You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Dear Editor,<br />

The Central Bank of Iran is now issuing checks for 500,000 and<br />

1,000,000 rials, which are circulating as banknotes; but should<br />

they be considered as banknotes? The highest denomination<br />

“banknote” now circulating in Iran is the 50,000-rial note<br />

(P.149), which has two signature varieties. Based on today’s<br />

exchange rate this note is worth about USD5.00.<br />

Despite the demand for higher denomination banknotes the<br />

Central Bank of Iran has refused to print banknotes in higher<br />

values. This task was left to local banks, Bank Meli, Bank Saderat,<br />

Bank Melat, etcetera, to print “Bank Cheques”, which were<br />

valid for circulation but could only be cashed at issuing banks.<br />

Depending on the bank the denominations were anywhere from<br />

100,000 rials to 2,500,000 rials.<br />

This created not only confusion, but restrictions. While<br />

merchants accept any “Bank-Cheques”, each utility bill has to<br />

be paid to a certain bank. So, if you had Bank Saderat “Bank-<br />

Cheques” in your wallet, and you wanted to pay your water bill,<br />

which has to be paid at Bank Melat’s branches, you could not use<br />

Bank Saderat’s “Bank-Cheques”.<br />

Eventually, the Central Bank started issuing high value<br />

banknotes; however, to avoid acknowledging inflation and<br />

calling them “banknotes”, they introduced the new notes as “Iran<br />

Cheques”. These notes are now circulating all over Iran and all<br />

the local banks have been asked to withdraw their local “Bank<br />

Cheques”. The Iran Cheques are not used once, like a personal<br />

or bank check, but circulate as currency without endorsement<br />

along with banknotes of smaller denominations. The new “notes”<br />

are vended from ATM machines and are printed on both sides<br />

(unlike most checks).<br />

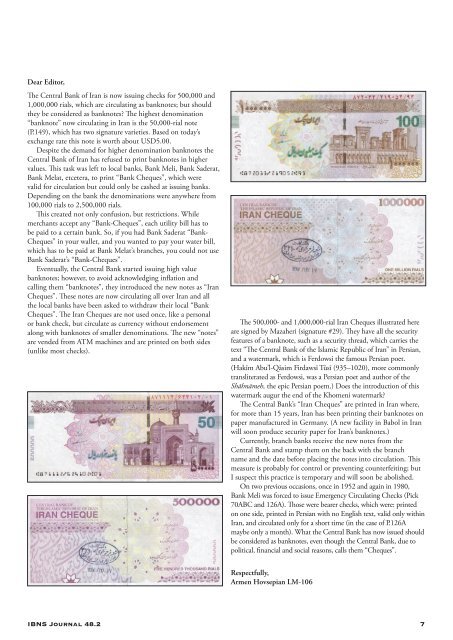

The 500,000- and 1,000,000-rial Iran Cheques illustrated here<br />

are signed by Mazaheri (signature #29). They have all the security<br />

features of a banknote, such as a security thread, which carries the<br />

text “The Central Bank of the Islamic Republic of Iran” in Persian,<br />

and a watermark, which is Ferdowsi the famous Persian poet.<br />

(Hakīm Abu’l-Qāsim Firdawsī Tūsī (935–1020), more commonly<br />

transliterated as Ferdowsi, was a Persian poet and author of the<br />

Shāhnāmeh, the epic Persian poem.) Does the introduction of this<br />

watermark augur the end of the Khomeni watermark?<br />

The Central Bank’s “Iran Cheques” are printed in Iran where,<br />

for more than 15 years, Iran has been printing their banknotes on<br />

paper manufactured in Germany. (A new facility in Babol in Iran<br />

will soon produce security paper for Iran’s banknotes.)<br />

Currently, branch banks receive the new notes from the<br />

Central Bank and stamp them on the back with the branch<br />

name and the date before placing the notes into circulation. This<br />

measure is probably for control or preventing counterfeiting; but<br />

I suspect this practice is temporary and will soon be abolished.<br />

On two previous occasions, once in 1952 and again in 1980,<br />

Bank Meli was forced to issue Emergency Circulating Checks (Pick<br />

70ABC and 126A). Those were bearer checks, which were: printed<br />

on one side, printed in Persian with no English text, valid only within<br />

Iran, and circulated only for a short time (in the case of P.126A<br />

maybe only a month). What the Central Bank has now issued should<br />

be considered as banknotes, even though the Central Bank, due to<br />

political, financial and social reasons, calls them “Cheques”.<br />

Respectfully,<br />

Armen Hovsepian LM-106<br />

<strong>IBNS</strong> Journal 48.2 7