REGIONAL ECONOMIC SITUATIONER Western ... - NEDA-RDC VI

REGIONAL ECONOMIC SITUATIONER Western ... - NEDA-RDC VI

REGIONAL ECONOMIC SITUATIONER Western ... - NEDA-RDC VI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

I. <strong>ECONOMIC</strong> PERFORMANCE<br />

1. Prices<br />

<strong>REGIONAL</strong> <strong>ECONOMIC</strong> <strong>SITUATIONER</strong><br />

<strong>Western</strong> Visayas Region<br />

Third Quarter 2005<br />

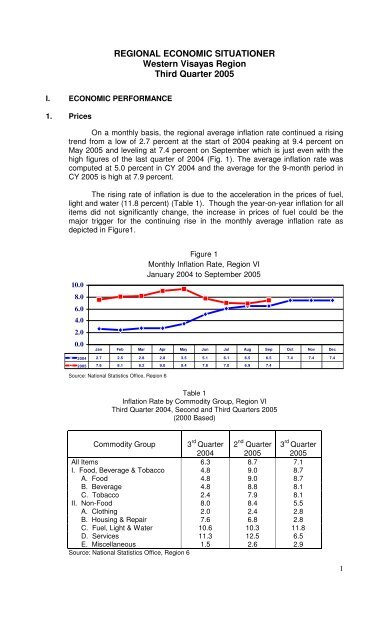

On a monthly basis, the regional average inflation rate continued a rising<br />

trend from a low of 2.7 percent at the start of 2004 peaking at 9.4 percent on<br />

May 2005 and leveling at 7.4 percent on September which is just even with the<br />

high figures of the last quarter of 2004 (Fig. 1). The average inflation rate was<br />

computed at 5.0 percent in CY 2004 and the average for the 9-month period in<br />

CY 2005 is high at 7.9 percent.<br />

The rising rate of inflation is due to the acceleration in the prices of fuel,<br />

light and water (11.8 percent) (Table 1). Though the year-on-year inflation for all<br />

items did not significantly change, the increase in prices of fuel could be the<br />

major trigger for the continuing rise in the monthly average inflation rate as<br />

depicted in Figure1.<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

Figure 1<br />

Monthly Inflation Rate, Region <strong>VI</strong><br />

January 2004 to September 2005<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

2004 2.7 2.5 2.8 2.8 3.5 5.1 6.1 6.5 6.5 7.4 7.4 7.4<br />

2005 7.6 8.1 8.2 9.0 9.4 7.8 7.0 6.9 7.4<br />

Source: National Statistics Office, Region 6<br />

Table 1<br />

Inflation Rate by Commodity Group, Region <strong>VI</strong><br />

Third Quarter 2004, Second and Third Quarters 2005<br />

(2000 Based)<br />

Commodity Group 3 rd Quarter 2<br />

2004<br />

nd Quarter 3<br />

2005<br />

rd Quarter<br />

2005<br />

All Items 6.3 8.7 7.1<br />

I. Food, Beverage & Tobacco 4.8 9.0 8.7<br />

A. Food 4.8 9.0 8.7<br />

B. Beverage 4.8 8.8 8.1<br />

C. Tobacco 2.4 7.9 8.1<br />

II. Non-Food 8.0 8.4 5.5<br />

A. Clothing 2.0 2.4 2.8<br />

B. Housing & Repair 7.6 6.8 2.8<br />

C. Fuel, Light & Water 10.6 10.3 11.8<br />

D. Services 11.3 12.5 6.5<br />

E. Miscellaneous 1.5 2.6 2.9<br />

Source: National Statistics Office, Region 6<br />

1

12.0<br />

10.0<br />

Inflation rates among the provinces have all gone down compared to the<br />

previous quarter, but had gone up compared to same period last year. This 3 rd<br />

quarter, Negros Occidental registered the lowest inflation rate (5.4%) while<br />

Antique and Guimaras registered the highest at 9.1% and 9.0%, respectively.<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

Figure 2<br />

Inflation Rate, By Province, Region <strong>VI</strong><br />

Third Quarter 2004, Second and Third Quarters 2005<br />

Region 6 Aklan Antique Capiz Guimaras Iloilo Neg. Occ.<br />

3Q '04 6.4 9.2 4.4 3.5 6.4 6.8 5.1<br />

2Q '05 8.7 7.5 10.8 6.8 9.1 10.4 6.6<br />

3Q '05 7.1 8.2 9.1 6.5 9.0 8.1 5.4<br />

Source: National Statistics Office, Region 6<br />

2. Employment<br />

As of July 2005, the labor force or population aged 15-64 years old in<br />

Region <strong>VI</strong> is around 2,963,000. There was a big increase in employment rate in<br />

2 nd quarter based year-on-year. For the 3 rd quarter there was a slight decrease of<br />

0.6 percentage points. In CY 2005, a slight decrease of 1.4 percentage points<br />

was observed from 2 nd to 3 rd quarter (Table 2).<br />

Unemployment rates decreased largely in 2 nd quarter but slightly<br />

increased in the 3 rd quarter based on year-on-year comparison. In CY 2005, a<br />

1.4 percentage point increase was observed from 2 nd to 3 rd quarter.<br />

The visible underemployment rates increased year-on-year (1.7<br />

percentage points in 2005). Due to increasing costs of basic commodities, more<br />

people tend to actively seek for another job on top of their existing ones causing<br />

the visible underemployment rates to increase.<br />

2004<br />

April<br />

July<br />

2005<br />

April<br />

July<br />

Difference<br />

Year-on-Year<br />

(July/3 rd Quarter)<br />

Quarter-on-Quarter<br />

(April-July 2005)<br />

Table 2<br />

Rates of Employment, Unemployment and<br />

Visible Underemployment, Region <strong>VI</strong><br />

April/July 2004 and 2005<br />

Employment<br />

Rate<br />

87.3<br />

93.6<br />

94.4<br />

93.0<br />

-0.6<br />

-1.4<br />

Source: National Statistics Office – Labor Force Survey<br />

Unemployment<br />

Rate<br />

12.7<br />

6.4<br />

5.6<br />

7.0<br />

0.6<br />

1.4<br />

`<br />

Visible<br />

Underemployment<br />

Rate<br />

15.9<br />

14.3<br />

16.6<br />

16.0<br />

1.7<br />

-0.6<br />

2

The Department of Labor and Employment, Region <strong>VI</strong> reported that<br />

during the 3rd Quarter of 2005 a total of 80 establishments had either closed<br />

shop or trimmed down the workforce. As a result, some 792 workers lost their<br />

jobs. This number, though is slightly lower (3.4%) than in the same quarter last<br />

year. Out of the 80 establishments that shut down, 27 were in the wholesale and<br />

retail trade sector. Financial problems caused the closure and/or retrenchment of<br />

the majority (58) of these establishments.<br />

Table 3<br />

Number of Shutdowns and Retrenchments<br />

and Number of Employees Affected, Region <strong>VI</strong><br />

Third Quarter 2004 and 2005<br />

3rd Quarter<br />

2004<br />

3rd Quarter<br />

2005<br />

Percent<br />

Change<br />

RETRENCHMENT<br />

No. of Establishments 38 61 60.5<br />

No. of Employees Affected<br />

SHUTDOWN<br />

485 494 1.9<br />

No. of Establishments 9 19 111.1<br />

No. of Employees Affected<br />

TOTAL<br />

335 298 -11.0<br />

No. of Establishments 47 80 70.2<br />

No. of Employees Affected 820 792 -3.4<br />

Source: Department of Labor and Employment, Region 6<br />

3. Agriculture Production<br />

A. Major Crops<br />

A year-on-year comparison is relevant for agriculture production because<br />

seasonality affects the quarter-on-quarter analysis. A three-year analysis is shown<br />

in Table 4.<br />

Palay production in 3 rd quarter 2005 is lower compared to the previous two<br />

years, i.e., 24% lower than Q3-04 and 10% less than Q3-03. July-September is<br />

the normal harvest season for first cropping of palay in the region. The negative<br />

production performance can be attributed to lack of water (less rain) especially<br />

during the flowering stage resulting to a low yield. Lack of water also resulted to<br />

stunted growth and proliferation of tungro and heat-induced plant diseases.<br />

Corn production, on the other hand, increased significantly, i.e., 25% higher<br />

than Q3-04 and 44% greater than Q3-03. Lack of water for palay production<br />

probably pushed farmers to plant corn resulting to higher corn production for this<br />

year.<br />

Sugarcane production showed a decreasing trend of around 18%<br />

compared to the past two years. Crop diversification and conversion of sugar lands<br />

to other crops, especially in Negros Occidental mainly caused this declining<br />

sugarcane output in the region.<br />

Banana production is on the uptrend. Despite the lack of water this year,<br />

there was a modest 2% increase over 2004 level and a respectable 6% increase<br />

over 2003 level. Banana production (especially the high valued lakatan variety) has<br />

replaced sugarcane in some parts of central Iloilo as plantations also continued to<br />

expand in the provinces of Capiz, Negros Occidental and Aklan.<br />

3

Table 4<br />

Selected Production Indicators, Region <strong>VI</strong><br />

Third Quarter 2003, 2004 and 2005<br />

3rd 3rd 3rd Percent Percent<br />

INDICATOR Quarter Quarter Quarter Change Change<br />

2003 2004 2005 Over '03 Over '04<br />

A. Crops (MT)<br />

Palay 687,299 806,341 617,232 -10.2 -23.5<br />

Corn 67,896 78,276 97,831 44.1 25.0<br />

Sugarcane 390,692 390,848 321,412 -17.7 -17.8<br />

Banana 39,234 40,533 41,467 5.7 2.3<br />

Mango 3,810 3,252 3,754 -1.5 15.4<br />

Coconuts ('000 nuts) 125,972 124,009 124,358 -1.3 0.3<br />

B. Animal Slaughtering<br />

(MT-Liveweight)<br />

Carabao 4,500 4,532 4,087 -9.2 -9.8<br />

Cattle 6,538 6,092 5,711 -12.6 -6.3<br />

Swine 33,710 35,820 41,513 23.1 15.9<br />

Goat 1,532 1,514 1,281 -16.4 -15.4<br />

Chicken 14,261 15,155 16,446 15.3 8.5<br />

Duck 1,362 1,021 902 -33.8 -11.7<br />

C. Fisheries (MT)<br />

Commercial 34,639 30,457 29,794 -14.0 -2.2<br />

Municipal 28,611 29,755 31,317 9.5 5.2<br />

Aquaculture 39,299 39,102 38,383 -2.3 -1.8<br />

Source: Bureau of Agricultural Statistics, Region 6<br />

Mango production in the region ranges between 3-4 million MT. For this<br />

period, output increased by 15% compared last year, but lower by 1% compared to<br />

2003 level. Mango production may be expected to increase over time as<br />

plantations expand as a result of crop diversification from sugarcane.<br />

Coconut production, on the other hand, widely ranges between 124-126<br />

million nuts for whole region. This period’s output increased insignificantly (0.3%)<br />

compared last year and decreased, also insignificantly (1%), compared to 2003<br />

level. Coconut output may not be expected to dramatically increase over time<br />

considering the continuous increasing demand for the cheap coconut lumber vis-àvis<br />

efforts of the government to expand planting of high yielding varieties all over<br />

the region.<br />

B. Animal Slaughtering<br />

Livestock and poultry production based on number slaughtered for<br />

consumption during this period, generally decreased compared to the previous<br />

two years, except for swine and chicken.<br />

Carabao and cattle slaughtering declined even as demand is increasing<br />

due to population. Factors like declining pastures and low incomes may be the<br />

main causes of this trend. Likewise, goat production also showed a steady<br />

decline. On the other hand, swine production steadily increased as, probably, it<br />

represents the cheaper alternative for meat and fish consumption. Moreover,<br />

backyard swine production has become a steady source of income for<br />

households as it is not affected by shrinking and drying pastures.<br />

Chicken slaughtering showed an increasing trend over the last two years.<br />

A bumper corn production in the region could have significantly contributed to the<br />

increase of chicken production. In contrast, duck production showed a<br />

dramatically decreasing trend. This could be largely due to drying up of irrigation<br />

canals and paddy fields – the main support system of duck-raising.<br />

4

C. Fishery<br />

Commercial fishing, allowed beyond the 15-km-from-shore municipal<br />

fishing boundary, showed a declining trend over the three-year period. Declining<br />

fish catch could be the result of unsustainable practices such as the use of fine<br />

mesh nets and coral destroying gears.<br />

On the other hand, municipal fishing has an increasing trend. The<br />

resurgence of shellfish production, especially angel wings or diwal in Capiz over<br />

the last two years, could have contributed to this increased output.<br />

Aquaculture output in the region, which is mainly production from inland or<br />

river-based ponds, ranged between 38,000-40,000 MT. The slight production<br />

decline over three years could be contributed by pollution and constriction of<br />

river flows due to siltation.<br />

4. Investments<br />

Total private investments through the Business Name Registration (BNR)<br />

for 3rd quarter 2005 increased by 13.4% compared to the same quarter last<br />

year. A total of 414 firms registered during the quarter compared to 494 firms<br />

registered on the previous quarter. Capiz posted the highest increase of 292%<br />

followed by Negros Occidental with 31% and by Aklan with 26%. Guimaras had<br />

the biggest decrease in investments of 42.5%. The registration of a memorial<br />

park, commercial establishment and a rice mill contributed to the high investment<br />

level in Capiz for this quarter.<br />

Table 5<br />

Private Investment, Region <strong>VI</strong><br />

Third Quarter 2004, Second and Third Quarters 2005<br />

3rd 2nd 3rd Percent Percent<br />

INDICATOR Quarter Quarter Quarter Change Change<br />

2004 2005 2005 Over Q2 '05 Over Q3 '04<br />

Business Name Registration 1,846.1 1,791.3 2,093.0 16.8 13.4<br />

(In Million Pesos)<br />

Aklan 80.0 137.0 100.8 -26.4 26.0<br />

Antique 46.9 40.5 38.2 -5.7 -18.6<br />

Capiz 66.1 85.5 258.9 203.0 291.4<br />

Guimaras 39.5 25.3 22.7 -10.4 -42.5<br />

Iloilo 892.8 378.7 727.8 92.2 -18.5<br />

Negros Occidental 720.8 1,124.3 944.6 -16.0 31.0<br />

Source: Department of Trade and Industry, Region 6<br />

5. Tourist Arrival and Receipts<br />

Seasonal differences also affect tourism. Compared to 2004 levels, tourist<br />

arrivals and receipts in 2005 increased by around 13% and 29%, respectively.<br />

However, this is lower than the previous quarter of same year. While foreign<br />

tourists increased from 2 nd to 3 rd quarter probably due to vacation timing (July-<br />

August is school break in the USA), domestic tourists largely declined because<br />

3 rd quarter is already a rainy season. Domestic tourists comprise the bulk of<br />

tourism in the region, about 84% and 72% of arrivals in the 2 nd and 3 rd quarters<br />

of 2005, respectively.<br />

5

Table 6<br />

Tourist Arrivals and Receipts, Region <strong>VI</strong><br />

Third Quarter 2004, Second and Third Quarters 2005<br />

3rd 2nd 3rd Percent Percent<br />

INDICATOR Quarter Quarter Quarter Change Change<br />

2004 2005 2005 Over Q2 '05 Over Q3 '04<br />

Total Tourist Arrivals 173,695 297,752 197,085 -33.8 13.5<br />

Domestic 101,003 249,281 141,519 -43.2 40.1<br />

Foreign 66,871 39,591 48,624 22.8 -27.3<br />

OFW 5,821 8,880 6,942 -21.8 19.3<br />

Receipts (Billion Pesos) 2.4 5.5 3.1 -42.5 29.3<br />

Source: Department of Tourism, Region 6<br />

II. DEVELOPMENT OUTLOOK<br />

1. Development Issues<br />

The discussion of potential and/or unique industries that may influence<br />

regional economic development has been revived in this issue of the QRES. This<br />

was made possible partly through the assistance of the GTZ for dovetailing of<br />

monitoring and evaluation efforts toward the regional development plan<br />

implementation and partly through the <strong>NEDA</strong> initiatives at the regional and<br />

national levels to improve the quarterly assessment of economic performance.<br />

Seven (7) commodities/industries are featured this quarter. From personal<br />

interviews with key informants and secondary data, a brief background is<br />

presented followed by the identification of development issues relative to the<br />

industry and the regional economy.<br />

A. Abalone<br />

The researchers of Southeast Asian Fisheries Development Center<br />

(SEAFDEC) based in Tigbauan, Iloilo have successfully spawned abalone (Haliotis<br />

Asinina) in captivity in 1994. This species is called by Australian scientists as the<br />

“fastest growing abalone in the world” and was proved here in the Philippines, in<br />

contrast to other countries like Australia, Japan, Mexico and New Zealand where<br />

similar species had been cultured.<br />

Local market demand for abalone has tremendously increased since<br />

1994. Most buyers are from Negros Occidental and high-end Chinese<br />

restaurants in Manila where abalone sells at P2,000 to P2,500 per plate.<br />

Like other fish stocks, however, abalone suffers from heavy fishing<br />

pressure and SEAFDEC needs to refine its existing breeding and hatchery<br />

techniques to produce sufficient seeds for re-stocking and to help restore the<br />

natural abalone population in the region. SEAFDEC has very limited resources to<br />

directly disseminate the technology to small fisherfolk. Hence, it banks on the<br />

cooperation of BFAR and interested private groups and local government units<br />

for partnering. Currently, several municipalities in the region have started<br />

abalone production with the help of some business groups or non-government<br />

organizations.<br />

6

B. Angel Wings Shellfish (Diwal)<br />

This delectable and high value shellfish, locally called Diwal due to its<br />

tongue-like projection and scientifically known as Pholas orientalis, has a long<br />

and dramatic history in the region, especially in Roxas City - the Seafood Capital<br />

of <strong>Western</strong> Visayas, where it abounds.<br />

The 1970s are considered the years of abundance of angel wings<br />

specifically growing in the inter-tidal zone (Barra) near the mouth of Palina and<br />

Panay rivers. Production was year-round at average selling price of 5 centavos<br />

per piece. In 1980-1986, harvesting became seasonal, May-August only, at<br />

average selling price of 25 centavos per piece. In 1987, angel wings started to<br />

disappear at a time when prawn became a sunrise industry. After a 5-year<br />

hiatus, a 1-ha angel wings population was found in an area (Punta Cogon) very<br />

far from its original growing site. Seasonal harvesting of limited quantity ensued<br />

until 1998. A study for policy and management purposes was conducted by UP<br />

Visayas with the support of the provincial government, PCAMRD and BFAR in<br />

1996. Transplantation was done to complete the one year intensive research. In<br />

1999, the city and provincial governments imposed the ban for collection of angel<br />

wings and Kapis – another valuable shellfish in Roxas City. In 2003, angel wings<br />

re-appeared in Barra. Production and collection of angel wings under the city’s<br />

Coastal Resource Management (CRM) Program highlighted the lifting of the ban<br />

in 2004. In July 2005, Roxas City successfully conducted the first Diwal Harvest<br />

Seafood Festival. In 2004, around 15 MT was harvested. In 2005, it reached<br />

almost 64 MT and sold at an average of P150/kg. According to Ms. Belinda<br />

Garrido, the CRMP Coordinator, God replenished Roxas City waters with<br />

abundant growth of diwal, so they are duty and faith bound to protect it.<br />

The following causes were cited for the disappearance of angel wings: 1)<br />

pollution from chemical discharges of prawn ponds; 2) trawling in traditional<br />

growing areas; 3) over-harvesting of undersized angel wings; 4) strong waves<br />

and current covered growing areas with sand leading to death of species; 5)<br />

diseases and predators; 6) use of cyanide and dynamite in municipal fishing; 7)<br />

siltation due to upland erosion and proliferation of structures in riverine areas.<br />

The re-appearance of angel wings are attributed to these factors: 1) use<br />

of chemicals abated when most fishpond owners went back to traditional bangus<br />

culture when the prawn industry got to losing end; and 2) LGU efforts to<br />

rehabilitate the resource through transplantation, moratorium on shellfish<br />

gathering in 1999-2003, and establishment of shellfish reservation zone with the<br />

passing of a new CRM ordinance and guidelines on angel wings management.<br />

In order to sustain the increase in annual harvest of angel wings, the city<br />

government resolves to: 1) encourage divers to become responsible stewards<br />

through continuous advocacy and education campaign; 2) strengthen and widen<br />

the multi-sectoral participation in the CRM program; 3) address siltation problem<br />

in Barra area through a comprehensive approach involving the upland<br />

communities; 4) ensure that enough volume of breeders are left in growing areas<br />

after harvest season; and 5) strict implementation of applicable fishery and<br />

environmental laws and rules.<br />

C. Furniture<br />

Production of furniture in the region this year was estimated to be about<br />

25% less than last year. The number of buyers also decreased by about 35%<br />

based on bookings and negotiated sales during local furniture shows. This is the<br />

general status of the regional furniture industry according to Ms. Marianne<br />

Tajanlangit, Executive Director of the Iloilo Furniture Manufacturing Association.<br />

7

The rising cost of oil prices caused raw materials to increase making the<br />

country, in general, less competitive with other furniture manufacturing countries<br />

like China and Vietnam. Political instability and the worldwide economic slump<br />

were also cited as factors affecting the industry.<br />

Iloilo could be as competitive as Cebu in terms of product development<br />

and design. It has an advantage over the latter in the availability of local<br />

materials for furniture development such as bamboo and rattan. Joining<br />

internationally organized furniture shows (especially the rich European Union<br />

market) would boost the sales of Iloilo furniture producers. Along this line,<br />

government assistance is vital not just for the furniture industry, but also for<br />

handicrafts export industry.<br />

D. Gamefowl<br />

The gamefowl industry contributes around P8-10 billion annually to the<br />

national economy. If feeds and veterinary products supporting the gamefowl<br />

industry are included, the national economic contribution could reach up to P30-<br />

40 billion per year. This is the significance of gamefowls to the economy<br />

according to Mr. Ricardo Palmares, President of the National Federation of<br />

Gamefowl Breeders Associations and the Panay-Guimaras Gamefowl Breeders<br />

Association.<br />

Production of gamefowls from commercial farms (>100 fowls) in Region<br />

<strong>VI</strong> has decreased by half (50%) over the last 2 years. This was mainly due to<br />

the proliferation of small and backyard breeders now comprising around 90% of<br />

regional and national breeders. Likewise, cockers who are normally buyers of<br />

ready-to-fight fowls started to breed their own fowls. Industry-wide, though<br />

gamefowl production is increasing every year. As a result there are more<br />

cockfights but lesser sales of gamefowls.<br />

A commercial farm economically supports 3-4 families on the average.<br />

The Federation has now 1,500 individual members representing 12 associations<br />

all over the country.<br />

The ban of gamefowl breeding in the USA, save for just two states, opens<br />

an export potential for local breeders to markets like Malaysia, Indonesia, Macau<br />

and Mexico. In order to promote this, the government should lift restrictions on<br />

gamefowl exports. On the other hand, the local feeds and veterinary businesses<br />

like Thunderbird have already started exporting their products.<br />

Gamefowls breeding and cockfighting to remain as a decent and viable<br />

industry should be promoted, as being done by the Federation, as a sport and<br />

tourist-attracting industry and not as a mere gambling industry. The Federation<br />

strives to encourage breeders, big or small, to formally join the associations<br />

where teachings of good values and attitudes formation are promoted.<br />

E. Handmade Paper<br />

There is a pioneering handmade paper industry in the region - Creative<br />

Paper, owned by Mr. Davy John Barlin based in San Miguel, Iloilo. The business<br />

started operating in 1993 with 40 personnel. Raw materials used are abaca and<br />

salago, a weed mostly found in Aklan province.<br />

Production peaked to almost 20,000 sheets in 2004, but it produced only<br />

half in 2005. Demand for handmade paper declined with the emergence of<br />

fancy paper. In order to stay competitive in the industry, a foreign-made<br />

8

machine costing around P150 million is needed by Creative Paper to produce<br />

fancy paper which is currently growing in demand.<br />

The export potential of handmade or fancy paper is great considering the<br />

quality and uniqueness of the product made from locally available materials<br />

providing a backward linkage to abaca farming and production of other local<br />

fibers.<br />

F. Muscovado<br />

G. Silk<br />

In 1970s Antique is one of the leading producers of muscovado sugar in the<br />

Philippines. The muscovado producers formed the Antique Muscovado Sugar<br />

Producers Association which was later reorganized into the Antique Livelihood<br />

Development, Inc. with assistance from DTI. A grant from DTI-SMED Project<br />

made possible the implementation of a two-year Antique Muscovado Sugar<br />

Industry Assistance Program.<br />

In 2001, the Antique Muscovado Sugar Producers Marketing Cooperative<br />

was organized with the installation of a marketing system, again with the help of<br />

DTI. The cooperative was strengthened in 2004 with the help of the Provincial<br />

Cooperative Development Office. There are eight (8) municipalities that are into<br />

muscovado sugar production. The Municipality of Laua-an is the leading producer<br />

with the most number of milling facilities that are all village type sugar mills and<br />

small processing facilities directly employing the local people.<br />

Muscovado production is increasing with 35 MT in 2003, 40 MT in 2004<br />

and more expected in 2005. However, it is still insufficient to meet the growing<br />

domestic and foreign market demands. El Maestro is a company in Antique now<br />

packaging high quality muscovado for export to California, USA. Only 3 out of<br />

112 mills are producing export grade muscovado for this venture. Alter Trade of<br />

Bacolod City buys most of the sugars produced by other millers. There is also a<br />

growing demand for organically produced muscovado.<br />

The provincial government of Antique provides financial and marketing<br />

assistance to the industry, making it the banner project/commodity of Antique.<br />

Agencies like the DTI, DOST and SRA continue to assist the industry. However,<br />

upgrading of old mills, technology dissemination and insufficient financial<br />

assistance to planters and millers remain as priority areas of support for the<br />

muscovado industry in Antique.<br />

<strong>Western</strong> Visayas is the largest silk producing region in the country today<br />

contributing 80-85% of annual supply according to Mrs. Thelma Watanabe,<br />

Manager of the Organization for Industrial, Spiritual and Cultural Advancement<br />

(OISCA), a Japanese-assisted NGO based in Bago City, Negros Occidental.<br />

OISCA supplied almost all the silk used in the Philippine Pavilion that won in the<br />

2005 World Expo in Aichi, Japan.<br />

In 2004, OISCA produced 1.7 MT compared to almost 4 MT in 2003. Two<br />

big local cocoon producers laid low when OISCA technicians assisting them<br />

transferred to other groups. Coupled with unfavorable weather, it led to low<br />

production in 2004. A 5 MT production is expected next year. Silk thread and<br />

yarn demands are strong within Region <strong>VI</strong> itself. About 90% of OISCA silk goes<br />

to Aklan and 3% to Iloilo for weaving into textiles in combination with husi, piña,<br />

hablon and other materials. Only 7% is sold to Jeanne Goulbourne in Manila.<br />

The demand for silk dramatically increased after OISCA participated in the<br />

WOW Philippines exposition held in Intramuros, Manila in 2003.<br />

9

The industry has strong support from the city of Bago and the province of<br />

Negros Occidental. The Governor of Negros Occidental gave OISCA a P3 million<br />

soft loan for silkworm farmers. An earlier loan of P7 million from JICA enabled<br />

OISCA to expand assistance from 50 to 120 farmers. With the continuous<br />

support of the LGU and the right attitude of the farmers, the industry could really<br />

improve the lives of silkworm farmers.<br />

Sericulture should be promoted as a priority industry in the region. A JICA<br />

study found that OISCA silk could compete with Japanese silk in Japan market.<br />

Importing silk worm eggs from Japan would facilitate expansion of local silk<br />

production possibilities.<br />

2. Recommendations<br />

The following policy recommendations were derived during key<br />

informants’ interviews about the national economy and as a follow through of<br />

issues on the development of potential/unique commodities/industries in the<br />

region for this quarter.<br />

Generally, it is recommended that government financial and technical<br />

support should be focused more into ventures that promote high value<br />

agriculture and agriculture-based products for domestic and foreign markets.<br />

Political problems should not serve as hindrance to the development of national<br />

or local economies. Hence, it should not be the main focus of governance.<br />

Region <strong>VI</strong> has distinct advantages with the commodities/industries<br />

featured in this report. Silk could be produced anywhere in the country, but<br />

OISCA had established the local silkworm breeding technology in Bago City<br />

producing quality silk that could even be exported to Japan. The expansion of<br />

this venture into adjacent areas in Negros Occidental should be given priority<br />

over other areas. In support of the sericulture industry, the DA and DTI may look<br />

into liberalization of silkworm breeders trading especially between the Philippines<br />

and Japan.<br />

Muscovado maybe produced in any sugarmill across the country today,<br />

but the sugar base in Antique has unique qualities that pull traders toward the<br />

province. The Sugar Regulatory Agency is currently stationed in Bacolod City<br />

which is far away from Laua-an where most muscovado mills are located.<br />

Besides financial and marketing support, Antique needs technicians to improve<br />

its sugar output from the cane to muscovado with a quality that is specially<br />

acceptable in the international markets.<br />

Local weaving materials are abundant in the region and their potentials<br />

should be fully harnessed in fashion, handicrafts and furniture industries. A set of<br />

clear and attractive investment incentives package by local governments for the<br />

private sector could readily give impetus for these ventures. Government support<br />

should be continued and intensified in the fields of technology, marketing and<br />

enterprise development. Trade liberalization should facilitate lowering of input<br />

costs in these industries while at the same time strengthening the country’s<br />

position in the world market for the products.<br />

The region, particularly Roxas City has a clear comparative advantage on<br />

angel wings production. With SEAFDEC’s presence in the region, we have a<br />

competitive advantage in abalone production. These two products could make<br />

the economy shine even with just local efforts, especially if government and<br />

business sectors put their heads and resources together on this matter.<br />

10

The gamefowl industry should be allowed to emerge and promoted as a<br />

tourist attraction venture. It has a very strong and wide backward linkage to<br />

agriculture and industrial sectors. Production of feed components should be<br />

import-substituting; veterinary products developed locally could be exported; and<br />

amenities offer a wide range of possibilities like fruit production complementing<br />

gamefowl breeding farms enhancing forestry areas for eco- or farm-tourism. This<br />

industry should be looked more closely by government agencies like the DOT,<br />

DOST, DENR, DA and DLR, among others.<br />

The LGUs with the support of business and private groups should take the<br />

opportunity with these commodities/industries to prove to the national<br />

government that they could initiate and manage viable enterprises toward<br />

greater decentralization.<br />

11