introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

introducere in instrumente financiare derivate - Bursa de valori ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SC <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti SA<br />

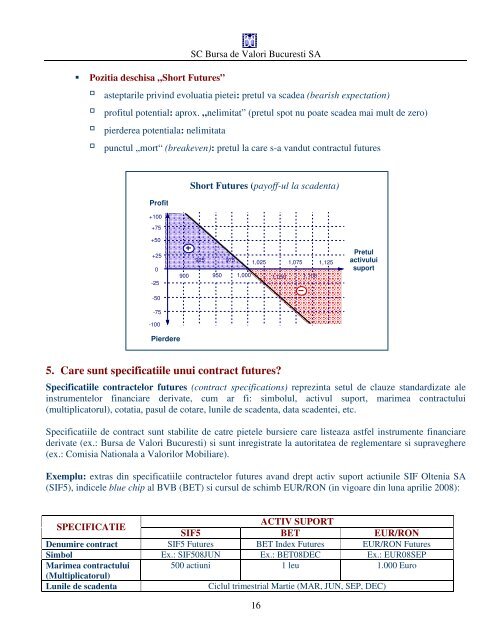

Pozitia <strong>de</strong>schisa „Short Futures”<br />

asteptarile priv<strong>in</strong>d evoluatia pietei: pretul va sca<strong>de</strong>a (bearish expectation)<br />

profitul potential: aprox. „nelimitat” (pretul spot nu poate sca<strong>de</strong>a mai mult <strong>de</strong> zero)<br />

pier<strong>de</strong>rea potentiala: nelimitata<br />

punctul „mort“ (breakeven): pretul la care s-a vandut contractul futures<br />

Profit<br />

+100<br />

+75<br />

+50<br />

Short Futures (payoff-ul la sca<strong>de</strong>nta)<br />

+25<br />

0<br />

-25<br />

900<br />

925<br />

950<br />

975 1,025 1,075 1,125<br />

1,000 1,050 1,100<br />

Pretul<br />

activului<br />

suport<br />

-50<br />

-75<br />

-100<br />

Pier<strong>de</strong>re<br />

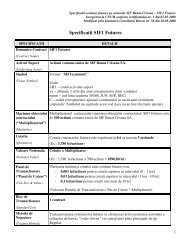

5. Care sunt specificatiile unui contract futures?<br />

Specificatiile contractelor futures (contract specifications) reprez<strong>in</strong>ta setul <strong>de</strong> clauze standardizate ale<br />

<strong>in</strong>strumentelor f<strong>in</strong>anciare <strong><strong>de</strong>rivate</strong>, cum ar fi: simbolul, activul suport, marimea contractului<br />

(multiplicatorul), cotatia, pasul <strong>de</strong> cotare, lunile <strong>de</strong> sca<strong>de</strong>nta, data sca<strong>de</strong>ntei, etc.<br />

Specificatiile <strong>de</strong> contract sunt stabilite <strong>de</strong> catre pietele bursiere care listeaza astfel <strong>in</strong>strumente f<strong>in</strong>anciare<br />

<strong><strong>de</strong>rivate</strong> (ex.: <strong>Bursa</strong> <strong>de</strong> Valori Bucuresti) si sunt <strong>in</strong>registrate la autoritatea <strong>de</strong> reglementare si supraveghere<br />

(ex.: Comisia Nationala a Valorilor Mobiliare).<br />

Exemplu: extras d<strong>in</strong> specificatiile contractelor futures avand drept activ suport actiunile SIF Oltenia SA<br />

(SIF5), <strong>in</strong>dicele blue chip al BVB (BET) si cursul <strong>de</strong> schimb EUR/RON (<strong>in</strong> vigoare d<strong>in</strong> luna aprilie 2008):<br />

SPECIFICATIE<br />

ACTIV SUPORT<br />

SIF5 BET EUR/RON<br />

Denumire contract SIF5 Futures BET In<strong>de</strong>x Futures EUR/RON Futures<br />

Simbol Ex.: SIF508JUN Ex.: BET08DEC Ex.: EUR08SEP<br />

Marimea contractului 500 actiuni 1 leu 1.000 Euro<br />

(Multiplicatorul)<br />

Lunile <strong>de</strong> sca<strong>de</strong>nta<br />

Ciclul trimestrial Martie (MAR, JUN, SEP, DEC)<br />

16