introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

respectiv. Marcarea la piata a <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> este efectuata cel put<strong>in</strong> zilnic <strong>in</strong> ve<strong>de</strong>rea<br />

efectuarii <strong>de</strong>contarii zilnice a profiturilor/pier<strong>de</strong>rilor <strong>in</strong>registrate <strong>in</strong> urma acestei evaluari.<br />

Suplimentar fata <strong>de</strong> marcarea la piata zilnica, Casa <strong>de</strong> Compensare Bucuresti efectueaza marcarea la piata<br />

<strong>in</strong> timp real, respectiv reevaluarea pozitiilor <strong>de</strong>schise dupa <strong>in</strong>cheierea fiecarei tranzactii <strong>in</strong> piata <strong>in</strong> ve<strong>de</strong>rea<br />

<strong>de</strong>term<strong>in</strong>arii rezultatului acumulat <strong>in</strong> timpul sed<strong>in</strong>tei <strong>de</strong> tranzactionare respectiva.<br />

Drepturile si obligatiile rezultate <strong>in</strong> urma marcarii la piata sunt st<strong>in</strong>se <strong>de</strong> catre Casa <strong>de</strong> Compensare<br />

Bucuresti pr<strong>in</strong> <strong>in</strong>termediul procesului <strong>de</strong> <strong>de</strong>contare, dupa cum urmeaza:<br />

Decontarea zilnica presupune st<strong>in</strong>gerea drepturilor si obligatiilor banesti rezultate d<strong>in</strong> marcarea la<br />

piata a pozitiei <strong>de</strong>schise la pretul zilnic <strong>de</strong> <strong>de</strong>contare al <strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat;<br />

Decontarea f<strong>in</strong>ala presupune st<strong>in</strong>gerea drepturilor si obligatiilor banesti rezultate d<strong>in</strong> marcarea la<br />

piata a pozitiei <strong>de</strong>schise la pretul f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare al <strong>in</strong>strumentului f<strong>in</strong>anciar <strong>de</strong>rivat.<br />

Pretul zilnic <strong>de</strong> <strong>de</strong>contare si pretul f<strong>in</strong>al <strong>de</strong> <strong>de</strong>contare reflecta nivelul curent al preturilor <strong>in</strong> piata si sunt<br />

<strong>de</strong>term<strong>in</strong>ate <strong>de</strong> catre piata bursiera respectiva (ex.: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti), <strong>in</strong> conformitate cu<br />

specificatiile contractului futures <strong>in</strong>registrate la autoritatea <strong>de</strong> reglementare si supraveghere (ex.: Comisia<br />

Nationala a Valorilor Mobiliare).<br />

Exemplu:<br />

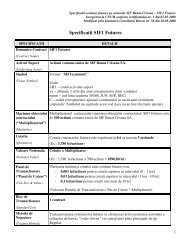

Presupunem ca <strong>in</strong> cadrul Pietei Derivatelor adm<strong>in</strong>istrate <strong>de</strong> <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti se tranzactioneaza un<br />

contract futures avand drept activ suport actiunile emise <strong>de</strong> societatea ABC (ABC Futures). Marimea<br />

obiectului contractului (multiplicatorul) este <strong>de</strong> 100 actiuni. Un <strong>in</strong>vestitor <strong>in</strong>cheie doua tranzactii cu<br />

contracte futures, dupa cum urmeaza:<br />

Cumparare: 1 contract la pretul <strong>de</strong> 150 lei/actiune (T1);<br />

Vanzare: 5 contracte la pretul <strong>de</strong> 155 lei/actiune (T2)<br />

Pozitia neta a <strong>in</strong>vestitorului dupa executarea celor doua tranzactii este short:<br />

NET (Short) = 1 – 5 = - 4 contracte<br />

De asemenea, <strong>in</strong> Piata Derivatelor se <strong>in</strong>cheie si alte tranzactii <strong>de</strong> catre alti participanti <strong>in</strong> baza carora se<br />

<strong>de</strong>term<strong>in</strong>a pretul zilnic <strong>de</strong> <strong>de</strong>contare <strong>de</strong> 160 lei/actiune pentru sed<strong>in</strong>ta <strong>de</strong> tranzactionare respectiva.<br />

Determ<strong>in</strong>area diferentelor banesti favorabile sau nefavorabile (profit / pier<strong>de</strong>re) se poate efectua pr<strong>in</strong><br />

marcarea la piata <strong>in</strong> doua modalitati:<br />

Varianta 1: pr<strong>in</strong> marcarea la piata a fiecarei tranzactii <strong>in</strong> parte (T1 si T2);<br />

Varianta 2: pr<strong>in</strong> compensarea <strong>valori</strong>i notionale a contractelor futures tranzactionate si marcarea la<br />

piata a pozitiei <strong>de</strong>schise nete existente la f<strong>in</strong>ele sed<strong>in</strong>tei <strong>de</strong> tranzactionare, utilizand urmatorii<br />

parametri:<br />

18