Clariden Leu (Gue) ILS Plus Fund CHF B

Clariden Leu (Gue) ILS Plus Fund CHF B

Clariden Leu (Gue) ILS Plus Fund CHF B

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Clariden</strong> <strong>Leu</strong> (<strong>Gue</strong>) <strong>ILS</strong> <strong>Plus</strong> <strong>Fund</strong> <strong>CHF</strong> B<br />

Investment Objective<br />

The fund invests in a broadly diversified portfolio of insurance-linked bonds<br />

referred to as cat bonds, and financial insurance agreements. These structures<br />

are issued by insurance and reinsurance companies to hedge against damage<br />

events. The risk assumed by the investor is therefore tied to clearly defined disasters<br />

(e.g. earthquakes, hurricanes). Counterparty or credit risks are to a large extent<br />

eliminated in the structure. The fund aims to achieve a stable return that is higher<br />

than the risk-free interest rate, with a low correlation to fluctuations in financial<br />

markets, and a low fixed interest rate exposure due to the variable interest rate<br />

component. This share class provides a hedge against currency risk versus the<br />

reference currency (USD).<br />

Key Information<br />

NAV (30.04.12) <strong>CHF</strong> 128.27<br />

<strong>Fund</strong> Size (in m) <strong>CHF</strong> 609.5 (all share classes)<br />

Valor 2232183<br />

ISIN GG00B2918810<br />

WKN A0YBME<br />

Bloomberg PRM<strong>ILS</strong>A GU<br />

Launch Date 27.05.2005<br />

Benchmark Citigroup <strong>CHF</strong> 3 Months Eurodeposit<br />

Investment Manager <strong>Clariden</strong> <strong>Leu</strong>, Zurich<br />

<strong>Fund</strong> Type <strong>Gue</strong>rnsey OEIC<br />

ESD Tax Status no EU taxation<br />

Dealing monthly, 20th calendar day until 16:00 CET<br />

Close of Financial Year March 31<br />

Distribution none, accumulation<br />

Management Fee 2.0% p.a.<br />

Event Risk<br />

Event in % of NAV*<br />

Hurricane Northeast USA 40.5<br />

Hurricane Southeast USA 40.7<br />

Earthquake California 36.9<br />

Earthquake Northwest USA 28.9<br />

Earthquake Midwest USA 30.0<br />

Windstorm Europe 24.1<br />

Earthquake Europe 14.7<br />

Typhoon Japan 14.5<br />

Earthquake Japan 14.6<br />

Cyclone Australia 9.8<br />

Earthquake Australia 10.5<br />

Aviation / Space 3.8<br />

Life 6.1<br />

Other (events not allocated to any other event category) 21.3<br />

* Some financial instruments may cover more than one peril, therefore the sum of the risk<br />

categories may exceed 100%<br />

Portfolio Breakdown in %<br />

Instrument <strong>Fund</strong><br />

Insurance-linked Securities (<strong>ILS</strong>, Cat Bonds) 67.7<br />

Financial Insurance Contracts (FIC, Derivatives) 32.2<br />

Insurance-linked <strong>Fund</strong>s 0.1<br />

Total 100.0<br />

Additional portfolio information is available upon request.<br />

The fund is open to qualified investors only<br />

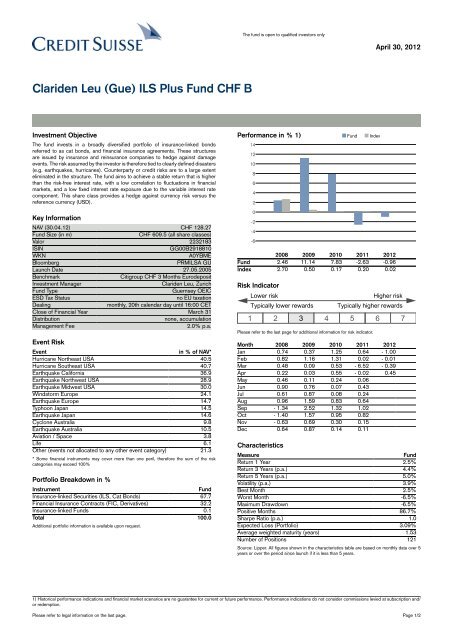

Performance in % 1) <strong>Fund</strong> Index<br />

April 30, 2012<br />

1) Historical performance indications and financial market scenarios are no guarantee for current or future performance. Performance indications do not consider commissions levied at subscription and/<br />

or redemption.<br />

Please refer to legal information on the last page. Page 1/2<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

2008 2009 2010 2011 2012<br />

<strong>Fund</strong> 2.46 11.14 7.83 -2.63 -0.96<br />

Index 2.70 0.50 0.17 0.20 0.02<br />

Risk Indicator<br />

Lower risk<br />

Typically lower rewards<br />

Higher risk<br />

Typically higher rewards<br />

1 2 3 4 5 6 7<br />

Please refer to the last page for additional information for risk indicator.<br />

Month 2008 2009 2010 2011 2012<br />

Jan 0.74 0.37 1.25 0.64 - 1.00<br />

Feb 0.82 1.16 1.31 0.02 - 0.01<br />

Mar 0.48 0.09 0.53 - 6.52 - 0.39<br />

Apr 0.22 0.03 0.55 - 0.02 0.45<br />

May 0.46 0.11 0.24 0.06<br />

Jun 0.90 0.76 0.07 0.43<br />

Jul 0.61 0.87 0.08 0.24<br />

Aug 0.96 1.59 0.83 0.64<br />

Sep - 1.34 2.52 1.32 1.02<br />

Oct - 1.40 1.57 0.95 0.82<br />

Nov - 0.63 0.69 0.30 0.15<br />

Dec 0.64 0.87 0.14 0.11<br />

Characteristics<br />

Measure <strong>Fund</strong><br />

Return 1 Year 2.5%<br />

Return 3 Years (p.a.) 4.4%<br />

Return 5 Years (p.a.) 5.0%<br />

Volatility (p.a.) 3.9%<br />

Best Month 2.5%<br />

Worst Month -6.5%<br />

Maximum Drawdown -6.5%<br />

Positive Months 86.7%<br />

Sharpe Ratio (p.a.) 1.0<br />

Expected Loss (Portfolio) 3.09%<br />

Average weighted maturity (years) 1.53<br />

Number of Positions 121<br />

Source: Lipper. All figures shown in the characteristics table are based on monthly data over 5<br />

years or over the period since launch if it is less than 5 years.

Risk Indicator: The calculation of the risk indicator is based on the CESR/10-673 Directive. The risk indicator is based on historic and partly simulated data; it cannot be used to predict future developments.<br />

The classification of the fund may change in future and does not represent a guarantee. A classification into category 1 is no risk-free investment either.<br />

Credit Suisse AG - Tel +41 844 844 001, www.credit-suisse.com<br />

This document was produced by Credit Suisse AG and/or its affiliates (hereafter "CS") with the greatest of care and to the best of its knowledge and belief. However, CS provides no guarantee with regard<br />

to its content and completeness and does not accept any liability for losses which might arise from making use of this information. The opinions expressed in this document are those of CS at the time of<br />

writing and are subject to change at any time without notice. If nothing is indicated to the contrary, all figures are unaudited. This document is provided for information purposes only and is for the exclusive<br />

use of the recipient. It does not constitute an offer or a recommendation to buy or sell financial instruments or banking services and does not release the recipient from exercising his/her own judgment.<br />

The recipient is in particular recommended to check that the information provided is in line with his/her own circumstances with regard to any legal, regulatory, tax or other consequences, if necessary with<br />

the help of a professional advisor. This document may not be reproduced either in part or in full without the written permission of CS. It is expressly not intended for persons who, due to their nationality<br />

or place of residence, are not permitted access to such information under local law. Neither this document nor any copy thereof may be sent, taken into or distributed in the United States or to any U. S.<br />

person (within the meaning of Regulation S under the US Securities Act of 1933, as amended). Every investment involves risk, especially with regard to fluctuations in value and return. Investments in<br />

foreign currencies involve the additional risk that the foreign currency might lose value against the investor's reference currency. Historical performance indications and financial market scenarios are no<br />

guarantee for current or future performance. Performance indications do not consider commissions levied at subscription and/or redemption. Furthermore, no guarantee can be given that the performance<br />

of the benchmark will be reached or outperformed. Emerging Markets are located in countries that possess one or more of the following characteristics: A certain degree of political instability, relatively<br />

unpredictable financial markets and economic growth patterns, a financial market that is still at the development stage or a weak economy. Emerging markets investments usually result in higher risks such<br />

as political risks, economical risks, credit risks, exchange rate risks, market liquidity risks, legal risks, settlement risks, market risks, shareholder risk and creditor risk. Alternative investments (e.g. Hedge<br />

<strong>Fund</strong>s or Private Equity) are complex instruments and may carry a very high degree of risk. Such risks can arise from extensive use of short sales, derivatives and debt capital. Furthermore, the minimum<br />

investment periods can be long. Hedge <strong>Fund</strong>s are intended only for investors who understand and accept the associated risks. Commodity investments are subject to greater fluctuations in value than<br />

normal investments and may lead to additional investment risks. In connection with this investment product, the Issuer and/or its affiliates may pay to third parties, or receive from third parties as part of their<br />

compensation or otherwise, one-time or recurring remunerations (e.g. placement or holding fees). You may request further information from your bank/relationship manager. Potential conflicts of interest<br />

can not be excluded. This document qualifies as marketing material that has been published for advertising purposes. It must not be read as independent research. The investment is considered foreign<br />

investment scheme pursuant to Art. 119 of the Swiss Federal Collective Investment Schemes Act (CISA). No application has been submitted to the Federal Financial Market Supervisory Authority (FINMA)<br />

to obtain approval within the meaning of Art. 120 CISA to publicly advertise, offer or distribute the investments in or from Switzerland, and no other steps have been taken in this direction. As a result,<br />

the investment is not registered with FINMA. Consequently, investors do not benefit from the specific investor protection and/or FINMA supervision pursuant to the CISA and its implementing ordinances.<br />

Any offer or sale must therefore be in strict compliance with Swiss law, and in particular with the provisions of the Collective Investment Schemes Act and its implementing ordinances, and FINMA circular<br />

2008/8 on public solicitation. Pursuant to the Collective Investment Schemes Act and its implementing ordinances, the units may not be offered, marketed or distributed to the public in or from Switzerland,<br />

but only to qualified investors. The Total Expense Ratio (TER) is the sum of all commissions and costs charged on an ongoing basis to the average fund assets (operating expenses). The value (ex ante)<br />

is expressed as a percentage of the fund's assets and projects the average of the next twelve months under the same preconditions.<br />

Switzerland: This product can only be offered to qualified investors according to art. 10 para. 3 CISA. This material is personal to each offeree and may only be used by those persons to whom it has<br />

been handed out.<br />

Hong Kong : The information in relation to any interest and/or investment referred to in this document has not been approved by the Securities and Futures Commission of Hong Kong. Accordingly (a)<br />

any interests or securities may not be offered or sold and have not been offered or sold in Hong Kong, by means of any document, other than to (i) "professional investors" as defined in the Securities<br />

and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (ii) in other circumstances which do not result in the document being a "prospectus" as defined in the<br />

Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and (b) no person has issued or had in its possession for the purposes<br />

of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to any interest or securities, which<br />

is directed at, or the contents of which are or are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under securities laws of Hong Kong) other than with respect to<br />

any interests or securities which are or are intended to be disposed of only to persons outside Hong Kong or only to "professional investors" within the definition of the Securities and Futures Ordinance<br />

(Cap. 571) of Hong Kong and any rules made under that Ordinance.<br />

Singapore : This document is not a prospectus as defined in the Securities and Futures Act, Chapter 289 of Singapore ("SFA") and has not been registered as a prospectus with the Monetary Authority of<br />

Singapore. Accordingly, statutory liability under the SFA in relation to the content of prospectuses would not apply, and this document should not be construed in any way as a solicitation or an offer to buy<br />

or sell any interest or investment referred to in this document. You should consider carefully whether the investment is suitable for you. The product named in this document is not authorised or recognized<br />

by the Monetary Authority of Singapore (the "MAS") and none of its interests / shares / units shall be allowed to be offered to retail public in Singapore.<br />

Netherlands: The information contained in this document is of a commercial nature. The units of the fund(s) described herein may not be offered, sold, transferred or delivered in the Netherlands, as<br />

part of their initial distribution or at any time thereafter, directly or indirectly, other than to qualified investors within the meaning of the Dutch Financial Supervision Act ("Wet op het financieel toezicht"),<br />

as amended from time to time.<br />

Japan: This fund may only be distributed subject to the small number private placement exemption (Article 2, Paragraph 3, Item 2(c) of the FIEL) to Japanese investors.<br />

Copyright © 2012 Credit Suisse Group AG and/or its affiliates. All rights reserved.<br />

Page 2/2