American - Press - American Paint Horse Association

American - Press - American Paint Horse Association

American - Press - American Paint Horse Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

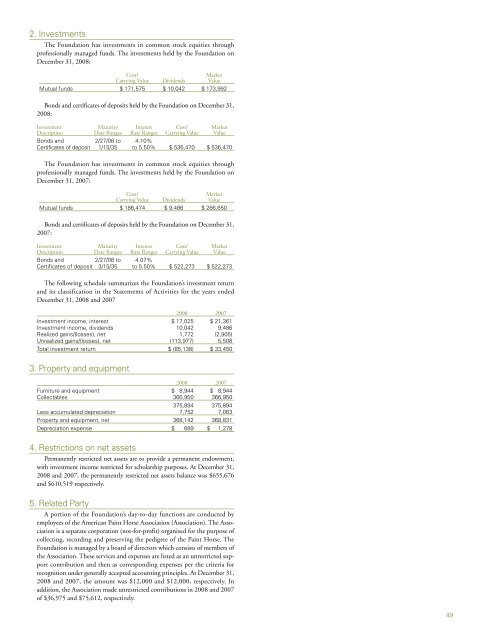

2. Investments<br />

The Foundation has investments in common stock equities through<br />

professionally managed funds. The investments held by the Foundation on<br />

December 31, 2008:<br />

Cost/ Market<br />

Carrying Value Dividends Value<br />

Mutual funds $ 171,575 $ 10,042 $ 173,992<br />

Bonds and certificates of deposits held by the Foundation on December 31,<br />

2008:<br />

Investment Maturity Interest Cost/ Market<br />

Description Date Ranges Rate Ranges Carrying Value Value<br />

Bonds and 2/27/08 to 4.10%<br />

Certificates of deposit 1/15/35 to 5.50% $ 536,470 $ 536,470<br />

The Foundation has investments in common stock equities through<br />

professionally managed funds. The investments held by the Foundation on<br />

December 31, 2007:<br />

Cost/ Market<br />

Carrying Value Dividends Value<br />

Mutual funds $ 186,474 $ 9,486 $ 286,650<br />

Bonds and certificates of deposits held by the Foundation on December 31,<br />

2007:<br />

Investment Maturity Interest Cost/ Market<br />

Description Date Ranges Rate Ranges Carrying Value Value<br />

Bonds and 2/27/08 to 4.07%<br />

Certificates of deposit 3/15/35 to 5.50% $ 522,273 $ 522,273<br />

The following schedule summarizes the Foundation’s investment return<br />

and its classification in the Statements of Activities for the years ended<br />

December 31, 2008 and 2007<br />

2008 2007<br />

Investment income, interest $ 17,025 $ 21,361<br />

Investment income, dividends 10,042 9,486<br />

Realized gains/(losses), net 1,772 (2,905)<br />

Unrealized gains/(losses), net (113,977) 5,508<br />

Total investment return $ (85,138) $ 33,450<br />

3. Property and equipment<br />

2008 2007<br />

Furniture and equipment $ 8,944 $ 8,944<br />

Collectables 366,950 366,950<br />

375,894 375,894<br />

Less accumulated depreciation 7,752 7,063<br />

Property and equipment, net 368,142 368,831<br />

Depreciation expense $ 689 $ 1,278<br />

4. Restrictions on net assets<br />

Permanently restricted net assets are to provide a permanent endowment,<br />

with investment income restricted for scholarship purposes. At December 31,<br />

2008 and 2007, the permanently restricted net assets balance was $655,676<br />

and $610,519 respectively.<br />

5. Related Party<br />

A portion of the Foundation’s day-to-day functions are conducted by<br />

employees of the <strong>American</strong> <strong>Paint</strong> <strong>Horse</strong> <strong>Association</strong> (<strong>Association</strong>). The <strong>Association</strong><br />

is a separate corporation (not-for-profit) organized for the purpose of<br />

collecting, recording and preserving the pedigree of the <strong>Paint</strong> <strong>Horse</strong>. The<br />

Foundation is managed by a board of directors which consists of members of<br />

the <strong>Association</strong>. These services and expenses are listed as an unrestricted support<br />

contribution and then as corresponding expenses per the criteria for<br />

recognition under generally accepted accounting principles. At December 31,<br />

2008 and 2007, the amount was $12,000 and $12,000, respectively. In<br />

addition, the <strong>Association</strong> made unrestricted contributions in 2008 and 2007<br />

of $36,975 and $75,612, respectively.<br />

49