power of love - Hong Kong Institute of Certified Public Accountants

power of love - Hong Kong Institute of Certified Public Accountants

power of love - Hong Kong Institute of Certified Public Accountants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Issue 2 volume 9 February 2013<br />

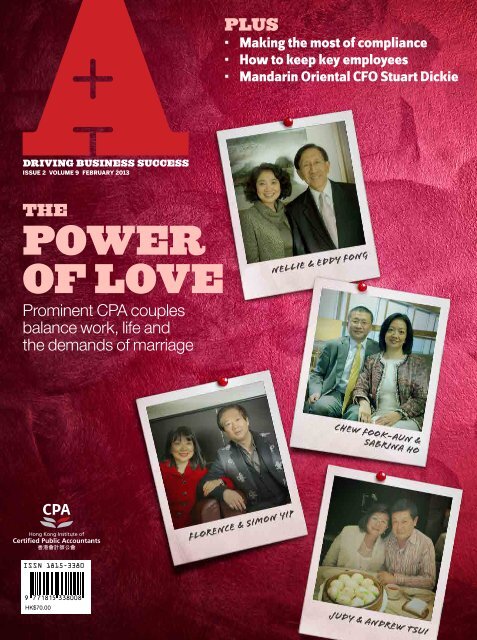

THE<br />

POWER<br />

OF LOVE<br />

Prominent CPA couples<br />

balance work, life and<br />

the demands <strong>of</strong> marriage<br />

HK$70.00<br />

PLUS<br />

• Making the most <strong>of</strong> compliance<br />

• How to keep key employees<br />

• Mandarin Oriental CFO Stuart Dickie

CE<br />

ISSUE 02 VOLUME 09 FEBRUARY 2013<br />

REGULARS<br />

01 President’s message<br />

04 <strong>Institute</strong> news<br />

06 International news<br />

10 Greater China news<br />

FEATURES<br />

14 From burden to benefit<br />

Craig Stephen finds out how compliance can actually help a<br />

company's stakeholders, customers and bottom line<br />

18 Meet the Council<br />

The <strong>Institute</strong>’s president, vice-presidents and immediate past<br />

president present their visions for the <strong>Institute</strong>’s future<br />

22 Crunching the numbers<br />

Accounting technology is rapidly changing. George W. Russell<br />

reports on new developments in hardware and s<strong>of</strong>tware<br />

28 Success ingredient<br />

Robin Lynam pr<strong>of</strong>iles Stuart Dickie, CFO <strong>of</strong> Mandarin Oriental,<br />

amid the iconic surroundings <strong>of</strong> the company’s flagship hotel<br />

34 Keeping talent<br />

George W. Russell finds out how accounting firms can hold on<br />

to their key talent and nurture younger recruits<br />

38 Love actually<br />

Jemelyn Yadao meets four <strong>Institute</strong> member couples who have<br />

stood together through good times as well as tough decisions<br />

SOURCE<br />

44 China finance<br />

Liu Yuting looks at enterprise financial management innovations<br />

46 Forensic accounting<br />

Katy Wong explains how data analytics can fight against fraud<br />

48 TechWatch 123<br />

The latest standards and technical developments<br />

50 Tech Q&A<br />

Your questions about standards answered<br />

54 People on the move<br />

The latest pr<strong>of</strong>essional appointments from around the region<br />

55 Events<br />

A guide to forthcoming courses, workshops and member activities<br />

LIFESTYLE<br />

56 Business travel<br />

Honnus Cheung chronicles the captivating charms <strong>of</strong> Melbourne<br />

58 After hours<br />

Aloysius Tse on wine; Jemelyn Yadao on watches<br />

60 Let’s get fiscal<br />

Nury Vittachi sends the wrong message<br />

2 February 2013<br />

CONTENTS<br />

28

Your chop Your Logo<br />

PHOTO: JOAN BOIVIN<br />

About our name: A PLUS stands for excellence, a<br />

reference to our top-notch accountant members who<br />

are success ingredients in business and in society. It<br />

is also the quality that we strive for in this magazine —<br />

going an extra mile to reach beyond grade A.<br />

President: Susanna Chiu<br />

Email: president@hkicpa.org.hk<br />

Vice Presidents: Clement Chan, Mabel Chan<br />

Chief Executive and Registrar: Raphael Ding<br />

Email: ce@hkicpa.org.hk<br />

Deputy Director <strong>of</strong> Communications: Stella To<br />

Editorial Advisers: Daniel Lin, Clement Chan, K.M. Wong<br />

Editorial Manager: John So<br />

Editorial Coordinator: Maggie Tam<br />

OFFICE ADDRESS:<br />

37/F, Wu Chung House,213 Queen’s Road East,<br />

Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

Tel: +852-2287-7228 Fax: +852-2865-6603<br />

MEMBER AND STUDENT SERVICES COUNTER:<br />

27/F, Wu Chung House, 213 Queen’s Road East,<br />

Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

WEBSITE: www.hkicpa.org.hk<br />

EMAIL: hkicpa@hkicpa.org.hk<br />

M&L<br />

Editor: George W. Russell<br />

Managing Editor: Gerry Ho<br />

Email: gerry.ho@mandl.asia<br />

Copy Editors: Jemelyn Yadao<br />

Contributors: Robin Lynam, Craig Stephen<br />

Production Manager: Jasmine Hu<br />

Design Manager: Jennifer Chung<br />

Editorial Assistant: Lucid Wong<br />

EDITORIAL OFFICE:<br />

2/F, Wang Kee Building,<br />

252 Hennessy Road, Wanchai, <strong>Hong</strong> <strong>Kong</strong><br />

ADVERTISING ENQUIRIES:<br />

Advertising Director: Derek Tsang<br />

Email: derek.tsang@mandl.asia<br />

Tel: +852-2656-2676<br />

A PLUS is the <strong>of</strong>ficial magazine <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong><br />

<strong>Certified</strong> <strong>Public</strong> <strong>Accountants</strong>. The <strong>Institute</strong> retains copyright in<br />

all material published in the magazine. No part <strong>of</strong> this magazine<br />

may be reproduced without the permission <strong>of</strong> the <strong>Institute</strong>. The<br />

views expressed in the magazine are not necessarily shared<br />

by the <strong>Institute</strong> or the publisher. The <strong>Institute</strong>, the publisher<br />

and authors accept no responsibilities for loss resulting from<br />

any person acting, or refraining from acting, because <strong>of</strong> views<br />

expressed or advertisements appearing in the magazine.<br />

© <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong> <strong>Certified</strong> <strong>Public</strong> <strong>Accountants</strong><br />

February 2013. Print run: 5,870 copies<br />

Subscription: HK$760 for 12 issues per year.<br />

See www.hkicpa.org.hk/aplus for details.

<strong>Institute</strong> makes submission<br />

on <strong>Hong</strong> <strong>Kong</strong>’s budget<br />

In its 2013-14 budget proposals, the <strong>Institute</strong><br />

called on the government to <strong>of</strong>fer more help<br />

to families and to increase the city’s international<br />

competitiveness. According to the<br />

<strong>Institute</strong>’s submission, one <strong>of</strong> the main concerns<br />

<strong>of</strong> the city’s taxpayers is keeping up<br />

with rising costs.<br />

The proposal suggests a range <strong>of</strong> measures<br />

to help families and individuals, including<br />

widening the marginal tax bands from<br />

HK$40,000 to HK$50,000, increasing child<br />

allowances from HK$63,000 to HK$70,000,<br />

allowing deductions for voluntary Mandatory<br />

Provident Fund contributions with an annual<br />

cap <strong>of</strong> HK$60,000 and allowing deductions<br />

for private healthcare insurance premiums<br />

with an annual cap <strong>of</strong> HK$12,000.<br />

The <strong>Institute</strong> also advocated <strong>of</strong>fering a rental<br />

payment deduction as an alternative to the<br />

home loan interest deduction, adjusting the<br />

price thresholds <strong>of</strong> different stamp duty rates<br />

in line with property price inflation, providing<br />

a waiver on property rates <strong>of</strong> up to HK$2,500<br />

per quarter and introducing an electricity subsidy<br />

<strong>of</strong> HK$1,800 for the coming year.<br />

Disciplinary finding<br />

Au Ping-lam, CPA (Practising)<br />

Complaint: Failed or neglected to observe,<br />

maintain or otherwise apply <strong>Hong</strong> <strong>Kong</strong> Financial<br />

Reporting Standard for Private Entities<br />

and <strong>Hong</strong> <strong>Kong</strong> Standard on Auditing 500<br />

Audit Evidence during the audit <strong>of</strong> the financial<br />

statements <strong>of</strong> a private company in <strong>Hong</strong><br />

<strong>Kong</strong> for the year ended 31 March 2010. Au admitted<br />

the complaints.<br />

Decision: Au was reprimanded. He was<br />

ordered to pay the <strong>Institute</strong> a penalty <strong>of</strong><br />

HK$46,000 and costs <strong>of</strong> the disciplinary<br />

proceedings amounting to HK$59,882.<br />

Details <strong>of</strong> the disciplinary findings are available<br />

at the <strong>Institute</strong>’s website: www.hkicpa.org.hk.<br />

Obituary<br />

The <strong>Institute</strong> notes with regret the passing<br />

<strong>of</strong> Lee Yim-wan, Penny, Ng Yin-ping and Wu<br />

Ying-Keung, Frank.<br />

4 February 2013<br />

NEWS<br />

THE INSTITUTE<br />

IFRS Foundation Trustees<br />

get together in <strong>Hong</strong> <strong>Kong</strong><br />

Heavyweights from business, government and the<br />

pr<strong>of</strong>ession take stock <strong>of</strong> financial reporting agenda<br />

Along with the IFRS Foundation Trustees, who were in town to hold a meeting,<br />

the <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong> CPAs last month co-hosted an evening devoted to the<br />

future <strong>of</strong> financial reporting.<br />

The first event was a press conference featuring Michel Prada, chairman<br />

<strong>of</strong> the IFRS Foundation Trustees, Hans Hoogervorst, chairman <strong>of</strong> the International<br />

Accounting Standards Board, Ronald Arculli, an IFRS Foundation trustee<br />

representing <strong>Hong</strong> <strong>Kong</strong>, and Clement Chan, vice-president <strong>of</strong> the <strong>Institute</strong> and<br />

a managing director <strong>of</strong> BDO.<br />

Prada described <strong>Hong</strong> <strong>Kong</strong> as an “extremely important” venue for the trustee<br />

meetings because <strong>of</strong> its full adoption and full support <strong>of</strong> IFRS. He said the twoday<br />

visit included discussions about strategy, funding, the establishment <strong>of</strong> the<br />

Accounting Standards Advisory Forum and the operations <strong>of</strong> the IFRS Asia-Oceania<br />

<strong>of</strong>fice in Tokyo.<br />

Hoogervorst said the Asia-Pacific region was vital to the future <strong>of</strong> financial<br />

reporting. “It’s the happening place to be in terms <strong>of</strong> economic development and<br />

the avid adoption <strong>of</strong> our standards.”<br />

He said he remained optimistic that the United States – the last major holdout<br />

on IFRS – would eventually adopt the single set <strong>of</strong> international standards. However,<br />

he added, convergence with IFRS must pave the way. “We cannot have this<br />

bilateral relationship with the FASB. We are a mature full-grown organization<br />

with 100 members and they have to come first.”<br />

The IASB chairman said he expected IFRS to enter a “period <strong>of</strong> calm” following<br />

the issuance <strong>of</strong> a standard on revenue recognition, which would occur very<br />

soon. A leasing standard is in the process <strong>of</strong> exposure.<br />

The press conference was followed by an evening <strong>of</strong> discussion on “The future<br />

<strong>of</strong> global financial reporting.”<br />

<strong>Hong</strong> <strong>Kong</strong>’s financial secretary, John Tsang, welcomed delegates by noting<br />

that IFRS has long been associated with global financial stability. “However, the<br />

financial tsunami and related events <strong>of</strong> recent years have highlighted the difficulties<br />

<strong>of</strong> aligning different financial systems in our era <strong>of</strong> globalization,” he said.<br />

With the rapid diversification <strong>of</strong> business and integration <strong>of</strong> companies<br />

across different borders, a robust financial reporting regime has become a prerequisite<br />

for the healthy development <strong>of</strong> the global economy, Tsang noted.<br />

“To strengthen the regulatory framework for auditors, we are working with<br />

the <strong>Institute</strong> and the Financial Reporting Council on ways to further enhance<br />

the independence <strong>of</strong> <strong>Hong</strong> <strong>Kong</strong>’s auditor oversight regime,” Tsang said.<br />

Arthur Yuen, deputy chief executive <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> Monetary Authority,<br />

gave the keynote address, “The importance <strong>of</strong> IFRSs in promoting a healthy economic<br />

environment.”<br />

Yuen noted the increased risk aversion <strong>of</strong> investors since the global financial<br />

crisis began five years ago. “That was partly due to the insufficient and inconsistent<br />

disclosure <strong>of</strong> financial risk information by financial institutions,” he said.

From left: James Riley, Carlson Tong, Hans Hoogervorst, Clement Chan<br />

and Jennifer Hughes (moderator from the Financial Times)<br />

“Standardizing financial reporting standards<br />

at the global level can help investors to<br />

compare financial information across institutions<br />

and across jurisdictions.”<br />

The speeches were followed by a thoughtprovoking<br />

panel discussion on the subject<br />

<strong>of</strong> financial reporting in which Hoogervorst<br />

and Chan joined Carlson Tong, chairman <strong>of</strong><br />

the Securities and Futures Commission and<br />

an <strong>Institute</strong> past vice-president, and James<br />

Riley, group finance director <strong>of</strong> Jardine<br />

Matheson Holdings and an <strong>Institute</strong> fellow.<br />

Financial reporting must benefit all stakeholders,<br />

Tong told the panel. He said financial<br />

statements had become more difficult<br />

to decipher. “I’ve been an accountant for 37<br />

years and now I have no idea which page to<br />

turn to. We have to ask ourselves, what are<br />

accounts for?”<br />

Tong noted that global accounting stan-<br />

dards were far more uniform than any other<br />

comparable international regime, such<br />

as the supervision <strong>of</strong> the world’s financial<br />

institutions.<br />

Riley echoed the IASB viewpoint, saying<br />

he would prefer the U.S. to join IFRS,<br />

but added that he was concerned that convergence<br />

had meant the IASB had become<br />

too accommodating <strong>of</strong> the American model.<br />

“I’m worried that reaching a settlement with<br />

the U.S. would mean ticking 10,000 boxes,”<br />

he said. “The drift has been too much towards<br />

a compliance requirement approach.”<br />

Hoogervorst acknowledged that increasing<br />

regulatory burdens were making auditors<br />

more risk-averse, meaning that financial<br />

statements were clogged with unnecessary<br />

disclosures, hampering effective interpretations<br />

<strong>of</strong> corporate results. “We are actively<br />

engaging with auditors on how we can help<br />

A PLUS<br />

them use their judgment more,” he said.<br />

The panel also discussed increasingly<br />

complex auditors’ opinions. “As an auditor, I<br />

would like to give a very simple audit opinion<br />

based on the work that was done,” Chan<br />

said. “However, [it is not possible] given the<br />

different requirements that regulators impose,<br />

whether in different parts <strong>of</strong> the world<br />

or in different cases.”<br />

Chan added that he would like to see<br />

more communication between auditors and<br />

their regulators.<br />

The panel emphasized that the future <strong>of</strong><br />

financial reporting would involve accounts<br />

that were more intelligible to the various<br />

stakeholders, given the wider investment<br />

community. “Financial statements are important<br />

to anyone who entrusts their money<br />

to someone else,” said Hoogervorst. “Our audience<br />

is society at large.”<br />

February 2013 5

NEWS<br />

INTERNATIONAL<br />

Cameron calls for global crackdown<br />

on tax avoidance by businesses<br />

British PM warns against aggressively complex arrangements<br />

The British prime minister, David<br />

Cameron, called for global action<br />

on tax avoidance in his keynote<br />

speech at the World Economic<br />

Forum in Davos, Switzerland,<br />

last month. Cameron told world<br />

leaders that as the head <strong>of</strong> the G8<br />

group <strong>of</strong> the largest economies<br />

this year, the United Kingdom<br />

would continue to focus on corporate<br />

revenue dodgers.<br />

“Any businesses who think<br />

that they can carry on dodging<br />

that fair share or that they can<br />

keep on selling to the U.K. and<br />

setting up ever-more complex tax<br />

arrangements abroad to squeeze<br />

their tax bill right down – well,<br />

they need to wake up and smell<br />

the c<strong>of</strong>fee because the public who<br />

buy from them have had enough,”<br />

he said, adding that some forms<br />

<strong>of</strong> tax avoidance have become “so<br />

aggressive.”<br />

The speech comes after a<br />

British parliamentary commit-<br />

Google announced a jump in<br />

annual revenues after a strong<br />

fourth-quarter performance.<br />

The world’s largest Internet<br />

search engine company earned<br />

a net pr<strong>of</strong>it <strong>of</strong> US$2.89 billion<br />

in the final three months <strong>of</strong> last<br />

year, up 6.7 percent from the year<br />

earlier.<br />

The company reported fourthquarter<br />

revenue <strong>of</strong> US$14.42<br />

billion, up 36 percent from the<br />

same period the year before.<br />

6 February 2013<br />

“We ended 2012 with a<br />

strong quarter,” said Larry Page,<br />

Google’s c<strong>of</strong>ounder and chief<br />

executive. “We hit US$50 billion<br />

in revenues for the first time last<br />

year – not a bad achievement in<br />

just a decade and a half.”<br />

According to analysts, the<br />

company benefited from business<br />

growth in international<br />

markets. “Business looked really<br />

strong, especially from a pr<strong>of</strong>itability<br />

perspective. They really<br />

AFP<br />

David Cameron<br />

tee questioned executives from<br />

multinationals such as Amazon,<br />

Google and Starbucks in November<br />

2012 for paying little U.K. tax.<br />

Last year, Starbucks said it would<br />

voluntarily make tax payments<br />

<strong>of</strong> £20 million over the next two<br />

years after a Reuters investigation<br />

found that the company had not<br />

paid British corporation tax in the<br />

previous three years.<br />

Cameron’s “smell the c<strong>of</strong>fee”<br />

reference was widely regarded as<br />

a dig at Starbucks in particular,<br />

upsetting the American-owned<br />

beverage chain. “The PM is<br />

singling the business out for<br />

cheap shots,” the Daily Telegraph<br />

quoted an unnamed company<br />

source as saying.<br />

The House <strong>of</strong> Commons public<br />

accounts committee said last<br />

month it would hold a hearing at<br />

which senior tax specialists from<br />

PricewaterhouseCoopers, Ernst<br />

and Young, KPMG and Deloitte<br />

would answer questions over<br />

their roles in assisting big companies<br />

to minimize their tax bills.<br />

E&Y’s Mark Otty, managing<br />

partner for Europe, Middle East<br />

and Africa, told the Telegraph that<br />

companies have an “obligation”<br />

to their investors to pay the<br />

lowest tax possible. “The only<br />

way you can resolve this issue is<br />

through a legal code,” he said.<br />

grew their margins in the core<br />

business,” Sameet Sinha, an analyst<br />

at B. Riley Caris, told Reuters.<br />

“Most <strong>of</strong> that strength seems to<br />

be coming from international<br />

markets which grew revenues<br />

quite substantially: up 23 percent<br />

year over year, versus the 15 percent<br />

growth in the third quarter.”<br />

The revenue results pleased<br />

investors who had been concerned<br />

about a decline in digital<br />

ad sales following the increasing<br />

Apple’s shares<br />

slide 12 percent<br />

on poor results<br />

Shares in Apple fell 12 percent in<br />

a day as the technology company<br />

reported disappointing Mac and<br />

iPhone 5 sales. About US$50<br />

billion was wiped <strong>of</strong>f Apple’s<br />

market value on 24 January<br />

after it posted its slowest pr<strong>of</strong>it<br />

growth since 2003.<br />

Results from its first fiscal<br />

quarter caused Apple’s shares<br />

to fall to US$450, before<br />

recovering some <strong>of</strong> its losses,<br />

raising concerns over the<br />

company’s smartphone growth<br />

prospects. The shares had hit a<br />

high <strong>of</strong> US$702 in September<br />

2012.<br />

The released figures also<br />

indicated that pr<strong>of</strong>its had<br />

remained the same from a year<br />

earlier at US$13.1 billion, while<br />

revenue was US$54.5 billion,<br />

an increase <strong>of</strong> 18 percent from a<br />

year ago.<br />

Analysts had expected<br />

revenues <strong>of</strong> about US$55 billion.<br />

Google’s annual revenue hits US$50 billion in fourth-quarter surge<br />

AFP<br />

popularity <strong>of</strong> smaller screened<br />

smartphones.<br />

Google executives told analysts<br />

in a conference call that the<br />

company had focused on improving<br />

the average cost-per-click, a<br />

metric which indicates the price<br />

advertisers pay Google.<br />

The fourth-quarter figures<br />

include Motorola Mobility, which<br />

Google acquired in May 2012. The<br />

subsidiary had an operating loss <strong>of</strong><br />

US$353 million during the quarter.

Spain falls deeper into recession<br />

amid spending cuts, record jobless<br />

Rajoy plans stimulus measures to <strong>of</strong>fset weakening data<br />

Spain’s economic output fell by<br />

1.8 percent from a year earlier,<br />

according to data from the<br />

National Statistics <strong>Institute</strong>,<br />

indicating that the country’s<br />

recession had deepened in the<br />

fourth quarter.<br />

Gross domestic product<br />

fell 0.7 percent in the last<br />

three months <strong>of</strong> 2012 from the<br />

previous quarter, its steepest<br />

contraction in a year as government<br />

spending cuts and rising<br />

unemployment hit households.<br />

“These sharp falls [in GDP]<br />

leave a tough scenario for the<br />

first two quarters <strong>of</strong> this year.<br />

The question is how market<br />

improvements can s<strong>of</strong>ten the<br />

falls, but it’s still too early to<br />

tell,” Citigroup strategist José<br />

Luis Martínez told Reuters.<br />

On 30 January, the Spanish<br />

prime minister, Mariano Rajoy,<br />

responded to the weak data<br />

by telling parliament he was<br />

India expects<br />

resolution to<br />

Vodafone row<br />

India’s finance minister,<br />

Palaniappan Chidambaram, is<br />

confident that a US$2.6 billion<br />

dispute between the country’s<br />

tax <strong>of</strong>fice and Vodafone, the largest<br />

corporate investor in India,<br />

will be resolved as talks between<br />

the two sides continued.<br />

The stand-<strong>of</strong>f relates to<br />

Vodafone’s US$10.9 billion<br />

acquisition <strong>of</strong> <strong>Hong</strong> <strong>Kong</strong>-based<br />

Hutchison Whampoa’s India<br />

mobile business in 2007.<br />

“ I’m confident we will<br />

resolve [the Vodafone] issue,”<br />

Chidambaram told the Financial<br />

Times.<br />

In January 2012, India’s<br />

Supreme Court ruled that Vodafone,<br />

the British telecoms group,<br />

was not liable to pay any tax arising<br />

out <strong>of</strong> the acquisition.<br />

However, the Indian government<br />

reopened the case by<br />

amending tax laws to enable it to<br />

make retrospective tax claims.<br />

BP to make US$4.5 billion payout in criminal settlement for spill<br />

A judge in the United States<br />

approved an agreement by BP,<br />

the British oil giant, to pay US$4<br />

billion in a record criminal settlement<br />

related to the fatal Deepwater<br />

Horizon disaster in 2010.<br />

In November 2012, BP said<br />

it would pay the amount to the<br />

U.S. Department <strong>of</strong> Justice and<br />

pleaded guilty to 14 criminal<br />

charges, including those related<br />

to the deaths <strong>of</strong> 11 workers.<br />

Luke Keller, a vice-president<br />

AFP<br />

AFP<br />

Mariano Rajoy<br />

planning a package <strong>of</strong> stimulus<br />

measures, but vowed that Spain<br />

would stick to planned budget<br />

cuts. The package includes tax<br />

breaks for entrepreneurs.<br />

The data also revealed that<br />

unemployment reached 26<br />

percent <strong>of</strong> the workforce at<br />

the end <strong>of</strong> Rajoy’s first year in<br />

<strong>power</strong>, the highest rate since the<br />

<strong>of</strong> BP America, apologized to a<br />

federal court in New Orleans and<br />

the families <strong>of</strong> the dead, for its<br />

role in the accident. “Our guilty<br />

plea makes clear, BP understands<br />

and acknowledges its role in that<br />

tragedy, and … BP apologizes to<br />

all those injured and especially<br />

to the families <strong>of</strong> the lost <strong>love</strong>d<br />

ones,” he said. “BP is also sorry for<br />

the harm to the environment that<br />

resulted from the spill.”<br />

The company has been selling<br />

country returned to democracy<br />

in 1975.<br />

Spain’s economy fell into its<br />

second recession since 2009 at<br />

the end <strong>of</strong> 2011 because <strong>of</strong> the<br />

fallout from a burst property<br />

bubble.<br />

The government expects the<br />

economy to grow again before<br />

the end <strong>of</strong> 2013. Economy minister<br />

Luis de Guindos said that<br />

“the Spanish economy is able to<br />

grow in the second half <strong>of</strong> this<br />

year,” in a press conference at<br />

the World Economic Forum held<br />

in Switzerland last month.<br />

The government has pledged<br />

to lower the public deficit from<br />

the equivalent <strong>of</strong> 9.4 percent <strong>of</strong><br />

annual gross domestic product<br />

in 2011 to 6.3 percent in 2012,<br />

4.5 percent in 2013 and 2.8<br />

percent in 2014. But analysts say<br />

reaching those targets will be<br />

difficult in a period <strong>of</strong> declining<br />

economic activity.<br />

assets worth billions to raise money<br />

to settle all claims, reported<br />

BBC News. BP is expected to make<br />

a final payment <strong>of</strong> US$860 million<br />

into the US$20 billion Gulf<br />

<strong>of</strong> Mexico compensation fund by<br />

the end <strong>of</strong> the year.<br />

The criminal settlement,<br />

before federal judge Sarah<br />

Vance, includes payments <strong>of</strong><br />

nearly US$2.4 billion to be paid<br />

to the National Fish and Wildlife<br />

Foundation and US$350 million<br />

to the National Academy <strong>of</strong> Sciences<br />

over a period <strong>of</strong> five years.<br />

BP will also pay US$525 million<br />

to the Securities and Exchange<br />

Commission over three years.<br />

Other companies involved<br />

in the spill include rig owner<br />

Transocean and Halliburton,<br />

which provided cementing<br />

services.<br />

The disaster emitted more<br />

than 200 million gallons (757<br />

million litres) <strong>of</strong> oil into the sea.<br />

February 2013 7

Indian firms split over<br />

proposal to cap audits<br />

Indian accounting firms are divided over a<br />

clause in the Companies Bill that would cap<br />

the number <strong>of</strong> companies that can be audited<br />

by a single firm at 20. Big Four firms, which<br />

audit 55 percent <strong>of</strong> Indian public companies,<br />

want the scope <strong>of</strong> the provision to be restricted<br />

to public companies, while small and mid-tier<br />

firms favour the cap to be applied to all clients,<br />

India’s Business Standard newspaper reported.<br />

The lower house <strong>of</strong> parliament has passed the<br />

bill, while the upper house is likely to take up<br />

the bill for passage in the next session, which<br />

begins next month.<br />

Schroders gives KPMG<br />

mandate to audit books<br />

Asset manager Schroders has selected KPMG<br />

as its new auditor, ending a relationship with<br />

PricewaterhouseCoopers that lasted more<br />

than 50 years. Schroders paid PwC £3.1 million<br />

for audit and audit-related work plus another<br />

£1.6 million for unrelated work in 2011.<br />

KPMG won the mandate after a tender process<br />

that started last year.<br />

Australian, NZ bodies<br />

launch joint programme<br />

The <strong>Institute</strong> <strong>of</strong> Chartered <strong>Accountants</strong> in Australia<br />

and the New Zealand <strong>Institute</strong> <strong>of</strong> Chartered<br />

<strong>Accountants</strong> are set to launch their joint<br />

Chartered <strong>Accountants</strong> Programme this month,<br />

the ICAA’s monthly magazine reported. The<br />

new programme consists <strong>of</strong> five modules <strong>of</strong><br />

learning materials that are almost all common<br />

to both countries and a single set <strong>of</strong> requirements<br />

for mentored practical experience.<br />

Accounting graduates<br />

are sought after in U.S.<br />

An employment survey in the United States last<br />

month showed that 68 percent <strong>of</strong> the most recent<br />

accounting majors received job <strong>of</strong>fers — the<br />

highest percentage <strong>of</strong> any major nationwide.<br />

The National Association <strong>of</strong> Colleges and Employers<br />

report stated that the unemployment<br />

rate for accountants stood at just 4.1 percent at<br />

the end <strong>of</strong> 2012, the Salt Lake City Deseret News<br />

reported.<br />

8 February 2013<br />

NEWS<br />

INTERNATIONAL<br />

U.S. delays on IFRS to be<br />

expensive, says Hoogervorst<br />

Washington faces sidelining in future<br />

Hans Hoogervorst, the chairman <strong>of</strong> the International Accounting Standards<br />

Board, has warned the United States that its continued delays in moving to<br />

International Financial Reporting Standards will probably cost more than the<br />

eventual switch.<br />

The U.S. also risks losing much <strong>of</strong> its influence over global standard setting<br />

by not being a driving force for IFRS, Hoogervorst told securities analysts at a<br />

conference in New York on 10 January.<br />

Hoogervorst said investors are bearing huge costs for the process <strong>of</strong> trying to<br />

compare and contrast the financial performance <strong>of</strong> companies around the world<br />

using different standards. Those costs “are probably a lot bigger than the one-time<br />

conversion cost that an economy has to make when it converts” to IFRS, he said.<br />

The U.S. Securities and Exchange Commission has considered a move to IFRS<br />

for some years, but recently appeared to cool on the idea <strong>of</strong> making the change.<br />

SEC staff disappointed global rule-setters last year by issuing a final report on a<br />

switch to IFRS with no recommendation.<br />

Support for a switch has waned amid concerns about the costs and worries<br />

that IFRS allows more management judgment than highly detailed U.S.<br />

accounting rules. “I don’t see any signs <strong>of</strong> any imminent decisions in Washington,”<br />

Hoogervorst said.<br />

In November, the IASB proposed a new 12-member Accounting Standards<br />

Advisory Forum, expected to become an important source <strong>of</strong> input to<br />

international rules. Membership on the board requires a commitment to a single<br />

set <strong>of</strong> global accounting standards, which would leave out the U.S.<br />

Auditors face legal action over alleged<br />

failure to scrutinize troubled loans<br />

The United States Securities and Exchange Commission charged two KPMG<br />

employees with failing to uncover problems at a bank that later failed.<br />

It is the first time the commission has taken action against auditors in a case<br />

related to the global financial crisis.<br />

The two KPMG auditors, John J. Aesoph and Darren M. Bennett, failed to<br />

adequately scrutinize bad-loan reserves at TierOne Bank in Nebraska, the SEC said<br />

in an administrative proceeding. The action could result in the two auditors losing<br />

their right to audit public companies.<br />

TierOne hid millions <strong>of</strong> dollars in losses on troubled loans made during the<br />

height <strong>of</strong> the financial crisis before the bank eventually failed in 2010, according to<br />

the commission, which filed suit against three TierOne executives last year.<br />

The SEC case against the auditors, more than four years after the crisis, revives<br />

lingering questions about whether auditors did enough to prevent questionable<br />

practices and whether authorities have done enough to hold them to account.<br />

KPMG does not face any action in the TierOne case.

NEWS<br />

GREATER CHINA<br />

Economic rebound emerges despite<br />

13-year low for GDP growth<br />

Cautious analysts warn <strong>of</strong> slow improvement amid “headwinds”<br />

China showed signs <strong>of</strong> an economic<br />

rebound in the last three<br />

months <strong>of</strong> 2012, despite gross<br />

domestic product finishing at<br />

a 13-year low. GDP grew by 7.8<br />

percent last year, down from 9.3<br />

percent in 2011 and the lowest<br />

annual rate since 1999.<br />

However, with a pick-up in<br />

the fourth quarter showing yearon-year<br />

growth <strong>of</strong> 7.9 percent<br />

from 7.4 percent in the previous<br />

quarter, analysts believe a stronger<br />

performance is inevitable<br />

in 2013. “The overall national<br />

economic performance [has<br />

been] stabilized,” Ma Jiantang,<br />

commissioner for China’s National<br />

Bureau <strong>of</strong> Statistics, told<br />

reporters.<br />

The rebound, which breaks<br />

a streak <strong>of</strong> seven consecutive<br />

weaker quarters, was driven by<br />

state investment in infrastructure<br />

projects and efforts to get<br />

consumers and companies to<br />

Shares in China Vanke, the country’s<br />

biggest property developer<br />

by market value, rose sharply after<br />

the company announced plans to<br />

move its foreign currency B-shares<br />

to <strong>Hong</strong> <strong>Kong</strong> from Shenzhen.<br />

Vanke announced on 18<br />

January that it will convert its<br />

Shenzhen-listed B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong>-listed H-shares following<br />

the successful migration<br />

<strong>of</strong> shipping container company<br />

China International Marine<br />

10 February 2013<br />

Ma Jiantang<br />

spend, BBC News reported. The<br />

data were released as China’s<br />

newly installed leaders prepare<br />

to take charge <strong>of</strong> the country.<br />

“It is obvious that the slowdown<br />

in the Chinese economy<br />

has halted for the moment,” Fraser<br />

Howie, managing director <strong>of</strong><br />

fund manager CLSA in Singapore<br />

and co-author <strong>of</strong> the 2011 book<br />

Red Capitalism, told BBC News.<br />

Howie cautioned that the<br />

improvement will not be drastic,<br />

Containers Group’s B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong> in December 2012.<br />

Vanke will maintain its yuandenominated<br />

A-share listing.<br />

After the announcement, both<br />

Vanke’s yuan-denominated Ashares<br />

and its <strong>Hong</strong> <strong>Kong</strong> dollar<br />

B-shares surged by 10 percent,<br />

their highest prices in more than<br />

three years. The A-shares hit the<br />

top <strong>of</strong> the trading limit and closed<br />

at 11.13 yuan on the Shenzhen<br />

exchange while its B-shares<br />

adding that “one has to be mindful<br />

that any recovery will be<br />

limited in its scope, not least because<br />

<strong>of</strong> the various headwinds<br />

that China is facing.”<br />

China’s economy will grow<br />

8.5 percent this year with<br />

domestic demand driving the<br />

expansion, Shanghai Daily reported<br />

last month, citing a Bank<br />

<strong>of</strong> Communications forecast.<br />

The new leaders, who take<br />

charge next month, will have to<br />

find the right balance between<br />

trying to prevent the formation<br />

<strong>of</strong> a property bubble and keeping<br />

a healthy growth rate going, according<br />

to Howie.<br />

The slowdown in annual<br />

growth last year came as China<br />

had to deal with weakness in the<br />

global economy, particularly its<br />

key export markets <strong>of</strong> the United<br />

States and the European Union,<br />

and as the government took measures<br />

to cool the property market.<br />

China Vanke’s shares soar on <strong>Hong</strong> <strong>Kong</strong> plan<br />

AFP<br />

jumped to HK$13.75.<br />

If approved, the move <strong>of</strong> its<br />

foreign currency B-shares to<br />

<strong>Hong</strong> <strong>Kong</strong> will widen Vanke’s<br />

access to global investors, giving<br />

the company entry to an exchange<br />

where the daily trading<br />

value is more than 100 times<br />

higher, Bloomberg reported.<br />

“The move will help Vanke access<br />

more resources in the long run,”<br />

Jinsong Du, a property analyst at<br />

Credit Suisse, told Bloomberg.<br />

Huawei pr<strong>of</strong>it<br />

rises in line<br />

with forecasts<br />

Huawei, the Chinese telecoms<br />

equipment manufacturer,<br />

said that its net pr<strong>of</strong>it grew 33<br />

percent to 15.4 billion yuan last<br />

year, in line with its forecast<br />

earlier last month.<br />

The company, which has<br />

been trying to tap into the smartphone<br />

market, said it made huge<br />

breakthroughs in selling the<br />

devices in Japan, North America,<br />

Europe and other markets in<br />

2012.<br />

Revenue last year increased<br />

by 8 percent to 220.2 billion<br />

yuan, the company added. For<br />

2013, the firm expects its overall<br />

revenue to grow between 10 and<br />

12 percent.<br />

Despite the improvement,<br />

“smartphone penetration is still<br />

way too low and there is a lot<br />

<strong>of</strong> room for growth,” BBC News<br />

quoted Cathy Meng, Huawei’s<br />

chief financial <strong>of</strong>ficer and<br />

daughter <strong>of</strong> company founder<br />

Ren Zhengfei, as saying.<br />

Huawei recently pledged to<br />

start publishing more detailed<br />

financial information in order<br />

to dispel increased scrutiny by<br />

foreign governments.<br />

The company, along with<br />

rival ZTE, poses a national security<br />

threat to the United States, a<br />

U.S. congressional investigation<br />

concluded last year.<br />

Meanwhile, security concerns<br />

about Huawei’s links to the<br />

People’s Liberation Army led the<br />

Australian government to ban it<br />

from tendering for its national<br />

broadband network.

Companies ditch U.S. listings in wake<br />

<strong>of</strong> investigations, share price slumps<br />

Markets closer to home <strong>of</strong>fer better valuations, fewer headaches<br />

A record number <strong>of</strong> Chinese companies<br />

have pulled out <strong>of</strong> stock<br />

markets in the United States<br />

suggesting that they see fewer<br />

advantages in a U.S. listing.<br />

In 2012, 27 China-based<br />

companies with U.S. listings<br />

announced plans to go private,<br />

up from 16 in 2011, according to<br />

investment bank Roth Capital<br />

Partners, Reuters reported.<br />

Also, about 50 mainly small<br />

Chinese companies deregistered<br />

last year with the U.S. Securities<br />

and Exchange Commission,<br />

ending their requirements for<br />

going public. This is up from<br />

about 40 in 2011 and the most<br />

since around 1994.<br />

Experts cite the U.S. government<br />

investigations <strong>of</strong> financial<br />

reports and low share prices<br />

Maurice “Hank” Greenberg<br />

as diminishing many Chinese<br />

companies’ chances <strong>of</strong> raising<br />

new money in the U.S.<br />

“There’s very little in the way<br />

<strong>of</strong> new capital flows to those<br />

companies, their valuations are<br />

low and they’re encountering<br />

significant headwinds in terms <strong>of</strong><br />

FDI drops for the first time in three years<br />

Foreign direct investment flows<br />

into China fell last year – the<br />

first decline since 2009 – as the<br />

economy grew at its slowest pace<br />

in 13 years.<br />

Last year, total FDI into<br />

China stood at US$111.7 billion,<br />

3.7 percent lower than 2011,<br />

according to data released<br />

last month by the Ministry <strong>of</strong><br />

Commerce. Outbound Chinese<br />

direct investment, however, grew<br />

28.6 percent from a year earlier to<br />

a record US$77.2 billion.<br />

Analysts say that the drop in<br />

foreign investment is the result <strong>of</strong><br />

China’s overall slowing growth<br />

AFP<br />

and Europe’s ongoing debt crisis,<br />

Bloomberg reported.<br />

It is also spurred by China<br />

losing its competitive edge<br />

as a low-cost manufacturing<br />

base, making other investment<br />

destinations more attractive.<br />

“For 20 years China has<br />

been the major recipient <strong>of</strong><br />

foreign direct investment in<br />

the developing world but rising<br />

costs from higher wages and<br />

currency appreciation are seeing<br />

multinationals look to expand<br />

elsewhere,” Trinh Nguyen, an<br />

economist at HSBC in <strong>Hong</strong><br />

<strong>Kong</strong>, wrote in a recent report.<br />

regulatory oversight,” James Feltman,<br />

a senior managing director<br />

at Mesirow Financial Consulting<br />

in Chicago, told Reuters.<br />

Last month, a <strong>Hong</strong> <strong>Kong</strong> arbitration<br />

panel ruled that China<br />

MediaExpress Holdings, which<br />

obtained a U.S. stock listing<br />

without an initial public <strong>of</strong>fering<br />

by buying a listed company, was<br />

a fraudulent enterprise, awarding<br />

US$77 million in damages to<br />

Starr International, a firm run by<br />

Maurice “Hank” Greenberg, the<br />

former chief executive <strong>of</strong>ficer <strong>of</strong><br />

American International Group.<br />

Greenberg sued the company<br />

as well as its auditor Deloitte<br />

Touche Tohmatsu in Delaware<br />

in 2011, claiming Starr was<br />

fraudulently induced into investing<br />

in the Chinese company.<br />

“India, Indonesia and Vietnam<br />

stand to benefit most as they<br />

have large labour forces and<br />

strong domestic markets.”<br />

Despite companies shifting<br />

to other countries, in a survey<br />

<strong>of</strong> about 300 members <strong>of</strong><br />

the American Chamber <strong>of</strong><br />

Commerce in China, 58 percent<br />

<strong>of</strong> respondents said that the<br />

Mainland remains in their top<br />

three investment priorities,<br />

up from 47 percent in 2011.<br />

However, only 20 percent said<br />

China was their top investment<br />

priority, compared with 31<br />

percent the year before.<br />

Alibaba founder<br />

set to quit as<br />

CEO<br />

The founder <strong>of</strong> Alibaba, the<br />

Mainland’s biggest e-commerce<br />

company, will step down as the<br />

firm’s chief executive.<br />

“Alibaba’s young people have<br />

better, more brilliant dreams<br />

than mine, and they are more<br />

capable <strong>of</strong> building a future<br />

that belongs to them,” Jack<br />

Ma, who founded the company<br />

14 years ago, said in a letter to<br />

employees. He added that “the<br />

Internet belongs to the young<br />

people.”<br />

Just days before the<br />

announcement was made, it<br />

was revealed that Alibaba was<br />

breaking up its business into 25<br />

units, led by different executives,<br />

to be more agile in responding to<br />

the market.<br />

Ma said he would appoint<br />

a successor and act only as an<br />

executive chairman from 10 May.<br />

Analysts believe that the<br />

next chief executive will need<br />

to ensure a smooth transition in<br />

the business model in order to be<br />

successful.<br />

“The biggest challenge a new<br />

chief executive <strong>of</strong>ficer faces is<br />

making sure the new business<br />

units can effectively coordinate<br />

among themselves,” Yang<br />

Xiao, a Beijing-based analyst<br />

with research firm Analysys<br />

International, told BBC News.<br />

Alibaba is the parent<br />

company <strong>of</strong> Alibaba.com, an<br />

online marketplace for small<br />

businesses, Taobao, a shopping<br />

website, and Alipay, an online<br />

payment service.<br />

February 2013 11

Auditors asked to enhance<br />

IPO due-diligence methods<br />

The China Securities Regulatory Commission<br />

encouraged auditors to step up their approach<br />

to due diligence in an effort to restore confidence<br />

in the Mainland’s new stock market<br />

listings. Bankers who attended a meeting<br />

with the regulator on 8 January said auditors<br />

were asked to use more behavioural analysis<br />

when assessing potential IPO candidates, including<br />

techniques used in the United States.<br />

“A senior CSRC <strong>of</strong>ficial mentioned the [U.S.]<br />

Federal Bureau <strong>of</strong> Investigation’s people-reading<br />

technique in particular as an example,” a<br />

banker told the International Finance Review.<br />

Mainland IPOs to pick up<br />

this year, PwC forecasts<br />

The number <strong>of</strong> initial public <strong>of</strong>ferings in China’s<br />

A-share market is expected to rebound,<br />

PricewaterhouseCoopers forecast last month.<br />

“PwC is expecting 200 IPOs to raise 130 billion<br />

to 150 billion yuan in 2013 by listing on<br />

the Shanghai and Shenzhen stock markets,”<br />

Frank Lyn, managing partner <strong>of</strong> PwC China,<br />

said at a press conference in Beijing. The forecast<br />

compares to 155 IPOs listed in 2012, with<br />

total funds raised at 108.3 billion yuan.<br />

Audit authority recovers<br />

embezzled housing funds<br />

The National Audit Office, China’s top auditing<br />

authority, announced that 2.96 billion yuan<br />

embezzled from affordable-housing funds in<br />

2011 had been recovered. According to a report<br />

by the auditing authority, its audit work<br />

has cancelled about 7,000 households’ rights<br />

to benefit from the housing.<br />

Central bank balance sheet<br />

shrinks for first time<br />

Data from the People’s Bank <strong>of</strong> China indicated<br />

that its balance sheet, which expanded<br />

eightfold from 2002 to 2011, shrank for the<br />

first time last year, the People’s Daily reported<br />

last month. It showed that the central<br />

bank’s assets totalled nearly 29 trillion yuan<br />

at the end <strong>of</strong> November 2012, nearly 514.7 billion<br />

yuan less than the amount at the end <strong>of</strong><br />

January 2012.<br />

12 February 2013<br />

NEWS<br />

GREATER CHINA<br />

Deloitte opposes request by<br />

SEC to resume audit case<br />

Firm claims regulator contributed to impasse<br />

Deloitte has asked a judge in the United States to reject a Securities and<br />

Exchange Commission case forcing the firm to hand over work papers from<br />

its audit <strong>of</strong> Longtop Financial Technologies, an allegedly fraudulent Chinese<br />

company.<br />

Deloitte had previously resisted handing over the accounting documents,<br />

citing Chinese secrecy laws.<br />

Last month the U.S. regulator requested that the federal court case, which<br />

began in May 2011, be reopened following a six-month hiatus when negotiations<br />

between the SEC and the Chinese Securities Regulatory Commission failed to<br />

reach a solution.<br />

Deloitte’s lawyers filed papers saying that the case should be postponed<br />

pending the outcome <strong>of</strong> the SEC’s recent administrative proceedings against<br />

five accounting firms, including Deloitte, as part <strong>of</strong> an investigation into alleged<br />

accounting fraud at nine U.S.-listed Chinese companies.<br />

Deloitte also argued that the SEC’s issue is partly <strong>of</strong> their own making. “The<br />

SEC has long been aware that the CSRC forbids China-based audit firms to<br />

produce audit work papers directly to the SEC, and yet the SEC chose to allow<br />

China-based companies to sell securities in the United States despite those<br />

restrictions,” the firm said in the papers it filed.<br />

Caterpillar grapples with accounting<br />

scandal over Chinese subsidiary<br />

Caterpillar, the world’s largest manufacturer <strong>of</strong> tractors and excavators, announced<br />

it had discovered accounting misconduct at a Chinese company it had<br />

acquired in June last year.<br />

This led to Caterpillar, which paid about US$700 million for ERA Mining Machinery,<br />

writing down more than half its expected earnings for the last quarter<br />

<strong>of</strong> 2012.<br />

On 18 January, the manufacturer announced in a statement that an investigation<br />

<strong>of</strong> ERA and its subsidiary, Zhengzhou Siwei Mechanical & Electrical<br />

Equipment Manufacturing Company, which provides equipment for the mining<br />

industry, found “deliberate, multi-year, coordinated accounting misconduct.” As<br />

a result, Caterpillar said it would take a non-cash goodwill impairment charge <strong>of</strong><br />

US$580 million, or 87 cents per share, in the quarter.<br />

It also stated that the probe “determined several Siwei senior managers<br />

engaged in deliberate misconduct beginning several years prior to Caterpillar’s<br />

acquisition <strong>of</strong> Siwei.” Caterpillar replaced these senior managers and said that<br />

“the actions carried out by these individuals are <strong>of</strong>fensive and completely unacceptable.”<br />

The company found discrepancies in November 2012 between the<br />

inventory in Siwei’s books and its actual inventory.<br />

Caterpillar’s shares fell by 1.5 percent after news <strong>of</strong> the fraud broke out.

Compliance<br />

New legislation and standards have increased<br />

the compliance burden on companies. But not all<br />

executives are in despair, as new frameworks can be<br />

good for management, shareholders and the market.<br />

Craig Stephen reports<br />

14 February 2013<br />

Illustrations by Harry Harrison

<strong>Hong</strong> <strong>Kong</strong> executives had<br />

at least one extra resolution<br />

on their minds on<br />

New Year’s Day. That<br />

was the day the Securities<br />

and Futures (Amendment) Ordinance<br />

2012, requiring any inside information<br />

that comes to their knowledge to be disclosed,<br />

came into effect.<br />

Failure to make timely disclosures <strong>of</strong> inside<br />

information – defined as specific news<br />

that if generally known to persons likely to<br />

deal in the listed securities would materially<br />

affect the price – could attract a fine <strong>of</strong> up to<br />

HK$8 million among other penalties.<br />

The new rule is the latest in a series <strong>of</strong><br />

legislative moves designed to increase transparency<br />

in <strong>Hong</strong> <strong>Kong</strong>’s markets. However,<br />

for many companies the new regulations are<br />

part <strong>of</strong> an increasing burden on doing business.<br />

A recent raft <strong>of</strong> legislation – amending<br />

laws governing short selling, trade descriptions,<br />

data privacy, competition and overthe-counter<br />

derivatives, to name a few – combined<br />

with new accounting standards and<br />

tougher extraterritorial financial regulations<br />

have made many executives and accountants<br />

cry “enough.”<br />

The growing burden is a worldwide<br />

phenomenon: According to a recent global<br />

KPMG survey <strong>of</strong> corporate general counsel,<br />

the increasing volume and complexity <strong>of</strong><br />

regulations was rated as the greatest risk to<br />

corporations over the next five years.<br />

But rather than panic, some companies<br />

are choosing to accentuate the positive and<br />

focus on how a more tightly regulated environment<br />

can be good for business. As much<br />

as the elephant in the room might seem<br />

unnecessary and to be taking up valuable<br />

space, with the right training it<br />

can also be put to useful work.<br />

“The vast majority <strong>of</strong><br />

compliance measures<br />

deliver a benefit,” says<br />

John MacPherson,<br />

who manages compliance<br />

issues for Sinclair<br />

Knight Merz, a British<br />

civil engineering company. “They can be ensuring<br />

safety, setting a benchmark for product<br />

quality, putting a price on environmental<br />

impacts, protecting the consumer from<br />

bad business practices or providing a fairer<br />

deal for stakeholders, investors and wider<br />

society.”<br />

Constructing a culture<br />

Financial reporting standards are a<br />

prime example <strong>of</strong> an extra burden being<br />

worthwhile, says William Lim, technical<br />

partner for HKFRS and IFRS at Deloitte in<br />

<strong>Hong</strong> <strong>Kong</strong> and a <strong>Hong</strong> <strong>Kong</strong> <strong>Institute</strong> <strong>of</strong><br />

CPAs member.<br />

“It means companies are easier to analyse,<br />

which gives them better access to international<br />

capital,” Lim says. “This gives a<br />

competitive advantage to <strong>Hong</strong> <strong>Kong</strong>’s capital<br />

markets. It makes our job more difficult<br />

but this just means we have to structure appropriately<br />

so we have standards specialists<br />

in place.”<br />

Proper implementation <strong>of</strong> systems to meet<br />

obligations does not just help companies<br />

avoid new regulatory pitfalls, but also serves<br />

to raise performance. “It can change the<br />

culture <strong>of</strong> a company for the better,” says Paul<br />

Phenix, who heads the technical department<br />

at Baker Tilly in <strong>Hong</strong> <strong>Kong</strong> and is also an<br />

<strong>Institute</strong> member. He cites recent changes to<br />

the <strong>Hong</strong> <strong>Kong</strong> stock exchange<br />

corporate governance<br />

code as an example.<br />

One <strong>of</strong> the changes to the code calls for a<br />

robust whistle-blowing protection regime.<br />

This, says Phenix, helps make a company<br />

more open to listening to employees about<br />

performance problems that can be fixed,<br />

which leads to raising the company’s value.<br />

Compliance objectives can strengthen a<br />

company’s governance from the bottom up,<br />

he says, adding that the rules covering the<br />

release <strong>of</strong> inside information can surprisingly<br />

have the greatest impact on relatively<br />

low-level employees, such as accounting<br />

clerks or goods vehicle drivers with access to<br />

important information.<br />

Advisers try to stress the upside <strong>of</strong> compliance-mandated<br />

change. “We approach<br />

from both a compliance aspect and what we<br />

call a commercial benefits character,” says<br />

Hugh Gozzard, an enterprise risk services<br />

principal at Deloitte in <strong>Hong</strong> <strong>Kong</strong> and an<br />

<strong>Institute</strong> member.<br />

“We try to engage clients and explain<br />

the benefits,” he adds. “They need to take<br />

a broader view and not just say ‘This is horrible.’<br />

If there are costs associated to put in<br />

controls, there are also gains to be made<br />

from the avoidance <strong>of</strong> reputational damage,<br />

sanctions or unpleasant publicity.”<br />

Making the most <strong>of</strong> it<br />

To be sure, not all new rules have an upside.<br />

In many cases, they impose requirements<br />

that regulators see as necessary. One example<br />

is the Foreign Account Tax Compliance<br />

Act, known as FATCA, enacted by the United<br />

States in 2010, which requires non-U.S.<br />

banks to disclose details <strong>of</strong> accounts held by<br />

U.S. citizens.<br />

“In the tax field, regulatory requirements<br />

continue to increase, with<br />

FATCA being perhaps the most<br />

extreme example, as the<br />

U.S. has imposed its tax<br />

enforcement standards<br />

on banks worldwide,”<br />

says Scott Michel, a partner at<br />

Caplin & Drysdale, a law firm<br />

in Washington. “FATCA is<br />

February 2013 15

Compliance<br />

the law and [there is] really no choice but to<br />

try to make the best <strong>of</strong> it.”<br />

Another example <strong>of</strong> compliance imposed<br />

from outside <strong>Hong</strong> <strong>Kong</strong> is the decision by<br />

the G-20 group <strong>of</strong> major world economies<br />

to regulate over-the-counter derivatives by<br />

centralizing their clearing, reporting and<br />

trading through electronic platforms. The<br />

<strong>Hong</strong> <strong>Kong</strong> Monetary Authority, along with<br />

its counterparts in Singapore and Australia,<br />

has largely adopted the new derivatives<br />

rules, but while noting the regulatory burden<br />

imposed on companies.<br />

Michael Go, executive director <strong>of</strong> MMADX,<br />

a derivatives trading platform in Australia,<br />

agrees that there could be practical and<br />

economic difficulties moving derivatives to<br />

an electronic platform. However, he adds,<br />

“there are also benefits for the market in<br />

pooling liquidity [and] efficiencies from improvements<br />

to risk management.”<br />

Data privacy is another prime example <strong>of</strong><br />

an evolving regulatory area as many jurisdictions<br />

change and update rules.<br />

<strong>Hong</strong> <strong>Kong</strong>’s amended Personal Data<br />

16 February 2013<br />

(Privacy) Ordinance came into effect in<br />

October 2012. Maximum fines for violating<br />

the ordinance will rise from HK$50,000 to<br />

HK$1 million. Meanwhile, a draft bill before<br />

the European parliament could see a company<br />

fined 2 percent <strong>of</strong> its global revenue for<br />

data privacy violations.<br />

“Companies need to know what personal,<br />

customer, intellectual or financial<br />

information they are keeping,” says Anthony<br />

Crampton, a risk consulting director at<br />

KPMG China in <strong>Hong</strong> <strong>Kong</strong>. “What data do<br />

you have? How is it classified? Where is it?<br />

How secure is it? Is access to your data appropriately<br />

controlled?”<br />

Bearing the cost<br />

There is no doubt that meeting new obligations<br />

bears a cost and the benefits need to<br />

be analysed. Simon Riley, director <strong>of</strong> the<br />

<strong>Institute</strong>’s standard setting department,<br />

says the <strong>Institute</strong> recently hosted, with the<br />

International Accounting Standards Board,<br />

a roundtable meeting to study implementation<br />

<strong>of</strong> the segment reporting standard.<br />

“Concerns were understandably raised<br />

about the costs and benefits <strong>of</strong> requiring<br />

certain disclosures,” Riley says <strong>of</strong> the roundtable,<br />

which was attended by financial statement<br />

preparers, auditors, academia, regulators,<br />

investors and other users <strong>of</strong> financial<br />

statements.<br />

“We know these concerns exist not only<br />

in <strong>Hong</strong> <strong>Kong</strong>, but also internationally, and<br />

we welcome the efforts <strong>of</strong> the IASB to examine<br />

the concepts underlying disclosure<br />

requirements as part <strong>of</strong> the continual effort<br />

to arrive at financial reports that are both<br />

relevant and useful and balance up the compliance<br />

costs in their preparation.”<br />

Hans Hoogervorst, chairman <strong>of</strong> the<br />

IASB, points out that although the cost <strong>of</strong><br />

convergence with IFRS can be high, it is outweighed<br />

by the longer-term benefits. “There<br />

is a one-time cost and that cost is real, but<br />

it is nothing compared to the cost <strong>of</strong> lack <strong>of</strong><br />

investment because you haven’t adopted a<br />

global standard,” he told a press conference<br />

at an IFRS Foundation Trustees event hosted<br />

by the <strong>Institute</strong> last month.

Local regulators agree, saying that one<strong>of</strong>f<br />

costs are <strong>of</strong>fset by continuing savings.<br />

“Standardizing reporting standards, for<br />

example, reduces the costs <strong>of</strong> preparing financial<br />

statements,” Arthur Yuen, deputy<br />

chief executive <strong>of</strong> the <strong>Hong</strong> <strong>Kong</strong> Monetary<br />

Authority, said at the same event.<br />

Value in transparency<br />

Jim Woods, China risk, control and assurance<br />

practice leader at PricewaterhouseCoopers<br />

and an <strong>Institute</strong> member, believes now is<br />

“crunch time,” when the current landscape<br />

<strong>of</strong> new rules and standards means companies<br />

must improve controls. Rather than<br />

despairing, Woods urges companies to emphasize<br />

the upside. “It will give you a competitive<br />

edge,” he says.<br />

Meeting new obligations, Woods adds,<br />

can deliver much greater transparency for<br />

investors and other stakeholders, which can<br />

have direct benefits for a company’s stock<br />

price. “The common complaint from listed<br />

companies is their share price is too low be-<br />

cause investors don’t understand their business,”<br />

he says. “That is why there is value in<br />

transparency.”<br />

To help seek and understand that value,<br />

Andy Cheung, chief financial <strong>of</strong>ficer <strong>of</strong> The<br />

Link Real Estate Investment Trust and an <strong>Institute</strong><br />

member, says his company is always<br />

looking ahead to the prospect <strong>of</strong> new rules<br />

and laws. “We always try to be ahead <strong>of</strong> the<br />

ball game,” he says.<br />

For example, Link REIT began producing<br />

sustainability reports two years ago. “This<br />

gives us a sense <strong>of</strong> how the organization as a<br />

whole is working,” says Cheung. “Using key<br />

performance indicators, we can see gaps for<br />

improvements internally as well as giving us<br />

a good global benchmark against our peers.”<br />

Cheung says proper preparation is the<br />

key to building effective compliance frameworks<br />

that don’t impact the bottom line. He<br />

says Link REIT’s pr<strong>of</strong>essional management<br />

teams work closely with external consultants<br />

to assess any regulatory risks. “Once it<br />

is known, we assess how it will impact the<br />

A PLUS<br />

business from a financial point <strong>of</strong> view, from<br />

operations, and develop a policy. This is reported<br />

and discussed at board level.<br />

“Good reporting is more than just about<br />

more financial disclosure and controls,”<br />

Cheung adds. “Over the years we have improved<br />

the quality <strong>of</strong> our disclosure to cater<br />

for a much broader readership such as<br />

stakeholders in the community. This means<br />

using less jargon, plain English, as well as<br />

more charts and diagrams.”<br />

Ultimately, being prepared for compliance<br />

requires a strategic or longer term perspective.<br />

“Companies should be introducing<br />

clearer policies or additional approvals<br />

and reviews to their processes,” explains<br />

Luis Hui, head <strong>of</strong> compliance at Siemens<br />

China in Beijing and an <strong>Institute</strong> member.<br />

“Although this does not show up immediately<br />

on the pr<strong>of</strong>it and loss as a gain,<br />

this commitment to instilling and building<br />

sustainability into their businesses, like<br />

upgraded infrastructure, will reap future<br />

benefits.”<br />

February 2013 17

Council members<br />

Meet the Council<br />

Members are our<br />

biggest asset<br />

Kicking <strong>of</strong>f a series in which Council<br />

members meet with our readers,<br />

<strong>Institute</strong> president Susanna Chiu outlines<br />

her vision <strong>of</strong> the needs <strong>of</strong> the pr<strong>of</strong>ession<br />

It has been 18 years since I first started<br />

my service at the <strong>Institute</strong>, initially as a<br />

volunteer member on one <strong>of</strong> the committees.<br />

Since then, it has been a wonderful<br />

journey that has blessed me with many<br />

friendships and valuable experiences.<br />

Now that I have been given the honour <strong>of</strong><br />

leading the <strong>Institute</strong> as president, I will dedicate<br />

myself to working with the Council and<br />

management to set our organization in good<br />

stead as we celebrate our 40th year. I’m committed<br />

to building an even stronger <strong>Institute</strong><br />

and CPA brand to serve members and the<br />

<strong>Hong</strong> <strong>Kong</strong> public in the years to come.<br />

Many have asked me what plans there<br />

are for my year as president. There are<br />

many, including continuing the good work<br />

<strong>of</strong> the immediate past president, Keith Pogson,<br />

and his predecessors. We will also start<br />

new initiatives, such as the sixth long-range<br />

plan. But if I had to choose a theme, it would<br />

be “diversity,” because it encompasses our<br />

many plans and also represents the diverse<br />

pr<strong>of</strong>ile and needs <strong>of</strong> our membership.<br />

We have more than 35,000 members <strong>of</strong><br />

all ages. We have one <strong>of</strong> the most genderequal<br />

pr<strong>of</strong>essions – with 49 percent women<br />

and 51 percent men – and a young membership,<br />

with more than 45 percent <strong>of</strong> members<br />

under the age <strong>of</strong> 40. Practising members<br />

make up 23 percent, while 77 percent <strong>of</strong><br />

our members are pr<strong>of</strong>essional accountants<br />

in business and others. Diversity is an issue<br />

close to my heart, and I am sure the <strong>Institute</strong><br />

will continue recognizing this and providing<br />

services that aren’t just administrative,<br />

but that deliver added value to our members<br />

and engage them in a meaningful way.<br />

For our members working in practice, auditor<br />

liability reform is a pressing concern.<br />

There is a need to objectively examine the<br />

current regulatory and liability landscape<br />

and look at how the <strong>Institute</strong> as the pr<strong>of</strong>ession’s<br />

leader can manage the transition<br />

smoothly in collaboration with the government<br />

and other stakeholders.<br />

18 February 2013<br />

Meanwhile, as a pr<strong>of</strong>essional accountant<br />

in business for more than 16 years, I can<br />

see the challenges <strong>of</strong> members in this field<br />

including the support they need in daily<br />

work and expanding the breadth and depth<br />

<strong>of</strong> their career horizon. As CPAs, we are<br />

prominent global business executives and<br />

advisers, contributing to the development<br />

<strong>of</strong> business and finance in <strong>Hong</strong> <strong>Kong</strong> and<br />

around the world. Our members are multiskilled<br />

and doing multi-disciplinary work,<br />

and this requires us to evolve our thinking<br />

as a pr<strong>of</strong>ession and the positioning <strong>of</strong> our<br />

CPA brand.<br />

We must continue to examine and improve<br />

the services the <strong>Institute</strong> provides to all<br />

“We will continue<br />

achieving<br />

sustainable<br />

success for our<br />

pr<strong>of</strong>ession, our<br />

<strong>Institute</strong> and all<br />

our members.”<br />

Susanna Chiu<br />

President<br />

members throughout their careers as CPAs.<br />

These include education and extending the<br />

mobility and influence <strong>of</strong> our CPA designation<br />

in the Mainland and internationally.<br />

I have been actively engaging members<br />

to participate in the <strong>Institute</strong>’s social and<br />

recreational activities throughout the past<br />

few years. I encourage you to take part as<br />

there is good value in it. The camaraderie,<br />

mutual support and pride <strong>of</strong> being a CPA<br />

– and working together as a pr<strong>of</strong>ession to<br />

achieve things that we couldn’t do alone –<br />

are important parts <strong>of</strong> being a member <strong>of</strong><br />

the <strong>Institute</strong>.<br />

The fast-changing world will no doubt<br />

present new challenges to our pr<strong>of</strong>ession.

But by working together – and focusing on<br />

members – I am confident that with the collective<br />

skills, experience and commitment<br />

<strong>of</strong> our Council and management, we will<br />

continue achieving sustainable success for<br />

our pr<strong>of</strong>ession, our <strong>Institute</strong> and all our<br />

members.<br />

Susanna Chiu is also a director <strong>of</strong> Li & Fung<br />

Development (China).<br />

Staying on top and in front<br />

Clement Chan, <strong>Institute</strong> vice-president,<br />

looks at the pr<strong>of</strong>ession’s regulatory reform<br />

challenges<br />

The <strong>Hong</strong> <strong>Kong</strong> government and<br />

the Financial Reporting Council<br />

are looking at potential reforms <strong>of</strong><br />

the audit regulatory framework to put <strong>Hong</strong><br />

<strong>Kong</strong> in line with global norms and eligible<br />

for membership <strong>of</strong> the International Forum<br />

<strong>of</strong> Independent Audit Regulators. It is an<br />

important step towards maintaining <strong>Hong</strong><br />

<strong>Kong</strong>’s position as an international financial<br />

centre.<br />