2002/03 Annual report - Agri-Food & Veterinary Authority of Singapore

2002/03 Annual report - Agri-Food & Veterinary Authority of Singapore

2002/03 Annual report - Agri-Food & Veterinary Authority of Singapore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

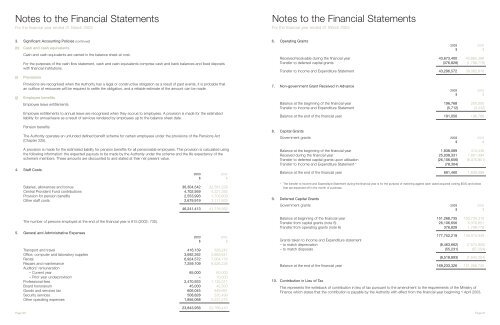

Notes to the Financial Statements<br />

For the financial year ended 31 March 20<strong>03</strong><br />

3. Significant Accounting Policies (continued)<br />

(h) Cash and cash equivalents<br />

Cash and cash equivalents are carried in the balance sheet at cost.<br />

Page 90<br />

For the purposes <strong>of</strong> the cash flow statement, cash and cash equivalents comprise cash and bank balances and fixed deposits<br />

with financial institutions.<br />

(i) Provisions<br />

Provisions are recognised when the <strong>Authority</strong> has a legal or constructive obligation as a result <strong>of</strong> past events, it is probable that<br />

an outflow <strong>of</strong> resources will be required to settle the obligation, and a reliable estimate <strong>of</strong> the amount can be made.<br />

(j) Employee benefits<br />

Employee leave entitlements<br />

Employee entitlements to annual leave are recognised when they accrue to employees. A provision is made for the estimated<br />

liability for annual leave as a result <strong>of</strong> services rendered by employees up to the balance sheet date.<br />

Pension benefits<br />

The <strong>Authority</strong> operates an unfunded defined benefit scheme for certain employees under the provisions <strong>of</strong> the Pensions Act<br />

(Chapter 225).<br />

A provision is made for the estimated liability for pension benefits for all pensionable employees. This provision is calculated using<br />

the following information: the expected payouts to be made by the <strong>Authority</strong> under the scheme and the life expectancy <strong>of</strong> the<br />

scheme’s members. These amounts are discounted to and stated at their net present value.<br />

4. Staff Costs<br />

20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Salaries, allowances and bonus 36,304,542 32,581,228<br />

Central Provident Fund contributions 4,702,959 4,321,392<br />

Provision for pension benefits 2,553,993 1,7<strong>03</strong>,809<br />

Other staff costs 2,679,919 3,111,833<br />

The number <strong>of</strong> persons employed at the end <strong>of</strong> the financial year is 815 (<strong>2002</strong>: 730).<br />

5. General and Administrative Expenses<br />

46,241,413 41,718,262<br />

20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Transport and travel 416,139 328,242<br />

Office, computer and laboratory supplies 3,692,262 3,883,641<br />

Rental 6,924,572 7,064,176<br />

Repairs and maintenance 7,259,109 6,526,235<br />

Auditors’ remuneration<br />

– Current year 65,000 60,000<br />

– Prior year underprovision – 10,000<br />

Pr<strong>of</strong>essional fees 2,470,933 1,135,011<br />

Board honorarium 45,000 42,500<br />

Goods and services tax 606,045 949,891<br />

Security services 508,828 535,499<br />

Other operating expenses 1,856,068 2,231,215<br />

23,843,956 22,766,410<br />

Notes to the Financial Statements<br />

For the financial year ended 31 March 20<strong>03</strong><br />

6. Operating Grants<br />

20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Received/receivable during the financial year 43,673,400 40,862,388<br />

Transfer to deferred capital grants (376,828) (1,799,778)<br />

Transfer to Income and Expenditure Statement 43,296,572 39,062,610<br />

7. Non-government Grant Received in Advance<br />

20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Balance at the beginning <strong>of</strong> the financial year 196,768 200,000<br />

Transfer to Income and Expenditure Statement (5,712) (3,232)<br />

Balance at the end <strong>of</strong> the financial year 191,056 196,768<br />

8. Capital Grants<br />

Government grants 20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Balance at the beginning <strong>of</strong> the financial year 1,838,089 413,446<br />

Received during the financial year 25,<strong>03</strong>8,331 7,801,494<br />

Transfer to deferred capital grants upon utilisation (26,106,656) (6,376,851)<br />

Transfer to Income and Expenditure Statement * (78,304) –<br />

Balance at the end <strong>of</strong> the financial year 691,460 1,838,089<br />

* The transfer to Income and Expenditure Statement during the financial year is for the purpose <strong>of</strong> matching against each asset acquired costing $500 and below<br />

that are expensed <strong>of</strong>f in the month <strong>of</strong> purchase.<br />

9. Deferred Capital Grants<br />

Government grants 20<strong>03</strong> <strong>2002</strong><br />

$ $<br />

Balance at beginning <strong>of</strong> the financial year 151,268,735 150,734,310<br />

Transfer from capital grants (note 8) 26,106,656 6,376,851<br />

Transfer from operating grants (note 6) 376,828 1,799,778<br />

177,752,219 158,910,939<br />

Grants taken to Income and Expenditure statement<br />

– to match depreciation (8,463,662) (7,574,950)<br />

– to match disposals (55,231) (67,254)<br />

(8,518,893) (7,642,204)<br />

Balance at the end <strong>of</strong> the financial year 169,233,326 151,268,735<br />

10. Contribution in Lieu <strong>of</strong> Tax<br />

This represents the writeback <strong>of</strong> contribution in lieu <strong>of</strong> tax pursuant to the amendment to the requirements <strong>of</strong> the Ministry <strong>of</strong><br />

Finance which states that the contribution is payable by the <strong>Authority</strong> with effect from the financial year beginning 1 April 20<strong>03</strong>.<br />

Page 91