power of love - Hong Kong Institute of Certified Public Accountants

power of love - Hong Kong Institute of Certified Public Accountants

power of love - Hong Kong Institute of Certified Public Accountants

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Issue 2 volume 9 February 2013<br />

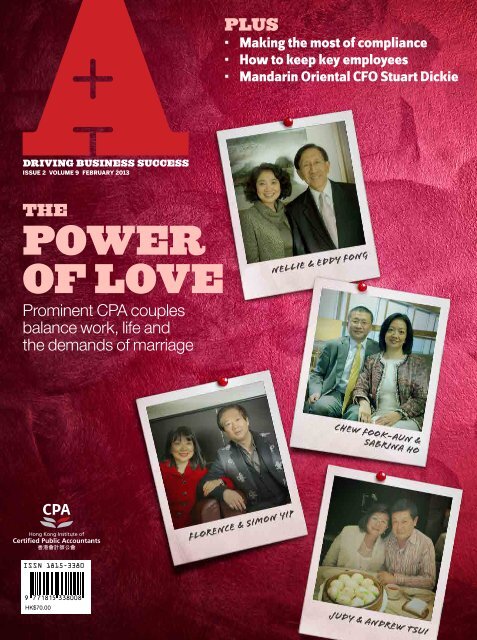

THE<br />

POWER<br />

OF LOVE<br />

Prominent CPA couples<br />

balance work, life and<br />

the demands <strong>of</strong> marriage<br />

HK$70.00<br />

PLUS<br />

• Making the most <strong>of</strong> compliance<br />

• How to keep key employees<br />

• Mandarin Oriental CFO Stuart Dickie

CE<br />

ISSUE 02 VOLUME 09 FEBRUARY 2013<br />

REGULARS<br />

01 President’s message<br />

04 <strong>Institute</strong> news<br />

06 International news<br />

10 Greater China news<br />

FEATURES<br />

14 From burden to benefit<br />

Craig Stephen finds out how compliance can actually help a<br />

company's stakeholders, customers and bottom line<br />

18 Meet the Council<br />

The <strong>Institute</strong>’s president, vice-presidents and immediate past<br />

president present their visions for the <strong>Institute</strong>’s future<br />

22 Crunching the numbers<br />

Accounting technology is rapidly changing. George W. Russell<br />

reports on new developments in hardware and s<strong>of</strong>tware<br />

28 Success ingredient<br />

Robin Lynam pr<strong>of</strong>iles Stuart Dickie, CFO <strong>of</strong> Mandarin Oriental,<br />

amid the iconic surroundings <strong>of</strong> the company’s flagship hotel<br />

34 Keeping talent<br />

George W. Russell finds out how accounting firms can hold on<br />

to their key talent and nurture younger recruits<br />

38 Love actually<br />

Jemelyn Yadao meets four <strong>Institute</strong> member couples who have<br />

stood together through good times as well as tough decisions<br />

SOURCE<br />

44 China finance<br />

Liu Yuting looks at enterprise financial management innovations<br />

46 Forensic accounting<br />

Katy Wong explains how data analytics can fight against fraud<br />

48 TechWatch 123<br />

The latest standards and technical developments<br />

50 Tech Q&A<br />

Your questions about standards answered<br />

54 People on the move<br />

The latest pr<strong>of</strong>essional appointments from around the region<br />

55 Events<br />

A guide to forthcoming courses, workshops and member activities<br />

LIFESTYLE<br />

56 Business travel<br />

Honnus Cheung chronicles the captivating charms <strong>of</strong> Melbourne<br />

58 After hours<br />

Aloysius Tse on wine; Jemelyn Yadao on watches<br />

60 Let’s get fiscal<br />

Nury Vittachi sends the wrong message<br />

2 February 2013<br />

CONTENTS<br />

28

Your chop Your Logo<br />

PHOTO: JOAN BOIVIN<br />

About our name: A PLUS stands for excellence, a<br />

reference to our top-notch accountant members who<br />

are success ingredients in business and in society. It<br />

is also the quality that we strive for in this magazine —<br />

going an extra mile to reach beyond grade A.<br />

President: Susanna Chiu<br />

Email: president@hkicpa.org.hk<br />

Vice Presidents: Clement Chan, Mabel Chan<br />

Chief Executive and Registrar: Raphael Ding<br />

Email: ce@hkicpa.org.hk<br />

Deputy Director <strong>of</strong> Communications: Stella To<br />

Editorial Advisers: Daniel Lin, Clement Chan, K.M. Wong<br />

Editorial Manager: John So<br />

Editorial Coordinator: Maggie Tam<br />

OFFICE ADDRESS:<br />

37/F, Wu Chung House,213 Queen’s Road East,<br />

Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

Tel: +852-2287-7228 Fax: +852-2865-6603<br />

MEMBER AND STUDENT SERVICES COUNTER:<br />

27/F, Wu Chung House, 213 Queen’s Road East,<br />

Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

WEBSITE: www.hkicpa.org.hk<br />

EMAIL: hkicpa@hkicpa.org.hk<br />

M&L<br />

Editor: George W. Russell<br />

Managing Editor: Gerry Ho<br />

Email: gerry.ho@mandl.asia<br />

Copy Editors: Jemelyn Yadao<br />

Contributors: Robin Lynam, Craig Stephen<br />

Production Manager: Jasmine Hu<br />

Design Manager: Jennifer Chung<br />

Editorial Assistant: Lucid Wong<br />

EDITORIAL OFFICE:<br />

2/F, Wang Kee Building,<br />

252 Hennessy Road, Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

ADVERTISING ENQUIRIES:<br />

Advertising Director: Derek Tsang<br />

Email: derek.tsang@mandl.asia<br />

Tel: +852-2656-2676<br />

A PLUS is the <strong>of</strong>ficial magazine <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong><br />

<strong>Certified</strong> <strong>Public</strong> <strong>Accountants</strong>. The <strong>Institute</strong> retains copyright in<br />

all material published in the magazine. No part <strong>of</strong> this magazine<br />

may be reproduced without the permission <strong>of</strong> the <strong>Institute</strong>. The<br />

views expressed in the magazine are not necessarily shared<br />

by the <strong>Institute</strong> or the publisher. The <strong>Institute</strong>, the publisher<br />

and authors accept no responsibilities for loss resulting from<br />

any person acting, or refraining from acting, because <strong>of</strong> views<br />

expressed or advertisements appearing in the magazine.<br />

© <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong> <strong>Certified</strong> <strong>Public</strong> <strong>Accountants</strong><br />

February 2013. Print run: 5,870 copies<br />

Subscription: HK$760 for 12 issues per year.<br />

See www.hkicpa.org.hk/aplus for details.

<strong>Institute</strong> makes submission<br />

on <strong>Hong</strong> <strong>Kong</strong>’s budget<br />

In its 2013-14 budget proposals, the <strong>Institute</strong><br />

called on the government to <strong>of</strong>fer more help<br />

to families and to increase the city’s international<br />

competitiveness. According to the<br />

<strong>Institute</strong>’s submission, one <strong>of</strong> the main concerns<br />

<strong>of</strong> the city’s taxpayers is keeping up<br />

with rising costs.<br />

The proposal suggests a range <strong>of</strong> measures<br />

to help families and individuals, including<br />

widening the marginal tax bands from<br />

HK$40,000 to HK$50,000, increasing child<br />

allowances from HK$63,000 to HK$70,000,<br />

allowing deductions for voluntary Mandatory<br />

Provident Fund contributions with an annual<br />

cap <strong>of</strong> HK$60,000 and allowing deductions<br />

for private healthcare insurance premiums<br />

with an annual cap <strong>of</strong> HK$12,000.<br />

The <strong>Institute</strong> also advocated <strong>of</strong>fering a rental<br />

payment deduction as an alternative to the<br />

home loan interest deduction, adjusting the<br />

price thresholds <strong>of</strong> different stamp duty rates<br />

in line with property price inflation, providing<br />

a waiver on property rates <strong>of</strong> up to HK$2,500<br />

per quarter and introducing an electricity subsidy<br />

<strong>of</strong> HK$1,800 for the coming year.<br />

Disciplinary finding<br />

Au Ping-lam, CPA (Practising)<br />

Complaint: Failed or neglected to observe,<br />

maintain or otherwise apply <strong>Hong</strong> <strong>Kong</strong> Financial<br />

Reporting Standard for Private Entities<br />

and <strong>Hong</strong> <strong>Kong</strong> Standard on Auditing 500<br />

Audit Evidence during the audit <strong>of</strong> the financial<br />

statements <strong>of</strong> a private company in <strong>Hong</strong><br />

<strong>Kong</strong> for the year ended 31 March 2010. Au admitted<br />

the complaints.<br />

Decision: Au was reprimanded. He was<br />

ordered to pay the <strong>Institute</strong> a penalty <strong>of</strong><br />

HK$46,000 and costs <strong>of</strong> the disciplinary<br />

proceedings amounting to HK$59,882.<br />

Details <strong>of</strong> the disciplinary findings are available<br />

at the <strong>Institute</strong>’s website: www.hkicpa.org.hk.<br />

Obituary<br />

The <strong>Institute</strong> notes with regret the passing<br />

<strong>of</strong> Lee Yim-wan, Penny, Ng Yin-ping and Wu<br />

Ying-Keung, Frank.<br />

4 February 2013<br />

NEWS<br />

THE INSTITUTE<br />

IFRS Foundation Trustees<br />

get together in <strong>Hong</strong> <strong>Kong</strong><br />

Heavyweights from business, government and the<br />

pr<strong>of</strong>ession take stock <strong>of</strong> financial reporting agenda<br />

Along with the IFRS Foundation Trustees, who were in town to hold a meeting,<br />

the <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong> CPAs last month co-hosted an evening devoted to the<br />

future <strong>of</strong> financial reporting.<br />

The first event was a press conference featuring Michel Prada, chairman<br />

<strong>of</strong> the IFRS Foundation Trustees, Hans Hoogervorst, chairman <strong>of</strong> the International<br />

Accounting Standards Board, Ronald Arculli, an IFRS Foundation trustee<br />

representing <strong>Hong</strong> <strong>Kong</strong>, and Clement Chan, vice-president <strong>of</strong> the <strong>Institute</strong> and<br />

a managing director <strong>of</strong> BDO.<br />

Prada described <strong>Hong</strong> <strong>Kong</strong> as an “extremely important” venue for the trustee<br />

meetings because <strong>of</strong> its full adoption and full support <strong>of</strong> IFRS. He said the twoday<br />

visit included discussions about strategy, funding, the establishment <strong>of</strong> the<br />

Accounting Standards Advisory Forum and the operations <strong>of</strong> the IFRS Asia-Oceania<br />

<strong>of</strong>fice in Tokyo.<br />

Hoogervorst said the Asia-Pacific region was vital to the future <strong>of</strong> financial<br />

reporting. “It’s the happening place to be in terms <strong>of</strong> economic development and<br />

the avid adoption <strong>of</strong> our standards.”<br />

He said he remained optimistic that the United States – the last major holdout<br />

on IFRS – would eventually adopt the single set <strong>of</strong> international standards. However,<br />

he added, convergence with IFRS must pave the way. “We cannot have this<br />

bilateral relationship with the FASB. We are a mature full-grown organization<br />

with 100 members and they have to come first.”<br />

The IASB chairman said he expected IFRS to enter a “period <strong>of</strong> calm” following<br />

the issuance <strong>of</strong> a standard on revenue recognition, which would occur very<br />

soon. A leasing standard is in the process <strong>of</strong> exposure.<br />

The press conference was followed by an evening <strong>of</strong> discussion on “The future<br />

<strong>of</strong> global financial reporting.”<br />

<strong>Hong</strong> <strong>Kong</strong>’s financial secretary, John Tsang, welcomed delegates by noting<br />

that IFRS has long been associated with global financial stability. “However, the<br />

financial tsunami and related events <strong>of</strong> recent years have highlighted the difficulties<br />

<strong>of</strong> aligning different financial systems in our era <strong>of</strong> globalization,” he said.<br />

With the rapid diversification <strong>of</strong> business and integration <strong>of</strong> companies<br />

across different borders, a robust financial reporting regime has become a prerequisite<br />

for the healthy development <strong>of</strong> the global economy, Tsang noted.<br />

“To strengthen the regulatory framework for auditors, we are working with<br />

the <strong>Institute</strong> and the Financial Reporting Council on ways to further enhance<br />

the independence <strong>of</strong> <strong>Hong</strong> <strong>Kong</strong>’s auditor oversight regime,” Tsang said.<br />

Arthur Yuen, deputy chief executive <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> Monetary Authority,<br />

gave the keynote address, “The importance <strong>of</strong> IFRSs in promoting a healthy economic<br />

environment.”<br />

Yuen noted the increased risk aversion <strong>of</strong> investors since the global financial<br />

crisis began five years ago. “That was partly due to the insufficient and inconsistent<br />

disclosure <strong>of</strong> financial risk information by financial institutions,” he said.

From left: James Riley, Carlson Tong, Hans Hoogervorst, Clement Chan<br />

and Jennifer Hughes (moderator from the Financial Times)<br />

“Standardizing financial reporting standards<br />

at the global level can help investors to<br />

compare financial information across institutions<br />

and across jurisdictions.”<br />

The speeches were followed by a thoughtprovoking<br />

panel discussion on the subject<br />

<strong>of</strong> financial reporting in which Hoogervorst<br />

and Chan joined Carlson Tong, chairman <strong>of</strong><br />

the Securities and Futures Commission and<br />

an <strong>Institute</strong> past vice-president, and James<br />

Riley, group finance director <strong>of</strong> Jardine<br />

Matheson Holdings and an <strong>Institute</strong> fellow.<br />

Financial reporting must benefit all stakeholders,<br />

Tong told the panel. He said financial<br />

statements had become more difficult<br />

to decipher. “I’ve been an accountant for 37<br />

years and now I have no idea which page to<br />

turn to. We have to ask ourselves, what are<br />

accounts for?”<br />

Tong noted that global accounting stan-<br />

dards were far more uniform than any other<br />

comparable international regime, such<br />

as the supervision <strong>of</strong> the world’s financial<br />

institutions.<br />

Riley echoed the IASB viewpoint, saying<br />

he would prefer the U.S. to join IFRS,<br />

but added that he was concerned that convergence<br />

had meant the IASB had become<br />

too accommodating <strong>of</strong> the American model.<br />

“I’m worried that reaching a settlement with<br />

the U.S. would mean ticking 10,000 boxes,”<br />

he said. “The drift has been too much towards<br />

a compliance requirement approach.”<br />

Hoogervorst acknowledged that increasing<br />

regulatory burdens were making auditors<br />

more risk-averse, meaning that financial<br />

statements were clogged with unnecessary<br />

disclosures, hampering effective interpretations<br />

<strong>of</strong> corporate results. “We are actively<br />

engaging with auditors on how we can help<br />

A PLUS<br />

them use their judgment more,” he said.<br />

The panel also discussed increasingly<br />

complex auditors’ opinions. “As an auditor, I<br />

would like to give a very simple audit opinion<br />

based on the work that was done,” Chan<br />

said. “However, [it is not possible] given the<br />

different requirements that regulators impose,<br />

whether in different parts <strong>of</strong> the world<br />

or in different cases.”<br />

Chan added that he would like to see<br />

more communication between auditors and<br />

their regulators.<br />

The panel emphasized that the future <strong>of</strong><br />

financial reporting would involve accounts<br />

that were more intelligible to the various<br />

stakeholders, given the wider investment<br />

community. “Financial statements are important<br />

to anyone who entrusts their money<br />

to someone else,” said Hoogervorst. “Our audience<br />

is society at large.”<br />

February 2013 5

NEWS<br />

INTERNATIONAL<br />

Cameron calls for global crackdown<br />

on tax avoidance by businesses<br />

British PM warns against aggressively complex arrangements<br />

The British prime minister, David<br />

Cameron, called for global action<br />

on tax avoidance in his keynote<br />

speech at the World Economic<br />

Forum in Davos, Switzerland,<br />

last month. Cameron told world<br />

leaders that as the head <strong>of</strong> the G8<br />

group <strong>of</strong> the largest economies<br />

this year, the United Kingdom<br />

would continue to focus on corporate<br />

revenue dodgers.<br />

“Any businesses who think<br />

that they can carry on dodging<br />

that fair share or that they can<br />

keep on selling to the U.K. and<br />

setting up ever-more complex tax<br />

arrangements abroad to squeeze<br />

their tax bill right down – well,<br />

they need to wake up and smell<br />

the c<strong>of</strong>fee because the public who<br />

buy from them have had enough,”<br />

he said, adding that some forms<br />

<strong>of</strong> tax avoidance have become “so<br />

aggressive.”<br />

The speech comes after a<br />

British parliamentary commit-<br />

Google announced a jump in<br />

annual revenues after a strong<br />

fourth-quarter performance.<br />

The world’s largest Internet<br />

search engine company earned<br />

a net pr<strong>of</strong>it <strong>of</strong> US$2.89 billion<br />

in the final three months <strong>of</strong> last<br />

year, up 6.7 percent from the year<br />

earlier.<br />

The company reported fourthquarter<br />

revenue <strong>of</strong> US$14.42<br />

billion, up 36 percent from the<br />

same period the year before.<br />

6 February 2013<br />

“We ended 2012 with a<br />

strong quarter,” said Larry Page,<br />

Google’s c<strong>of</strong>ounder and chief<br />

executive. “We hit US$50 billion<br />

in revenues for the first time last<br />

year – not a bad achievement in<br />

just a decade and a half.”<br />

According to analysts, the<br />

company benefited from business<br />

growth in international<br />

markets. “Business looked really<br />

strong, especially from a pr<strong>of</strong>itability<br />

perspective. They really<br />

AFP<br />

David Cameron<br />

tee questioned executives from<br />

multinationals such as Amazon,<br />

Google and Starbucks in November<br />

2012 for paying little U.K. tax.<br />

Last year, Starbucks said it would<br />

voluntarily make tax payments<br />

<strong>of</strong> £20 million over the next two<br />

years after a Reuters investigation<br />

found that the company had not<br />

paid British corporation tax in the<br />

previous three years.<br />

Cameron’s “smell the c<strong>of</strong>fee”<br />

reference was widely regarded as<br />

a dig at Starbucks in particular,<br />

upsetting the American-owned<br />

beverage chain. “The PM is<br />

singling the business out for<br />

cheap shots,” the Daily Telegraph<br />

quoted an unnamed company<br />

source as saying.<br />

The House <strong>of</strong> Commons public<br />

accounts committee said last<br />

month it would hold a hearing at<br />

which senior tax specialists from<br />

PricewaterhouseCoopers, Ernst<br />

and Young, KPMG and Deloitte<br />

would answer questions over<br />

their roles in assisting big companies<br />

to minimize their tax bills.<br />

E&Y’s Mark Otty, managing<br />

partner for Europe, Middle East<br />

and Africa, told the Telegraph that<br />

companies have an “obligation”<br />

to their investors to pay the<br />

lowest tax possible. “The only<br />

way you can resolve this issue is<br />

through a legal code,” he said.<br />

grew their margins in the core<br />

business,” Sameet Sinha, an analyst<br />

at B. Riley Caris, told Reuters.<br />

“Most <strong>of</strong> that strength seems to<br />

be coming from international<br />

markets which grew revenues<br />

quite substantially: up 23 percent<br />

year over year, versus the 15 percent<br />

growth in the third quarter.”<br />

The revenue results pleased<br />

investors who had been concerned<br />

about a decline in digital<br />

ad sales following the increasing<br />

Apple’s shares<br />

slide 12 percent<br />

on poor results<br />

Shares in Apple fell 12 percent in<br />

a day as the technology company<br />

reported disappointing Mac and<br />

iPhone 5 sales. About US$50<br />

billion was wiped <strong>of</strong>f Apple’s<br />

market value on 24 January<br />

after it posted its slowest pr<strong>of</strong>it<br />

growth since 2003.<br />

Results from its first fiscal<br />

quarter caused Apple’s shares<br />

to fall to US$450, before<br />

recovering some <strong>of</strong> its losses,<br />

raising concerns over the<br />

company’s smartphone growth<br />

prospects. The shares had hit a<br />

high <strong>of</strong> US$702 in September<br />

2012.<br />

The released figures also<br />

indicated that pr<strong>of</strong>its had<br />

remained the same from a year<br />

earlier at US$13.1 billion, while<br />

revenue was US$54.5 billion,<br />

an increase <strong>of</strong> 18 percent from a<br />

year ago.<br />

Analysts had expected<br />

revenues <strong>of</strong> about US$55 billion.<br />

Google’s annual revenue hits US$50 billion in fourth-quarter surge<br />

AFP<br />

popularity <strong>of</strong> smaller screened<br />

smartphones.<br />

Google executives told analysts<br />

in a conference call that the<br />

company had focused on improving<br />

the average cost-per-click, a<br />

metric which indicates the price<br />

advertisers pay Google.<br />

The fourth-quarter figures<br />

include Motorola Mobility, which<br />

Google acquired in May 2012. The<br />

subsidiary had an operating loss <strong>of</strong><br />

US$353 million during the quarter.

Spain falls deeper into recession<br />

amid spending cuts, record jobless<br />

Rajoy plans stimulus measures to <strong>of</strong>fset weakening data<br />

Spain’s economic output fell by<br />

1.8 percent from a year earlier,<br />

according to data from the<br />

National Statistics <strong>Institute</strong>,<br />

indicating that the country’s<br />

recession had deepened in the<br />

fourth quarter.<br />

Gross domestic product<br />

fell 0.7 percent in the last<br />

three months <strong>of</strong> 2012 from the<br />

previous quarter, its steepest<br />

contraction in a year as government<br />

spending cuts and rising<br />

unemployment hit households.<br />

“These sharp falls [in GDP]<br />

leave a tough scenario for the<br />

first two quarters <strong>of</strong> this year.<br />

The question is how market<br />

improvements can s<strong>of</strong>ten the<br />

falls, but it’s still too early to<br />

tell,” Citigroup strategist José<br />

Luis Martínez told Reuters.<br />

On 30 January, the Spanish<br />

prime minister, Mariano Rajoy,<br />

responded to the weak data<br />

by telling parliament he was<br />

India expects<br />

resolution to<br />

Vodafone row<br />

India’s finance minister,<br />

Palaniappan Chidambaram, is<br />

confident that a US$2.6 billion<br />

dispute between the country’s<br />

tax <strong>of</strong>fice and Vodafone, the largest<br />

corporate investor in India,<br />

will be resolved as talks between<br />

the two sides continued.<br />

The stand-<strong>of</strong>f relates to<br />

Vodafone’s US$10.9 billion<br />

acquisition <strong>of</strong> <strong>Hong</strong> <strong>Kong</strong>-based<br />

Hutchison Whampoa’s India<br />

mobile business in 2007.<br />

“ I’m confident we will<br />

resolve [the Vodafone] issue,”<br />

Chidambaram told the Financial<br />

Times.<br />

In January 2012, India’s<br />

Supreme Court ruled that Vodafone,<br />

the British telecoms group,<br />

was not liable to pay any tax arising<br />

out <strong>of</strong> the acquisition.<br />

However, the Indian government<br />

reopened the case by<br />

amending tax laws to enable it to<br />

make retrospective tax claims.<br />

BP to make US$4.5 billion payout in criminal settlement for spill<br />

A judge in the United States<br />

approved an agreement by BP,<br />

the British oil giant, to pay US$4<br />

billion in a record criminal settlement<br />

related to the fatal Deepwater<br />

Horizon disaster in 2010.<br />

In November 2012, BP said<br />

it would pay the amount to the<br />

U.S. Department <strong>of</strong> Justice and<br />

pleaded guilty to 14 criminal<br />

charges, including those related<br />

to the deaths <strong>of</strong> 11 workers.<br />

Luke Keller, a vice-president<br />

AFP<br />

AFP<br />

Mariano Rajoy<br />

planning a package <strong>of</strong> stimulus<br />

measures, but vowed that Spain<br />

would stick to planned budget<br />

cuts. The package includes tax<br />

breaks for entrepreneurs.<br />

The data also revealed that<br />

unemployment reached 26<br />

percent <strong>of</strong> the workforce at<br />

the end <strong>of</strong> Rajoy’s first year in<br />

<strong>power</strong>, the highest rate since the<br />

<strong>of</strong> BP America, apologized to a<br />

federal court in New Orleans and<br />

the families <strong>of</strong> the dead, for its<br />

role in the accident. “Our guilty<br />

plea makes clear, BP understands<br />

and acknowledges its role in that<br />

tragedy, and … BP apologizes to<br />

all those injured and especially<br />

to the families <strong>of</strong> the lost <strong>love</strong>d<br />

ones,” he said. “BP is also sorry for<br />

the harm to the environment that<br />

resulted from the spill.”<br />

The company has been selling<br />

country returned to democracy<br />

in 1975.<br />

Spain’s economy fell into its<br />

second recession since 2009 at<br />

the end <strong>of</strong> 2011 because <strong>of</strong> the<br />

fallout from a burst property<br />

bubble.<br />

The government expects the<br />

economy to grow again before<br />

the end <strong>of</strong> 2013. Economy minister<br />

Luis de Guindos said that<br />

“the Spanish economy is able to<br />

grow in the second half <strong>of</strong> this<br />

year,” in a press conference at<br />

the World Economic Forum held<br />

in Switzerland last month.<br />

The government has pledged<br />

to lower the public deficit from<br />

the equivalent <strong>of</strong> 9.4 percent <strong>of</strong><br />

annual gross domestic product<br />

in 2011 to 6.3 percent in 2012,<br />

4.5 percent in 2013 and 2.8<br />

percent in 2014. But analysts say<br />

reaching those targets will be<br />

difficult in a period <strong>of</strong> declining<br />

economic activity.<br />

assets worth billions to raise money<br />

to settle all claims, reported<br />

BBC News. BP is expected to make<br />

a final payment <strong>of</strong> US$860 million<br />

into the US$20 billion Gulf<br />

<strong>of</strong> Mexico compensation fund by<br />

the end <strong>of</strong> the year.<br />

The criminal settlement,<br />

before federal judge Sarah<br />

Vance, includes payments <strong>of</strong><br />

nearly US$2.4 billion to be paid<br />

to the National Fish and Wildlife<br />

Foundation and US$350 million<br />

to the National Academy <strong>of</strong> Sciences<br />

over a period <strong>of</strong> five years.<br />

BP will also pay US$525 million<br />

to the Securities and Exchange<br />

Commission over three years.<br />

Other companies involved<br />

in the spill include rig owner<br />

Transocean and Halliburton,<br />

which provided cementing<br />

services.<br />

The disaster emitted more<br />

than 200 million gallons (757<br />

million litres) <strong>of</strong> oil into the sea.<br />

February 2013 7

Indian firms split over<br />

proposal to cap audits<br />

Indian accounting firms are divided over a<br />

clause in the Companies Bill that would cap<br />

the number <strong>of</strong> companies that can be audited<br />

by a single firm at 20. Big Four firms, which<br />

audit 55 percent <strong>of</strong> Indian public companies,<br />

want the scope <strong>of</strong> the provision to be restricted<br />

to public companies, while small and mid-tier<br />

firms favour the cap to be applied to all clients,<br />

India’s Business Standard newspaper reported.<br />

The lower house <strong>of</strong> parliament has passed the<br />

bill, while the upper house is likely to take up<br />

the bill for passage in the next session, which<br />

begins next month.<br />

Schroders gives KPMG<br />

mandate to audit books<br />

Asset manager Schroders has selected KPMG<br />

as its new auditor, ending a relationship with<br />

PricewaterhouseCoopers that lasted more<br />

than 50 years. Schroders paid PwC £3.1 million<br />

for audit and audit-related work plus another<br />

£1.6 million for unrelated work in 2011.<br />

KPMG won the mandate after a tender process<br />

that started last year.<br />

Australian, NZ bodies<br />

launch joint programme<br />

The <strong>Institute</strong> <strong>of</strong> Chartered <strong>Accountants</strong> in Australia<br />

and the New Zealand <strong>Institute</strong> <strong>of</strong> Chartered<br />

<strong>Accountants</strong> are set to launch their joint<br />

Chartered <strong>Accountants</strong> Programme this month,<br />

the ICAA’s monthly magazine reported. The<br />

new programme consists <strong>of</strong> five modules <strong>of</strong><br />

learning materials that are almost all common<br />

to both countries and a single set <strong>of</strong> requirements<br />

for mentored practical experience.<br />

Accounting graduates<br />

are sought after in U.S.<br />

An employment survey in the United States last<br />

month showed that 68 percent <strong>of</strong> the most recent<br />

accounting majors received job <strong>of</strong>fers — the<br />

highest percentage <strong>of</strong> any major nationwide.<br />

The National Association <strong>of</strong> Colleges and Employers<br />

report stated that the unemployment<br />

rate for accountants stood at just 4.1 percent at<br />

the end <strong>of</strong> 2012, the Salt Lake City Deseret News<br />

reported.<br />

8 February 2013<br />

NEWS<br />

INTERNATIONAL<br />

U.S. delays on IFRS to be<br />

expensive, says Hoogervorst<br />

Washington faces sidelining in future<br />

Hans Hoogervorst, the chairman <strong>of</strong> the International Accounting Standards<br />

Board, has warned the United States that its continued delays in moving to<br />

International Financial Reporting Standards will probably cost more than the<br />

eventual switch.<br />

The U.S. also risks losing much <strong>of</strong> its influence over global standard setting<br />

by not being a driving force for IFRS, Hoogervorst told securities analysts at a<br />

conference in New York on 10 January.<br />

Hoogervorst said investors are bearing huge costs for the process <strong>of</strong> trying to<br />

compare and contrast the financial performance <strong>of</strong> companies around the world<br />

using different standards. Those costs “are probably a lot bigger than the one-time<br />

conversion cost that an economy has to make when it converts” to IFRS, he said.<br />

The U.S. Securities and Exchange Commission has considered a move to IFRS<br />

for some years, but recently appeared to cool on the idea <strong>of</strong> making the change.<br />

SEC staff disappointed global rule-setters last year by issuing a final report on a<br />

switch to IFRS with no recommendation.<br />

Support for a switch has waned amid concerns about the costs and worries<br />

that IFRS allows more management judgment than highly detailed U.S.<br />

accounting rules. “I don’t see any signs <strong>of</strong> any imminent decisions in Washington,”<br />

Hoogervorst said.<br />

In November, the IASB proposed a new 12-member Accounting Standards<br />

Advisory Forum, expected to become an important source <strong>of</strong> input to<br />

international rules. Membership on the board requires a commitment to a single<br />

set <strong>of</strong> global accounting standards, which would leave out the U.S.<br />

Auditors face legal action over alleged<br />

failure to scrutinize troubled loans<br />

The United States Securities and Exchange Commission charged two KPMG<br />

employees with failing to uncover problems at a bank that later failed.<br />

It is the first time the commission has taken action against auditors in a case<br />

related to the global financial crisis.<br />

The two KPMG auditors, John J. Aesoph and Darren M. Bennett, failed to<br />

adequately scrutinize bad-loan reserves at TierOne Bank in Nebraska, the SEC said<br />

in an administrative proceeding. The action could result in the two auditors losing<br />

their right to audit public companies.<br />

TierOne hid millions <strong>of</strong> dollars in losses on troubled loans made during the<br />

height <strong>of</strong> the financial crisis before the bank eventually failed in 2010, according to<br />

the commission, which filed suit against three TierOne executives last year.<br />

The SEC case against the auditors, more than four years after the crisis, revives<br />

lingering questions about whether auditors did enough to prevent questionable<br />

practices and whether authorities have done enough to hold them to account.<br />

KPMG does not face any action in the TierOne case.

NEWS<br />

GREATER CHINA<br />

Economic rebound emerges despite<br />

13-year low for GDP growth<br />

Cautious analysts warn <strong>of</strong> slow improvement amid “headwinds”<br />

China showed signs <strong>of</strong> an economic<br />

rebound in the last three<br />

months <strong>of</strong> 2012, despite gross<br />

domestic product finishing at<br />

a 13-year low. GDP grew by 7.8<br />

percent last year, down from 9.3<br />

percent in 2011 and the lowest<br />

annual rate since 1999.<br />

However, with a pick-up in<br />

the fourth quarter showing yearon-year<br />

growth <strong>of</strong> 7.9 percent<br />

from 7.4 percent in the previous<br />

quarter, analysts believe a stronger<br />

performance is inevitable<br />

in 2013. “The overall national<br />

economic performance [has<br />

been] stabilized,” Ma Jiantang,<br />

commissioner for China’s National<br />

Bureau <strong>of</strong> Statistics, told<br />

reporters.<br />

The rebound, which breaks<br />

a streak <strong>of</strong> seven consecutive<br />

weaker quarters, was driven by<br />

state investment in infrastructure<br />

projects and efforts to get<br />

consumers and companies to<br />

Shares in China Vanke, the country’s<br />

biggest property developer<br />

by market value, rose sharply after<br />

the company announced plans to<br />

move its foreign currency B-shares<br />

to <strong>Hong</strong> <strong>Kong</strong> from Shenzhen.<br />

Vanke announced on 18<br />

January that it will convert its<br />

Shenzhen-listed B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong>-listed H-shares following<br />

the successful migration<br />

<strong>of</strong> shipping container company<br />

China International Marine<br />

10 February 2013<br />

Ma Jiantang<br />

spend, BBC News reported. The<br />

data were released as China’s<br />

newly installed leaders prepare<br />

to take charge <strong>of</strong> the country.<br />

“It is obvious that the slowdown<br />

in the Chinese economy<br />

has halted for the moment,” Fraser<br />

Howie, managing director <strong>of</strong><br />

fund manager CLSA in Singapore<br />

and co-author <strong>of</strong> the 2011 book<br />

Red Capitalism, told BBC News.<br />

Howie cautioned that the<br />

improvement will not be drastic,<br />

Containers Group’s B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong> in December 2012.<br />

Vanke will maintain its yuandenominated<br />

A-share listing.<br />

After the announcement, both<br />

Vanke’s yuan-denominated Ashares<br />

and its <strong>Hong</strong> <strong>Kong</strong> dollar<br />

B-shares surged by 10 percent,<br />

their highest prices in more than<br />

three years. The A-shares hit the<br />

top <strong>of</strong> the trading limit and closed<br />

at 11.13 yuan on the Shenzhen<br />

exchange while its B-shares<br />

adding that “one has to be mindful<br />

that any recovery will be<br />

limited in its scope, not least because<br />

<strong>of</strong> the various headwinds<br />

that China is facing.”<br />

China’s economy will grow<br />

8.5 percent this year with<br />

domestic demand driving the<br />

expansion, Shanghai Daily reported<br />

last month, citing a Bank<br />

<strong>of</strong> Communications forecast.<br />

The new leaders, who take<br />

charge next month, will have to<br />

find the right balance between<br />

trying to prevent the formation<br />

<strong>of</strong> a property bubble and keeping<br />

a healthy growth rate going, according<br />

to Howie.<br />

The slowdown in annual<br />

growth last year came as China<br />

had to deal with weakness in the<br />

global economy, particularly its<br />

key export markets <strong>of</strong> the United<br />

States and the European Union,<br />

and as the government took measures<br />

to cool the property market.<br />

China Vanke’s shares soar on <strong>Hong</strong> <strong>Kong</strong> plan<br />

AFP<br />

jumped to HK$13.75.<br />

If approved, the move <strong>of</strong> its<br />

foreign currency B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong> will widen Vanke’s<br />

access to global investors, giving<br />

the company entry to an exchange<br />

where the daily trading<br />

value is more than 100 times<br />

higher, Bloomberg reported.<br />

“The move will help Vanke access<br />

more resources in the long run,”<br />

Jinsong Du, a property analyst at<br />

Credit Suisse, told Bloomberg.<br />

Huawei pr<strong>of</strong>it<br />

rises in line<br />

with forecasts<br />

Huawei, the Chinese telecoms<br />

equipment manufacturer,<br />

said that its net pr<strong>of</strong>it grew 33<br />

percent to 15.4 billion yuan last<br />

year, in line with its forecast<br />

earlier last month.<br />

The company, which has<br />

been trying to tap into the smartphone<br />

market, said it made huge<br />

breakthroughs in selling the<br />

devices in Japan, North America,<br />

Europe and other markets in<br />

2012.<br />

Revenue last year increased<br />

by 8 percent to 220.2 billion<br />

yuan, the company added. For<br />

2013, the firm expects its overall<br />

revenue to grow between 10 and<br />

12 percent.<br />

Despite the improvement,<br />

“smartphone penetration is still<br />

way too low and there is a lot<br />

<strong>of</strong> room for growth,” BBC News<br />

quoted Cathy Meng, Huawei’s<br />

chief financial <strong>of</strong>ficer and<br />

daughter <strong>of</strong> company founder<br />

Ren Zhengfei, as saying.<br />

Huawei recently pledged to<br />

start publishing more detailed<br />

financial information in order<br />

to dispel increased scrutiny by<br />

foreign governments.<br />

The company, along with<br />

rival ZTE, poses a national security<br />

threat to the United States, a<br />

U.S. congressional investigation<br />

concluded last year.<br />

Meanwhile, security concerns<br />

about Huawei’s links to the<br />

People’s Liberation Army led the<br />

Australian government to ban it<br />

from tendering for its national<br />

broadband network.

Companies ditch U.S. listings in wake<br />

<strong>of</strong> investigations, share price slumps<br />

Markets closer to home <strong>of</strong>fer better valuations, fewer headaches<br />

A record number <strong>of</strong> Chinese companies<br />

have pulled out <strong>of</strong> stock<br />

markets in the United States<br />

suggesting that they see fewer<br />

advantages in a U.S. listing.<br />

In 2012, 27 China-based<br />

companies with U.S. listings<br />

announced plans to go private,<br />

up from 16 in 2011, according to<br />

investment bank Roth Capital<br />

Partners, Reuters reported.<br />

Also, about 50 mainly small<br />

Chinese companies deregistered<br />

last year with the U.S. Securities<br />

and Exchange Commission,<br />

ending their requirements for<br />

going public. This is up from<br />

about 40 in 2011 and the most<br />

since around 1994.<br />

Experts cite the U.S. government<br />

investigations <strong>of</strong> financial<br />

reports and low share prices<br />

Maurice “Hank” Greenberg<br />

as diminishing many Chinese<br />

companies’ chances <strong>of</strong> raising<br />

new money in the U.S.<br />

“There’s very little in the way<br />

<strong>of</strong> new capital flows to those<br />

companies, their valuations are<br />

low and they’re encountering<br />

significant headwinds in terms <strong>of</strong><br />

FDI drops for the first time in three years<br />

Foreign direct investment flows<br />

into China fell last year – the<br />

first decline since 2009 – as the<br />

economy grew at its slowest pace<br />

in 13 years.<br />

Last year, total FDI into<br />

China stood at US$111.7 billion,<br />

3.7 percent lower than 2011,<br />

according to data released<br />

last month by the Ministry <strong>of</strong><br />

Commerce. Outbound Chinese<br />

direct investment, however, grew<br />

28.6 percent from a year earlier to<br />

a record US$77.2 billion.<br />

Analysts say that the drop in<br />

foreign investment is the result <strong>of</strong><br />

China’s overall slowing growth<br />

AFP<br />

and Europe’s ongoing debt crisis,<br />

Bloomberg reported.<br />

It is also spurred by China<br />

losing its competitive edge<br />

as a low-cost manufacturing<br />

base, making other investment<br />

destinations more attractive.<br />

“For 20 years China has<br />

been the major recipient <strong>of</strong><br />

foreign direct investment in<br />

the developing world but rising<br />

costs from higher wages and<br />

currency appreciation are seeing<br />

multinationals look to expand<br />

elsewhere,” Trinh Nguyen, an<br />

economist at HSBC in <strong>Hong</strong><br />

<strong>Kong</strong>, wrote in a recent report.<br />

regulatory oversight,” James Feltman,<br />

a senior managing director<br />

at Mesirow Financial Consulting<br />

in Chicago, told Reuters.<br />

Last month, a <strong>Hong</strong> <strong>Kong</strong> arbitration<br />

panel ruled that China<br />

MediaExpress Holdings, which<br />

obtained a U.S. stock listing<br />

without an initial public <strong>of</strong>fering<br />

by buying a listed company, was<br />

a fraudulent enterprise, awarding<br />

US$77 million in damages to<br />

Starr International, a firm run by<br />

Maurice “Hank” Greenberg, the<br />

former chief executive <strong>of</strong>ficer <strong>of</strong><br />

American International Group.<br />

Greenberg sued the company<br />

as well as its auditor Deloitte<br />

Touche Tohmatsu in Delaware<br />

in 2011, claiming Starr was<br />

fraudulently induced into investing<br />

in the Chinese company.<br />

“India, Indonesia and Vietnam<br />

stand to benefit most as they<br />

have large labour forces and<br />

strong domestic markets.”<br />

Despite companies shifting<br />

to other countries, in a survey<br />

<strong>of</strong> about 300 members <strong>of</strong><br />

the American Chamber <strong>of</strong><br />

Commerce in China, 58 percent<br />

<strong>of</strong> respondents said that the<br />

Mainland remains in their top<br />

three investment priorities,<br />

up from 47 percent in 2011.<br />

However, only 20 percent said<br />

China was their top investment<br />

priority, compared with 31<br />

percent the year before.<br />

Alibaba founder<br />

set to quit as<br />

CEO<br />

The founder <strong>of</strong> Alibaba, the<br />

Mainland’s biggest e-commerce<br />

company, will step down as the<br />

firm’s chief executive.<br />

“Alibaba’s young people have<br />

better, more brilliant dreams<br />

than mine, and they are more<br />

capable <strong>of</strong> building a future<br />

that belongs to them,” Jack<br />

Ma, who founded the company<br />

14 years ago, said in a letter to<br />

employees. He added that “the<br />

Internet belongs to the young<br />

people.”<br />

Just days before the<br />

announcement was made, it<br />

was revealed that Alibaba was<br />

breaking up its business into 25<br />

units, led by different executives,<br />

to be more agile in responding to<br />

the market.<br />

Ma said he would appoint<br />

a successor and act only as an<br />

executive chairman from 10 May.<br />

Analysts believe that the<br />

next chief executive will need<br />

to ensure a smooth transition in<br />

the business model in order to be<br />

successful.<br />

“The biggest challenge a new<br />

chief executive <strong>of</strong>ficer faces is<br />

making sure the new business<br />

units can effectively coordinate<br />

among themselves,” Yang<br />

Xiao, a Beijing-based analyst<br />

with research firm Analysys<br />

International, told BBC News.<br />

Alibaba is the parent<br />

company <strong>of</strong> Alibaba.com, an<br />

online marketplace for small<br />

businesses, Taobao, a shopping<br />

website, and Alipay, an online<br />

payment service.<br />

February 2013 11

Auditors asked to enhance<br />

IPO due-diligence methods<br />

The China Securities Regulatory Commission<br />

encouraged auditors to step up their approach<br />

to due diligence in an effort to restore confidence<br />

in the Mainland’s new stock market<br />

listings. Bankers who attended a meeting<br />

with the regulator on 8 January said auditors<br />

were asked to use more behavioural analysis<br />

when assessing potential IPO candidates, including<br />

techniques used in the United States.<br />

“A senior CSRC <strong>of</strong>ficial mentioned the [U.S.]<br />

Federal Bureau <strong>of</strong> Investigation’s people-reading<br />

technique in particular as an example,” a<br />

banker told the International Finance Review.<br />

Mainland IPOs to pick up<br />

this year, PwC forecasts<br />

The number <strong>of</strong> initial public <strong>of</strong>ferings in China’s<br />

A-share market is expected to rebound,<br />

PricewaterhouseCoopers forecast last month.<br />

“PwC is expecting 200 IPOs to raise 130 billion<br />

to 150 billion yuan in 2013 by listing on<br />

the Shanghai and Shenzhen stock markets,”<br />

Frank Lyn, managing partner <strong>of</strong> PwC China,<br />

said at a press conference in Beijing. The forecast<br />

compares to 155 IPOs listed in 2012, with<br />

total funds raised at 108.3 billion yuan.<br />

Audit authority recovers<br />

embezzled housing funds<br />

The National Audit Office, China’s top auditing<br />

authority, announced that 2.96 billion yuan<br />

embezzled from affordable-housing funds in<br />

2011 had been recovered. According to a report<br />

by the auditing authority, its audit work<br />

has cancelled about 7,000 households’ rights<br />

to benefit from the housing.<br />

Central bank balance sheet<br />

shrinks for first time<br />

Data from the People’s Bank <strong>of</strong> China indicated<br />

that its balance sheet, which expanded<br />

eightfold from 2002 to 2011, shrank for the<br />

first time last year, the People’s Daily reported<br />

last month. It showed that the central<br />

bank’s assets totalled nearly 29 trillion yuan<br />

at the end <strong>of</strong> November 2012, nearly 514.7 billion<br />

yuan less than the amount at the end <strong>of</strong><br />

January 2012.<br />

12 February 2013<br />

NEWS<br />

GREATER CHINA<br />

Deloitte opposes request by<br />

SEC to resume audit case<br />

Firm claims regulator contributed to impasse<br />

Deloitte has asked a judge in the United States to reject a Securities and<br />

Exchange Commission case forcing the firm to hand over work papers from<br />

its audit <strong>of</strong> Longtop Financial Technologies, an allegedly fraudulent Chinese<br />

company.<br />

Deloitte had previously resisted handing over the accounting documents,<br />

citing Chinese secrecy laws.<br />

Last month the U.S. regulator requested that the federal court case, which<br />

began in May 2011, be reopened following a six-month hiatus when negotiations<br />

between the SEC and the Chinese Securities Regulatory Commission failed to<br />

reach a solution.<br />

Deloitte’s lawyers filed papers saying that the case should be postponed<br />

pending the outcome <strong>of</strong> the SEC’s recent administrative proceedings against<br />

five accounting firms, including Deloitte, as part <strong>of</strong> an investigation into alleged<br />

accounting fraud at nine U.S.-listed Chinese companies.<br />

Deloitte also argued that the SEC’s issue is partly <strong>of</strong> their own making. “The<br />

SEC has long been aware that the CSRC forbids China-based audit firms to<br />

produce audit work papers directly to the SEC, and yet the SEC chose to allow<br />

China-based companies to sell securities in the United States despite those<br />

restrictions,” the firm said in the papers it filed.<br />

Caterpillar grapples with accounting<br />

scandal over Chinese subsidiary<br />

Caterpillar, the world’s largest manufacturer <strong>of</strong> tractors and excavators, announced<br />

it had discovered accounting misconduct at a Chinese company it had<br />

acquired in June last year.<br />

This led to Caterpillar, which paid about US$700 million for ERA Mining Machinery,<br />

writing down more than half its expected earnings for the last quarter<br />

<strong>of</strong> 2012.<br />

On 18 January, the manufacturer announced in a statement that an investigation<br />

<strong>of</strong> ERA and its subsidiary, Zhengzhou Siwei Mechanical & Electrical<br />

Equipment Manufacturing Company, which provides equipment for the mining<br />

industry, found “deliberate, multi-year, coordinated accounting misconduct.” As<br />

a result, Caterpillar said it would take a non-cash goodwill impairment charge <strong>of</strong><br />

US$580 million, or 87 cents per share, in the quarter.<br />

It also stated that the probe “determined several Siwei senior managers<br />

engaged in deliberate misconduct beginning several years prior to Caterpillar’s<br />

acquisition <strong>of</strong> Siwei.” Caterpillar replaced these senior managers and said that<br />

“the actions carried out by these individuals are <strong>of</strong>fensive and completely unacceptable.”<br />

The company found discrepancies in November 2012 between the<br />

inventory in Siwei’s books and its actual inventory.<br />

Caterpillar’s shares fell by 1.5 percent after news <strong>of</strong> the fraud broke out.

Compliance<br />

New legislation and standards have increased<br />

the compliance burden on companies. But not all<br />

executives are in despair, as new frameworks can be<br />

good for management, shareholders and the market.<br />

Craig Stephen reports<br />

14 February 2013<br />

Illustrations by Harry Harrison

<strong>Hong</strong> <strong>Kong</strong> executives had<br />

at least one extra resolution<br />

on their minds on<br />

New Year’s Day. That<br />

was the day the Securities<br />

and Futures (Amendment) Ordinance<br />

2012, requiring any inside information<br />

that comes to their knowledge to be disclosed,<br />

came into effect.<br />

Failure to make timely disclosures <strong>of</strong> inside<br />

information – defined as specific news<br />

that if generally known to persons likely to<br />

deal in the listed securities would materially<br />

affect the price – could attract a fine <strong>of</strong> up to<br />

HK$8 million among other penalties.<br />

The new rule is the latest in a series <strong>of</strong><br />

legislative moves designed to increase transparency<br />

in <strong>Hong</strong> <strong>Kong</strong>’s markets. However,<br />

for many companies the new regulations are<br />

part <strong>of</strong> an increasing burden on doing business.<br />

A recent raft <strong>of</strong> legislation – amending<br />

laws governing short selling, trade descriptions,<br />

data privacy, competition and overthe-counter<br />

derivatives, to name a few – combined<br />

with new accounting standards and<br />

tougher extraterritorial financial regulations<br />

have made many executives and accountants<br />

cry “enough.”<br />

The growing burden is a worldwide<br />

phenomenon: According to a recent global<br />

KPMG survey <strong>of</strong> corporate general counsel,<br />

the increasing volume and complexity <strong>of</strong><br />

regulations was rated as the greatest risk to<br />

corporations over the next five years.<br />

But rather than panic, some companies<br />

are choosing to accentuate the positive and<br />

focus on how a more tightly regulated environment<br />

can be good for business. As much<br />

as the elephant in the room might seem<br />

unnecessary and to be taking up valuable<br />

space, with the right training it<br />

can also be put to useful work.<br />

“The vast majority <strong>of</strong><br />

compliance measures<br />

deliver a benefit,” says<br />

John MacPherson,<br />

who manages compliance<br />

issues for Sinclair<br />

Knight Merz, a British<br />

civil engineering company. “They can be ensuring<br />

safety, setting a benchmark for product<br />

quality, putting a price on environmental<br />

impacts, protecting the consumer from<br />

bad business practices or providing a fairer<br />

deal for stakeholders, investors and wider<br />

society.”<br />

Constructing a culture<br />

Financial reporting standards are a<br />

prime example <strong>of</strong> an extra burden being<br />

worthwhile, says William Lim, technical<br />

partner for HKFRS and IFRS at Deloitte in<br />

<strong>Hong</strong> <strong>Kong</strong> and a <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong><br />

CPAs member.<br />

“It means companies are easier to analyse,<br />

which gives them better access to international<br />

capital,” Lim says. “This gives a<br />

competitive advantage to <strong>Hong</strong> <strong>Kong</strong>’s capital<br />

markets. It makes our job more difficult<br />

but this just means we have to structure appropriately<br />

so we have standards specialists<br />

in place.”<br />

Proper implementation <strong>of</strong> systems to meet<br />

obligations does not just help companies<br />

avoid new regulatory pitfalls, but also serves<br />

to raise performance. “It can change the<br />

culture <strong>of</strong> a company for the better,” says Paul<br />

Phenix, who heads the technical department<br />

at Baker Tilly in <strong>Hong</strong> <strong>Kong</strong> and is also an<br />

<strong>Institute</strong> member. He cites recent changes to<br />

the <strong>Hong</strong> <strong>Kong</strong> stock exchange<br />

corporate governance<br />

code as an example.<br />

One <strong>of</strong> the changes to the code calls for a<br />

robust whistle-blowing protection regime.<br />

This, says Phenix, helps make a company<br />

more open to listening to employees about<br />

performance problems that can be fixed,<br />

which leads to raising the company’s value.<br />

Compliance objectives can strengthen a<br />

company’s governance from the bottom up,<br />

he says, adding that the rules covering the<br />

release <strong>of</strong> inside information can surprisingly<br />

have the greatest impact on relatively<br />

low-level employees, such as accounting<br />

clerks or goods vehicle drivers with access to<br />

important information.<br />

Advisers try to stress the upside <strong>of</strong> compliance-mandated<br />

change. “We approach<br />

from both a compliance aspect and what we<br />

call a commercial benefits character,” says<br />

Hugh Gozzard, an enterprise risk services<br />

principal at Deloitte in <strong>Hong</strong> <strong>Kong</strong> and an<br />

<strong>Institute</strong> member.<br />

“We try to engage clients and explain<br />

the benefits,” he adds. “They need to take<br />

a broader view and not just say ‘This is horrible.’<br />

If there are costs associated to put in<br />

controls, there are also gains to be made<br />

from the avoidance <strong>of</strong> reputational damage,<br />

sanctions or unpleasant publicity.”<br />

Making the most <strong>of</strong> it<br />

To be sure, not all new rules have an upside.<br />

In many cases, they impose requirements<br />

that regulators see as necessary. One example<br />

is the Foreign Account Tax Compliance<br />

Act, known as FATCA, enacted by the United<br />

States in 2010, which requires non-U.S.<br />

banks to disclose details <strong>of</strong> accounts held by<br />

U.S. citizens.<br />

“In the tax field, regulatory requirements<br />

continue to increase, with<br />

FATCA being perhaps the most<br />

extreme example, as the<br />

U.S. has imposed its tax<br />

enforcement standards<br />

on banks worldwide,”<br />

says Scott Michel, a partner at<br />

Caplin & Drysdale, a law firm<br />

in Washington. “FATCA is<br />

February 2013 15

Compliance<br />

the law and [there is] really no choice but to<br />

try to make the best <strong>of</strong> it.”<br />

Another example <strong>of</strong> compliance imposed<br />

from outside <strong>Hong</strong> <strong>Kong</strong> is the decision by<br />

the G-20 group <strong>of</strong> major world economies<br />

to regulate over-the-counter derivatives by<br />

centralizing their clearing, reporting and<br />

trading through electronic platforms. The<br />

<strong>Hong</strong> <strong>Kong</strong> Monetary Authority, along with<br />

its counterparts in Singapore and Australia,<br />

has largely adopted the new derivatives<br />

rules, but while noting the regulatory burden<br />

imposed on companies.<br />

Michael Go, executive director <strong>of</strong> MMADX,<br />

a derivatives trading platform in Australia,<br />

agrees that there could be practical and<br />

economic difficulties moving derivatives to<br />

an electronic platform. However, he adds,<br />

“there are also benefits for the market in<br />

pooling liquidity [and] efficiencies from improvements<br />

to risk management.”<br />

Data privacy is another prime example <strong>of</strong><br />

an evolving regulatory area as many jurisdictions<br />

change and update rules.<br />

<strong>Hong</strong> <strong>Kong</strong>’s amended Personal Data<br />

16 February 2013<br />

(Privacy) Ordinance came into effect in<br />

October 2012. Maximum fines for violating<br />

the ordinance will rise from HK$50,000 to<br />

HK$1 million. Meanwhile, a draft bill before<br />

the European parliament could see a company<br />

fined 2 percent <strong>of</strong> its global revenue for<br />

data privacy violations.<br />

“Companies need to know what personal,<br />

customer, intellectual or financial<br />

information they are keeping,” says Anthony<br />

Crampton, a risk consulting director at<br />

KPMG China in <strong>Hong</strong> <strong>Kong</strong>. “What data do<br />

you have? How is it classified? Where is it?<br />

How secure is it? Is access to your data appropriately<br />

controlled?”<br />

Bearing the cost<br />

There is no doubt that meeting new obligations<br />

bears a cost and the benefits need to<br />

be analysed. Simon Riley, director <strong>of</strong> the<br />

<strong>Institute</strong>’s standard setting department,<br />

says the <strong>Institute</strong> recently hosted, with the<br />

International Accounting Standards Board,<br />

a roundtable meeting to study implementation<br />

<strong>of</strong> the segment reporting standard.<br />

“Concerns were understandably raised<br />

about the costs and benefits <strong>of</strong> requiring<br />

certain disclosures,” Riley says <strong>of</strong> the roundtable,<br />

which was attended by financial statement<br />

preparers, auditors, academia, regulators,<br />

investors and other users <strong>of</strong> financial<br />

statements.<br />

“We know these concerns exist not only<br />

in <strong>Hong</strong> <strong>Kong</strong>, but also internationally, and<br />

we welcome the efforts <strong>of</strong> the IASB to examine<br />

the concepts underlying disclosure<br />

requirements as part <strong>of</strong> the continual effort<br />

to arrive at financial reports that are both<br />

relevant and useful and balance up the compliance<br />

costs in their preparation.”<br />

Hans Hoogervorst, chairman <strong>of</strong> the<br />

IASB, points out that although the cost <strong>of</strong><br />

convergence with IFRS can be high, it is outweighed<br />

by the longer-term benefits. “There<br />

is a one-time cost and that cost is real, but<br />

it is nothing compared to the cost <strong>of</strong> lack <strong>of</strong><br />

investment because you haven’t adopted a<br />

global standard,” he told a press conference<br />

at an IFRS Foundation Trustees event hosted<br />

by the <strong>Institute</strong> last month.

Local regulators agree, saying that one<strong>of</strong>f<br />

costs are <strong>of</strong>fset by continuing savings.<br />

“Standardizing reporting standards, for<br />

example, reduces the costs <strong>of</strong> preparing financial<br />

statements,” Arthur Yuen, deputy<br />

chief executive <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> Monetary<br />

Authority, said at the same event.<br />

Value in transparency<br />

Jim Woods, China risk, control and assurance<br />

practice leader at PricewaterhouseCoopers<br />

and an <strong>Institute</strong> member, believes now is<br />

“crunch time,” when the current landscape<br />

<strong>of</strong> new rules and standards means companies<br />

must improve controls. Rather than<br />

despairing, Woods urges companies to emphasize<br />

the upside. “It will give you a competitive<br />

edge,” he says.<br />

Meeting new obligations, Woods adds,<br />

can deliver much greater transparency for<br />

investors and other stakeholders, which can<br />

have direct benefits for a company’s stock<br />

price. “The common complaint from listed<br />

companies is their share price is too low be-<br />

cause investors don’t understand their business,”<br />

he says. “That is why there is value in<br />

transparency.”<br />

To help seek and understand that value,<br />

Andy Cheung, chief financial <strong>of</strong>ficer <strong>of</strong> The<br />

Link Real Estate Investment Trust and an <strong>Institute</strong><br />

member, says his company is always<br />

looking ahead to the prospect <strong>of</strong> new rules<br />

and laws. “We always try to be ahead <strong>of</strong> the<br />

ball game,” he says.<br />

For example, Link REIT began producing<br />

sustainability reports two years ago. “This<br />

gives us a sense <strong>of</strong> how the organization as a<br />

whole is working,” says Cheung. “Using key<br />

performance indicators, we can see gaps for<br />

improvements internally as well as giving us<br />

a good global benchmark against our peers.”<br />

Cheung says proper preparation is the<br />

key to building effective compliance frameworks<br />

that don’t impact the bottom line. He<br />

says Link REIT’s pr<strong>of</strong>essional management<br />

teams work closely with external consultants<br />

to assess any regulatory risks. “Once it<br />

is known, we assess how it will impact the<br />

A PLUS<br />

business from a financial point <strong>of</strong> view, from<br />

operations, and develop a policy. This is reported<br />

and discussed at board level.<br />

“Good reporting is more than just about<br />

more financial disclosure and controls,”<br />

Cheung adds. “Over the years we have improved<br />

the quality <strong>of</strong> our disclosure to cater<br />

for a much broader readership such as<br />

stakeholders in the community. This means<br />

using less jargon, plain English, as well as<br />

more charts and diagrams.”<br />

Ultimately, being prepared for compliance<br />

requires a strategic or longer term perspective.<br />

“Companies should be introducing<br />

clearer policies or additional approvals<br />

and reviews to their processes,” explains<br />

Luis Hui, head <strong>of</strong> compliance at Siemens<br />

China in Beijing and an <strong>Institute</strong> member.<br />

“Although this does not show up immediately<br />

on the pr<strong>of</strong>it and loss as a gain,<br />

this commitment to instilling and building<br />

sustainability into their businesses, like<br />

upgraded infrastructure, will reap future<br />

benefits.”<br />

February 2013 17

Council members<br />

Meet the Council<br />

Members are our<br />

biggest asset<br />

Kicking <strong>of</strong>f a series in which Council<br />

members meet with our readers,<br />

<strong>Institute</strong> president Susanna Chiu outlines<br />

her vision <strong>of</strong> the needs <strong>of</strong> the pr<strong>of</strong>ession<br />

It has been 18 years since I first started<br />

my service at the <strong>Institute</strong>, initially as a<br />

volunteer member on one <strong>of</strong> the committees.<br />

Since then, it has been a wonderful<br />

journey that has blessed me with many<br />

friendships and valuable experiences.<br />

Now that I have been given the honour <strong>of</strong><br />

leading the <strong>Institute</strong> as president, I will dedicate<br />

myself to working with the Council and<br />

management to set our organization in good<br />

stead as we celebrate our 40th year. I’m committed<br />

to building an even stronger <strong>Institute</strong><br />

and CPA brand to serve members and the<br />

<strong>Hong</strong> <strong>Kong</strong> public in the years to come.<br />

Many have asked me what plans there<br />

are for my year as president. There are<br />

many, including continuing the good work<br />

<strong>of</strong> the immediate past president, Keith Pogson,<br />

and his predecessors. We will also start<br />

new initiatives, such as the sixth long-range<br />

plan. But if I had to choose a theme, it would<br />

be “diversity,” because it encompasses our<br />

many plans and also represents the diverse<br />

pr<strong>of</strong>ile and needs <strong>of</strong> our membership.<br />

We have more than 35,000 members <strong>of</strong><br />

all ages. We have one <strong>of</strong> the most genderequal<br />

pr<strong>of</strong>essions – with 49 percent women<br />

and 51 percent men – and a young membership,<br />

with more than 45 percent <strong>of</strong> members<br />

under the age <strong>of</strong> 40. Practising members<br />

make up 23 percent, while 77 percent <strong>of</strong><br />

our members are pr<strong>of</strong>essional accountants<br />

in business and others. Diversity is an issue<br />

close to my heart, and I am sure the <strong>Institute</strong><br />

will continue recognizing this and providing<br />

services that aren’t just administrative,<br />

but that deliver added value to our members<br />

and engage them in a meaningful way.<br />

For our members working in practice, auditor<br />

liability reform is a pressing concern.<br />

There is a need to objectively examine the<br />

current regulatory and liability landscape<br />

and look at how the <strong>Institute</strong> as the pr<strong>of</strong>ession’s<br />

leader can manage the transition<br />

smoothly in collaboration with the government<br />

and other stakeholders.<br />

18 February 2013<br />

Meanwhile, as a pr<strong>of</strong>essional accountant<br />

in business for more than 16 years, I can<br />

see the challenges <strong>of</strong> members in this field<br />

including the support they need in daily<br />

work and expanding the breadth and depth<br />

<strong>of</strong> their career horizon. As CPAs, we are<br />

prominent global business executives and<br />

advisers, contributing to the development<br />

<strong>of</strong> business and finance in <strong>Hong</strong> <strong>Kong</strong> and<br />

around the world. Our members are multiskilled<br />

and doing multi-disciplinary work,<br />

and this requires us to evolve our thinking<br />

as a pr<strong>of</strong>ession and the positioning <strong>of</strong> our<br />

CPA brand.<br />

We must continue to examine and improve<br />

the services the <strong>Institute</strong> provides to all<br />

“We will continue<br />

achieving<br />

sustainable<br />

success for our<br />

pr<strong>of</strong>ession, our<br />

<strong>Institute</strong> and all<br />

our members.”<br />

Susanna Chiu<br />

President<br />

members throughout their careers as CPAs.<br />

These include education and extending the<br />

mobility and influence <strong>of</strong> our CPA designation<br />

in the Mainland and internationally.<br />

I have been actively engaging members<br />

to participate in the <strong>Institute</strong>’s social and<br />

recreational activities throughout the past<br />

few years. I encourage you to take part as<br />

there is good value in it. The camaraderie,<br />

mutual support and pride <strong>of</strong> being a CPA<br />

– and working together as a pr<strong>of</strong>ession to<br />

achieve things that we couldn’t do alone –<br />

are important parts <strong>of</strong> being a member <strong>of</strong><br />

the <strong>Institute</strong>.<br />

The fast-changing world will no doubt<br />

present new challenges to our pr<strong>of</strong>ession.

But by working together – and focusing on<br />

members – I am confident that with the collective<br />

skills, experience and commitment<br />

<strong>of</strong> our Council and management, we will<br />

continue achieving sustainable success for<br />

our pr<strong>of</strong>ession, our <strong>Institute</strong> and all our<br />

members.<br />

Susanna Chiu is also a director <strong>of</strong> Li & Fung<br />

Development (China).<br />

Staying on top and in front<br />

Clement Chan, <strong>Institute</strong> vice-president,<br />

looks at the pr<strong>of</strong>ession’s regulatory reform<br />

challenges<br />

The <strong>Hong</strong> <strong>Kong</strong> government and<br />

the Financial Reporting Council<br />

are looking at potential reforms <strong>of</strong><br />

the audit regulatory framework to put <strong>Hong</strong><br />

<strong>Kong</strong> in line with global norms and eligible<br />

for membership <strong>of</strong> the International Forum<br />

<strong>of</strong> Independent Audit Regulators. It is an<br />

important step towards maintaining <strong>Hong</strong><br />

<strong>Kong</strong>’s position as an international financial<br />

centre.<br />