introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

Burse <strong>de</strong> Marfuri si Derivate: entitati specializate <strong>in</strong> <strong>de</strong>zvoltarea <strong>de</strong> <strong>in</strong>strumente f<strong>in</strong>anciare<br />

<strong><strong>de</strong>rivate</strong> si a mecanismelor <strong>de</strong> piata necesare tranzactionarii <strong>in</strong>strumentelor respective <strong>in</strong> cadrul<br />

pietei reglementate la termen.<br />

Exemplu: Chicago Board of Tra<strong>de</strong> (CBOT), Chicago Mercantile Exchange (CME), Chicago<br />

Board of Options Exchange (CBOE), Eurex Exchange.<br />

Burse <strong>de</strong> Valori: entitati specializate <strong>in</strong> crearea mecanismelor <strong>de</strong> piata necesare tranzactionarii<br />

<strong>in</strong>strumentelor f<strong>in</strong>anciare atat <strong>in</strong> Piata Spot cat si <strong>in</strong> Piata Derivatelor, astfel:<br />

piete reglementate la ve<strong>de</strong>re (ex.: actiuni, obligatiuni, drepturi);<br />

piete reglementate la termen (ex.: contracte futures / options).<br />

Exemplu: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti, Wiener Börse, NYSE Euronext.<br />

In mod traditional, <strong>in</strong>strumentele f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> au fost tranzactionate <strong>de</strong> catre brokeri <strong>in</strong> cadrul<br />

unui r<strong>in</strong>g bursier pr<strong>in</strong> <strong>in</strong>termediul unui mecanism <strong>de</strong> negociere avand la baza negocierea directa si<br />

utilizarea unui set standard si complex <strong>de</strong> semnale vocale si ale ma<strong>in</strong>ii <strong>de</strong>numit „licitatie cu strigare”<br />

(open outcry system).<br />

Odata cu trecerea timpului, precum si ca urmare a progreselor <strong>in</strong>registrate <strong>in</strong> domeniul tehnologiei<br />

<strong>in</strong>formationale, mecanismele <strong>de</strong> tranzactionare ale <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> au evoluat <strong>de</strong> la<br />

sistemul „licitatiei cu strigare” la „tranzactionarea electronica” (electronic trad<strong>in</strong>g). In prezent, aproape<br />

toate bursele d<strong>in</strong> lume utilizeaza platforme electronice performante, r<strong>in</strong>gurile <strong>de</strong> tranzactionare <strong>in</strong>trand<br />

astfel <strong>in</strong> istoria mo<strong>de</strong>rna a pietelor bursiere.<br />

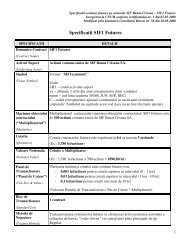

In cadrul pietelor bursiere se tranzactioneaza <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> standardizate <strong>in</strong> ceea ce<br />

priveste elementele caracteristice, <strong>de</strong>numite „specificatii <strong>de</strong> contract”. Participantii autorizati la piata<br />

bursiera sunt <strong>in</strong>termediarii care <strong>de</strong>t<strong>in</strong> dreptul <strong>de</strong> a <strong>in</strong>cheia tranzactii <strong>in</strong> nume propriu sau <strong>in</strong> numele<br />

clientilor, cum ar fi <strong>in</strong>vestitori <strong>in</strong>stitutionali (banci comerciale, fonduri mutuale sau <strong>de</strong> pensii, societati<br />

<strong>de</strong> asigurari, corporatii) sau <strong>in</strong>vestitori <strong>de</strong> retail (persoane fizice).<br />

Avantajele pr<strong>in</strong>cipale ale tranzactionarii <strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> <strong>in</strong> cadrul unei piete bursiere<br />

sunt urmatoarele:<br />

Transparenta pietei:<br />

pretul contractelor futures este „<strong>de</strong>scoperit” pr<strong>in</strong> utilizarea unui registru <strong>de</strong> ord<strong>in</strong>e centralizat<br />

<strong>in</strong> care ord<strong>in</strong>ele <strong>de</strong> cumparare si vanzare sunt <strong>in</strong>troduse <strong>de</strong> catre <strong>in</strong>termediari <strong>in</strong> nume propriu<br />

sau al clientilor, fi<strong>in</strong>d executate <strong>in</strong> functie <strong>de</strong> criteriul pret si timp;<br />

statisticile <strong>de</strong> piata cu privire la tranzactiile <strong>in</strong>cheiate (pret, valoare, volum, pozitii <strong>de</strong>schise)<br />

sunt disponibile publicului larg.<br />

Lichiditatea pietei:<br />

Pozitiile <strong>de</strong>schise (Long/Short) cu <strong>in</strong>strumente f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong> pot fi <strong>de</strong>schise si <strong>in</strong>chise cu<br />

usur<strong>in</strong>ta datorita atragerii unui numar mare <strong>de</strong> participanti <strong>in</strong>tr-un cadru <strong>de</strong> negociere centralizat<br />

si formalizat.<br />

6