Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

percent cash reserves against its outstanding notes, an extremely<br />

conservative measure, making this bank one of the soundest<br />

financial institutions. Its other source of income came from its<br />

real-estate business. Considerable profits were made through<br />

the purchase and development of Shanghai land for commercial<br />

and residential use. The National Commercial and Savings Bank<br />

exercised its right to issue notes in 1924, and stopped issuing<br />

them altogether after the national currency reform of 1935.<br />

At one point, due to a shortage of bank notes in circulation,<br />

the bank authorized its notes to be cut in half so they could<br />

circulate at one-half their face value. Each half had to be signed<br />

by a bank official to be accepted. Most whole notes in collections<br />

today are, in reality, two halves joined together.<br />

The British and Belgian Industrial Bank of China’s existence<br />

was discovered only when several of its bank notes surfaced<br />

unexpectedly. Kann reports that these notes, in the amount of<br />

5 and 10 taels, were issued at Changsha, the capital of Hunan<br />

province. It is not known if the bank ever opened its doors to<br />

business. Since Hunan province was intensely anti-foreign and<br />

noted for opposition to all things foreign, especially regarding<br />

control of the local financial market, it is quite possible that the<br />

bank was never permitted to operate there, despite the organization<br />

having been set up and Changsha bank notes printed. The notes<br />

may be seen by examining the SCWPM, Vol. 1.<br />

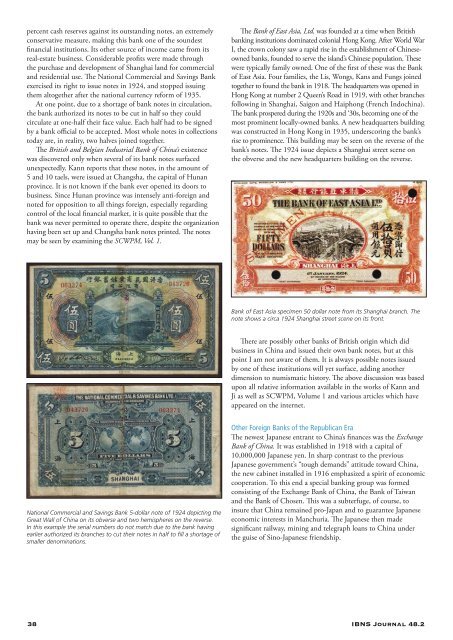

National Commercial and Savings Bank 5-dollar note of 1924 depicting the<br />

Great Wall of China on its obverse and two hemispheres on the reverse.<br />

In this example the serial numbers do not match due to the bank having<br />

earlier authorized its branches to cut their notes in half to fill a shortage of<br />

smaller denominations.<br />

The Bank of East Asia, Ltd. was founded at a time when British<br />

banking institutions dominated colonial Hong Kong. After World War<br />

I, the crown colony saw a rapid rise in the establishment of Chineseowned<br />

banks, founded to serve the island’s Chinese population. These<br />

were typically family owned. One of the first of these was the Bank<br />

of East Asia. Four families, the Lis, Wongs, Kans and Fungs joined<br />

together to found the bank in 1918. The headquarters was opened in<br />

Hong Kong at number 2 Queen’s Road in 1919, with other branches<br />

following in Shanghai, Saigon and Haiphong (French Indochina).<br />

The bank prospered during the 1920s and ‘30s, becoming one of the<br />

most prominent locally-owned banks. A new headquarters building<br />

was constructed in Hong Kong in 1935, underscoring the bank’s<br />

rise to prominence. This building may be seen on the reverse of the<br />

bank’s notes. The 1924 issue depicts a Shanghai street scene on<br />

the obverse and the new headquarters building on the reverse.<br />

Bank of East Asia specimen 50 dollar note from its Shanghai branch. The<br />

note shows a circa 1924 Shanghai street scene on its front.<br />

There are possibly other banks of British origin which did<br />

business in China and issued their own bank notes, but at this<br />

point I am not aware of them. It is always possible notes issued<br />

by one of these institutions will yet surface, adding another<br />

dimension to numismatic history. The above discussion was based<br />

upon all relative information available in the works of Kann and<br />

Ji as well as SCWPM, Volume 1 and various articles which have<br />

appeared on the internet.<br />

Other Foreign Banks of the Republican Era<br />

The newest Japanese entrant to China’s finances was the Exchange<br />

Bank of China. It was established in 1918 with a capital of<br />

10,000,000 Japanese yen. In sharp contrast to the previous<br />

Japanese government’s “tough demands” attitude toward China,<br />

the new cabinet installed in 1916 emphasized a spirit of economic<br />

cooperation. To this end a special banking group was formed<br />

consisting of the Exchange Bank of China, the Bank of Taiwan<br />

and the Bank of Chosen. This was a subterfuge, of course, to<br />

insure that China remained pro-Japan and to guarantee Japanese<br />

economic interests in Manchuria. The Japanese then made<br />

significant railway, mining and telegraph loans to China under<br />

the guise of Sino-Japanese friendship.<br />

38 <strong>IBNS</strong> Journal 48.2