Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Money matters<br />

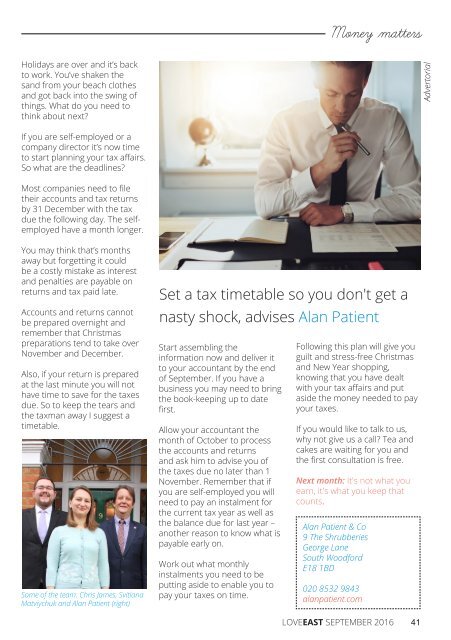

Holidays are over and it’s back<br />

to work. You’ve shaken the<br />

sand from your beach clothes<br />

and got back into the swing of<br />

things. What do you need to<br />

think about next?<br />

Advertorial<br />

If you are self-employed or a<br />

company director it’s now time<br />

to start planning your tax affairs.<br />

So what are the deadlines?<br />

Most companies need to file<br />

their accounts and tax returns<br />

by 31 December with the tax<br />

due the following day. The selfemployed<br />

have a month longer.<br />

You may think that’s months<br />

away but forgetting it could<br />

be a costly mistake as interest<br />

and penalties are payable on<br />

returns and tax paid late.<br />

Accounts and returns cannot<br />

be prepared overnight and<br />

remember that Christmas<br />

preparations tend to take over<br />

November and December.<br />

Also, if your return is prepared<br />

at the last minute you will not<br />

have time to save for the taxes<br />

due. So to keep the tears and<br />

the taxman away I suggest a<br />

timetable.<br />

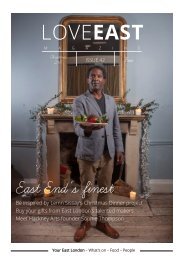

Some of the team: Chris James, Svitlana<br />

Matviychuk and Alan Patient (right)<br />

Set a tax timetable so you don't get a<br />

nasty shock, advises Alan Patient<br />

Start assembling the<br />

information now and deliver it<br />

to your accountant by the end<br />

of <strong>September</strong>. If you have a<br />

business you may need to bring<br />

the book-keeping up to date<br />

first.<br />

Allow your accountant the<br />

month of October to process<br />

the accounts and returns<br />

and ask him to advise you of<br />

the taxes due no later than 1<br />

November. Remember that if<br />

you are self-employed you will<br />

need to pay an instalment for<br />

the current tax year as well as<br />

the balance due for last year –<br />

another reason to know what is<br />

payable early on.<br />

Work out what monthly<br />

instalments you need to be<br />

putting aside to enable you to<br />

pay your taxes on time.<br />

Following this plan will give you<br />

guilt and stress-free Christmas<br />

and New Year shopping,<br />

knowing that you have dealt<br />

with your tax affairs and put<br />

aside the money needed to pay<br />

your taxes.<br />

If you would like to talk to us,<br />

why not give us a call? Tea and<br />

cakes are waiting for you and<br />

the first consultation is free.<br />

Next month: It's not what you<br />

earn, it's what you keep that<br />

counts.<br />

Alan Patient & Co<br />

9 The Shrubberies<br />

George Lane<br />

South Woodford<br />

E18 1BD<br />

020 8532 9843<br />

alanpatient.com<br />

LOVEEAST SEPTEMBER <strong>2016</strong> 41