</strong>ficitului existent <strong>in</strong> contul <strong>in</strong> marja.<br />

Tranzactiile cu contracte futures prez<strong>in</strong>ta un grad ridicat <strong>de</strong> risc ca urmare a faptului ca se poate<br />

<strong>in</strong>registra o pier<strong>de</strong>re foarte mare <strong>de</strong> bani <strong>in</strong>tr-o perioada <strong>de</strong> timp foarte scurta. Ca urmare al efectului<br />

<strong>de</strong> levier specific contractelor futures, pier<strong>de</strong>rea suferita <strong>de</strong> un <strong>in</strong>vestitor poate sa fie teoretic „nelimitata”,<br />

<strong>de</strong>pas<strong>in</strong>d <strong>in</strong> mod semnificativ marja <strong>de</strong>pusa <strong>in</strong>itial pentru <strong>in</strong>cadrarea <strong>in</strong> necesarul <strong>de</strong> marja.<br />

Cuantumul marjei <strong>in</strong>itiale este relativ mic comparativ cu valoarea notionala a contractului futures,<br />

astfel <strong>in</strong>cat, cu o suma <strong>de</strong> bani redusa, se pot <strong>de</strong>schi<strong>de</strong> pozitii cu aceste contracte. O modificare relativ<br />

m<strong>in</strong>ora a pretului <strong>in</strong> piata, <strong>in</strong> cazul <strong>in</strong> care este <strong>in</strong> directia <strong>de</strong>favorabila <strong>in</strong>vestitorului, poate genera o<br />

pier<strong>de</strong>re <strong>in</strong> cuantum egal sau mai mare <strong>de</strong>cat marja <strong>de</strong>pusa <strong>in</strong>itial, fi<strong>in</strong>d necesara <strong>de</strong>punerea unor fonduri<br />

suplimentare pentru ment<strong>in</strong>erea pozitiei <strong>de</strong>schise respective.<br />

In situatii speciale, cum ar fi cresterea semnificativa a volatilitatii pietei, exista posibilitatea ca nivelul<br />

marjelor stabilite pentru contractele futures sa fie majorat <strong>de</strong> catre casa <strong>de</strong> compensare/contrapartea<br />

centrala, crescand astfel probabilitatea ca <strong>in</strong>vestitorul sa primeasca <strong>in</strong> mod neprevazut un apel <strong>in</strong> marja<br />

pentru <strong>de</strong>punerea <strong>de</strong> fonduri suplimentare.<br />

In cazul <strong>in</strong> care un <strong>in</strong>vestitor nu raspun<strong>de</strong> la un apel <strong>in</strong> marja sau nu dispune <strong>de</strong> resursele necesare pentru<br />

suplimentarea contului <strong>in</strong> marja <strong>in</strong> termenul stabilit <strong>in</strong> contract, exista riscul ca pozitiile acestuia sa fie<br />

lichidate fortat <strong>de</strong> catre <strong>in</strong>termediarul la care a <strong>de</strong>schis cont sau chiar <strong>de</strong> catre casa <strong>de</strong><br />

compensare/contrapartea centrala.<br />

20

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

III. Tranzactionarea contractelor futures la BVB<br />

1. Cum se tranzactioneaza contractele futures la BVB ?<br />

In cazul tranzactiilor <strong>in</strong>cheiate <strong>in</strong> cadrul pietei la ve<strong>de</strong>re (Piata Spot), cumparatorii au obligatia <strong>de</strong> a achita<br />

<strong>in</strong>tegral contravaloarea <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong>in</strong> maximum trei zile lucratoare <strong>de</strong> la data <strong>in</strong>cheierii<br />

tranzactiei (data <strong>de</strong>contarii).<br />

In ceea ce priveste tranzactionarea pe piata reglementata la termen adm<strong>in</strong>istrata <strong>de</strong> BVB (Piata<br />

Derivatelor), atat cumparatorul cat si vanzatorul contractelor futures au obligatia <strong>de</strong> a <strong>de</strong>pune doar o<br />

anumita parte d<strong>in</strong> valoarea contractului futures. Aceasta suma este <strong>de</strong>numita „marja” si reprez<strong>in</strong>ta garantia<br />

f<strong>in</strong>anciara pe care atat cumparatorul, cat si vanzatorul trebuie sa o <strong>de</strong>puna <strong>in</strong> contul <strong>in</strong>termediarului<br />

(membrului compensator) <strong>in</strong>a<strong>in</strong>te <strong>de</strong> <strong>in</strong>itierea pozitiei.<br />

Rolul acestei marje este <strong>de</strong> asigurare a casei <strong>de</strong> compensare <strong>in</strong> calitate <strong>de</strong> contraparte centrala ca exista<br />

fonduri suficiente pentru acoperirea pier<strong>de</strong>rii acumulate, <strong>in</strong> cazul <strong>in</strong> care pretul <strong>in</strong> piata urmeaza un trend<br />

contrar asteptarilor. Evolutia preturilor <strong>in</strong>fluenteaza nivelul marjei <strong>de</strong>puse la <strong>in</strong>itierea pozitiei, astfel <strong>in</strong>cat<br />

contractele futures cu o volatilitate mare a pretului vor avea o marja <strong>in</strong>itiala mai mare <strong>de</strong>cat cele cu o<br />

volatilitate mai mica.<br />

Aceasta <strong>in</strong>seamna ca pentru <strong>de</strong>schi<strong>de</strong>rea unei pozitii cu contracte futures (Long sau Short) este necesara<br />

<strong>de</strong>punerea unei sume <strong>de</strong> bani mai mici <strong>de</strong>cat <strong>in</strong> cazul achizitionarii activului suport corespunzator (<strong>in</strong>tre 5-<br />

20% <strong>in</strong> functie <strong>de</strong> fiecare contract futures <strong>in</strong> parte).<br />

Nota:<br />

Cumparatorul unui contract futures care actioneaza <strong>in</strong> calitate <strong>de</strong> speculator mizeaza pe obt<strong>in</strong>erea <strong>de</strong> profit<br />

d<strong>in</strong> cresterea pretului activului suport, <strong>in</strong> timp ce vanzatorul se asteapta ca pretul sa scada pentru a obt<strong>in</strong>e<br />

profit, astfel <strong>in</strong>cat la data sca<strong>de</strong>ntei sau la <strong>in</strong>chi<strong>de</strong>rea pozitiei sa castige d<strong>in</strong> diferenta <strong>in</strong>registrata.<br />

In ve<strong>de</strong>rea <strong>in</strong>itierii unei pozitii cu contracte futures, (Long sau Short), trebuie <strong>de</strong>pusa marja sub forma <strong>de</strong><br />

fonduri banesti <strong>in</strong> contul <strong>in</strong> marja <strong>de</strong>schis la <strong>in</strong>termediarul cu care se <strong>in</strong>cheie contract <strong>de</strong> <strong>in</strong>termediere si<br />

care <strong>de</strong>t<strong>in</strong>e calitatea <strong>de</strong> membru compensator la Casa <strong>de</strong> Compensare Bucuresti (CCB). Intermediarul va<br />

<strong>de</strong>pune la CCB marja corespunzatoare conturilor <strong>in</strong> marja ale clientilor, <strong>in</strong> cuantumul solicitat <strong>de</strong> CCB <strong>in</strong><br />

relatia cu membrii compensatori.<br />

Managementul riscului utilizat <strong>de</strong> Casa <strong>de</strong> Compensare Bucuresti are la baza <strong>de</strong>punerea acestei marje<br />

(marja <strong>in</strong>itiala) si ment<strong>in</strong>erea <strong>in</strong> contul <strong>in</strong> marja a unui anumit nivel al acesteia (marja <strong>de</strong> ment<strong>in</strong>ere)<br />

pana la momentul <strong>in</strong>chi<strong>de</strong>rii pozitiei (executarea unei tranzactii <strong>de</strong> sens contrar pe acelasi contract si<br />

sca<strong>de</strong>nta, pentru acelasi numar <strong>de</strong> contracte cu cele tranzactionate <strong>in</strong>itial) sau pana la data sca<strong>de</strong>ntei, cand<br />

CCB <strong>in</strong>chi<strong>de</strong> la sca<strong>de</strong>nta toate pozitiile ramase <strong>de</strong>schise.<br />

Pentru a m<strong>in</strong>imiza riscul la care este expusa CCB ca urmare a <strong>in</strong>terpunerii <strong>in</strong>tre membrul compensator<br />

cumparator si membrul compensator vanzator pana la momentul <strong>in</strong>chi<strong>de</strong>rii pozitiei/sca<strong>de</strong>ntei, risc care este<br />

generat <strong>de</strong> pier<strong>de</strong>rile <strong>in</strong>registrate d<strong>in</strong> evolutia preturilor, CCB efectueaza marcarea la piata, proces pr<strong>in</strong> care<br />

sunt reevaluate la pretul <strong>de</strong> cotare pozitiile <strong>de</strong>schise.<br />

21

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Marcarea la piata se efectueaza <strong>in</strong> timp real <strong>in</strong> timpul sed<strong>in</strong>tei <strong>de</strong> tranzactionare pe baza tranzactiilor cu<br />

contracte futures <strong>in</strong>cheiate <strong>in</strong> Piata Derivatelor, pentru fiecare serie / luna <strong>de</strong> sca<strong>de</strong>nta. De asemenea, <strong>in</strong><br />

ve<strong>de</strong>rea profitului sau pier<strong>de</strong>rii zilnice care fac obiectul <strong>de</strong>contarii zilnice sau f<strong>in</strong>ale (la sca<strong>de</strong>nta), se<br />

utilizeaza marcarea la piata pe baza pretului zilnic sau f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare <strong>de</strong>term<strong>in</strong>at <strong>de</strong> BVB dupa<br />

<strong>in</strong>chi<strong>de</strong>rea sed<strong>in</strong>tei <strong>de</strong> tranzactionare, <strong>in</strong> conformitate cu specificatiile <strong>de</strong> contract.<br />

Detalii suplimentare referitoare la <strong>de</strong>term<strong>in</strong>area pretului zilnic / f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare se regasesc <strong>in</strong><br />

specificatiile contractelor publicate pe site-ul www.bvb.ro, sectiunea Reglementari.<br />

Exemplu:<br />

Presupunem ca un <strong>in</strong>vestitor anticipeaza o crestere a preturilor actiunilor societatilor <strong>de</strong> <strong>in</strong>vestitii f<strong>in</strong>anciare<br />

cupr<strong>in</strong>se <strong>in</strong> cosul <strong>in</strong>dicelui BET-FI ® , calculat <strong>de</strong> BVB. Avand <strong>in</strong> ve<strong>de</strong>re ca pentru a achizitiona titluri pe<br />

piata la ve<strong>de</strong>re <strong>in</strong>vestitorul trebuie sa plateasca <strong>in</strong>tegral contravaloarea actiunilor cumparate, acesta <strong>de</strong>ci<strong>de</strong><br />

sa cumpere un contract futures avand ca suport activ <strong>in</strong>dicele BET-FI ® .<br />

Pentru <strong>in</strong>itierea pozitiei long pentru contractul futures care are sca<strong>de</strong>nta <strong>in</strong> luna <strong>de</strong>cembrie 2008 (simbol:<br />

BFX08DEC), <strong>in</strong>vestitorul trebuie sa <strong>de</strong>puna <strong>in</strong> contul <strong>in</strong>termediarului (membrului compensator) suma <strong>de</strong><br />

bani corespunzatoare marjei <strong>in</strong>itiale. Se consi<strong>de</strong>ra ca marja <strong>in</strong>itiala stabilita si solicitata <strong>de</strong> catre membrul<br />

compensator clientului este egala cu cea solicitata <strong>de</strong> Casa <strong>de</strong> Compensare Bucuresti (CCB), respectiv 450<br />

lei / contract.<br />