Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

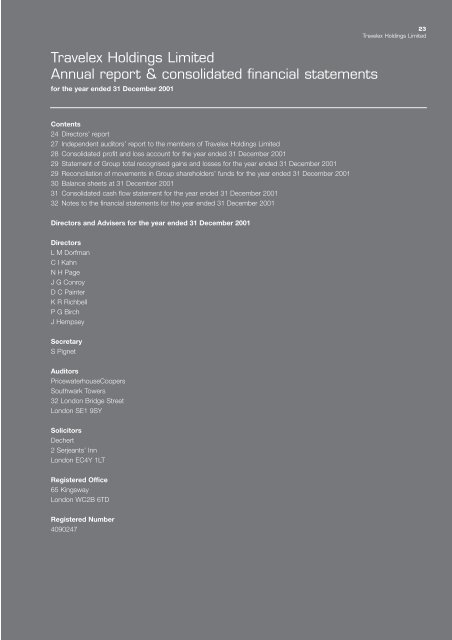

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

<strong>Annual</strong> <strong>report</strong> & <strong>consolidated</strong> <strong>financial</strong> statements<br />

for the year ended 31 December 2001<br />

Contents<br />

24 Directors’ <strong>report</strong><br />

27 Independent auditors’ <strong>report</strong> to the members of <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

28 Consolidated profit and loss account for the year ended 31 December 2001<br />

29 Statement of Group total recognised gains and losses for the year ended 31 December 2001<br />

29 Reconciliation of movements in Group shareholders’ funds for the year ended 31 December 2001<br />

30 Balance sheets at 31 December 2001<br />

31 Consolidated cash flow statement for the year ended 31 December 2001<br />

32 Notes to the <strong>financial</strong> statements for the year ended 31 December 2001<br />

Directors and Advisers for the year ended 31 December 2001<br />

Directors<br />

L M Dorfman<br />

C I Kahn<br />

N H Page<br />

J G Conroy<br />

D C Painter<br />

K R Richbell<br />

P G Birch<br />

J Hempsey<br />

Secretary<br />

S Pignet<br />

Auditors<br />

PricewaterhouseCoopers<br />

Southwark Towers<br />

32 London Bridge Street<br />

London SE1 9SY<br />

Solicitors<br />

Dechert<br />

2 Serjeants’ Inn<br />

London EC4Y 1LT<br />

Registered Office<br />

65 Kingsway<br />

London WC2B 6TD<br />

Registered Number<br />

4090247<br />

23<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong>

24<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Directors’ <strong>report</strong><br />

for the year ended 31 December 2001<br />

The directors present their <strong>report</strong> and the audited accounts of <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong> and its subsidiaries (the Group) and<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong> (the Company) for the year ended 31 December 2001. The Group accounts comprise the<br />

<strong>consolidated</strong> accounts of the Company including its subsidiary and associated undertakings as defined by the Companies Act<br />

1985. The comparatives are for the <strong>Travelex</strong> plc group for the period 7 August 2000 to 31 December 2000.<br />

The Company was incorporated on 13 October 2000 under the name of IBIS (621) <strong>Limited</strong>. On 9 January 2001 it changed<br />

its name to <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong>. On 25 January 2001, the Company acquired all of the issued shares of <strong>Travelex</strong> plc,<br />

the previous holding company, prior to which the Company had been a dormant entity.<br />

During the year the Company purchased the Global and Financial Services (G&FS) divisions of Thomas Cook <strong>Holdings</strong> <strong>Limited</strong><br />

and subsequently undertook an integration and restructuring programme.<br />

Principal activities<br />

The Group’s principal activities are the provision of travel money services, funds transfer services, issuance of travellers<br />

cheques, dealing in foreign bank notes and provision of other travel and <strong>financial</strong> related services. The Group operates in the<br />

United Kingdom, Americas, Asia Pacific, Continental Europe and Africa.<br />

Review of business and future developments<br />

The Chairman’s statement contains a review of the Group’s trading results for the year and future developments.<br />

Results and dividend<br />

The Group made an operating profit of £35.0 million (2000: £7.1 million). The year’s profit before taxation was £21.6 million<br />

(2000: £3.9 million).<br />

Interim dividends of £33,200 were paid on the ‘A’ ordinary shares during the year (2000: nil). The directors do not recommend<br />

the payment of a final dividend (2000: nil).<br />

Introduction of the euro<br />

The Group has operations in a number of the countries that adopted the euro as a single currency on 1 January 1999 and<br />

introduced euro bank notes on l January 2002.<br />

The Group experienced a trouble-free transition on both occasions. No material expenditure was incurred as a consequence<br />

of the change.<br />

The directors believe that the introduction of the single currency into countries in which the Group operates has presented<br />

opportunities to gain a larger share of the market for travel money services.

Directors’ <strong>report</strong> continued<br />

for the year ended 31 December 2001<br />

Directors and their interests<br />

The current directors of the Group and their interests in the share capital of the Group at the year end were:<br />

L M Dorfman Appointed 15 January 2001 566,950*<br />

C I Kahn ACA Appointed 15 January 2001 28,605<br />

J G Conroy BA Hons Appointed 25 January 2001 –<br />

N H Page MA FCA Appointed 25 January 2001 4,042<br />

P G Birch CBE Appointed 25 January 2001 6,737<br />

K R Richbell BA Hons, MBA, FCIB Appointed 25 January 2001 –<br />

D C Painter BA Hons ACMA Appointed 25 April 2001 –<br />

J Hempsey BA CA Appointed 25 April 2001 –<br />

*Including family interests<br />

25<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Ordinary Shares of £1 each<br />

The directors on formation, Dechert Nominees <strong>Limited</strong>, resigned on 15 January 2001. On 28 February 2001, O A Hajilou<br />

(appointed 25 January 2001) also resigned as a director.<br />

Employees<br />

The Group is committed to employee involvement as business objectives are best achieved if the Group’s staff understand<br />

and support the Group’s strategy. Staff members are kept informed of performance through briefing meetings, supplemented<br />

by a range of staff magazines and internal communications.<br />

Executives regularly visit business locations and discuss matters of current interest with staff. The Company’s <strong>financial</strong><br />

performance is presented and explained to staff during the year.<br />

Equal opportunities<br />

The Group’s policy is not to discriminate against anyone, on any grounds. Training is provided and available to all levels<br />

of staff, and investment in employee development continues to be a priority. Within this policy, the Group gives full<br />

consideration to applications for employment from disabled persons where the requirements of the job can be adequately<br />

fulfilled by a disabled person.<br />

Where existing employees become disabled, it is the Group’s policy wherever practicable to provide continuing employment<br />

under normal terms and conditions and to provide training and career development and promotion to disabled employees<br />

wherever appropriate.<br />

Policy and practice on payment of creditors<br />

The Group’s policy is to fix terms of payment for all suppliers when agreeing the terms of such business transactions, to<br />

ensure the supplier is aware of those terms and to abide by the agreed terms of payment. At the year-end trade creditors,<br />

including amounts payable under contracts to supply foreign currency, represented three days of purchases.<br />

Charitable and political donations<br />

During the year, the Group made donations in the United Kingdom for charitable purposes amounting to £62,500<br />

(2000: £10,373). Political donations were £6,300 (2000: nil).

26<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Directors’ <strong>report</strong> continued<br />

for the year ended 31 December 2001<br />

Post-balance sheet events<br />

To the best of the directors’ knowledge, there have been no material post-balance sheet events affecting these <strong>financial</strong><br />

statements.<br />

Directors’ responsibilities<br />

Company law requires the directors to prepare <strong>financial</strong> statements for each <strong>financial</strong> year which give a true and fair view of the<br />

state of affairs of the Company and of the profit or loss of the Company for that year. In preparing those <strong>financial</strong> statements,<br />

the directors are required to:<br />

• select suitable accounting policies and then apply them consistently;<br />

• make judgements and estimates that are reasonable and prudent;<br />

• state whether applicable accounting standards have been followed, subject to any material departures disclosed<br />

and explained in the <strong>financial</strong> statements; and<br />

• prepare the <strong>financial</strong> statements on the going concern basis unless it is inappropriate to presume that the Company<br />

will continue in business.<br />

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the<br />

<strong>financial</strong> position of the Company and to enable them to ensure that the <strong>financial</strong> statements comply with the Companies Act<br />

1985. They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the<br />

prevention and detection of fraud and other irregularities.<br />

Auditors<br />

PricewaterhouseCoopers have informed the Group of their willingness to continue in office as auditors. In accordance with<br />

Section 385 of the Companies Act 1985, a resolution proposing their re-election as auditors will be submitted to the <strong>Annual</strong><br />

General Meeting.<br />

By order of the Board<br />

Sylvain Pignet<br />

Secretary<br />

Registered office<br />

65 Kingsway<br />

London<br />

WC2B 6TD

Independent auditors’ <strong>report</strong> to the members<br />

of <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

for the year ended 31 December 2001<br />

27<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

We have audited the <strong>financial</strong> statements on pages 28 to 60 which have been prepared under the historical cost convention<br />

and the accounting policies set out on pages 32 to 34.<br />

Respective responsibilities of directors and auditors<br />

The directors’ responsibilities for preparing the annual <strong>report</strong> and the <strong>financial</strong> statements in accordance with applicable United<br />

Kingdom law and accounting standards are set out in the statement of directors’ responsibilities on page 26.<br />

Our responsibility is to audit the <strong>financial</strong> statements in accordance with relevant legal and regulatory requirements and United<br />

Kingdom Auditing Standards issued by the Auditing Practices Board.<br />

We <strong>report</strong> to you our opinion as to whether the <strong>financial</strong> statements give a true and fair view and are properly prepared in<br />

accordance with the Companies Act 1985. We also <strong>report</strong> to you if, in our opinion, the directors’ <strong>report</strong> is not consistent with<br />

the <strong>financial</strong> statements, if the Company has not kept proper accounting records, if we have not received all the information<br />

and explanations we require for our audit, or if information specified by law regarding directors’ remuneration and transactions<br />

is not disclosed.<br />

We read the other information contained in the annual <strong>report</strong> and consider the implications for our <strong>report</strong> if we become aware<br />

of any apparent misstatements or material inconsistencies with the <strong>financial</strong> statements.<br />

Basis of audit opinion<br />

We conducted our audit in accordance with auditing standards issued by the Auditing Practices Board. An audit includes<br />

examination, on a test basis, of evidence relevant to the amounts and disclosures in the <strong>financial</strong> statements. It also includes<br />

an assessment of the significant estimates and judgements made by the directors in the preparation of the <strong>financial</strong><br />

statements, and of whether the accounting policies are appropriate to the Group’s circumstances, consistently applied and<br />

adequately disclosed.<br />

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in<br />

order to provide us with sufficient evidence to give reasonable assurance that the <strong>financial</strong> statements are free from material<br />

misstatement, whether caused by fraud or other irregularity or error. In forming our opinion we also evaluated the overall<br />

adequacy of the presentation of information in the <strong>financial</strong> statements.<br />

Opinion<br />

In our opinion the <strong>financial</strong> statements give a true and fair view of the state of affairs of the Company and the Group at<br />

31 December 2001 and the profit and cash flows of the Group for the year then ended and have been properly prepared<br />

in accordance with the Companies Act 1985.<br />

PricewaterhouseCoopers<br />

Chartered Accountants and Registered Auditors<br />

London<br />

27 March 2002

28<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Consolidated profit and loss account<br />

for the year ended 31 December 2001<br />

Continuing operations<br />

Acquisitions Total Total<br />

5 months<br />

2001 2001 2001 2000<br />

Note £’000 £’000 £’000 £’000<br />

Turnover (including share of joint ventures) 169,802 228,124 397,926 71,101<br />

Less: share of turnover of joint ventures (75) – (75) –<br />

Turnover 2 169,727 228,124 397,851 71,101<br />

Cost of sales (101,285) (116,690) (217,975) (37,759)<br />

Gross profit 68,442 111,434 179,876 33,342<br />

Net operating expenses 3 (60,973) (83,920) (144,893) (26,210)<br />

Operating profit 7,469 27,514 34,983 7,132<br />

Income from interests in associated undertakings – 697 697 –<br />

Share of operating loss in joint ventures (100) – (100) –<br />

Profit on ordinary activities before interest 7,369 28,211 35,580 7,132<br />

Interest receivable and similar income 4 588 400 988 209<br />

Interest payable and similar charges 4 (9,372) (5,591) (14,963) (3,464)<br />

Profit/(loss) on ordinary activities before taxation 5 (1,415) 23,020 21,605 3,877<br />

Tax on profit/(loss) on ordinary activities 7 (3,188) (318) (3,506) (2,362)<br />

Profit/(loss) on ordinary activities after taxation (4,603) 22,702 18,099 1,515<br />

Equity minority interests 21 (756) (160) (916) (280)<br />

Profit/(loss) for the <strong>financial</strong> year (5,359) 22,542 17,183 1,235<br />

Dividends 9 – (33) (33) –<br />

Retained profit/(loss) for the <strong>financial</strong> year (5,359) 22,509 17,150 1,235<br />

The profit on ordinary activities above is in respect of continuing operations.<br />

There is no difference between the profit on ordinary activities before taxation and the retained profit for the year stated above<br />

and their historical cost requirements.

29<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Statement of Group total recognised gains and losses<br />

for the year ended 31 December 2001<br />

2001 2000<br />

£’000 £’000<br />

Profit for the <strong>financial</strong> year 17,183 1,235<br />

Currency translation differences on foreign currency net investments (767) 444<br />

Total gains and losses recognised since last annual <strong>report</strong> 16,416 1,679<br />

Reconciliation of movements in Group shareholders’ funds<br />

for the year ended 31 December 2001<br />

2001 2000<br />

£’000 £’000<br />

Profit for the <strong>financial</strong> year 17,183 1,235<br />

Dividends (33) –<br />

17,150 1,235<br />

Other recognised (losses)/gains relating to the year (767) 444<br />

Nominal value of ordinary shares issued – 900<br />

Premium (net of issue expenses) on ordinary shares issued – 19,100<br />

Net change in shareholders’ funds 16,383 21,679<br />

Shareholders’ funds at 1 January 21,679 –<br />

Shareholders’ funds at 31 December 38,062 21,679

30<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Balance sheets<br />

at 31 December 2001<br />

Group Company<br />

2001 2000 2001 2000<br />

Note £’000 £’000 £’000 £’000<br />

Fixed assets<br />

Intangible assets 11 401,830 68,385 – –<br />

Tangible assets 12 74,420 19,655 – –<br />

Investments<br />

Investments in joint ventures<br />

13 2,957 – 900 –<br />

– share of gross assets 160 – – –<br />

– share of gross liabilities (260) – – –<br />

479,107 88,040 900 –<br />

Current assets<br />

Stock<br />

Debtors<br />

14 62,478 13,802 – –<br />

– due within one year 15 747,236 170,242 70,713 –<br />

– due after more than one year<br />

Investments<br />

15 2,475 – – –<br />

– due within one year 16 534,367 – – –<br />

– due after more than one year 16 684,811 – – –<br />

Cash at bank and in hand 44,102 28,393 298 –<br />

2,075,469 212,437 71,011 –<br />

Creditors – amounts falling due within one year 17 (2,190,230) (198,879) (3,850) –<br />

Net current (liabilities)/assets (114,761) 13,558 67,161 –<br />

Total assets less current liabilities 364,346 101,598 68,061 –<br />

Creditors – amounts falling due after more than one year 18 (314,889) (78,609) (60,808) –<br />

Provisions for liabilities and charges 23 (10,817) (1,030) – –<br />

Net assets 38,640 21,959 7,253 –<br />

Capital and reserves<br />

Called up share capital 28 900 900 900 –<br />

Share premium account 29 – 19,100 – –<br />

Other reserves 29 19,100 – – –<br />

Profit and loss reserve 29 18,062 1,679 6,353 –<br />

Total shareholders’ funds 38,062 21,679 7,253 –<br />

Equity minority interests 21 578 280 – –<br />

Capital employed 38,640 21,959 7,253 –<br />

The <strong>financial</strong> statements on pages 28 to 60 were approved by the Board of Directors on 27 March 2002 and were<br />

signed on its behalf by:<br />

L M Dorfman C I Kahn<br />

Director Director

Consolidated cash flow statement<br />

for the year ended 31 December 2001<br />

Continuing operations<br />

31<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Acquisitions Total<br />

2001 2001 2001 2000<br />

Note £’000 £’000 £’000 £’000<br />

Net cash (outflow)/inflow from operating activities<br />

Returns on investments and servicing of finance<br />

24 28,746 (44,106) (15,360) 3,982<br />

Interest received 588 400 988 209<br />

Interest paid (9,040) (3,683) (12,723) (3,224)<br />

Interest received in advance on structured deposit – 274,254 274,254 –<br />

Interest element of finance lease payments – (255) (255) (102)<br />

Dividends paid to minority interests (618) – (618) –<br />

Net cash inflow/(outflow) from returns on investments<br />

and servicing of finance (9,070) 270,716 261,646 (3,117)<br />

Taxation<br />

Capital expenditure and <strong>financial</strong> investment<br />

(3,133) (15,097) (18,230) (2,562)<br />

Purchase of tangible fixed assets (14,544) (6,799) (21,343) (3,117)<br />

Sale of tangible fixed assets 838 916 1,754 34<br />

Net cash outflow for capital expenditure and <strong>financial</strong> investment (13,706) (5,883) (19,589) (3,083)<br />

Acquisitions<br />

Purchase of subsidiary undertakings (250) (409,763) (410,013) (26,358)<br />

Net cash acquired with subsidiary undertakings 26 – 16,529 16,529 11,160<br />

Net cash outflow for acquisitions (250) (393,234) (393,484) (15,198)<br />

Equity dividends paid to shareholders (33) – (33) –<br />

Net cash (outflow)/inflow before use<br />

of liquid resources and financing 25 2,554 (187,604) (185,050) (19,978)<br />

Management of liquid resources<br />

Reduction/(increase) in short-term deposits with banks – 183,278 183,278 71,680<br />

Financing<br />

Capital element of finance lease payments (529) (794) (1,323) (1,099)<br />

Decrease in borrowings – – – (31,233)<br />

Net cash outflow from financing (529) (794) (1,323) (32,332)<br />

(Decrease)/increase in net cash 24 2,025 (5,120) (3,095) 19,370

32<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements<br />

for the year ended 31 December 2001<br />

1 Accounting policies<br />

(a) Basis of preparation<br />

These <strong>financial</strong> statements have been prepared under the historical cost convention, in accordance with applicable accounting<br />

standards. A summary of the more important Group accounting policies is set out below, together with an explanation<br />

of where changes have been made to previous policies on the adoption of new accounting standards in the year.<br />

The Group <strong>financial</strong> statements consolidate the <strong>financial</strong> statements of the Company and all its subsidiaries. All significant<br />

intercompany transactions have been eliminated on consolidation. Equity accounting is applied for all associate undertakings.<br />

The Company was incorporated on 13 October 2000 as the ultimate holding company of the Group.<br />

On 25 January 2001, the company acquired all of the issued shares of <strong>Travelex</strong> plc, the previous holding company, by issuing<br />

an equal number of shares in the Company to the shareholders of <strong>Travelex</strong> plc. This has been accounted for using merger<br />

accounting principles. The <strong>consolidated</strong> and Company <strong>financial</strong> statements for the year ended 31 December 2001 include the<br />

results of the new parent from 13 October 2000 to 31 December 2001. The comparatives show the <strong>consolidated</strong> and<br />

Company results of the previous holding company, <strong>Travelex</strong> plc, for the period 7 August 2000 to 31 December 2000.<br />

(b) Changes in accounting policies<br />

The Group has adopted FRS 19 ‘Deferred tax’ in these <strong>financial</strong> statements. The adoption of this standard represents<br />

a change in accounting policy, however there were no changes to the comparative figures.<br />

FRS 18 ‘Accounting policies’ has been adopted in the current year, however this did not require any change<br />

in accounting policy.<br />

(c) Revenue recognition<br />

The key components of turnover are described below:<br />

1 Revenue from currency exchange transactions is recognised as the difference between the cost and selling price<br />

of currency, together with foreign exchange commissions on the sale and purchase of currencies and commissions<br />

on the sale and purchase of travellers cheques.<br />

2 Revenue from the sale of insurance policies is recognised at the time of sale of the insurance policy and represents the<br />

commission earned on the sale of the policy.<br />

3 Revenue from global payments is recognised as the currency margin on the transactions at the rates prevailing on the<br />

transaction date plus any commissions charged.<br />

4 Income from investment activities is derived principally from the investment of funds arising from the sale of travellers<br />

cheques. Such funds are held to satisfy unencashed travellers cheques included within the travellers cheques awaiting<br />

redemption balance. The income comprises interest on deposits with <strong>financial</strong> institutions.<br />

In the opinion of the directors, disclosure of revenue is most appropriately represented for the Group by including the items<br />

above. This represents an adaptation of the profit and loss account format laid down in Schedule 4 to the Companies Act<br />

1985 due to the special nature of the Group’s business.<br />

(d) Cost of sales<br />

Cost of sales comprises direct selling costs (including salaries), rebates and incentive commissions.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

33<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

(e) Goodwill and intangible assets<br />

The excess of the fair value of the cost of investments in subsidiaries over the fair value of net assets acquired which is not<br />

otherwise allocated to individual assets and liabilities is determined to be goodwill and is amortised on a straight-line basis over<br />

a period not exceeding 20 years.<br />

An impairment review of goodwill balances is performed in the first <strong>financial</strong> year following a year in which an acquisition<br />

generating goodwill occurred. The carrying amount of goodwill is reviewed by analysing the <strong>financial</strong> performance of the<br />

business acquired compared to the forecasts on which the acquisition was based. When any such impairment exists, the<br />

related goodwill is written down to fair value.<br />

(f) Tangible fixed assets<br />

Tangible fixed assets are initially recorded at cost and depreciated so as to write off the cost of the asset over its estimated life.<br />

Cost includes those which are directly attributable to bringing the asset into working condition for its intended use.<br />

Where events or changes in circumstances indicate that the carrying amount of fixed assets may not be recoverable the<br />

assets are written down to their recoverable amount.<br />

Depreciation is provided to write off the cost, less any estimated residual value, of all tangible fixed assets over their expected<br />

useful lives. It is calculated on a straight-line basis using the following rates:<br />

Freehold land Nil<br />

Freehold and long leasehold property 2% per annum<br />

Short leasehold property 10 – 20% per annum or over the term of the lease if shorter<br />

Furniture, fittings and equipment 10 – 50% per annum<br />

Automatic cash machines 12.5% per annum<br />

Computer hardware and software 33.3% per annum<br />

Motor vehicles 20% per annum<br />

(g) Fixed asset investments<br />

Fixed asset investments are stated at cost unless, in the opinion of the directors, there has been a permanent diminution in value.<br />

(h) Current asset investments<br />

Current asset investments comprise money market deposits and a series of structured deposits, which are held to maturity<br />

and are stated at the face value of the deposit.<br />

(i) Deferred taxation<br />

Full provision is made for all tax timing differences.<br />

Deferred tax assets are recognised where it is more likely than not there will be suitable taxable profits from which the future<br />

reversal of the underlying timing differences can be deducted.<br />

(j) Foreign currencies<br />

Assets and liabilities of overseas subsidiaries are translated at the closing exchange rate. Income and expenditure of these<br />

subsidiaries are translated at the average rates of exchange during the year.<br />

Exchange differences on the translation of opening net assets of subsidiary undertakings are taken to reserves.<br />

All other exchange profits and losses, which arise from normal trading activities, are included in the profit and loss account<br />

as incurred.

34<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

(k) Travellers cheques awaiting redemption<br />

A liability is recorded for all travellers cheques issued but not encashed. This is then adjusted to take account of the value<br />

of those cheques, which it is anticipated will never be presented for payment. In estimating this amount the directors use the<br />

services of a firm of independent actuaries. The difference between the opening and closing position of this float write-back<br />

is included in turnover.<br />

(l) Currency stock<br />

Currency stock consists of all foreign currencies held in tills, in transit and in distribution centres. Currency stock is valued<br />

at the lower of cost and net realisable value.<br />

(m) Financial instruments<br />

Financial instruments include forward foreign currency exchange contracts and foreign exchange swaps in the foreign<br />

exchange markets. The Group uses these instruments to hedge existing assets and liabilities (refer to note 22 – Financial<br />

instruments – Objectives, policies and strategies in holding and managing <strong>financial</strong> instruments).<br />

Gains and losses on these instruments are included in turnover. The gross asset and liability relating to forward foreign<br />

currency exchange contracts are <strong>report</strong>ed on the balance sheet.<br />

Where the instrument is used to hedge an underlying transaction which itself is marked-to-market, the instrument is valued<br />

in the same way and changes in the market value are recognised in the profit and loss account in the same period. Where the<br />

underlying transaction is recorded on an accruals basis, the instrument is recorded in a similar manner. In this case, the costs<br />

of establishing the hedge instrument are capitalised; the market value of the instrument is not recognised in the profit and loss<br />

account but the effective rate applied in expensing the underlying transaction.<br />

Forward foreign currency exchange contracts entered into as foreign exchange deals and foreign currency assets and liabilities<br />

are valued at the rate of exchange ruling at the balance sheet date.<br />

(n) Leases<br />

Assets held under finance leases are included within fixed assets at fair value which is considered to approximate the present<br />

value of minimum lease payments and are depreciated over the shorter of the lease term or their estimated useful life. Future<br />

instalments under such leases, net of finance charges, are included within creditors. Rentals payable are apportioned between<br />

the finance element, which is charged to the profit and loss account as interest, and the capital element, which reduces the<br />

outstanding obligation for future instalments.<br />

Rentals under operating leases are charged to the profit and loss account on a straight-line basis over the lease term.<br />

Incentives offered to/received as lessees are spread over the shorter of the lease term and a date from which it is expected<br />

that the prevailing market rental will be payable, on a straight-line basis as a reduction to rental income/expense.<br />

(o) Finance costs<br />

Finance costs associated with the issue of debt are deducted from the proceeds of the issue and released to the profit and<br />

loss account over the term of the debt on a straight-line basis.<br />

(p) Pension costs<br />

Contributions to the Group’s defined contribution pension schemes are charged to the profit and loss account as incurred.<br />

Contributions to the Group’s defined benefit schemes are charged to the profit and loss account so as to spread the cost<br />

of providing pensions over the employees’ working lives within the Group. Variations in pension cost, which are identified<br />

as a result of actuarial valuations, are amortised over the average expected remaining working lives of the employees.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

2 Segmental <strong>report</strong>ing<br />

Business analysis<br />

The business analysis represents the major categories of business conducted by the Group.<br />

35<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Travel money – includes bureaux de change operations, encompassing locations in airports, tourist locations and on board<br />

international ferry services, the issue of travellers cheques, income arising from the investment of travellers cheque fund, the<br />

operation of automatic teller machines (ATMs) and the provision of travel money services to corporates.<br />

Global payments – includes international funds transfer services for commercial customers.<br />

Third party outsourcing – includes the provision of outsourced travel money services to fulfil individual orders of retail<br />

customers of major high street banks, travel agencies and <strong>financial</strong> institutions.<br />

Insurance – includes the distribution of travel insurance policies to US residents through a dedicated website, airport bureaux<br />

locations, third parties and call centres.<br />

Other operations – includes person-to-person funds transfer services for retail customers, the provision of travel-related<br />

emergency and concierge services and wholesale bank note and dealing operations.<br />

Turnover Profit before tax Net assets<br />

2001 2000 2001 2000 2001 2000<br />

Business analysis £’000 £’000 £’000 £’000 £’000 £’000<br />

Travel money 258,473 46,600 34,120 1,807 (154,628) 13,935<br />

Global payments 50,460 7,443 24,388 2,344 19,711 2,639<br />

Third party outsourcing 41,259 13,322 4,596 2,598 4,982 4,320<br />

Insurance 9,955 3,736 1,231 230 1,385 1,065<br />

Other operations 37,704 – (887) – 4,470 –<br />

Central overheads and financing – – (23,383) (1,154) – –<br />

Goodwill – – (18,460) (1,948) 401,830 –<br />

Interest received in advance – – – – (239,109) –<br />

Total 397,851 71,101 21,605 3,877 38,640 21,959

36<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

Geographical analysis<br />

Geographical analysis is based on the country in which a transaction takes place, which in the case of international<br />

funds transfers is the location in which the transaction is initiated. In the case of travellers cheques analysis is based<br />

on the domicile of the entity investing the travellers cheque float. The acquisition of the Thomas Cook Global and Financial<br />

Services Group (G&FS) during the year did not require the expansion of the geographical segments.<br />

No restatement of comparatives has been necessary.<br />

Turnover Profit before tax Net assets<br />

2001 2000 2001 2000 2001 2000<br />

Geographical analysis £’000 £’000 £’000 £’000 £’000 £’000<br />

United Kingdom 191,113 38,673 24,269 (1,540) (61,766) 12,558<br />

Continental Europe 44,619 9,069 9,009 2,680 43,717 2,086<br />

North America 103,867 17,864 20,308 5,580 (92,335) 6,745<br />

Asia Pacific 58,276 5,495 9,768 259 (15,064) 570<br />

Other regions (24) – 94 – 1,367 –<br />

Central overheads and financing – – (23,383) (1,154) – –<br />

Goodwill – – (18,460) (1,948) 401,830 –<br />

Interest received in advance – – – – (239,109) –<br />

Total 397,851 71,101 21,605 3,877 38,640 21,959<br />

The Thomas Cook G&FS business was acquired during the year and therefore no comparatives are given for that business.<br />

3 Net operating expenses<br />

Continuing operations<br />

Acquisitions Total<br />

2001 2001 2001 2000<br />

£’000 £’000 £’000 £’000<br />

Net operating expenses:<br />

Administrative expenses 60,973 94,739 155,712 26,210<br />

Other operating income – (10,819) (10,819) –<br />

60,973 83,920 144,893 26,210<br />

Other operating income primarily relates to the provision of administrative services to Thomas Cook <strong>Holdings</strong> <strong>Limited</strong>.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

4 Interest and similar items<br />

37<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

2001 2000<br />

£’000 £’000<br />

Interest payable:<br />

Interest payable on bank loans and overdrafts (4,402) (402)<br />

Interest payable on senior notes (7,875) (2,822)<br />

Amortisation of deferred consideration discount (1,654) –<br />

Amortisation of issue costs of senior notes (332) (138)<br />

Interest payable on other loans (445) –<br />

Interest payable on finance leases (255) (102)<br />

Total interest and similar charges payable (14,963) (3,464)<br />

Interest receivable:<br />

Interest on bank deposits and money market instruments 46,869 –<br />

Interest on operating bank accounts 988 209<br />

Total interest receivable and similar income 47,857 209<br />

Less: included in turnover (in accordance with accounting policies) (46,869) –<br />

Net interest payable and similar items (13,975) (3,255)<br />

Continuing operations (8,784) (3,255)<br />

Acquisitions (5,191) –<br />

Net interest payable and similar items (13,975) (3,255)

38<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

5 Profit/(loss) on ordinary activities before taxation<br />

2001 2000<br />

£’000 £’000<br />

Profit/(loss) before taxation is stated after charging/(crediting):<br />

Staff costs (note 6)<br />

Depreciation of tangible fixed assets<br />

110,674 16,073<br />

– owned assets 10,852 1,633<br />

– under finance leases<br />

Amortisation of goodwill<br />

3,293 324<br />

– subsidiaries 18,460 1,948<br />

Loss on disposal of fixed assets 12 71<br />

Hire of machinery and equipment 1,342 106<br />

Other operating lease rentals<br />

Auditors’ remuneration<br />

48,029 601<br />

– Audit 1,152 161<br />

– Non-audit 328 186<br />

6 Employees and directors<br />

The average monthly number of persons employed during the year, calculated on a full-time equivalent basis, by the Group<br />

were as follows:<br />

2001 2000<br />

Analysed by geographical location Number Number<br />

United Kingdom 3,025 947<br />

Continental Europe 341 257<br />

North America 884 366<br />

Asia Pacific 1,028 290<br />

Other regions 26 –<br />

5,304 1,860<br />

2001 2000<br />

Staff costs for the group during the year £’000 £’000<br />

Wages and salaries 98,205 14,321<br />

Social security costs 8,668 1,452<br />

Other pension costs (note 27) 3,801 300<br />

110,674 16,073

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

39<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

2001 2000<br />

Directors’ remuneration £’000 £’000<br />

Aggregate emoluments 3,001 1,012<br />

Company contributions to pension schemes 99 39<br />

No director has any benefits accruing under defined benefit schemes (2000: nil).<br />

3,100 1,051<br />

2001 2000<br />

Highest paid director £’000 £’000<br />

Aggregate emoluments 1,069 288<br />

Company pension contributions 30 15<br />

7 Tax on profit on ordinary activities<br />

1,099 303<br />

2001 2000<br />

Analysis of charge in period £’000 £’000<br />

United Kingdom tax<br />

Corporation tax at 30% (2000: 30%) 1,918 1,043<br />

Prior year under provision 350 –<br />

2,268 1,043<br />

Foreign tax<br />

Corporation taxes 5,921 1,211<br />

Prior year over provision (13) –<br />

Total current tax<br />

Deferred tax<br />

8,176 2,254<br />

Origination and reversal of timing differences (4,670) 108<br />

Representing:<br />

United Kingdom (4,387) 108<br />

Foreign tax (283) –<br />

Total deferred tax (4,670) 108<br />

Tax on profit on ordinary activities 3,506 2,362

40<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

The tax for the year is lower (2000: higher) than the standard rate of corporation tax in the UK (30%).<br />

The differences are explained below:<br />

Profit on ordinary activities before tax 21,605<br />

2001<br />

£’000<br />

Profit on ordinary activities multiplied by standard rate of corporation tax in the UK of 30%<br />

Effects of:<br />

6,482<br />

Adjustment to tax in respect of prior period 337<br />

Adjustment in respect of foreign tax rates (4,692)<br />

Expenses not deductible for tax purposes 1,379<br />

8 Profits of holding company<br />

Of the profit for the <strong>financial</strong> year, a profit of £6.4 million (2000: nil) is dealt with in the accounts of <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong>.<br />

This profit includes interest receivable from subsidiaries of £18.5 million. The directors have taken advantage of the exemption<br />

available under Section 230 of the Companies Act 1985 and not presented a profit and loss account for the company alone.<br />

9 Dividends<br />

3,506<br />

2001 2000<br />

£’000 £’000<br />

Equity – ‘A’ Ordinary shares<br />

Final paid for 2000 4 –<br />

Interim paid 29 –<br />

10 Security charged over assets<br />

33 –<br />

The Group has given fixed and floating charges over predominantly all of their assets in relation to various facilities provided<br />

by the Group’s bankers, in the normal course of business.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

11 Intangible fixed assets<br />

41<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Group Goodwill<br />

£’000<br />

Cost<br />

At 1 January 2001 73,684<br />

Additions (note 26) 351,515<br />

Increase of existing goodwill 250<br />

Exchange adjustments 155<br />

At 31 December 2001 425,604<br />

Aggregate amortisation<br />

At 1 January 2001 (5,299)<br />

Charge for the year (18,460)<br />

Exchange adjustments (15)<br />

At 31 December 2001 (23,774)<br />

Net book amount at 31 December 2001 401,830<br />

Net book amount at 31 December 2000 68,385<br />

Goodwill arising on the acquisition of subsidiaries and businesses is amortised on a straight-line basis over the periods detailed<br />

below. These periods are those in which the directors estimate the values of the underlying businesses acquired are expected<br />

to exceed the value of the underlying assets.<br />

Thomas Cook Global and Financial Services Group 20 years<br />

Travellers Exchange Corporation <strong>Limited</strong> 20 years<br />

<strong>Travelex</strong> Group Investments <strong>Limited</strong> 20 years<br />

Transpay division of Barclays Bank plc 10 years

42<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

12 Tangible fixed assets<br />

Freehold Furniture,<br />

land & fixtures & Motor<br />

buildings equipment vehicles Total<br />

£’000 £’000 £’000 £’000<br />

Cost<br />

At 1 January 2001 – 21,347 252 21,599<br />

Additions at cost – 20,741 602 21,343<br />

Acquisitions 24,758 23,175 1,388 49,321<br />

Disposals – (3,068) (847) (3,915)<br />

Exchange adjustment – 61 14 75<br />

At 31 December 2001 24,758 62,256 1,409 88,423<br />

Depreciation<br />

At 1 January 2001 – (1,922) (22) (1,944)<br />

Charge for the year (273) (13,347) (525) (14,145)<br />

Disposals – 1,741 408 2,149<br />

Exchange adjustment – (58) (5) (63)<br />

At 31 December 2001 (273) (13,586) (144) (14,003)<br />

Net book value at 31 December 2001 24,485 48,670 1,265 74,420<br />

Net book value at 31 December 2000 – 19,425 230 19,655<br />

The net book value of tangible fixed assets includes an amount of £1,730,000 (2000: £3,695,000) in respect of assets held<br />

under finance leases and hire purchase contracts.<br />

Freehold land and buildings are stated at cost less accumulated depreciation.<br />

Company<br />

The Company has no tangible fixed assets.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

13 Investments<br />

43<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

2001<br />

Group interest in associated undertakings £’000<br />

At 1 January 2001 –<br />

Additions in year 2,257<br />

Share of post-acquisition reserves 697<br />

Exchange adjustments 3<br />

At 31 December 2001 2,957<br />

2001<br />

Company shares in Group undertakings £’000<br />

At 1 January 2001 –<br />

Additions in year 900<br />

At 31 December 2001 900<br />

The Company additions in the year of £900,000 represents the acquisition by <strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong> of all the issued share<br />

capital of <strong>Travelex</strong> plc.<br />

Investments in Group undertakings are stated at cost. As permitted by Section 133 of the Companies Act 1985, where the<br />

relief afforded under Section 131 of the Companies Act 1985 applies, cost is the aggregate of the nominal value of the relevant<br />

number of the company’s shares and the fair value of any other consideration given to acquire the share capital of the<br />

subsidiary undertakings.<br />

The directors consider that to give full particulars of all subsidiary undertakings, associate undertakings and joint ventures<br />

would lead to a statement of excessive length. The principal operating subsidiaries, associates and joint ventures have<br />

therefore been detailed in note 33. A full list of subsidiary undertakings, associate undertakings and joint ventures,<br />

at 31 December 2001, will be annexed to the Company’s next annual return.<br />

14 Stock<br />

Group<br />

2001 2000<br />

£’000 £’000<br />

Foreign currency 56,585 13,802<br />

Travellers cheques 2,785 –<br />

Precious metals 984 –<br />

Other 2,124 –<br />

There is no stock held by the Company.<br />

62,478 13,802

44<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

15 Debtors<br />

Group Company<br />

2001 2000 2001 2000<br />

£’000 £’000 £’000 £’000<br />

Amounts falling due within one year:<br />

Trade debtors 324,195 15,608 – –<br />

Amounts due from Group undertakings – – 70,000 –<br />

Amounts due from associated undertakings 83 – – –<br />

Amounts due from joint ventures 34 – – –<br />

Forward exchange contracts 386,553 144,391 – –<br />

Other debtors 24,448 6,415 713 –<br />

Prepayments and accrued income 9,358 3,828 – –<br />

Deferred tax 2,565 – – –<br />

747,236 170,242 70,713 –<br />

Amounts falling due after more than one year:<br />

Forward exchange contracts 1,653 – – –<br />

Other debtors 822 – – –<br />

16 Current asset investments<br />

2,475 – – –<br />

Group Company<br />

2001 2000 2001 2000<br />

£’000 £’000 £’000 £’000<br />

Amounts due within one year:<br />

Money market deposits 303,704 – – –<br />

Money on structured deposits 230,663 – – –<br />

534,367 – – –<br />

Amounts due after more than one year:<br />

Money on structured deposits 684,811 – – –<br />

Funds have been placed on a series of structured deposits with a bank. The repayment profile of the deposits have been<br />

structured to match the expected travellers cheque encashment profile over the term of the deposits. The Group is able to make<br />

early draw downs against the funds if necessary, subject to certain charges and restrictions as to the timing of draw downs.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

17 Creditors – amounts falling due within one year<br />

45<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Group Company<br />

2001 2000 2001 2000<br />

£’000 £’000 £’000 £’000<br />

Bank and other borrowings (note 19) 27,849 9,023 71 –<br />

Obligations under finance leases (note 20) 2,921 1,465 – –<br />

Trade creditors 119,931 18,127 – –<br />

Travellers cheques awaiting redemption (1) 1,476,733 – – –<br />

Forward exchange contracts 387,636 144,011 – –<br />

Corporation tax 1,146 2,736 3,432 –<br />

Other taxes and social security costs 1,376 814 – –<br />

Other creditors 15,772 7,834 – –<br />

Accruals and deferred income 114,855 14,869 347 –<br />

Interest received in advance (2) 42,011 – – –<br />

2,190,230 198,879 3,850 –<br />

(1) Travellers cheques awaiting redemption represents the value of all travellers cheques issued but not encashed. This is then<br />

adjusted to take account of the value of those cheques, which it is anticipated will never be presented for payment.<br />

(2) An amount of the travellers cheque funds have been placed on a series of structured deposits with a bank for a term of 23<br />

years (refer to note 16). The net present value of interest receivable on the deposits has been paid in advance.<br />

18 Creditors – amounts falling due after more than one year<br />

Group Company<br />

2001 2000 2001 2000<br />

£’000 £’000 £’000 £’000<br />

Loans and other borrowings (note 19) 72,151 71,819 – –<br />

Hire purchase and finance lease obligations (note 20) 959 790 – –<br />

Deferred consideration for acquisitions (1) 43,025 6,000 37,025 –<br />

Amounts due to Group undertakings – – 23,783 –<br />

Forward exchange contracts 1,656 – – –<br />

Interest received in advance (2) 197,098 – – –<br />

314,889 78,609 60,808 –<br />

(1) Deferred consideration of £43,025,000 represents: (1) £6,000,000 relating to the acquisition of Transpay in September<br />

1999, and is based on the directors’ best estimate of the balance due on the acquisition. This business is conducted by<br />

the 80% owned subsidiary <strong>Travelex</strong> Currency Services <strong>Limited</strong>; (2) £37,025,000 relating to the acquisition of Thomas Cook<br />

Global and Financial Services Group during the current year. The amount is based on the fixed principal payable in 2006<br />

of £47,500,000 discounted to its current net present value.<br />

(2) Refer to notes 16 and 17 for explanation of interest received in advance.

46<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

19 Loans and other borrowings<br />

Group Company<br />

2001 2000 2001 2000<br />

£’000 £’000 £’000 £’000<br />

10.5% Senior Notes due 2010 75,000 75,000 – –<br />

Unamortised issue costs (2,849) (3,181) – –<br />

Bank loans and overdrafts 27,849 9,023 71 –<br />

Finance leases 3,880 2,255 – –<br />

103,880 83,097 71 –<br />

Maturity of debt<br />

In one year or less, or on demand 30,770 10,488 71 –<br />

In more than one year, but not more than two years 575 648 – –<br />

In more than two years, but not more than five years 384 142 – –<br />

In more than five years 72,151 71,819 – –<br />

20 Obligations under leases<br />

103,880 83,097 71 –<br />

2001 2000<br />

Finance leases £’000 £’000<br />

Amounts payable:<br />

Within one year 3,195 1,640<br />

Between one and two years 671 726<br />

Between two and five years 407 160<br />

4,273 2,526<br />

Less: Finance charges allocated to future periods (393) (271)<br />

3,880 2,255<br />

Shown as:<br />

Due within one year 2,921 1,465<br />

Due after one year 959 790<br />

3,880 2,255

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

47<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Land & Land &<br />

Buildings Other Buildings Other<br />

<strong>Annual</strong> commitments under non-cancellable 2001 2001 2000 2000<br />

operating leases are as follows: £’000 £’000 £’000 £’000<br />

Operating leases which expire:<br />

Within one year 53,264 362 1,647 –<br />

Between two and five years 39,055 534 5,423 –<br />

After five years 11,143 – 9,642 –<br />

21 Equity minority interests<br />

103,462 896 16,712 –<br />

2001 2000<br />

£’000 £’000<br />

Opening balance 280 –<br />

Minority interest in current year profit 916 280<br />

Dividend paid during the year (618) –<br />

22 Financial instruments<br />

578 280<br />

Objectives, policies and strategies in holding and managing <strong>financial</strong> instruments<br />

Foreign currency exposures in respect of overseas subsidiaries are minor due to related foreign currency borrowings. Other<br />

currency exposure is managed through currency hedging, where appropriate.<br />

Where the Group undertakes a transfer of funds denominated in foreign currency, on behalf of customers, this exposure<br />

is hedged to the extent that it cannot be covered out of existing currency exposures.<br />

Gains and losses on foreign exchange contracts are recognised on the contract date of the matched contracts.<br />

At the year-end there are no unrecognised gains or losses on foreign exchange contracts. The amounts at which the foreign<br />

exchange contracts are disclosed in debtors and creditors reflect their fair value.<br />

The long-term foreign exchange exposure of the Group’s bureaux de change business is managed through foreign currency<br />

borrowings and other hedging instruments.<br />

All foreign exchange hedging activities are strictly controlled and regularly monitored as part of the Group’s treasury function.<br />

Short-term debtors and creditors have been included in all the following disclosures.

48<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

Currency and interest rate risk profile of <strong>financial</strong> liabilities of the Group<br />

A <strong>financial</strong> liability is defined as any liability that is a contractual obligation to deliver cash or another <strong>financial</strong> asset to another<br />

entity, or to exchange <strong>financial</strong> instruments with another entity. Financial liabilities include creditors – amounts falling due within<br />

one year, creditors – amounts falling due after one year and provisions for liabilities and charges, excluding corporation tax and<br />

other taxes and social security costs.<br />

The currency and interest rate risk profile of the Group’s <strong>financial</strong> liabilities at 31 December 2001, was:<br />

Financial<br />

Floating liabilities on<br />

rate Fixed rate which no<br />

<strong>financial</strong> <strong>financial</strong> interest<br />

Total liabilities liabilities is paid<br />

Currency £’000 £’000 £’000 £’000<br />

Sterling 910,620 19,895 76,031 814,694<br />

US dollars 1,256,467 2,573 – 1,253,894<br />

Euro 73,334 2,531 – 70,803<br />

Canadian dollars 57,429 1,137 – 56,292<br />

Australian dollars 108,898 829 – 108,069<br />

Other currencies 104,936 884 – 104,052<br />

At 31 December 2001 2,511,684 27,849 76,031 2,407,804<br />

Sterling 196,621 7,777 74,074 114,770<br />

US dollars 49,908 807 – 49,101<br />

Euro 387 92 – 295<br />

Australian dollars 27,022 347 – 26,675<br />

At 31 December 2000 273,938 9,023 74,074 190,841<br />

The Group did not have any interest rate swaps in 2001 (2000: nil).<br />

The major fixed rate <strong>financial</strong> liability as at 31 December 2001 is the Senior Notes with a rate of 10.5% (2000: 10.5%) and<br />

a remaining term of 8.5 years (2000: 9.5 years).<br />

Floating rate <strong>financial</strong> liabilities bear interest at rates, based on relevant national LIBOR equivalents, which are fixed in advance<br />

for periods of between one month and six months.<br />

Financial liabilities on which no interest is paid consists primarily of travellers cheques awaiting redemption of £1,476,733,000<br />

(2000: nil) (note 17), current liabilities due within one year (note 17) and discounted deferred consideration of £43,025,000<br />

(2000: £6,000,000) on which the discount rate applied was 5.5%.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

49<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Currency and interest rate risk profile of <strong>financial</strong> assets of the Group<br />

A <strong>financial</strong> asset is defined as any asset that is cash, including cash at bank, short-term deposits and monetary investments,<br />

a contractual right to receive cash or another <strong>financial</strong> asset from another entity, to exchange <strong>financial</strong> instruments with another<br />

entity under conditions that are potentially favourable or an equity instrument of another entity. Financial assets comprise all<br />

current assets except the deferred taxation.<br />

Financial<br />

Floating Fixed assets on<br />

interest rate interest rate which no<br />

<strong>financial</strong> <strong>financial</strong> interest is<br />

Total assets assets received<br />

Currency £’000 £’000 £’000 £’000<br />

Sterling 601,513 4,694 136,907 459,912<br />

US dollars 1,214,431 23,880 974,960 215,591<br />

Euro 76,109 5,861 42,077 28,171<br />

Canadian dollars 45,841 3,578 25,239 17,024<br />

Australian dollars 100,574 2,525 34,192 63,857<br />

Other currencies 34,436 3,564 5,803 25,069<br />

At 31 December 2001 2,072,904 44,102 1,219,178 809,624<br />

Floating sterling 130,087 19,636 – 110,451<br />

Fixed US dollars 50,231 3,303 – 46,928<br />

Euro 5,008 3,665 – 1,343<br />

Australian dollars 27,111 1,789 – 25,322<br />

At 31 December 2000 212,437 28,393 – 184,044<br />

The major fixed interest rate assets are a series of long-term structured deposits (note 16) placed with a bank in various<br />

currencies for which the interest has been paid in advance. The balance of the fixed rate assets are money market deposits<br />

primarily held in sterling and US dollars which are placed with banks on short-term deposits and earn interest at an average<br />

of 2% (2000: 3%) per annum.<br />

Floating rate cash earns interest based on relevant national LIBOR equivalents or government bond rates.<br />

Financial assets on which no interest is received primarily consists of debtors due within one year.

50<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

Maturity of <strong>financial</strong> liabilities<br />

The maturity profile of the carrying amount of the Group’s <strong>financial</strong> liabilities (as defined above) at 31 December was as follows:<br />

Other Other<br />

Finance <strong>financial</strong> Total Finance <strong>financial</strong> Total<br />

Debt leases liabilities 2001 Debt leases liabilities 2000<br />

£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000<br />

In one year or less,<br />

or on demand 27,849 2,921 2,165,284 2,196,054 9,023 1,465 184,841 195,329<br />

In more than one year but<br />

not more than two years – 591 33,579 34,170 – 648 – 648<br />

In more than two years but<br />

not more than five years – 368 102,183 102,551 – 142 3,600 3,742<br />

In more than five years 72,151 – 106,758 178,909 71,819 – 2,400 74,219<br />

100,000 3,880 2,407,804 2,511,684 80,842 2,255 190,841 273,938<br />

The 10.5% Senior Notes 2010 are shown at the aggregate principal amount of £75,000,000 less unamortised issue costs.<br />

Interest is calculated at 10.5% and paid semi-annually. The Notes mature on 31 July 2010.<br />

Borrowing facilities<br />

The Group had £36,484,000 (2000: £8,931,000) of undrawn borrowing facilities available at 31 December 2001 in respect of<br />

which all conditions precedent had been met at that date. The total facility is £45,000,000 of which £15,000,000 is renewable<br />

on 10 August 2003 and £30,000,000 (which was not used at 31 December 2001) is renewable on 31 March 2002.<br />

Fair values of <strong>financial</strong> assets and <strong>financial</strong> liabilities<br />

There are no significant differences between the market value and the book value of the <strong>financial</strong> assets and liabilities held<br />

on the balance sheet at 31 December. The fair value of short-term deposits, loans and overdrafts approximates the carrying<br />

amount because of the short maturity of these instruments. The fair value of the Notes has been estimated using quoted<br />

market prices as at 31 December 2001. In the case of bank loans and other loans, the fair value approximates the carrying<br />

value <strong>report</strong>ed in the balance sheet as the majority are floating rate where payments are reset to market rates at intervals<br />

of less than one year.<br />

Currency exposures<br />

There were no significant unhedged currency exposures held in the balance sheets of subsidiary companies and as a<br />

consequence no significant exchange gains and losses have been recognised in the results. The directors therefore believe<br />

that the exposures are not sufficiently material to warrant disclosure as required by FRS 13 ‘Derivatives and other Financial<br />

Instruments: disclosures’.<br />

Hedges<br />

The Group does not undertake any interest rate hedging. As described above the Group does enter into currency hedges.<br />

Gains and losses are recognised in the <strong>financial</strong> statements.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

23 Provisions for liabilities and charges<br />

51<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Onerous Deferred<br />

contracts tax Other Total<br />

£’000 £’000 £’000 £’000<br />

At 1 January 2001 – 1,030 – 1,030<br />

On acquisition of G&FS (note 26) 8,698 1,640 5,543 1 5,881<br />

Exchange adjustments (107) – 10 (97)<br />

Charged to profit and loss account – (940) 835 (105)<br />

Utilised in year (2,527) – (2,898) (5,425)<br />

Transfer from/to profit and loss account – – (467) (467)<br />

At 31 December 2001 6,064 1,730 3,023 10,817<br />

Onerous contracts<br />

With the acquisition of G&FS the Group acquired an onerous lease provision relating to Hong Kong airport, which expires<br />

December 2002, and contracts relating to an abandoned software development project.<br />

2001 2000<br />

£’000 £’000<br />

Deferred taxation has been provided in respect of:<br />

Capital allowances (357) 1,030<br />

Short-term timing differences 2,087 –<br />

There is no deferred tax provision in the Company.<br />

1,730 1,030<br />

Deferred taxation in respect of earnings which are retained overseas is not provided for because the availability of double<br />

taxation relief will ensure that no tax will be payable on earnings remitted to the United Kingdom.<br />

There is no other material unprovided deferred taxation liability for the Group and Company.

52<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

24 Cash flow from operating activities<br />

(a) Reconciliation of operating profit to operating cash flows<br />

2001 2000<br />

£’000 £’000<br />

Operating profit 34,983 7,132<br />

Depreciation charge (net of profit/loss on disposals) 14,157 2,028<br />

Deferred interest income amortisation (35,145) –<br />

Goodwill amortisation 18,460 1,948<br />

(Increase)/decrease in stocks (3,006) 483<br />

Increase in debtors (361,921) (56,297)<br />

Increase in creditors 335,315 48,888<br />

Decrease in travellers cheques awaiting redemption (17,586) –<br />

Exchange adjustment (617) (200)<br />

Net cash (outflow)/inflow from operating activities (15,360) 3,982<br />

(b) Reconciliation to net (debt)/cash<br />

2001 2000<br />

£’000 £’000<br />

(Decrease)/increase in net cash (3,095) 19,370<br />

Cash inflow/(outflow) from short-term deposits with banks (183,278) (71,680)<br />

Cash (inflow)/outflow from finance leases 1,323 1,099<br />

Cash (inflow)/outflow from borrowings – 31,233<br />

Net cash (outflow)/inflow before use of liquid resources and financing (185,050) (19,978)<br />

Acquisitions of deposits 1,402,456 (35,569)<br />

Acquisition of finance leases (2,949) –<br />

Other non-cash changes (332) (138)<br />

Exchange adjustments (22) 982<br />

1,214,103 (54,703)<br />

Net cash/(debt) at 1 January (54,703) –<br />

Net cash/(debt) at 31 December 1,159,400 (54,703)

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

25 Analysis of net (debt)/cash<br />

53<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Acquisition<br />

At 1 (excluding Other At 31<br />

January cash and non-cash Exchange December<br />

2001 Cash flow overdrafts) changes movements 2001<br />

£’000 £’000 £’000 £’000 £’000 £’000<br />

Cash in hand and at bank 28,394 15,700 – – 8 44,102<br />

Overdrafts (9,023) (18,795) – – (31) (27,849)<br />

(3,095)<br />

Deposits and money on call – (183,278) 1,402,456 – – 1,219,178<br />

Debt due after one year (71,819) – – (332) – (72,151)<br />

Debt due within one year – – – – – –<br />

Finance leases (2,255) 1,323 (2,949) – 1 (3,880)<br />

26 Acquisitions<br />

(54,703) (185,050) 1,399,507 (332) (22) 1,159,400<br />

Acquisition of Thomas Cook Global and Financial Services Group (G&FS)<br />

The Group purchased G&FS on 27 March 2001 for a total consideration of £487,634,000. The total adjustments required<br />

to the book values of the assets and liabilities acquired in order to present the net assets at fair values in accordance with<br />

Group accounting principles were £29,026,000, details of which are set out within this note, together with the resultant<br />

amount of goodwill arising. This has been accounted for as an acquisition.<br />

From the date of acquisition to 31 December 2001 the acquisitions contributed £228,124,000 to turnover, £13,270,000 to<br />

profit before interest and amortisation, £28,211,000 to profit before interest and £23,020,000 to profit after interest. G&FS<br />

contributed an outflow of £44,931,000 to the Group’s net operating cash flows, received £270,716,000 in respect of interest,<br />

utilised £15,097,000 in respect of taxation and utilised £6,799,000 for capital expenditure.<br />

In its last <strong>financial</strong> year to 31 December 2000 G&FS made a profit after tax and minority interests of £31,586,000. For the<br />

period since that date to the date of acquisition, G&FS management accounts show:<br />

Turnover<br />

£’000<br />

78,043<br />

Cost of sales (36,079)<br />

Net operating expenses (32,260)<br />

Profit before interest and taxation 9,704<br />

Net interest (1,702)<br />

Taxation and minority interests (2,629)<br />

Profit attributable to shareholders 5,373

54<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

Net assets acquired<br />

Consistency of<br />

accounting Provisional<br />

Book value Revaluations policy Other fair value<br />

G&FS acquisition £’000 £’000 £’000 £’000 £’000<br />

Intangible fixed assets 646 – – – 646<br />

Tangible fixed assets 71,806 (22,485) – – 49,321<br />

Investments in associate undertakings 2,910 (653) – – 2,257<br />

Stock 51,683 – – – 51,683<br />

Debtors 255,939 – – 2,348 258,287<br />

Creditors (128,552) – – (9,244) (137,796)<br />

Travellers cheques awaiting redemption<br />

Taxation<br />

(1,486,377) – (7,942) – (1,494,319)<br />

– Current (14,514) – – 3,854 (10,660)<br />

– Deferred 1,917 – – (3,557) (1,640)<br />

Cash 44,484 – – – 44,484<br />

Overdrafts (27,955) – – – (27,955)<br />

Current asset investments 1,393,804 8,653 – – 1,402,457<br />

Net assets acquired 165,791 (14,485) (7,942) (6,599) 136,765<br />

Goodwill 350,869<br />

Consideration 487,634<br />

Consideration satisfied by:<br />

Cash 393,530<br />

Acquisition costs paid 16,233<br />

Net present value of deferred consideration 35,371<br />

Debt forgiven 42,500<br />

The book value of the assets and liabilities have been taken from the management accounts of G&FS at 27 March 2001<br />

(the date of acquisition) at actual exchange rates on that date.<br />

Revaluation adjustments in respect of tangible fixed assets result from the impairment review of certain computer hardware<br />

and software.<br />

487,634<br />

Revaluations of current asset investments reflects the adjustment to estimated realisable value. The estimated realisable value<br />

at the date of acquisition is based on the sale value immediately following the acquisition.<br />

The fair value adjustment for the alignment of accounting policies reflects the restatement of a component of the travellers cheque<br />

float write-back, in respect of travellers cheques not considered likely to be encashed, in accordance with the Group’s policies.

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

The fair value adjustment to creditors is primarily the establishment of provisions against onerous contracts.<br />

55<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

The book values of the net assets acquired included provisions for reorganisation and restructuring costs amounting<br />

to £199,000. These provisions were established by G&FS and relate to an irrevocable reorganisation commenced by<br />

G&FS management before the acquisition. However, on review at the time of acquisition, the provisions were considered<br />

to be insufficient to cover the expected costs and have been increased by £1,578,000.<br />

27 Pensions<br />

The principal pension scheme in the UK is a defined contribution scheme, the assets of which are held separately from those<br />

of the Group in an independently administered fund. Overseas, the Group operates predominantly defined contribution<br />

schemes, however it does provide a defined benefit scheme in Canada. The total pension cost for all of the Group’s pension<br />

schemes in 2001 was £3.8 million (2000: £300,000).<br />

For the Group’s defined benefit scheme in Canada, a full actuarial valuation was carried out at 1 January 2001 by a qualified<br />

independent actuary.<br />

The total net pension cost of the defined benefit scheme was £291,000 (2000: £106,000). The cost is assessed in accordance<br />

with the advice of Towers Perrin, consulting actuaries. The latest actuarial valuation of the scheme was performed as at<br />

1 January 2001 using the Projected Unit Method. The principal assumptions adopted in the valuation were that, over the<br />

long term, the investment return would be 9.25% per annum and the rate of salary increase would be 4.5% per annum.<br />

At the date of the latest actuarial valuation, the market value of the assets of the scheme was £2,155,000 and the actuarial<br />

value of the assets was sufficient to cover 82.9% of the benefits that had accrued to members, after allowing for expected<br />

future increases in earnings.<br />

The Company contributes the minimum required under the Employee Retirement Income Security Act on an annual basis<br />

as calculated by the actuary.<br />

FRS 17 disclosure<br />

This valuation was updated as at 31 December 2001 as required by FRS 17. The major assumptions used by the actuary were:<br />

Rate of increase in salaries 4.0%<br />

Discount rate 7.25%<br />

Inflation assumption 2.5%<br />

The assets in the scheme and the expected rate of return were:<br />

Long-term rate<br />

of return at Value at<br />

31 December 31 December<br />

2001 2001<br />

£’000<br />

Equities 9.25% 2,031

56<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

The following amounts at 31 December 2001 were measured in accordance with the requirements of FRS 17.<br />

Total market value of assets 2,031<br />

Present value of scheme liabilities (3,473)<br />

Deficit in the scheme (1,442)<br />

Related deferred tax asset (at 35%) 505<br />

Net pension liability (937)<br />

If the above amounts had been recognised in the <strong>financial</strong> statements the Group’s net assets and profit and loss reserve<br />

at 31 December 2001 would be as follows:<br />

Net assets excluding pension asset 38,640<br />

Pension liability (937)<br />

Net assets including pension liability 37,703<br />

Profit and loss reserve excluding pension liability 18,062<br />

Pension reserve (937)<br />

Profit and loss reserve 17,125<br />

28 Share capital<br />

£’000<br />

£’000<br />

Group and Company<br />

2001 2000<br />

Number of 2001 Number of 2000<br />

Shares £’000 shares £’000<br />

Authorised:<br />

Ordinary shares – £1 each<br />