Download - Insurance Council of New Zealand

Download - Insurance Council of New Zealand

Download - Insurance Council of New Zealand

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.icnz.org.nz<br />

<strong>Insurance</strong> <strong>Council</strong> Review<br />

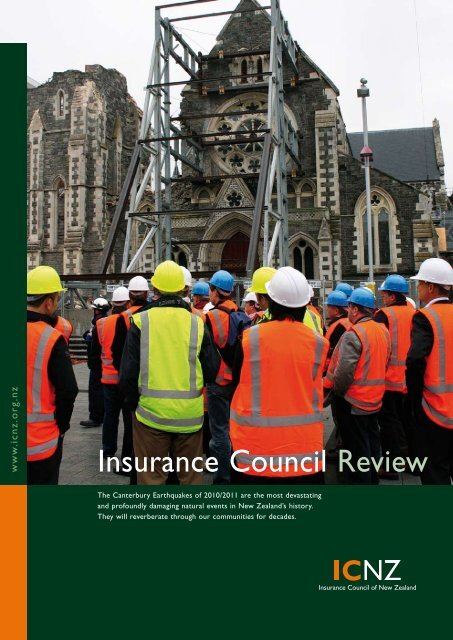

The Canterbury Earthquakes <strong>of</strong> 2010/2011 are the most devastating<br />

and pr<strong>of</strong>oundly damaging natural events in <strong>New</strong> <strong>Zealand</strong>’s history.<br />

They will reverberate through our communities for decades.

<strong>Council</strong> Structure<br />

Board<br />

<strong>Insurance</strong> Manager<br />

John Lucas<br />

Legal Advisor<br />

Simon Wilson<br />

Committee Structure<br />

Board and Membership<br />

Executive<br />

Chief Executive<br />

Chris Ryan<br />

Communications Manager<br />

Brett Solvander<br />

Administration & Support<br />

Madeleine Mitchell & Sharon Baldwin<br />

Finance & Regulation Manager<br />

Terry Jordan<br />

Accident Commercial Employment Finance Liability Marine Motor Personal Regulatory Travel<br />

Earthquake Recovery<br />

Commercial<br />

<strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong> Board 2011<br />

Back row, left to right: Terry Jordan ICNZ, Martin Kreft Munich Re, Cris Knell Chartis, Martin Stokes MAS,<br />

Gary Dransfield Vero, John Balmforth AMI, John Lucas ICNZ.<br />

Front row, left to right: Christopher Crowder Gen Re, Chris Black FMG, Jacki Johnson IAG,<br />

John Lyon President Lumley, Chris Ryan Chief Executive ICNZ.<br />

Vision<br />

Working<br />

Groups<br />

Earthquake Recovery<br />

Residential<br />

The <strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong> provides members with the<br />

means to deal with issues that are more effectively and efficiently<br />

handled on a collective basis. It works to increase their efficiency, image<br />

and financial strength as they serve their customers and community.

President’s Report<br />

<strong>New</strong> <strong>Zealand</strong> Treasury<br />

estimates the total cost<br />

<strong>of</strong> the earthquakes at<br />

around $30 billion<br />

The past 18 months have been the most challenging<br />

period in the history <strong>of</strong> the NZ insurance industry. We<br />

have faced incredible operational challenges in the<br />

most stressful <strong>of</strong> conditions and we have had to deal<br />

with unprecedented financial losses, all the while in<br />

an environment full <strong>of</strong> volatility and rapid change.<br />

Meanwhile, we have been subject to intense media<br />

scrutiny and have had to manage a raft <strong>of</strong> new and<br />

existing stakeholders.<br />

But the challenges have highlighted, like never<br />

before, the essential value which insurance brings to<br />

individuals, businesses, communities and the nation.<br />

1<br />

The year began with the continued response to the<br />

September 4th earthquake, and just as we thought<br />

we were getting on top <strong>of</strong> the recovery, we had the<br />

devastating earthquake on February 22nd.<br />

The February earthquake was the most destructive,<br />

fatal and extensive insured event in the history <strong>of</strong> <strong>New</strong><br />

<strong>Zealand</strong>. The event ranks seventh in Aon Benfield’s list<br />

<strong>of</strong> Top 10 insured loss events between 1980 and 2011.<br />

Even more dramatically, the Christchurch earthquakes<br />

<strong>of</strong> February and June rank in the top ten insured loss<br />

events in the world for 2011. For a country as small as<br />

<strong>New</strong> <strong>Zealand</strong> to suffer three earthquakes on this sort <strong>of</strong><br />

scale is unprecedented and has tested everyone within<br />

the industry to the utmost.<br />

As a result <strong>of</strong> the February 22nd earthquake, 185 people<br />

lost their lives and many more were injured. Extensive<br />

damage to land and buildings means thousands <strong>of</strong><br />

people have to replace their homes. <strong>New</strong> <strong>Zealand</strong><br />

Treasury estimates the total cost <strong>of</strong> the earthquakes at<br />

around $30 billion, which is about 15% <strong>of</strong> GDP. To put<br />

this estimate in context, the March 2011 earthquake<br />

<strong>of</strong>f the north-east coast <strong>of</strong> Japan, although larger in<br />

physical terms, is estimated to have caused damage<br />

equivalent to around 3 – 5% <strong>of</strong> Japan’s GDP.

“Over the past 18 months the relevance<br />

<strong>of</strong> insurance has been proven, time and<br />

time again. Not just with individuals,<br />

but also in terms <strong>of</strong> facilitating social<br />

and economic recovery. We should<br />

never underestimate the part we play in<br />

helping <strong>New</strong> <strong>Zealand</strong> to move forward”<br />

Rebuilding and recovery therefore represents a huge<br />

challenge for the <strong>New</strong> <strong>Zealand</strong> insurance industry, for<br />

Canterbury communities, and for the whole country.<br />

The facts are stark. 185 people died, 100,000 homes<br />

damaged and 7,000 homes “Red Zoned“.<br />

In the CBD, 3,000 <strong>of</strong> 5,000 businesses displaced, 1,400<br />

buildings demolished, one hundred and twenty<br />

four kilometres <strong>of</strong> water mains and three hundred<br />

kilometres <strong>of</strong> sewer pipes damaged.<br />

2<br />

The community lost 635 rest home beds, 19 community<br />

pharmacies and 5 general practices. More than 50% <strong>of</strong><br />

the residential roading network required repair and 12<br />

schools, or parts <strong>of</strong> schools, had to be relocated.<br />

<strong>New</strong> <strong>Zealand</strong> as a nation has been shocked, but the<br />

insurance sector has not only responded remarkably<br />

well to this historic event, it continues to respond to<br />

its customers’ requirements despite the fact that we<br />

have now experienced over 10,000 aftershocks since<br />

the initial earthquake in September 2010. We are in the<br />

third calendar year <strong>of</strong> aftershocks.<br />

As President <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong>, I would like to<br />

pay a tribute to all those in the insurance sector who<br />

have responded to an event almost unimaginable in<br />

insurance terms for a country the size <strong>of</strong> <strong>New</strong> <strong>Zealand</strong>.<br />

<strong>Insurance</strong> losses currently sit in the order <strong>of</strong> $20 billion.<br />

They are likely to continue rising.

“Cantabrians and <strong>New</strong> <strong>Zealand</strong>ers have<br />

been courageous, resilient, patient and<br />

strong. We understand and share many<br />

<strong>of</strong> their current frustrations, and as an<br />

industry are committed to doing all we<br />

can to help make progress.”<br />

The impact <strong>of</strong> the earthquakes is that there has been<br />

a fundamental and permanent shift in the insurance<br />

market. The way in which earthquake risks are insured<br />

has changed forever. An example <strong>of</strong> this is the approach<br />

to older buildings, particularly those with unreinforced<br />

masonry, which are now more difficult to insure for<br />

replacement cover throughout <strong>New</strong> <strong>Zealand</strong>. Many risks<br />

will be unable to attract full insurance cover, and this<br />

development will require collective dialogue between<br />

banks, government, insurers and business groups, to<br />

ensure that economic growth continues in earthquake<br />

prone regions.<br />

A major challenge going forward is to find a good balance<br />

between building standards and cost effectiveness.<br />

Excessive standards will lead to restricted development,<br />

whereas inadequate standards will simply perpetuate<br />

the challenges we have faced in Canterbury where<br />

many buildings and houses have been shown to have<br />

inadequate foundations or design for the conditions.<br />

The cost <strong>of</strong> insurance has risen dramatically and is likely<br />

to continue increasing as the costs <strong>of</strong> the earthquake<br />

claims rise. Residential properties have not been impacted<br />

as severely as Commercial but, in general, insurers<br />

are charging significantly more, and the Earthquake<br />

Commission levy tripled from 1 February 2012.<br />

Most insurers appear to be moving away from<br />

percentage <strong>of</strong> loss deductibles to percentage <strong>of</strong> insured<br />

value deductibles for earthquake, and the levels <strong>of</strong><br />

deductibles on many commercial properties have risen.<br />

The impact on the cost and availability <strong>of</strong> reinsurance<br />

is major. Catastrophe reinsurers around the world have<br />

experienced an abnormally costly 2011 with significant<br />

floods in Brisbane, the Canterbury earthquakes, Japan’s<br />

tsunami and earthquake, and the Thai floods. The<br />

catastrophe reinsurance modellers are likely to begin<br />

to review their models for <strong>New</strong> <strong>Zealand</strong> risk in the<br />

next year or two. This could see a further round <strong>of</strong><br />

earthquake insurance cost increases.<br />

3<br />

There will be other changes which will impact the<br />

market as we learn the lessons from Canterbury. These<br />

include issues <strong>of</strong> under-insurance, open-ended covers,<br />

outdated valuations, insufficient Business Interruption<br />

indemnity periods and insufficient business continuity<br />

planning. We, as an industry, will be looking to our<br />

broker colleagues to assist us in the <strong>Insurance</strong> <strong>Council</strong><br />

highlighting the increased need for scrutiny in these areas.<br />

Despite the challenges <strong>of</strong> the earthquake, the <strong>Insurance</strong><br />

<strong>Council</strong> and the insurance industry have been required<br />

to carry out their normal daily work. In <strong>New</strong> <strong>Zealand</strong><br />

the <strong>Insurance</strong> <strong>Council</strong> has again been leading the<br />

debate on insurance and has continued creating a better<br />

understanding <strong>of</strong> the economic and social value <strong>of</strong> our<br />

industry to a successful <strong>New</strong> <strong>Zealand</strong>.<br />

The <strong>Council</strong> has maintained a strong and positive<br />

relationship with the government throughout the<br />

catastrophe recovery period, and also has seen<br />

its relationship with the Opposition, particularly<br />

local Canterbury MPs, built to a very positive<br />

level. Where there are clear differences <strong>of</strong> opinion<br />

between the government and the <strong>Council</strong>, we have<br />

sought to engage constructively in expressing<br />

our concerns. However, looking towards the<br />

remainder <strong>of</strong> 2012 and beyond, we will continue<br />

to build and maintain a strong, constructive and<br />

open relationship with the government on issues<br />

<strong>of</strong> wider concern to our members, and also in the<br />

continued recovery <strong>of</strong> the Canterbury region.

The year saw some devastating impacts on members<br />

<strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong> as a consequence <strong>of</strong> the huge<br />

claims for earthquake. AMI <strong>Insurance</strong> was supported<br />

by the government and is now likely to be sold to IAG.<br />

Other members <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong> withdrew from<br />

the market, and others withdrew cover for earthquake.<br />

However, the strength <strong>of</strong> the insurance industry has been<br />

such that remaining insurers have continued to provide<br />

full cover for the vast majority <strong>of</strong> <strong>New</strong> <strong>Zealand</strong>ers<br />

despite the huge impact <strong>of</strong> the Canterbury quakes. This<br />

again reinforces the value <strong>of</strong> our international reinsurers<br />

and the international nature <strong>of</strong> the market.<br />

The <strong>Council</strong>’s Strategic and Business Plans identify the<br />

priorities and actions in our three core businesses <strong>of</strong><br />

Representation, Knowledge Management and Industry<br />

Regulation. I am pleased to report the <strong>Insurance</strong> <strong>Council</strong><br />

Executive has continued to deliver on the objectives <strong>of</strong><br />

the Strategic Plan in addition to the work on responding<br />

to the earthquakes.<br />

Considerable effort has been directed to liaison with<br />

related organisations. Constructive and regular<br />

dialogue has continued with the <strong>New</strong> <strong>Zealand</strong> Fire<br />

Service, particularly on budgetary and financial<br />

management issues. Regrettably we have not seen any<br />

advances in resolving our concern with the funding <strong>of</strong><br />

the Fire Service. Discussions on this issue have been<br />

held with the Minister and there is hope action will be<br />

taken. This will continue to be a strong focus for the<br />

<strong>Council</strong> in coming years.<br />

4<br />

A very constructive and beneficial relationship has been<br />

maintained with <strong>New</strong> <strong>Zealand</strong> Police. The <strong>Council</strong> has<br />

supported a number <strong>of</strong> Police initiatives, particularly<br />

the commitment by the Police <strong>of</strong> additional resources to<br />

the area <strong>of</strong> burglary and car theft. These activities have<br />

shown positive results.<br />

“Twenty billion dollars <strong>of</strong> insurance<br />

money is now being paid to the people<br />

<strong>of</strong> Canterbury to rebuild their lives and<br />

businesses.”<br />

Liaison with the <strong>Insurance</strong> Brokers has been maintained<br />

and enhanced. Our relationship with brokers has<br />

been particularly important this year. On behalf <strong>of</strong> the<br />

<strong>Insurance</strong> <strong>Council</strong> I would like to pay tribute to the<br />

enormous additional efforts insurance brokers have<br />

gone to in responding to the needs <strong>of</strong> their customers,<br />

not only in the wake <strong>of</strong> the earthquake claims but also<br />

as the market has responded to the post-earthquake<br />

underwriting and reinsurance environment. We are keen<br />

to continue building a close relationship with the brokers<br />

and increase dialogue between our two industry bodies.<br />

The <strong>Council</strong> has been extensively tested but coped<br />

admirably with the deluge <strong>of</strong> regulation through<br />

the <strong>Insurance</strong> Prudential Supervision Bill and the<br />

appointment <strong>of</strong> the Reserve Bank as key regulator for<br />

the industry.

One <strong>of</strong> the most impressive aspects <strong>of</strong> the <strong>Council</strong> is<br />

the considerable goodwill and commitment to the<br />

development <strong>of</strong> our industry that exists between our<br />

members. While operating day-to-day on a fiercely<br />

competitive basis, member companies readily commit<br />

staff and resource to the furtherance <strong>of</strong> the collective<br />

interest. Once again this has been evidenced through<br />

the work and success <strong>of</strong> our committee structure. All<br />

committees have worked to individual Business Plans<br />

and again I thank all <strong>of</strong> those involved for their immense<br />

contribution. We should strive to ensure that the spirit <strong>of</strong><br />

co-operation continues, particularly in these difficult and<br />

testing times.<br />

On behalf <strong>of</strong> all members, I would like to express our<br />

thanks and appreciation to our <strong>Insurance</strong> <strong>Council</strong><br />

staff for the very pr<strong>of</strong>essional, enthusiastic and<br />

committed way they have gone about ensuring the<br />

role and objectives <strong>of</strong> the <strong>Council</strong> are realised. With<br />

very limited resources, the team, under Chris Ryan’s<br />

leadership, have done a commendable job <strong>of</strong> furthering<br />

the industry’s interests, in the most challenging <strong>of</strong><br />

circumstances. I have been hugely impressed by the<br />

dedication and passion shown by the team, to whom<br />

the Board and I owe a huge debt <strong>of</strong> gratitude.<br />

I would like to thank the industry members who have<br />

contributed to our work through participation on the<br />

Board, committees and working groups. Without these<br />

committed supporters we would not have the <strong>Council</strong><br />

achievements that we do. I am especially indebted to<br />

my fellow directors for their support in the governance<br />

activities <strong>of</strong> the <strong>Council</strong>, and for providing exemplary<br />

industry leadership at a critical time.<br />

5<br />

But the most important accolades must go to the staff <strong>of</strong><br />

all insurers involved in the earthquake response, for the<br />

enormous contribution they have made to rebuild the<br />

communities <strong>of</strong> Canterbury. I have seen first-hand the<br />

stress and trauma that impacted many <strong>of</strong> our front line<br />

teams, and we owe all <strong>of</strong> these great ambassadors <strong>of</strong> the<br />

industry our greatest thanks.<br />

Looking forward, the blurring <strong>of</strong> traditional boundaries<br />

between insurers and financial markets will continue to<br />

present challenges to our <strong>Council</strong>. Our activities must<br />

remain relevant to the varied and broad interests <strong>of</strong><br />

current and potential members, while at the same time<br />

providing a value proposition that is seen as a suitable<br />

return on members’ investment in the <strong>Council</strong>.<br />

The Canterbury response will continue for years<br />

to come. We need to maintain a strong and unified<br />

<strong>Insurance</strong> <strong>Council</strong> to ensure we undertake this work<br />

effectively for the benefit <strong>of</strong> all our stakeholders. This,<br />

combined with the impeccable reputation the <strong>Insurance</strong><br />

<strong>Council</strong> has maintained, and our focussed strategy and<br />

strong financial position should ensure a positive and<br />

progressive future for all insured <strong>New</strong> <strong>Zealand</strong>ers.<br />

John Lyon<br />

President<br />

<strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong>

<strong>Council</strong> Activities 2011 /12<br />

The following list <strong>of</strong> activities is provided to identify the<br />

specific work outcomes <strong>of</strong> the <strong>Council</strong>, Committees and<br />

Working Groups.<br />

Some <strong>of</strong> the activities were extensive in nature, others<br />

relatively minor. All, however, are part <strong>of</strong> the <strong>Insurance</strong><br />

<strong>Council</strong>’s drive to deliver the Strategic and Business<br />

Objectives set down by the members and Board.<br />

While a significant proportion <strong>of</strong> the <strong>Council</strong>’s activities<br />

during the 2011/2012 period have been earthquake related,<br />

the <strong>Council</strong> has also continued its normal core functions <strong>of</strong><br />

Regulation, Representation and Knowledge Management <strong>of</strong><br />

members’ interests.<br />

Submissions to Government on:<br />

Prudential Supervision Legislation<br />

• Submission on Reserve Bank Governance Guidelines<br />

(Mar 2011)<br />

• Submission on Solvency Standard for Non-Life Insurers<br />

(Jul 2011)<br />

• Submission on classification <strong>of</strong> consumer credit insurance<br />

policies as “life policies” (Feb 2012)<br />

Earthquake Matters<br />

• Submission on Canterbury Earthquake Recovery Bill<br />

(Apr 2011)<br />

• Submission to Christchurch City <strong>Council</strong> on its Draft<br />

Central City Plan (Sep 2011)<br />

• Submission on Variation to Retirement Villages Code <strong>of</strong><br />

Practice 2008 (Nov 2011)<br />

The <strong>Insurance</strong> <strong>Council</strong> pays tribute<br />

to all insurance people involved in<br />

the recovery <strong>of</strong> Canterbury. Insurers,<br />

Brokers, Adjustors, Call Centre<br />

Operators and Customer Service<br />

people have all gone beyond their<br />

normal responsibilities to help our<br />

customers in need.<br />

6<br />

Other Submissions<br />

• Submission on Government announcement on ACC<br />

reform in December 2010 (Feb 2011)<br />

• Submission on Government’s proposal for Increasing<br />

Choice in Workplace Accident Compensation (July 2011)<br />

• Submission on Structural Vehicle Repairer Licensing Regime<br />

(Mar 2011)<br />

• Submission to Auckland City <strong>Council</strong> on its Draft<br />

Earthquake-Prone, Dangerous and Insanitary Buildings<br />

Policy (Sep 2011)<br />

• Submission on MED proposal for levy to fund the FMA<br />

(Dec 2011)<br />

• Submission on MED’s Audit Firm Incorporation<br />

Consultation Paper (Feb 2012)<br />

Other <strong>Insurance</strong> <strong>Council</strong> activities and<br />

their outcomes:<br />

Earthquake Related Matters<br />

• High Court declaratory judgment regarding extent <strong>of</strong> EQC<br />

Cover for multiple earthquake events<br />

• Working with EQC on apportionment system for claims<br />

over multiple events following the declaratory judgment<br />

• Creating EQC Protocols (1, 2, 3, 4 and 5) and overarching<br />

MOU between EQC and Insurers<br />

• Creating Dispute Resolution Service with DBH/EQC<br />

pursuant to Protocol 1<br />

• Resolving repair methodology differences between private<br />

insurers and EQC<br />

• Working with the Commission for Financial Literacy and<br />

Retirement Income on the “Red Zone Financial Guide”<br />

Other Committee/Working Group Matters<br />

• Communications - Establishing the ICNZ Communications<br />

Working Group<br />

• ICR – Updating Participation Agreement, Users and<br />

Participants’ Codes <strong>of</strong> Practice and Responsibilities <strong>of</strong> ICR<br />

• Personal Lines – Preparing “Excess” and “Glossary <strong>of</strong><br />

<strong>Insurance</strong> Terms” documents for <strong>Insurance</strong> <strong>Council</strong><br />

website<br />

• Presentations at the NZILA Conference, various ANZIIF<br />

Conferences and Lumley Edge Symposium

Chief Executive’s Report<br />

The responsibilities<br />

placed on the <strong>Insurance</strong><br />

<strong>Council</strong> have been<br />

extensive resulting in<br />

significant changes to<br />

our activities.<br />

The start <strong>of</strong> 2012 sees the third calendar year that we as<br />

an <strong>Insurance</strong> <strong>Council</strong> and industry have experienced<br />

the devastation <strong>of</strong> earthquakes in the Canterbury<br />

region. The quake in September 2010 was the first <strong>of</strong><br />

over 10,000 aftershocks and major quakes during 2011<br />

and continuing.<br />

The responsibilities placed on the <strong>Insurance</strong> <strong>Council</strong><br />

have been extensive resulting in significant changes to<br />

our activities. In particular we have had to build strong<br />

and new relationships with the Earthquake Commission<br />

[EQC], the Canterbury Earthquake Recovery Authority<br />

[CERA] and the Canterbury Earthquake Recovery<br />

Minister and associated agencies.<br />

We have worked very hard at representing the industry<br />

during this difficult time to ensure that the best outcome<br />

is found for our insured <strong>New</strong> <strong>Zealand</strong>ers and the<br />

members <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong>.<br />

In addition, there have been significant responsibilities<br />

in educating Cantabrians and <strong>New</strong> <strong>Zealand</strong>ers generally<br />

on the disciplines imposed by the marketplace on<br />

insurers responding to the earthquake and its aftermath.<br />

Nobody thought it would be two years<br />

before we could begin a serious rebuild<br />

but the earthquakes just kept on coming<br />

and destroying the ground and buildings<br />

even further. Even the most optimistic<br />

person couldn’t rebuild amidst over<br />

10,000 aftershocks.<br />

Reinsurers have been very clear that they are picking<br />

up the bulk <strong>of</strong> the bill which may be as high as $20<br />

billion in Canterbury.<br />

In addition to this work we have been trying very hard<br />

to ensure that the average Cantabrian is aware <strong>of</strong> the<br />

7<br />

difficulties being imposed by continuing seismic activity,<br />

liquefaction <strong>of</strong> land, unknown geotech status <strong>of</strong> land,<br />

resource consent issues and the general stresses and<br />

strains placed on everyone associated with recovery<br />

from the largest earthquake in the history <strong>of</strong> our nation.<br />

The <strong>Insurance</strong> <strong>Council</strong> hired a Communications<br />

Manager to cope with the wider media demands for<br />

updates and information during the year. We also hired<br />

a legally qualified staff member to cope with the number<br />

<strong>of</strong> technical, legal and insurance reports required to<br />

ensure that our members and our partners through<br />

central government, local government and the industry<br />

are fully informed on what the industry is doing.<br />

In addition to the work responding to the Canterbury<br />

earthquakes and encouraging the rebuild <strong>of</strong> the<br />

Canterbury region, we were required to carry out our<br />

core activities. In this area we were very conscious <strong>of</strong><br />

ensuring we were at the forefront <strong>of</strong> submissions to<br />

government on the new regulatory environment which is<br />

now taking place under the guidance <strong>of</strong> the Reserve Bank<br />

as the regulator. Extensive work was put into ensuring<br />

our members were prepared to be fully compliant with<br />

the requirements <strong>of</strong> this new regulatory regime.<br />

We continued the education <strong>of</strong> our members through<br />

finance seminars and the dispersal <strong>of</strong> all information<br />

pertinent to their operations during the year.

An additional working group was created specifically<br />

looking at communications to all parties relating to<br />

the Canterbury earthquake and this has seen a new<br />

set <strong>of</strong> skills applied to the insurance industry and<br />

the <strong>Insurance</strong> <strong>Council</strong> which, hopefully, will benefit<br />

everyone in the longer term.<br />

The <strong>Insurance</strong> <strong>Council</strong> has worked very closely with the<br />

broking community to explain some <strong>of</strong> the issues around<br />

the insurance industry’s response to the Canterbury<br />

earthquake and ensured that the relationship between<br />

brokers and underwriters remains strong.<br />

The <strong>Insurance</strong> <strong>Council</strong> has also worked with all other<br />

insurance disciplines including loss adjusting, the legal<br />

fraternity and actuarial pr<strong>of</strong>essions to ensure that the<br />

response <strong>of</strong> the insurance industry to the needs <strong>of</strong> the<br />

people <strong>of</strong> Canterbury and to insured <strong>New</strong> <strong>Zealand</strong>ers is<br />

what they expect from the industry.<br />

Numerous achievements <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong> are<br />

included in this document and the President, John Lyon,<br />

has also detailed many <strong>of</strong> the strategic objectives which<br />

we have delivered this year.<br />

On behalf <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong>, I thank the entire<br />

industry for the outstanding pr<strong>of</strong>essionalism which they<br />

have shown in responding to this unprecedented event.<br />

I also thank those insured <strong>New</strong> <strong>Zealand</strong>ers who have<br />

suffered at the hands <strong>of</strong> Mother Nature and been patient<br />

in awaiting a comprehensive response from the industry<br />

during a time <strong>of</strong> great difficulty and uncertainty from<br />

ongoing aftershocks.<br />

To the Board and staff <strong>of</strong> the <strong>Insurance</strong> <strong>Council</strong> and all<br />

other parties that have assisted us deliver, on behalf <strong>of</strong><br />

the industry and our customers, my very warm thanks<br />

are <strong>of</strong>fered.<br />

8<br />

The politicians and leaders <strong>of</strong> our<br />

communities have shown great maturity<br />

in not scoring political points with<br />

each other and working with common<br />

goals in the recovery process. They<br />

can be proud <strong>of</strong> their response to this<br />

demanding event.<br />

In addition, I think it is important to recognise those<br />

who assisted during the 2011/2012 period and the<br />

beginning <strong>of</strong> the recovery <strong>of</strong> Canterbury, including civil<br />

servants, local authority staff, recovery staff, Police and<br />

Civil Defence personnel.<br />

Despite the pressures the <strong>Insurance</strong> <strong>Council</strong> remains<br />

in good heart with strong financial fundamentals. We<br />

are very proud to represent the <strong>New</strong> <strong>Zealand</strong> insurance<br />

industry and our customers and will continue to provide<br />

a better understanding <strong>of</strong> the benefits <strong>of</strong> a sustainable<br />

and successful insurance industry to a wide range <strong>of</strong><br />

<strong>New</strong> <strong>Zealand</strong>ers.<br />

Chris Ryan<br />

Chief Executive<br />

<strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong>

9<br />

We Remember<br />

We remember those who lost their<br />

lives as a result <strong>of</strong> the devastating<br />

earthquake <strong>of</strong> February 22 2011.<br />

And we reflect on the bravery and<br />

resilience <strong>of</strong> those Cantabrians<br />

who lost their loved ones, homes,<br />

communities, livelihoods, directions<br />

and dreams.<br />

On behalf <strong>of</strong> the <strong>New</strong> <strong>Zealand</strong><br />

insurance industry, the <strong>Insurance</strong><br />

<strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong> takes this<br />

opportunity to pay tribute to you,<br />

and to pledge our determination to<br />

support the redevelopment <strong>of</strong> your<br />

vibrant region.

Christchurch<br />

Recounting the Cost<br />

On September 4th 2010 <strong>New</strong> <strong>Zealand</strong> suffered its largest<br />

earthquake event (in terms <strong>of</strong> insured loss) in the history<br />

<strong>of</strong> the nation. About six months later on February 22nd<br />

2011 <strong>New</strong> <strong>Zealand</strong> suffered its biggest earthquake<br />

superseding that <strong>of</strong> September 4th, which caused current<br />

estimates <strong>of</strong> $NZ 20 billion worth <strong>of</strong> damage and killed<br />

185 people.<br />

In the months following the initial earthquake on<br />

September 4th until the writing <strong>of</strong> this review in 2012,<br />

the Canterbury region was rocked by over 10,000<br />

aftershocks. Huge and devastating quakes were felt, not<br />

only in September and February, but also in June 2011<br />

and December 2011, just three days before Christmas.<br />

The billions <strong>of</strong> reinsurance being paid<br />

into Canterbury comes from insured<br />

people and insurance companies around<br />

the world. This is new money into our<br />

economy and will be needed by Kiwis to<br />

get back on their feet.<br />

The scale <strong>of</strong> devastation wreaked by the series <strong>of</strong><br />

earthquakes is almost impossible to totally grasp. The<br />

most basic <strong>of</strong> statistics gives some idea <strong>of</strong> what insurers<br />

and all recovery agencies were required to deal with:<br />

• 185 people died<br />

• more than 100,000 homes (or approximately half <strong>of</strong><br />

the housing stock <strong>of</strong> greater Christchurch) damaged<br />

• 7,000 homes totally destroyed and Red Zoned, with<br />

the government <strong>of</strong>fering to purchase these properties<br />

• more than 3,000 <strong>of</strong> the 5,000 businesses in the CBD<br />

displaced<br />

• more than 1,400 demolitions <strong>of</strong> buildings in the CBD<br />

• 124 kilometres <strong>of</strong> water mains damaged<br />

• 300 kilometres <strong>of</strong> sewer pipes damaged<br />

• over 7,000 <strong>of</strong> the 12,000 Canterbury District Health<br />

Board rooms damaged<br />

• 106 hospital beds at the Christchurch Hospital closed<br />

• 635 rest home beds lost<br />

• 19 community pharmacies lost<br />

• 5 general practices lost or damaged<br />

• more than 50% <strong>of</strong> the residential roading network<br />

requiring replacement or repair<br />

11<br />

• 12 schools, or parts <strong>of</strong> schools, relocated<br />

• over 1,600 projects listed in the draft central city<br />

plan requiring some form <strong>of</strong> capital for repair or<br />

rebuilding.<br />

Every part <strong>of</strong> the Canterbury community was affected.<br />

Housing, education, health, sports, culture and<br />

infrastructure all require major efforts to return to the<br />

levels <strong>of</strong> service and activity that existed before the<br />

earthquake. Among businesses, tourism, international<br />

Top ten insurance loss events in 2011<br />

Estimated losses in $USD<br />

Earthquake Japan 35.00 billion<br />

Earthquake <strong>New</strong> <strong>Zealand</strong>, 22 February 2011 13.50 billion<br />

Flooding Thailand 10.78 billion<br />

Severe Weather U.S. Southeast, Plains, Mid West 7.30 billion<br />

Severe Weather U.S. Plains, Mid West, Southeast 6.75 billion<br />

Severe Weather Hurricane Irene 5.00 billion<br />

Flooding Australia 2.42 billion<br />

Severe Weather U.S. Southeast, Plains, Mid West 2.00 billion<br />

Earthquake <strong>New</strong> <strong>Zealand</strong>, 22 December 2011 1.80 billion<br />

Severe Weather U.S. Plains, Mid West, Southeast 1.70 billion<br />

Canterbury’s first earthquake <strong>of</strong> 4 September 2010 was a<br />

globally significant loss event in its own right.<br />

Earthquake <strong>New</strong> <strong>Zealand</strong>, 04 September 2010 4.00 billion

education, and inner city retail were particularly hard<br />

hit. Most <strong>of</strong> the area’s hotels and backpacker facilities<br />

were located in the cordoned area <strong>of</strong> the CBD. Almost<br />

all the high-rise buildings in the CBD suffered total<br />

or serious damage including the 28-storey Grand<br />

Chancellor Hotel. Canterbury University suffered a drop<br />

<strong>of</strong> 1,500 equivalent full-time student numbers in 2011,<br />

projecting a loss <strong>of</strong> 20,000 equivalent full-time students<br />

over the next five years.<br />

Damage to residential areas was widespread with<br />

concentrations <strong>of</strong> extreme damage in the eastern suburbs<br />

<strong>of</strong> Christchurch. Particularly hard hit areas also included<br />

Kaiapoi and Lyttelton and the severity <strong>of</strong> the damage<br />

immediately saw a displacement <strong>of</strong> business and retail<br />

activity to other areas with Oxford, Lincoln, Rolleston<br />

and Rangiora all showing increases in retail trade.<br />

The challenge for the insurance sector was even more<br />

pr<strong>of</strong>ound than simply repairing or replacing damaged<br />

or destroyed buildings and infrastructure from the<br />

ground up. The earthquakes revealed significant risk<br />

from seismic activity arising from the geology <strong>of</strong> the<br />

greater Christchurch area. This meant assessments<br />

were required <strong>of</strong> each area to determine if remediation<br />

work on the land was required before rebuilding could<br />

begin. Land issues added a layer <strong>of</strong> additional complex<br />

retirement costs to recovery efforts.<br />

In some areas known as Red Zones and currently<br />

containing 7,000 residential properties, the land is<br />

so severely damaged that rebuilding is unlikely to<br />

be practical over the short to medium term. In some<br />

residential areas, such as the small north-eastern<br />

12<br />

community <strong>of</strong> Brooklands, the whole suburb has been<br />

assessed as unsuitable for repair or rebuilding in the<br />

short to medium term.<br />

As a result <strong>of</strong> these issues some parts <strong>of</strong> Christchurch<br />

will never return to the position they were in before<br />

the earthquakes. Some areas will no longer be suitable<br />

for building. In others, such as the CBD where more<br />

than 1,400 unsafe buildings will have to be demolished,<br />

the rebuild areas will look quite different to the pre-<br />

earthquake city.<br />

The value <strong>of</strong> insurance<br />

has never been more<br />

evident than in the<br />

aftermath <strong>of</strong> the quakes,<br />

yes there are problems<br />

but billions are being paid<br />

out and will continue to<br />

go into the pockets <strong>of</strong><br />

Cantabrians who could<br />

never have recovered<br />

without insurance.<br />

Throughout this the insurance sector responded on a<br />

continuous basis, not only to the enormous number<br />

<strong>of</strong> claims from Canterbury residents, but also to those<br />

claims from insured <strong>New</strong> <strong>Zealand</strong>ers for a wide range<br />

<strong>of</strong> losses. The resulting impact meant the insurance<br />

sector was unable to provide new cover during the time<br />

immediately after each major aftershock or new quake.<br />

This created problems for some people buying and<br />

selling homes, however the insurance industry was able<br />

to ensure existing cover stayed in place.<br />

The Earthquake Commission immediately came into<br />

play and it was clear from early on the sheer size <strong>of</strong> the<br />

event left the Earthquake Commission unable to cope<br />

with the level <strong>of</strong> response for such an unprecedented<br />

event. By November 2011 the EQC had received 680,000<br />

building, land or contents claims. The biggest previous<br />

event was the Inangahua earthquake in 1968 with 10,500<br />

claims. Internationally the 4 September and 22 February<br />

earthquakes were each among the five most damaging<br />

earthquakes in the world by insured losses.

The government reacted immediately to the earthquakes.<br />

Treasury now estimates the total cost <strong>of</strong> the earthquakes<br />

at around $30 billion, which is about 15% <strong>of</strong> GDP.<br />

The first significant issue for the insurance industry was<br />

duplication <strong>of</strong> claims from those claiming for the first<br />

$100,000 <strong>of</strong> EQC cover and then being required to claim<br />

the remainder <strong>of</strong> their insured loss with their insurance<br />

company. This created duplication <strong>of</strong> services, a<br />

contributing factor in delays to some customers’ claims.<br />

<strong>Insurance</strong> puts people back in the position<br />

they were before the quakes, it is not<br />

there to make people richer than they<br />

were before but in many cases it will.<br />

The Earthquake Recovery Act <strong>of</strong> the 19 April 2011 saw<br />

the creation <strong>of</strong> the Canterbury Earthquake Recovery<br />

Authority [CERA]. The role <strong>of</strong> CERA is to develop a<br />

recovery strategy, an over-arching long-term strategy<br />

for the reconstruction, rebuilding and recovery <strong>of</strong><br />

greater Christchurch. The aim is to restore the social,<br />

economic, cultural and environmental wellbeing<br />

<strong>of</strong> greater Christchurch communities as soon as<br />

practically possible.<br />

13<br />

The role <strong>of</strong> reinsurance in recovery was critical with<br />

the Earthquake Commission and the insurance<br />

sector heavily reinsured for the costs <strong>of</strong> the quakes.<br />

Reinsurance became a key discipline on the response <strong>of</strong><br />

insurers to the contracts they had written, not only with<br />

their reinsurers, but also with their customers.<br />

The problems <strong>of</strong> liquefaction and particularly lateral<br />

spread were clearly identified almost immediately,<br />

causing difficulty establishing costs <strong>of</strong> claims, costs <strong>of</strong><br />

rebuilds, and requiring the collection <strong>of</strong> wide statistical<br />

data before decisions could be made.<br />

The creation <strong>of</strong> Red Zones saw the destruction <strong>of</strong> entire<br />

suburbs and the central government ownership <strong>of</strong><br />

these Red Zone houses after negotiation with owners.<br />

The key issue for insurers was a cordon imposed for

safety reasons on the Christchurch central business<br />

district. This saw large parts <strong>of</strong> the city out <strong>of</strong> bounds<br />

to all customers, owners, insurers, and adjusters,<br />

and also affected the ability <strong>of</strong> the insurance sector to<br />

ascertain the value and status <strong>of</strong> claims. The cordon<br />

also imposed difficulties on insurers and businesses in<br />

terms <strong>of</strong> Business Interruption policies including the<br />

generally accepted 12-month indemnity period for many<br />

businesses. While insurers worked hard to overcome<br />

these difficulties, there was a lack <strong>of</strong> understanding<br />

that this was something outside <strong>of</strong> the control <strong>of</strong> the<br />

insurance sector.<br />

Our building codes will change, the way<br />

we live in our cities will change, but we<br />

will still be <strong>New</strong> <strong>Zealand</strong>ers and our<br />

nation will continue to prosper and grow<br />

thanks to high levels <strong>of</strong> insurance taken<br />

out by prudent Kiwis.<br />

15<br />

Significant levels <strong>of</strong> under-insurance were exposed,<br />

particularly in the commercial sector, and a key driver<br />

<strong>of</strong> this was outdated valuations on the properties being<br />

insured. A very large number <strong>of</strong> people are choosing<br />

cash settlements on their claims due to the continuing<br />

aftershocks and uncertainty about ground conditions,<br />

and the ability to rebuild within a set period <strong>of</strong> time.<br />

This prompted a degree <strong>of</strong> concern by authorities with<br />

capital leaving the Canterbury region and being invested<br />

elsewhere instead <strong>of</strong> in the rebuild.<br />

Significant work was undertaken with the business<br />

community to establish their concerns and relate the<br />

insurance responsibilities back to them as customers.<br />

However there are now, looking forward, extensive<br />

considerations for the future. The first is to establish the<br />

status <strong>of</strong> the land and then begin the rebuild which is<br />

expected to require at least 30,000 additional workers.<br />

In terms <strong>of</strong> future considerations for the <strong>Insurance</strong><br />

<strong>Council</strong>, issues <strong>of</strong> insurability will now be very high in<br />

the minds <strong>of</strong> insurers with many unreinforced and early

ick buildings potentially uninsurable for earthquake.<br />

The involvement <strong>of</strong> banks establishing the security<br />

<strong>of</strong> their investments in property and other aspects <strong>of</strong><br />

insurance has been highlighted and banks are likely<br />

to build much stronger and closer relationships with<br />

insurers in the future. The affordability <strong>of</strong> insurance<br />

post-earthquake will be a real issue with significant<br />

increases in premiums likely to continue, and a much<br />

greater awareness <strong>of</strong> risk by insurance companies.<br />

The policy issues for the insurance sector and<br />

government going forward will be establishing a<br />

much more sustainable structure for the Earthquake<br />

Commission, and establishing what it is covering<br />

and what it is not, and in particular reducing any<br />

duplication <strong>of</strong> services between the Earthquake<br />

Commission and the private insurance industry.<br />

16

Pr<strong>of</strong>ound changes will come from the<br />

earthquakes; insurance will change,<br />

buildings will change and people<br />

will need to be aware <strong>of</strong> risk in any<br />

investment they make.<br />

The <strong>Insurance</strong> <strong>Council</strong> is likely to raise the affordability<br />

issue with government with growing concern that a<br />

trebling <strong>of</strong> the earthquake levy, a possible increase in<br />

Fire Service taxes, and a recently increased level <strong>of</strong><br />

GST, all <strong>of</strong> which are attached to the original private<br />

insurance policy cost, will see affordability issues arise<br />

and a potential for a reduction in the levels <strong>of</strong> insurance.<br />

The levels <strong>of</strong> taxes and other levies attached to private<br />

insurance premiums will need to be reduced.<br />

The effects <strong>of</strong> the Canterbury earthquake will be felt<br />

for years to come. It featured 7 in the Top 10 insured<br />

loss events in the last 30 years on an international scale<br />

17<br />

according to a prominent reinsurance broker’s data.<br />

Many buildings that were thought to be up to modern<br />

Code did not survive the earthquake. Already tenants<br />

and owners as reassessing the risk <strong>of</strong> buildings, and<br />

their ability to be tenanted is being determined by their<br />

ability to withstand significant quakes. There is likely to<br />

be a strong and ongoing dialogue between the private<br />

insurance sector and central and local government in<br />

coming years to establish and rectify all the issues that<br />

have been exposed by the enormity <strong>of</strong> the earthquakes<br />

<strong>of</strong> 2010, 2011 and 2012.<br />

In the face <strong>of</strong> all this upheaval, the insurance industry<br />

was required to carry on with its normal daily business<br />

paying claims for fire and flood damaged homes,<br />

replacing items stolen as a result <strong>of</strong> crime, and the<br />

myriad <strong>of</strong> other ‘bread and butter’ operations that our<br />

industry achieves for ordinary <strong>New</strong> <strong>Zealand</strong>ers on a<br />

daily basis.

Industr y Statistics<br />

All Business 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 3,099,077,385 3,260,456,648 3,416,891,966 3,604,101,963 3,979,548,054<br />

Net Written Premium ($) 2,657,163,693 2,807,667,691 2,911,449,528 3,119,058,942 3,179,010,972<br />

Net Earned Premium ($) 2,608,081,917 2,747,509,546 2,857,200,899 3,073,050,146 2,962,014,374<br />

Claims Incurred ($) 1,736,503,436 1,880,923,174 1,845,390,159 2,096,548,674 3,311,871,292<br />

Loss Ratio (%) 66.58% 68.46% 64.59% 68.22% 111.81%<br />

Business Costs (Staff etc) ($) 825,984,278 897,685,308 941,101,455 996,683,386 1,023,410,108<br />

Combined Ratio (%) 98.25% 101.13% 97.53% 100.66% 146.36%<br />

Commercial Material Damage and Business Interruption 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 424,814,574 441,340,110 464,184,727 469,043,879 502,455,302<br />

Net Written Premium ($) 248,966,425 277,244,142 283,055,759 297,579,539 292,078,059<br />

Net Earned Premium ($) 249,854,108 270,404,011 275,462,767 291,158,018 280,155,525<br />

Claims Incurred ($) 175,041,037 185,283,249 167,431,550 172,180,899 155,895,787<br />

Loss Ratio (%) 70.06% 68.52% 60.78% 59.14% 55.65%<br />

Domestic Buildings and Contents 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 703,171,694 766,231,827 840,054,112 933,495,375 1,052,270,223<br />

Net Written Premium ($) 662,679,754 714,632,555 778,957,391 866,335,821 904,836,784<br />

Net Earned Premium ($) 640,728,100 687,754,814 755,435,740 839,897,275 826,974,807<br />

Claims Incurred ($) 535,037,934 566,260,572 541,263,823 525,356,791 515,234,420<br />

Loss Ratio (%) 83.50% 82.33% 71.65% 62.55% 62,30%<br />

Motor Commercial and Private 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 1,108,091,872 1,159,380,800 1,210,153,486 1,266,098,899 1,339,829,531<br />

Net Written Premium ($) 1,080,683,184 1,128,103,360 1,185,128,372 1,253,440,464 1,319,857,990<br />

Net Earned Premium ($) 1,077,998,789 1,104,655,954 1,157,985,830 1,233,098,039 1,265,751,060<br />

Claims Incurred ($) 770,080,686 813,957,780 811,497,477 791,265,591 824,763,162<br />

Loss Ratio (%) 71.44% 73.68% 70.08% 64.17% 65.16%<br />

18

Marine Hull and Cargo 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 107,516,864 113,768,514 126,435,782 119,594,972 125,403,642<br />

Net Written Premium ($) 79,129,286 94,679,961 108,294,198 97,666,992 95,310,182<br />

Net Earned Premium ($) 77,735,860 90,657,762 104,816,033 99,658,692 93,872,738<br />

Claims Incurred ($) 51,332,230 61,080,313 61,083,237 58,600,332 59,722,860<br />

Loss Ratio (%) 66.03% 67.37% 58.28% 58.80% 63.62%<br />

Liability Pr<strong>of</strong>essional & Defamation, Directors & Officers and Public Product & Other 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 252,485,737 267,149,616 279,800,946 298,229,655 313,644,264<br />

Net Written Premium ($) 219,954,01 234,968,804 242,850,562 255,992,543 269,481,979<br />

Net Earned Premium ($) 212,870,263 236,853,174 238,435,422 250,185,778 261,188,903<br />

Claims Incurred ($) 70,552,528 91,666,012 114,598,447 163,998,021 127,512,090<br />

Loss Ratio (%) 33.14% 38.70% 48.06% 65.55% 48.82%<br />

Earthquake Domestic, Commercial M.D., Business Interruption and Marine Cargo 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 212,597,837 206,530,977 212,963,164 220,172,442 350,256,361<br />

Net Written Premium ($) 114,429,759 95,928,127 112,741,108 116,710,783 69,248,376<br />

Net Earned Premium ($) 111,343,908 100,074,065 109,982,325 115,211,252 4,796,126<br />

Claims Incurred ($) 2,006,587 16,736,697 6,033,131 242,689,944 1,494,617,694<br />

Loss Ratio (%) 1.80% 16.72% 5.49% 210.65% 31163.02%<br />

Other Personal Accident,Travel, Livestock and Other 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Gross Written Premium ($) 290,398,807 306,054,804 283,299,749 297,466,741 295,688,731<br />

Net Written Premium ($) 251,321,275 262,110,742 200,422,138 231,332,796 228,197,602<br />

Net Earned Premium ($) 237,550,889 257,109,766 215,082,782 243,841,103 229,275,215<br />

Claims Incurred ($) 132,452,434 145,938,551 143,482,494 142,457,105 134,125,279<br />

Loss Ratio (%) 55.76% 56.76% 66.71% 58.42% 58.50%<br />

19

Gross Written Premiums <strong>of</strong> Business Classes 12 months to September<br />

Year-End 2007 2008 2009 2010 2011<br />

Commercial ($) 424,814,574 441,340,110 464,184,727 469,043,879 502,455,302<br />

Domestic ($) 703,171,694 766,231,827 840,054,112 933,495,375 1,052,270,223<br />

Motor ($) 1,108,091,872 1,159,380,800 1,210,153,486 1,266,098,899 1,339,829,531<br />

Marine ($) 107,516,864 113,768,514 126,435,782 119,594,972 125,403,642<br />

Liability ($) 252,485,737 267,149,616 279,800,946 298,229,655 313,644,264<br />

Earthquake ($) 212,597,837 206,530,977 212,963,164 220,172,442 350,256,361<br />

Other ($) 290,398,807 306,054,804 283,299,749 297,466,741 295,688,731<br />

Total ($) 3,099,077,385 3,260,456,648 3,416,891,966 3,604,101,963 3,979,548,054<br />

Gross Written Premiums <strong>of</strong> Business Classes by Percentage 12 months to September<br />

2002 2003 2004<br />

Commercial<br />

Domestic<br />

Motor<br />

Marine<br />

Liability<br />

Earthquake<br />

Other<br />

Gross Written Premium<br />

Claims Incurred<br />

Payments projected for 2012 and 2013<br />

13.7% 13.5% 13.6% 13.0%<br />

22.7% 23.5% 24.6% 25.9%<br />

35.8% 35.6% 35.4% 35.1%<br />

3.5% 3.5% 3.7% 3.3%<br />

8.1% 8.2% 8.2% 8.3%<br />

6.9% 6.3% 6.2% 6.1%<br />

9.4% 9.4% 8.3% 8.3%<br />

2007 2008 2009<br />

Earthquake Claims Incurred 10 years to September 2011 and conservative projections for the current year and 2013<br />

2010<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

20<br />

12.6%<br />

26.4%<br />

33.7%<br />

3.2%<br />

7.9%<br />

8.8%<br />

7.4%<br />

2011<br />

Projected to rise above NZ$ 5 billion<br />

Projected to rise well above NZ$ 15 billion<br />

NZ$ 15 billion<br />

NZ$ 10 billion<br />

NZ$ 5 billion

The <strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong><br />

President<br />

John Lyon<br />

Lumley<br />

Board Members<br />

John Balmforth<br />

AMI<br />

Roger Bell retired<br />

Vero<br />

Chris Black<br />

FMG<br />

Christopher Crowder<br />

General Re<br />

Gary Dransfield<br />

Vero<br />

Jacki Johnson Vice President<br />

IAG<br />

Chris Knell<br />

Chartis<br />

Martin Kreft<br />

Munich Re<br />

Martin Stokes<br />

MAS<br />

As Christchurch rebuilds its<br />

infrastructure, landscape and business,<br />

<strong>New</strong> <strong>Zealand</strong>ers and the business<br />

community at large take heart that<br />

history will remember not only what was<br />

lost but also what is yet to emerge.<br />

The next two years will be pivotal in<br />

directing and managing the shape <strong>of</strong> a<br />

renewed City.<br />

Standing Committees 2011<br />

Accident Committee<br />

Karl Armstrong IAG<br />

Malcolm Beaton Berkley Re<br />

Mark Caisley Lumley<br />

Michael Clapp Tower<br />

Nigel Edmiston Vero<br />

Ralph Hart MAS<br />

Jan Holden ACE<br />

Dave Kibblewhite FMG<br />

David Krawitz Allianz<br />

Peter Lam China Taiping<br />

Steve Loomes Zurich<br />

Glen Riddell General Re<br />

Mathew Spears Munich Re<br />

Kieran Sweetman AMI<br />

Trent Thomson Swiss Re<br />

Julian Travaglia Chartis<br />

Suzanne Wolton AA<br />

Commercial Committee<br />

Nathan Barrett FMG<br />

Malcolm Beaton Berkley Re<br />

John Beckett Lumley<br />

Brian Coleman Allianz<br />

Jeff Crawford Chartis<br />

Mark Cross Vero<br />

Deborah Cruickshank Munich Re<br />

Simon Foley Zurich<br />

Nancy George Mitsui Sumitomo<br />

David Morrow ACE<br />

Payal Sharma China Taiping<br />

John Stubbs General Re<br />

Andrew West IAG<br />

Employment Committee<br />

Andrea Brunner FMG<br />

Graham Bunkall Chartis<br />

Denise Deegan Lumley<br />

Tanya Hadfield IAG<br />

Nikki Howell AA<br />

Carolyn Pye Tower<br />

Ross McMillan MAS<br />

Barry Mitchell AMI<br />

Simone Nelson ACE<br />

Alison Shackell Vero<br />

Finance Committee<br />

Michael Brent General Re<br />

Peter Brown Vero<br />

Martin Chisholm AA<br />

Dan Coman IAG<br />

Theo De Koster Tower<br />

Dave Kibblewhite FMG<br />

Dean Phillips Munich Re<br />

Graeme Ross MAS<br />

Runesh Roy ACE<br />

Alistair Smith Lumley<br />

Paul Smith Ansvar<br />

Kieran Sweetman AMI<br />

Ying Zhou China Taiping<br />

Liability Committee<br />

Heather Bailey Vero<br />

Jeremy Batchelor IAG<br />

Craig Kirk Lumley<br />

Mark Downes ACE<br />

Nancy George Mitsui Sumitomo<br />

Karl Kemp Allianz<br />

Peter Lam China Taiping<br />

Stirling McGovern Munich Re<br />

Jeremy Nobbs Ansvar<br />

Andrew Pook Zurich<br />

Trevor Rossi General Re<br />

Jeremy Scott-Mackenzie Chartis<br />

Marine Committee<br />

Keith Auld Munich Re<br />

Christopher Barrett Sunderland Marine<br />

John McKelvie Vero<br />

Daniel McIntyre Zurich<br />

Glenn Nadworny Allianz<br />

Mark Roelink NZI Marine<br />

Andrew Scrivens Lumley<br />

Payal Sharma China Taiping<br />

Fraser Walker Chartis<br />

continues over page

Motor Committee<br />

Paul Liddle IAG<br />

Graeme Lynskey Vero<br />

Matt McEneaney Allianz<br />

Dean Munt AMI<br />

Kevin Paxton Zurich<br />

Laura Poru Tower<br />

Payal Sharma China Taiping<br />

Ian Taylor Lumley<br />

Personal Committee<br />

Peter Birmingham MAS<br />

Ross Collett Lumley<br />

Sue Dillon Allianz<br />

Richard Godman Vero<br />

Shaun Kelly AMI<br />

Paul Lightfoot China Taiping<br />

Chris O’Connor Ansvar<br />

Richelle Pirie Tower<br />

Rebekah Tregonning IAG<br />

Ge<strong>of</strong>f White FMG<br />

Regulatory Committee<br />

Sarah Allerby Allianz<br />

Rob Arcus Vero<br />

Peter Birmingham MAS<br />

David Cao China Taiping<br />

Craig Daly AMI<br />

Eugene Elisara Chartis<br />

Martin Hunter IAG<br />

Martin Kreft Munich Re<br />

Wendy Lau Lumley<br />

Craig Morrison Southern Cross Travel<br />

Lisa Murray FMG<br />

Elizabeth Papandrea ACE<br />

Paul Smith Ansvar<br />

Jacqui Thompson AA<br />

Travel Committee<br />

Toseef Ahmad Tower<br />

Will Ashcr<strong>of</strong>t Allianz<br />

John Beckett Lumley<br />

Michelle Boulger IAG<br />

Bob Davie Comprehensive Travel (Vero)<br />

Karl Dixon Great Lakes (Munich Re)<br />

Michael Joines Chartis<br />

Peter Lam China Taiping<br />

Craig Morrison Southern Cross Travel<br />

Lorraine Smart IAG<br />

<strong>Insurance</strong> <strong>Council</strong> Members<br />

AA (joined 2012)<br />

ACE<br />

Allianz<br />

AMI<br />

Ansvar<br />

Berkley Re<br />

Chartis<br />

China Taiping<br />

Cigna (joined 2012)<br />

Civic Assurance<br />

FMG<br />

General Re<br />

IAG<br />

Lloyd’s<br />

Lumley<br />

MAS<br />

Mitsui Sumitomo<br />

Munich Re<br />

Pacific International<br />

Hallmark<br />

Southern Cross Travel<br />

Sunderland Marine<br />

Swiss Re<br />

Tower<br />

Vero<br />

Zurich<br />

<strong>Insurance</strong> <strong>Council</strong> <strong>of</strong> <strong>New</strong> <strong>Zealand</strong><br />

PO Box 474<br />

Wellington 6140<br />

+64 4 472 5230<br />

www.icnz.org.nz