2004 Financial Report - Tampa International Airport

2004 Financial Report - Tampa International Airport

2004 Financial Report - Tampa International Airport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 0 0 4<br />

Excellence<br />

by<br />

Design<br />

Annual <strong>Report</strong>

Alfred S. Austin<br />

Chairman<br />

Louis E. Miller<br />

Executive Director<br />

n organization has to pursue<br />

excellence, in order to achieve it.<br />

We are proud that <strong>Tampa</strong> <strong>International</strong><br />

<strong>Airport</strong> has a global reputation for designing<br />

and implementing exceptional goals and<br />

plans. We know that achieving excellence<br />

takes high objectives, such as providing<br />

world-class transportation and world-class<br />

facilities; it takes sincere efforts to ensure<br />

convenience and efficiency; intelligent<br />

direction to provide a safe and secure<br />

environment; expert execution to implement<br />

a cost competitive structure; and a<br />

vision to see obstacles as opportunities.<br />

These long-term strategic initiatives were<br />

created for guiding the future of <strong>Tampa</strong><br />

2<br />

A<br />

Leadership<br />

<strong>International</strong> <strong>Airport</strong> and its three reliever airports: Peter O. Knight,<br />

Vandenberg and Plant City. These high objectives are the vision of the outstanding<br />

men and women of the Hillsborough County Aviation Authority.<br />

It has been an exceptional year for <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong>’s ongoing<br />

$790-million capital improvement program. Construction continues on the<br />

<strong>Airport</strong>’s largest airside terminal building – C. At an overall cost of $134.8<br />

million, the 315,000-square-foot, 16-gate facility is on budget and on time,<br />

scheduled for completion in April 2005.<br />

Also this year, a highly significant construction project was completed. On<br />

June 24, <strong>2004</strong>, the <strong>Airport</strong>’s new $124-million baggage handling system<br />

was completed and <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> became one of the few<br />

large hub airports in the United States to implement a new multi-user,<br />

in-line baggage handling system that is fully integrated with<br />

21 federally required Explosive Detection Systems (EDS)<br />

machines, making it 100 percent operational for screening<br />

all checked baggage at the <strong>Airport</strong>.<br />

The <strong>Tampa</strong> Bay Area is one of the nation’s most dynamic<br />

and prosperous regions and travelers love to visit. During<br />

Fiscal Year <strong>2004</strong>, over 16.9 million passengers used <strong>Tampa</strong><br />

<strong>International</strong> <strong>Airport</strong>, representing a 10.63 percent increase<br />

from the previous year. <strong>Tampa</strong> experienced 10 months of<br />

record-breaking passenger traffic during the year, always<br />

performing higher than the national average.<br />

This year, operating revenues increased by 8.7 percent to<br />

$137.4 million while operating expenses increased by 5.8<br />

percent to $65.7 million. The increase in operating<br />

expenses, while well within budgeted amounts, was a<br />

result of additional security measures required by the<br />

Transportation Security Administration, and necessary<br />

expenditures to maintain high service levels. During the year,<br />

the Aviation Authority invested $152.5 million in facility<br />

improvements, land and equipment. In support of its ongoing<br />

capital development program, the Authority received<br />

$33.6 million in Passenger Facility Charges (PFC) and $25.2<br />

million in Federal and State Grants and generated $30.9 million<br />

from operations in FY <strong>2004</strong>.<br />

The final cost for airlines serving <strong>Tampa</strong> was $4.21 per<br />

enplaned passenger and it continues to be well below the<br />

industry average for large hub airports, which represents<br />

the Aviation Authority’s commitment to cost containment<br />

efforts in controlling expenditures.<br />

For the fourth year, <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> had the<br />

privilege of receiving high votes from passengers, placing it<br />

among the world’s best for overall passenger satisfaction.<br />

The J. D. Power and Associates 2003 Global <strong>Airport</strong><br />

Passenger Satisfaction Study selected <strong>Tampa</strong> <strong>International</strong><br />

<strong>Airport</strong> as the fourth highest in overall passenger satisfaction<br />

in the mid-sized category. Just behind Singapore’s Changi<br />

<strong>International</strong> and Hong Kong’s Chek Lap Kok, <strong>Tampa</strong><br />

<strong>International</strong> <strong>Airport</strong> placed second highest in the U.S. —<br />

one point behind Pittsburgh <strong>International</strong> <strong>Airport</strong>.<br />

The talented <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> employees form this<br />

essence of excellence. They are the ones committed to the<br />

daily dedication of providing comfort, safety, convenience and<br />

well-being to the <strong>Airport</strong>’s customers and ultimately, responsible<br />

for the above-average passenger satisfaction ratings.<br />

Alfred S. Austin<br />

Chairman<br />

Louis E. Miller<br />

Executive Director<br />

3

4<br />

Stephen J. Mitchell<br />

Vice Chairman<br />

Partnership<br />

Hillsborough County<br />

Commissioner<br />

Thomas Scott<br />

Treasurer<br />

Alfred S. Austin<br />

Chairman<br />

Board Members Staff Roster<br />

Ken Anthony<br />

Secretary<br />

<strong>Tampa</strong> Mayor<br />

Pam Iorio<br />

Assistant Secretary/<br />

Assistant Treasurer<br />

Louis E. Miller<br />

Executive Director<br />

John Wheat<br />

Deputy Executive Director<br />

Linda Greif<br />

Administrative Assistant<br />

to the Executive Director<br />

Don Whitworth<br />

Director of Performance<br />

Management and Internal Audit<br />

George A. Elbe<br />

Director of<br />

Air Service Development<br />

and <strong>International</strong> Commerce<br />

Edward B. Cooley, III<br />

Senior Director of Operations<br />

and Public Safety<br />

Gigi Skipper<br />

General Counsel<br />

Director of Legal Affairs<br />

Don C. Welch<br />

Director of Human Resources<br />

Brenda S. Geoghagan<br />

Director of Public Information<br />

and Community Relations<br />

Louis P. Russo, Jr.<br />

Senior Director of Planning<br />

and Development<br />

Ann Davis<br />

Director of Finance<br />

Diane Pryor-Vercelli<br />

Senior Director of Properties<br />

and Contracts Administration<br />

Al Illustrato, Jr.<br />

Senior Director of Maintenance<br />

Ted W. Leslie<br />

Director of Properties and<br />

Contracts Administration<br />

Sharon Weaver<br />

Director of Administration<br />

and Information Technology<br />

Robert J. Burr<br />

Director of Operations<br />

Joseph H. Hills<br />

Director of Parking and<br />

Ground Transportation<br />

James W. Jones, Jr.<br />

Director of Engineering<br />

Rudolph R. Mueller, III<br />

Director of Architecture<br />

John Allen<br />

Director of Construction<br />

Nadine S. Jones<br />

Director of Planning and<br />

Noise Compatibility Programs<br />

Edward R. Haines<br />

Director of Development<br />

Program Services<br />

Paul F. Sireci<br />

Chief of Police<br />

Gary Houts<br />

Director of Maintenance<br />

5

Year In Review<br />

2003<br />

October<br />

• Gordon Bethune, chairman of the board<br />

and CEO of Continental Airlines, is named<br />

the recipient of the <strong>2004</strong> Tony Jannus<br />

Award, which recognizes an individual who<br />

has made significant contributions to commercial<br />

aviation.<br />

November<br />

• Air Canada initiates service to Montreal<br />

Dorval with two weekly departures.<br />

• <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> reinforces its<br />

“good neighbor” policy as construction is<br />

completed on a $5.9-million engine run<br />

up enclosure.<br />

December<br />

• Laker Airways returns to <strong>Tampa</strong> with two<br />

weekly departures to Freeport, Bahamas.<br />

• <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> joins the aviation<br />

community around the world in commemorating<br />

the centennial celebration of the<br />

Wright Brothers historic flight at Kitty Hawk,<br />

North Carolina on December 17, 1903.<br />

<strong>2004</strong><br />

January<br />

• JetBlue Airways increases service from <strong>Tampa</strong>,<br />

by offering two daily departures to Boston, MA.<br />

• Bahamas Air initiates service to Freeport,<br />

Bahamas with two daily departures.<br />

6<br />

Accomplishments<br />

• Sun Country offers seasonal service between Minneapolis and <strong>Tampa</strong> with one<br />

daily departure.<br />

• In response to a renewed surge in passenger traffic, the Aviation Authority revives<br />

plans to construct an economy parking garage. The garage will add 3,966 spaces<br />

by Thanksgiving 2005 and an additional 1,705 in 2006.<br />

February<br />

• AirTran expands service from <strong>Tampa</strong> with daily nonstop service to Akron/Canton.<br />

• Midwest Airlines expands its seasonal service between <strong>Tampa</strong> and Milwaukee<br />

with an additional daily departure.<br />

• Northwest Airlines adds service to two Michigan cities – one daily departure each<br />

to Flint and Grand Rapids.<br />

• In the 2003 Global <strong>Airport</strong> Satisfaction Study, J.D. Power and Associates awards<br />

<strong>Tampa</strong> high honors, recognizing it as #2 in the U.S. and #4 in the world for<br />

overall passenger satisfaction.<br />

March<br />

• United Airlines introduces Ted, its low cost carrier, to the <strong>Tampa</strong> Bay area and<br />

launches service between <strong>Tampa</strong> and Denver with three daily departures.<br />

• Continental Airlines offers new service to connect <strong>Tampa</strong> with two other Florida<br />

cities: two daily departures to Fort Myers and one to Sarasota/Bradenton.<br />

May<br />

• <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> is named 7th in the nation in rental car revenue.<br />

• Southwest Airlines extends “Brotherly Love” to <strong>Tampa</strong> with daily nonstop service<br />

to Philadelphia, PA.<br />

• With another record-breaking month of passenger traffic, Louis Miller announces<br />

<strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> is “all the way back” from September 11th. The airport<br />

will continue to exceed pre-9/11 passenger traffic numbers for the remainder<br />

of the year.<br />

June<br />

• <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> reaches another milestone in passenger convenience<br />

with the completion of the 100 percent in-line explosive detection system. The<br />

$124-million baggage handling system makes TPA the second large airport in the<br />

nation to go completely in-line, the first with multi-user capabilities.<br />

• The aviation community mourns the passing of George J. Bean, Executive<br />

Director of <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> from 1965 to 1996. Mr. Bean is credited with<br />

a lifetime of service to aviation organizations worldwide and the revolutionary<br />

design of <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong>.<br />

July<br />

• <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> fills another niche in customer service with the opening<br />

of an observation deck at Airside D. The deck allows smokers to step outside<br />

and indulge before boarding an aircraft, without having to go back and forth<br />

through security. Additional patios open later in the year at Airsides A, E and F.<br />

August<br />

• To increase customer convenience at Baggage Claim, large-scale dynamic flight<br />

information signage is added to the Arrival Drive. Drivers meeting arriving passengers<br />

can check flight status without leaving their vehicles.<br />

• Hurricane Charley bears down on West<br />

Central Florida, soon to be followed by<br />

Frances, Jeanne and Ivan, impacting flight<br />

operations statewide for 44 days. Thanks to<br />

preparation and an unprecedented cooperative<br />

effort by the <strong>Airport</strong> and tenants, the<br />

storm season concludes without substantial<br />

damage (approximately $2.2 million) to<br />

<strong>Tampa</strong> <strong>International</strong> and its three general<br />

aviation airports.<br />

• Providing airport passengers and visitors<br />

with a higher level of convenience and<br />

information, the new <strong>Tampa</strong> <strong>International</strong><br />

<strong>Airport</strong> website is launched.<br />

• <strong>Tampa</strong> <strong>International</strong> joins a few select airports<br />

on the cutting edge of security with the<br />

installation of a GE Ion Tracker trace detection<br />

portal. The explosive detection system<br />

is part of a TSA test program.<br />

September<br />

• Delta Air Lines announces a shift in hub<br />

operations. The result is the first nonstop<br />

flights from <strong>Tampa</strong> to Salt Lake City,<br />

Greensboro, NC and Dayton, OH.<br />

Additional service to Raleigh-Durham and<br />

Pensacola is planned.<br />

• Southwest Airlines adds new nonstop service<br />

between <strong>Tampa</strong> and Buffalo, NY.<br />

• Official opening of <strong>Tampa</strong> <strong>International</strong> Jet<br />

Center, the <strong>Airport</strong>’s second Fixed Base<br />

Operator.<br />

7

T<br />

he Aviation Authority is moving forward<br />

with its ongoing $790-million<br />

capital improvement program. Recognizing<br />

the environmental impact airport growth<br />

has on a community and the need to design<br />

reasonable mitigation measures that address<br />

noise, wetlands, stormwater management<br />

and other environmental issues are always<br />

primary concerns of the Aviation Authority.<br />

The Planning and Development Department<br />

reported 23 completed projects for FY<br />

<strong>2004</strong>. Of these projects, 96 percent were<br />

reported on time and on budget.<br />

Taxiway W, High Speed Exit<br />

Runway 36 Left/18 Right is the <strong>Airport</strong>’s<br />

most western north/south runway and<br />

the closest to <strong>Tampa</strong> Bay, handling nearly<br />

75 percent of all jet operations. The $9million<br />

construction of a high-speed taxiway<br />

and taxiway improvements near the<br />

south end of Runway 36 Left offers a significant<br />

benefit to <strong>Airport</strong> neighbors. It<br />

enables landing aircraft to exit the runway<br />

more quickly, thereby allowing more aircraft<br />

to land on 36 Left. As a result, fewer<br />

aircraft will need, or want, to land on<br />

Runway 36 Right (parallel runway to 36<br />

Left), keeping aircraft over the water and<br />

reducing noise impacts in the future.<br />

Progress<br />

The Aviation Authority working in cooperation with the contractors reduced<br />

the scheduled runway closure from 64 days to 43 days.<br />

Baggage Handling System<br />

On June 24, <strong>2004</strong>, <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> became one of the few<br />

large hub airports in the United States to implement a new multi-user in-line<br />

baggage handling system that is fully integrated with 21 federally required<br />

explosive detection systems (EDS), making it 100 percent operational for<br />

screening all checked baggage at the <strong>Airport</strong>.<br />

The $124-million baggage system has the capability to expand to 25 EDS. The<br />

processing rate is six (6) bags per minute for each EDS. The system has eight<br />

miles of conveyor belts and 3,000 electric motors and gear boxes. The total<br />

electrical cost is approximately $1 million annually, generating enough power to<br />

operate 500 average-sized homes. The system operates 20 hours per day<br />

and processes 35,000 bags in a peak day at the current passenger level.<br />

Completing this project has increased efficiency and passenger satisfaction<br />

of the <strong>Airport</strong>’s baggage systems.<br />

New Flight Information Signage<br />

Large-scale, large-letter electronic flight displays were installed on each of<br />

the four elevator core exterior walls at the Red (north) and Blue (south)<br />

Arrival Drives, displaying flight information visible to pedestrians, motorists<br />

and traffic personnel.<br />

Exterior Dynamic Signage<br />

The <strong>Airport</strong> has installed 10 new Dynamic Signs (computer variable messages) in<br />

order to communicate with <strong>Airport</strong> visitors by roadway messaging. Eight were<br />

installed on the George J. Bean Parkway, providing real-time traffic and directional<br />

information for travelers approaching the main terminal building and<br />

garage facilities. The total cost for the Dynamic Signage project is $2.1 million.<br />

Residential Sound Insulation Program<br />

A $3.2-million project to sound insulate 33 residential houses impacted by aircraft<br />

noise was completed this year. It included replacing doors and windows with<br />

acoustically rated insulation products, adding insulation in attics, gypsum<br />

board on walls and ceilings and replacing air-conditioning equipment.<br />

Service Building Expansion and Modifications<br />

Work has started on the $14.9-million design-build expansion and modification<br />

to the service building adjacent to the main terminal building. The facility is home<br />

to the Communication Center, Police Department, Planning and Development,<br />

Parking and Ground Transportation, General Aviation, Maintenance, Operations,<br />

airport identification badging office and an employee cafeteria. The expansion<br />

adds 31,500 square feet, reconfigures the second floor area and modifies the<br />

first floor facilities.<br />

The Police Department has already moved into its new space in the service building,<br />

featuring a modern dispatch center, crisis command center, administrative space<br />

and four holding cells. This project is scheduled for completion in July 2005.<br />

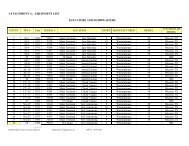

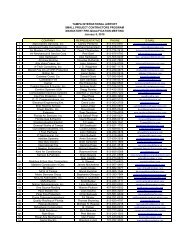

Disadvantaged Business Enterprise<br />

(DBE) Program<br />

The Properties and Contracts Department<br />

has been focusing on updating and<br />

improving the DBE program to assist<br />

with the <strong>Airport</strong>’s Capital Development<br />

Program.<br />

This year, 40 firms were eligible for<br />

recertification, 10 new firms were added<br />

to the directory and 299 affidavits were<br />

processed for continuing eligibility. A<br />

Reciprocal Certification Program with<br />

Florida Department of Transportation<br />

(FDOT) was established and six have<br />

been certified.<br />

Additionally, outreach activities included<br />

participation with the <strong>Tampa</strong> Urban<br />

League Conference, <strong>Airport</strong> Minority<br />

Advisory Council (AMAC) 20th Annual<br />

Conference, MED Week Planning<br />

Committee, George Edgecomb Awards<br />

Banquet, Regional Task Force Vendor’s<br />

Meeting, Airside C DBE Informational<br />

Meeting and Florida Minority Supplier<br />

Development Council (FMSDC) Outreach.<br />

A consultant has been selected to assist<br />

the Authority in conducting a Disparity<br />

Study in 2005.<br />

8 9

Momentum<br />

n July 1988, the Master Plan Update<br />

identified areas adjacent to <strong>Tampa</strong><br />

<strong>International</strong> <strong>Airport</strong> that will, according<br />

to projections, be needed by the Aviation<br />

Authority for airport expansion in the<br />

future. Therefore, it was necessary for the<br />

Authority to establish a land acquisition<br />

program, implemented as federal funds<br />

became available.<br />

To date, parcel acquisitions and the total<br />

acreage acquired are 83 percent complete<br />

(240 parcels out of 288 and 171<br />

acres out of 205). Five blocks representing<br />

over 20 parcels and owned entirely by<br />

the Authority have been consolidated<br />

and now are identified by two folio numbers.<br />

This assemblage is taking place to<br />

assist development planning as well as<br />

minimize potential costs in environmental<br />

remediation activities.<br />

Airside C<br />

Construction started January <strong>2004</strong> and<br />

continues on time and on budget for<br />

the new $134.8-million, 16-gate,<br />

315,000-square-foot Airside C. It is the<br />

second airside terminal to be design-built<br />

at <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong>. Beck and<br />

Alfonso Architects were selected as the<br />

contractor and designer.<br />

10<br />

I<br />

Southwest Airlines will operate 12 gates, with Spirit Airlines and Independence<br />

Air using the remaining four gates. HMSHost is creating 13,000 square feet of<br />

food and beverage concessions, offering Starbucks Coffee, Chili’s, a <strong>Tampa</strong> Bay<br />

Sports Bar and 6,000 square feet of retail space. Plus, after traveling through one<br />

of the eight security screening lanes, families can enjoy a children’s play area.<br />

Additionally, four artists have been commissioned to provide public art for five<br />

locations in the terminal. Harrison Covington of <strong>Tampa</strong> created an eight-foot<br />

bronze sculpture titled “Barnstormer”. Christopher Still of Tarpon Springs is<br />

developing an aviation-themed 19-foot-by-13-foot horizontal mural filled with<br />

historical details regarding the history of the <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong>. He is<br />

also fabricating an 80-foot-long aluminum sculpture titled “Q”, which is the<br />

expression of the dynamic pressure associated with force needed to lift an<br />

object/airplane. Imitating aircraft aluminum, it has cutouts depicting travelers<br />

from different time periods. Stephen Robin of Philadelphia is producing “Orange<br />

Blossom”, a 13 foot by 9 foot by 5 foot aluminum and cement sculpture in<br />

the round with branches and opening blossoms. Kristin Jones and Andrew<br />

Ginzel of New York are designing flooring art titled “Specula”, consisting of<br />

a series of mosaic medallions laid into the white terrazzo floor of the AGT<br />

shuttle departure lobby.<br />

Economy Parking Garage<br />

The design work is complete for a new $71-million, six-level Economy<br />

Parking Garage which will accommodate approximately 5,500 vehicles. The<br />

parking garage will be constructed in two phases, from east to west. The<br />

first two-thirds of the parking garage (Phase I) is scheduled to be completed<br />

by November 2005. The scheduled completion date for the remaining<br />

one-third (Phase II) is November 2006. A shuttle bus lane will run down the<br />

center of the parking garage on the first floor. All parking patrons will take<br />

elevators down to one of two elevator lobbies/bus stations on the first floor<br />

to meet the shuttle bus for transportation to the main terminal building.<br />

The shuttle lobbies on the first floor will be air conditioned and the shuttle<br />

buses will operate every 10 minutes.<br />

Three areas in the parking garage have been selected for public art: two<br />

interior walls, two interior floors and one outside space. The interior areas<br />

are located in the two shuttle lobbies. The artwork in these locations will<br />

enhance the environment and travel experience as patrons wait for a shuttle.<br />

The exterior artwork will be visually appealing to motorists from a distance.<br />

The Aviation Authority has budgeted $750,000 for this public art project.<br />

Master Plan Update<br />

An update of the 1999 <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> Master Plan is underway<br />

in order to define facility enhancements and capacity improvement<br />

projects that will be required to satisfy demand growth and serve tenant<br />

needs during the next twenty years. As in the past, the Aviation Authority<br />

is taking a collaborative approach with<br />

the master planning process that includes<br />

airlines, airport tenants and stakeholders,<br />

the community and the public.<br />

<strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> is situated in<br />

the midst of the <strong>Tampa</strong> Bay region, Florida’s<br />

most populous Metropolitan Statistical Area,<br />

with a permanent population of 2.56<br />

million. Plus, with <strong>Tampa</strong> <strong>International</strong>’s<br />

primary service area including Hillsborough,<br />

Pinellas, Pasco, and Hernando counties<br />

and secondary area including Polk,<br />

Manatee, Sarasota, Hardee, De Soto,<br />

Citrus and Sumter counties, it serves 3.97<br />

million permanent residents.<br />

With the service area population increasing<br />

every day, the Master Plan Update addresses<br />

needs up to the year 2025 and beyond.<br />

The plan will be complete by January 2006.<br />

11

Passengers<br />

Millions enplaned and deplaned<br />

14.9<br />

Evaluation<br />

1999 2000 2001 2002 2003 <strong>2004</strong><br />

Operations<br />

Thousands of landings and takeoffs<br />

272.3<br />

15.9<br />

277.2<br />

16.3<br />

269.8<br />

15.2<br />

245.5<br />

Airline Passenger Traffic*<br />

Air Cargo<br />

Millions of pounds<br />

Mail<br />

Millions of pounds<br />

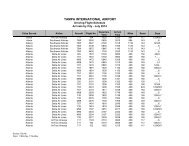

Fiscal Year Enplaned Average Annual Passenger Aircraft Departures Average Passengers<br />

Ending September Passengers % Change Annual Daily Enplaned Per Departure<br />

2001 . . . . . . . . . . 8,183,815 . . . . . . . . . 3.0% . . . . . . . . . . . . 109,516 . . . . . . . . . . 300 . . . . . . . . . . . . . . . 75<br />

2002 . . . . . . . . . . 7,618,598 . . . . . . . . –7.0% . . . . . . . . . . . . . 99,161 . . . . . . . . . . 272 . . . . . . . . . . . . . . . 77<br />

2003 . . . . . . . . . . 7,660,785 . . . . . . . . . 1.0% . . . . . . . . . . . . . 92,979 . . . . . . . . . . 255 . . . . . . . . . . . . . . . 82<br />

<strong>2004</strong> . . . . . . . . . . 8,465,720 . . . . . . . . 11.0% . . . . . . . . . . . . . 95,541 . . . . . . . . . . 262 . . . . . . . . . . . . . . . 89<br />

* Data includes major national, regional, charter and foreign-flag passenger carriers (both scheduled and non-scheduled)<br />

15.3<br />

231.9<br />

16.9<br />

238.1<br />

1999 2000 2001 2002 2003 <strong>2004</strong><br />

196.9<br />

48.7<br />

190.0<br />

46.3<br />

151.8<br />

36.5<br />

154.0<br />

178.8<br />

163.2<br />

1999 2000 2001 2002 2003 <strong>2004</strong><br />

33.7 34.6 34.7<br />

1999 2000 2001 2002 2003 <strong>2004</strong><br />

Top 25 Markets<br />

Twelve Months Ended June 30, <strong>2004</strong><br />

City Passengers Percent Air Miles<br />

1 New York . . . . . . . . . . 1,524,180 . . . . . . . . . . 16.92% . . . . . . . . 1,004<br />

2 Chicago . . . . . . . . . . . . . 630,370 . . . . . . . . . . . 7.00% . . . . . . . . 1,004<br />

3 Atlanta . . . . . . . . . . . . . . 552,330 . . . . . . . . . . . 6.13% . . . . . . . . . . 407<br />

4 Baltimore . . . . . . . . . . . . 483,860 . . . . . . . . . . . 5.37% . . . . . . . . . . 844<br />

5 Philadelphia . . . . . . . . . . 468,650 . . . . . . . . . . . 5.20% . . . . . . . . . . 921<br />

6 Boston . . . . . . . . . . . . . . 450,840 . . . . . . . . . . . 5.00% . . . . . . . . 1,186<br />

7 Detroit . . . . . . . . . . . . . . 431,400 . . . . . . . . . . . 4.79% . . . . . . . . . . 992<br />

8 Fort Lauderdale . . . . . . . 371,410 . . . . . . . . . . . 4.12% . . . . . . . . . . 197<br />

9 Washington D.C. . . . . . . 362,460 . . . . . . . . . . . 4.02% . . . . . . . . . . 814<br />

10 Hartford . . . . . . . . . . . . 303,620 . . . . . . . . . . . 3.37% . . . . . . . . 1,102<br />

11 Providence . . . . . . . . . . 295,740 . . . . . . . . . . . 3.28% . . . . . . . . 1,137<br />

12 Dallas/Fort Worth . . . . . 294,450 . . . . . . . . . . . 3.27% . . . . . . . . . . 927<br />

13 Los Angeles . . . . . . . . . . 267,660 . . . . . . . . . . . 2.97% . . . . . . . . 2,153<br />

14 Las Vegas . . . . . . . . . . . 266,530 . . . . . . . . . . . 2.96% . . . . . . . . 1,880<br />

15 Denver . . . . . . . . . . . . . 253,220 . . . . . . . . . . . 2.81% . . . . . . . . 1,504<br />

16 Minneapolis . . . . . . . . . . 237,170 . . . . . . . . . . . 2.63% . . . . . . . . 1,308<br />

17 Manchester . . . . . . . . . . 221,710 . . . . . . . . . . . 2.46% . . . . . . . . 1,205<br />

18 Pittsburgh . . . . . . . . . . . 209,120 . . . . . . . . . . . 2.32% . . . . . . . . . . 921<br />

19 Columbus . . . . . . . . . . . 206,230 . . . . . . . . . . . 2.29% . . . . . . . . . . 830<br />

20 Buffalo . . . . . . . . . . . . . . 205,810 . . . . . . . . . . . 2.28% . . . . . . . . 1,055<br />

21 St. Louis . . . . . . . . . . . . . 200,000 . . . . . . . . . . . 2.22% . . . . . . . . . . 870<br />

22 New Orleans . . . . . . . . . 198,690 . . . . . . . . . . . 2.21% . . . . . . . . . . 487<br />

23 Nashville . . . . . . . . . . . . 192,120 . . . . . . . . . . . 2.13% . . . . . . . . . . 613<br />

24 Raleigh/Durham . . . . . . 191,600 . . . . . . . . . . . 2.13% . . . . . . . . . . 588<br />

25 Houston . . . . . . . . . . . . 189,990 . . . . . . . . . . . 2.11% . . . . . . . . . . 780<br />

Market Share<br />

9,009,160 100.00%<br />

Source: United States Department of Transportation, Origin & Destination, T-100 Data<br />

Percentage based on enplaned passengers – September <strong>2004</strong><br />

20.9<br />

Southwest Airlines<br />

20.5<br />

Delta Air Lines<br />

11.0<br />

US<br />

Airways<br />

9.8<br />

American<br />

Airlines<br />

6.5 6.4 6.1 5.2<br />

4.5 9.1<br />

12 13<br />

Continental<br />

Airlines<br />

United<br />

Airlines<br />

Northwest<br />

Airlines<br />

AirTran<br />

Airways<br />

JetBlue<br />

Airways<br />

Other

<strong>Financial</strong>s Independent<br />

Auditors’ <strong>Report</strong><br />

The Board of Directors<br />

Hillsborough County Aviation Authority<br />

<strong>Tampa</strong>, Florida<br />

We have audited the accompanying statements of net assets of the Hillsborough County Aviation<br />

Authority (the “Authority”), as of September 30, <strong>2004</strong> and 2003, and the related statements of revenues,<br />

expenses, and changes in net assets, and of cash flows for the years then ended. These financial statements<br />

are the responsibility of the Authority’s management. Our responsibility is to express an opinion on these<br />

financial statements based on our audits.<br />

We conducted our audits in accordance with auditing standards generally accepted in the United States of<br />

America and the standards applicable to financial audits contained in Government Auditing Standards<br />

issued by the Comptroller General of the United States. Those standards require that we plan and perform<br />

the audit to obtain reasonable assurance about whether the financial statements are free of material<br />

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and<br />

disclosures in the financial statements. An audit also includes assessing the accounting principles used<br />

and significant estimates made by management, as well as evaluating the overall financial statement<br />

presentation. We believe that our audits provide a reasonable basis for our opinion.<br />

In our opinion, such financial statements present fairly, in all material respects, the financial position of<br />

the Authority at September 30, <strong>2004</strong> and 2003, and the changes in its financial position and its cash flows<br />

for the years then ended in conformity with accounting principles generally accepted in the United States<br />

of America.<br />

Management’s Discussion and Analysis is not a required part of the basic financial statements, but is<br />

supplementary information required by the Governmental Accounting Standards Board. This<br />

supplementary information is the responsibility of the Authority’s management. We have applied certain<br />

limited procedures, which consisted principally of inquiries of management regarding the methods of<br />

measurement and presentation of the supplementary information. However, we did not audit the<br />

information and we do not express an opinion on it.<br />

December 9, <strong>2004</strong><br />

15

Management’s Discussion And Analysis<br />

The following management’s discussion and analysis (MD&A) of the financial performance and activity of the Hillsborough County Aviation<br />

Authority (the Authority) is to provide an introduction and understanding of the financial statements of the Authority for the years ended<br />

September 30, <strong>2004</strong> and 2003 with selected comparisons to prior years. The information presented should be read in conjunction with<br />

the financial statements, notes and supplemental schedules found in this report.<br />

Introduction<br />

The Authority was created in 1945 and is an independent special district governed by the Hillsborough County Aviation Authority Act,<br />

Chapter 2003-370, Laws of Florida (the Act). The Act provides that the Authority will have exclusive jurisdiction, control, supervision and<br />

management over all publicly owned airports in Hillsborough County. There are five Authority Members, three residents of Hillsborough<br />

County appointed to the Authority by the Governor of the State of Florida for four year terms; the Mayor of the City of <strong>Tampa</strong>, ex-officio;<br />

and a Commissioner of and selected by the Board of County Commissioners of Hillsborough County, ex-officio.<br />

The Authority owns and operates <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> (the <strong>Airport</strong>) and three general aviation airports. The <strong>Airport</strong> occupies<br />

approximately 3,400 acres and is primarily an origination-destination (O&D) airport serving the greater <strong>Tampa</strong> Bay area. Peter O. Knight<br />

<strong>Airport</strong>, a 139-acre facility, is located six miles southeast of the <strong>Airport</strong>; Plant City <strong>Airport</strong>, a 199-acre facility, is located 22 miles east of the<br />

<strong>Airport</strong>; and Vandenberg <strong>Airport</strong>, a 407-acre facility, is located 12 miles east of the <strong>Airport</strong>.<br />

The Authority is a self-supporting organization and generates revenues from airport users to fund operating expenses and debt service<br />

requirements. Capital projects are funded through the use of bonds, short-term financing, passenger facility charges, federal and state<br />

grants and internally generated funds. Although empowered to levy ad-valorem property taxes, the Authority has not collected any tax<br />

funds since the early 1970s.<br />

<strong>Airport</strong> Activity Highlights<br />

For the fiscal year ended September 30, <strong>2004</strong>, passenger enplanements totaled 8,465,720, compared to 7,660,785 for FY2003 and<br />

7,618,598 for FY2002, increases of 10.5% and 11.1%, respectively. Nationally, airline passenger traffic for FY<strong>2004</strong> increased 4% over FY2003.<br />

The number of FY<strong>2004</strong> passengers for the <strong>Airport</strong> is a record, exceeding the previous record set in FY2001 by 281,905 passengers, an<br />

increase of 3.4%. Nationwide, passengers for FY<strong>2004</strong> compared to FY2001 declined by 7.7%, indicating the <strong>Airport</strong>’s recovery continues<br />

to exceed the industry average. Landed weight in FY<strong>2004</strong> totaled 11,181,590 thousand pounds, compared to 10,812,057 thousand<br />

pounds in FY2003 and 11,144,792 thousand pounds in FY2002, increases of 3.4% and .3%, respectively. The number of landings for<br />

domestic and international flights increased 2.8% in FY<strong>2004</strong> over the prior fiscal year. While airlines overall continue to struggle with<br />

higher operating costs and the recent economic downturn, these increases in activities at <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong> are a positive sign<br />

of the strength of this market area and the cost-competitive environment of the <strong>Airport</strong>.<br />

16<br />

Highlights of the Fiscal Year <strong>2004</strong> Budget<br />

As required by the Authority’s trust agreement, airline agreement and state statutes, the Authority is required to adopt an annual budget.<br />

On September 2, 2003 the Authority Board approved the Fiscal Year <strong>2004</strong> Operating and Capital Budget. The FY<strong>2004</strong> Budget continues<br />

the goal of returning to normal levels of customer service while maintaining the objectives of controlling expenses, maximizing non-airline<br />

revenues and limiting cost increases to those airlines serving <strong>Tampa</strong> <strong>International</strong> <strong>Airport</strong>. In the FY<strong>2004</strong> Operating Budget, revenues were<br />

projected at $138,981,200. The revenue estimates for the FY<strong>2004</strong> budget were based on projections of passenger activity returning to<br />

the levels of pre-9/11/2001. The FY<strong>2004</strong> Operating Budget expenses were projected at $66,107,000, and included funding for additional<br />

security measures and expenses associated with the operation of the new outbound baggage system for most of the year. Discussion of<br />

the FY<strong>2004</strong> Capital Budget is presented in the “Capital Improvement Program” section of this MD&A.<br />

Summaries of the operating budget and actual results for FY<strong>2004</strong> are shown below. This table is based on and presented in accordance with<br />

the airline-airport agreement (see “Airline Rates and Charges” section in this MD&A and Note 3 in the accompanying financial statements).<br />

Percent<br />

Fiscal Year <strong>2004</strong> Budget Actual of Budget<br />

___________________ ___________________ ___________________<br />

Revenues $138,981,200 $143,054,412 102.9%<br />

Expenses (66,107,000)<br />

___________________<br />

(64,502,950)<br />

___________________<br />

97.6%<br />

___________________<br />

Funds Available for Debt Service 72,874,200 78,551,462 107.8%<br />

Debt Service from Current Operations (40,756,698) (40,752,668) 100.0%<br />

Distribution of Airline Revenue Sharing (6,139,100)<br />

___________________<br />

(6,906,692)<br />

___________________<br />

112.5%<br />

___________________<br />

Net Increase for Capital<br />

Improvement Program and Reserves $ 25,978,402<br />

___________________<br />

$ 30,892,102<br />

___________________<br />

118.9%<br />

___________________<br />

Airline Rates and Charges<br />

Effective October 1, 1999, the Authority entered into a new airline-airport use and lease agreement (Airline-<strong>Airport</strong> Agreement) with the<br />

signatory airlines, which has a seven-year term and incorporates the lease and use of the terminal complex and the airfield at the <strong>Airport</strong>.<br />

The agreement establishes a “compensatory” rate making methodology where the signatory airlines pay fees and charges based on the<br />

Authority’s cost of providing facilities and services to the airlines.<br />

Rates and charges are calculated on an annual basis and reviewed and adjusted, if necessary, throughout each fiscal year to ensure that<br />

sufficient revenues are generated to satisfy all requirements of the Authority’s Trust Agreement. At the end of each fiscal year, the Authority<br />

will recalculate rates and charges based on audited financial data and a settlement will take place with the signatory airlines. Included in<br />

the Airline-<strong>Airport</strong> Agreement are rates and charges calculations with specific rebates of debt service coverage and sharing of net remaining<br />

revenues. This net revenue sharing component was established at 15% of net revenues, as defined, in fiscal years 2000 and 2001,<br />

16% for fiscal year 2002, 17% for fiscal year 2003, 18% for fiscal year <strong>2004</strong> and escalates 1% annually to 20% in fiscal year 2006. Nonsignatory<br />

rates and charges do not provide for a 25% debt service coverage reduction or the “net revenue sharing” component, thus the<br />

Authority charges two distinct rates to airlines operating at the airport based on the cost of providing services for facilities utilized.<br />

17

The table below summarizes passenger airline rents, landing fees, net revenue sharing and cost per enplaned (departing) passenger. Cost<br />

per enplaned passenger is a standard industry measurement, and the goal of the Authority is to maintain a competitive cost per enplanement<br />

at the <strong>Airport</strong>. The actual cost per enplanement for FY<strong>2004</strong> was $4.21, compared to the original budget of $4.70. This variance is<br />

attributable to actual expenses for the year coming in less than budget, reimbursements from the Transportation Security Administration,<br />

an increase in revenue sharing over the budget and actual enplanements for FY<strong>2004</strong> exceeding projections. For FY<strong>2004</strong> enplanements<br />

were estimated at 8,184,000 while actual enplanements of 8,465,720 exceeded the budget forecast and also resulted in a record year<br />

for the <strong>Airport</strong>.<br />

Passenger Airline Costs Percent<br />

Fiscal Year <strong>2004</strong> Budget Actual of Budget<br />

___________________ ___________________ ___________________<br />

Airline Landing Fees $10,387,500 $ 9,624,061 92.7%<br />

Landside Terminal Rentals 17,199,100 16,880,967 98.2%<br />

Airside Building Rentals 17,024,400<br />

___________________<br />

16,032,600<br />

___________________<br />

94.2%<br />

___________________<br />

Total Airline Fees and Charges 44,611,000 42,537,628 95.4%<br />

Less Airline Revenue Sharing (6,139,100)<br />

___________________<br />

(6,906,692)<br />

___________________<br />

112.5%<br />

___________________<br />

Net Airline Fees and Charges $38,471,900 $35,630,936 92.6%<br />

___________________ ___________________ ___________________<br />

___________________ ___________________ ___________________<br />

Enplaned Passengers 8,184,000 8,465,720 103.4%<br />

___________________ ___________________ ___________________<br />

Airline Cost Per Passenger $ 4.70 $ 4.21 89.5%<br />

___________________ ___________________ ___________________<br />

___________________ ___________________ ___________________<br />

Overview of the <strong>Financial</strong> Statements<br />

The Authority operates as a single enterprise fund with multiple costs centers. The financial statements are prepared on the accrual basis<br />

of accounting, therefore revenues are recognized when earned and expenses are recognized when incurred. Capital assets are capitalized<br />

and depreciated, except land, over their useful life. Reference should be made to Note 2 in the accompanying financial statements for a<br />

summary of the Authority’s significant accounting policies. Following this MD&A are the basic financial statements and supplemental schedules<br />

of the Authority. These statements and schedules, along with the MD&A, are designed to provide readers with an understanding of the<br />

Authority’s finances.<br />

The statements of net assets present information on all of the Authority’s assets and liabilities for the fiscal years ended September 30, <strong>2004</strong><br />

and 2003, with the difference between these reported as net assets. The statements of revenues, expenses and changes in net assets<br />

present financial information showing how the Authority’s net assets changed during the two fiscal years. These statements summarize<br />

the recording of financial transactions when the underlying events occur, not the receipt or disbursement of cash. The statements of cash<br />

flows relate to the cash and cash equivalents in-flows and out-flows as a result of financial transactions during the two fiscal years and<br />

also includes a reconciliation of operating income to the net cash provided by operating activities.<br />

18<br />

<strong>Financial</strong> Highlights<br />

Operating Revenues<br />

Percent Percent<br />

Change Change<br />

Fiscal Year Fiscal Year Fiscal Year 2003 to 2002 to<br />

Revenue Classification <strong>2004</strong> 2003 2002 <strong>2004</strong> 2003<br />

___________________ ___________________ ___________________ ______________ ______________<br />

Airfield $ 9,957,737 $ 9,057,481 $ 9,319,033 9.9% (2.8)%<br />

Terminal Building 30,499,660 26,655,750 22,230,673 14.4% 19.9%<br />

Airside Buildings 16,009,562 16,681,825 13,880,083 (4.0)% 20.2%<br />

Commercial Landside 71,068,176 64,791,477 63,487,870 9.7% 2.1%<br />

Cargo 1,935,081 1,681,681 1,084,928 15.1% 55.0%<br />

Auxiliary <strong>Airport</strong>s 594,772 563,695 480,871 5.5% 17.2%<br />

General Aviation 841,999 778,138 772,351 8.2% 0.7%<br />

Other 6,478,135 6,148,443 5,620,221 5.4% 9.4%<br />

___________________ ___________________ ___________________ ______________ ______________<br />

$137,385,122 $126,358,490 $116,876,030 8.7% 8.1%<br />

___________________ ___________________ ___________________ ______________ ______________<br />

___________________ ___________________ ___________________ ______________ ______________<br />

The table above presents the major operating revenue classifications for FY<strong>2004</strong>, FY2003 and FY2002. Airfield revenues are comprised of<br />

landing fees received from the airlines based on landed weight. In accordance with the airline agreement, landing fee rates are calculated<br />

by dividing 90% of total expenditures in the airfield cost center by the annual total landed weight of all commercial airlines. The increase<br />

in airfield revenues in the current year is attributable to the impact of applying operating grants in FY2003 to offset airfield expenses. The<br />

decrease in airfield revenues from FY2002 to FY2003 also relates to the impact of the operating grant in FY2003.<br />

Space rental fees to the airlines in the terminal building are based on the cost of providing the space to the airlines. The variance in terminal<br />

building revenues for FY<strong>2004</strong> compared to FY2003 is due to increases in space rental revenues (due to increases in expenses, i.e., full<br />

year of baggage handling system) and food and beverage and hotel concession revenues. FY<strong>2004</strong> concession revenues were all positively<br />

impacted by the increase in the passenger activity at the <strong>Airport</strong>. In FY2003 a partial year of operating a portion of the baggage<br />

handling system and increases in insurance costs contributed to the increase in revenues in this classification. The opening of the new<br />

Airside E in October 2002 contributed to increased concession revenues in FY2003 as did the elimination of the concession improvement<br />

trust. Payments to the trust of approximately $789,000 were recognized as revenues in FY2003 and future facility improvements will be<br />

paid directly by the concessionaires.<br />

The decrease in airside revenues in FY<strong>2004</strong> over the prior year is a result of the reimbursement of airside security costs from the Transportation<br />

Security Administration (TSA) and a decrease in the amount of investment service allocated to this cost center. The increase in airside revenues<br />

for FY2003 compared to FY2002 is due to the opening of Airside E (108,303 square feet larger than Airside C) and the closure of<br />

Airside C that resulted in additional space rental revenues of $2,712,200.<br />

The commercial landside classification consists primarily of car rental, parking and other concession revenues; all of these items were<br />

positively impacted by the increase in passenger enplanements in FY<strong>2004</strong>. Parking revenues increased $3.2 million in FY<strong>2004</strong>, indicating<br />

a continued increase in the use by those traveling as well as <strong>Airport</strong> patrons picking up passengers. Car rental concessions in FY<strong>2004</strong><br />

increased $3.2 million over the prior year as a result of increased activity and a settlement of a revenue audit that resulted in additional<br />

revenues of $1,582,500. Although passenger enplanements for FY2003 were only slightly above the prior year, parking revenues<br />

increased $1.6 million over FY2002, indicating an increase in the use of the parking facility by travelers.<br />

19

Cargo revenue increases in FY<strong>2004</strong> are due to higher occupancy in the cargo facilities. On March 1, 2003, the newly constructed Federal<br />

Express cargo sorting facility was opened, generating $597,400 additional revenues in the cargo complex in FY2003. Revenues generated<br />

from the general aviation operations in FY<strong>2004</strong> showed positive variances from the prior year and are higher than the FY<strong>2004</strong> budget by<br />

2.1%. Other revenues in FY<strong>2004</strong> increased over FY2003 due to additional rentals in the non-aviation areas of the <strong>Airport</strong>. In FY2003, this<br />

classification increased $528,200 over FY2002, due to additional rentals in the non-aviation area of the airport and a full year of revenues<br />

from the fuel farm. In mid-FY2002, improvements to the fuel farm were made by the Authority and the fees charged to the airlines were<br />

increased for the use of the facility.<br />

Operating Grants and Reimbursements<br />

From October 2002 through May 2003, the Authority recorded $664,400 in reimbursements from the Transportation Security Administration<br />

for providing law enforcement services on behalf of the TSA at the passenger security checkpoints. As of June 1, 2003, the agreement with<br />

the TSA was terminated. In FY<strong>2004</strong> the TSA reinstated the agreement and the Authority was reimbursed $1,241,772 (retro-active to June<br />

2003 through September <strong>2004</strong>) for providing the law enforcement services. The Authority has this agreement with the TSA for the next<br />

fiscal year and anticipates the TSA will continue with the reimbursement program. An annual grant in the amount of $120,500 from the<br />

TSA was received in each of the fiscal years presented to partially fund the three canine programs at the <strong>Airport</strong>. In FY<strong>2004</strong> $67,900 was<br />

received from the State of Florida for reimbursement of overtime expenses associated with security issues. In FY2003, the Authority<br />

received a $3,000,000 operating grant from the State of Florida under a program to provide economic assistance to public-use airports<br />

due to the economic impacts from the events of September 11, 2001.<br />

Operating Expenses<br />

Percent Percent<br />

Change Change<br />

Fiscal Year Fiscal Year Fiscal Year 2003 to 2002 to<br />

Expense Classification <strong>2004</strong> 2003 2002 <strong>2004</strong> 2003<br />

___________________ ___________________ ___________________ ______________ ______________<br />

Airfield $ 6,668,188 $ 7,118,577 $ 6,542,633 (6.3)% 8.8%<br />

Terminal Building 18,684,354 16,023,919 13,385,142 16.6% 19.7%<br />

Airside Buildings 14,558,486 14,228,730 12,301,327 2.3% 15.7%<br />

Commercial Landside 14,126,355 13,246,519 12,173,071 6.6% 8.8%<br />

Cargo 402,438 445,159 396,395 (9.6)% 12.3%<br />

Auxiliary <strong>Airport</strong>s 941,534 947,856 867,496 (0.7)% 9.3%<br />

General Aviation 438,260 413,634 473,086 0.6% (12.6)%<br />

Passenger Transfer System 2,776,560 2,710,074 2,255,462 2.5% 20.2%<br />

Roads and Grounds 5,378,920 5,442,293 4,279,061 (1.2)% 27.2%<br />

Other 1,688,938 1,461,778 1,270,687 15.5% 15.0%<br />

___________________ ___________________ ___________________ ______________ ______________<br />

$65,664,033 $62,038,539 $53,944,360 5.8% 15.0%<br />

___________________ ___________________ ___________________ ______________ ______________<br />

___________________ ___________________ ___________________ ______________ ______________<br />

The table above presents the major expense classifications for FY<strong>2004</strong>, FY2003 and FY2002. Total operating expenses for FY<strong>2004</strong> increased<br />

$3,625,500 (5.8%) over the prior fiscal year. The total actual expenses of $65,664,000 were within the budgeted amounts for the year<br />

(see “Highlights of the Fiscal Year <strong>2004</strong> Budget”). Total operating expenses for FY2003 increased $8,094,200 (15.0%) over the prior fiscal<br />

year. While this overall percentage increase compared to FY2002 is significant, it is important to note the FY2003 actual expenses were<br />

also within budgeted amounts and to also discuss the FY2002 results which were impacted by the cost containment program implemented<br />

after September 11, 2001 (see ”FY2003 Discussion of Operating Expenses”).<br />

20<br />

FY<strong>2004</strong> Discussion of Operating Expenses<br />

The airfield cost center expenses declined in FY<strong>2004</strong> over FY2003 as a result of the decrease in insurance expense for the <strong>Airport</strong> as well<br />

as less personnel costs being charged to this cost center. The increase in expenses in the terminal building cost center relate to the completion<br />

of the final phases of the outbound baggage handling system and security enhancement project. The Authority incurred approximately<br />

$1.35 million in additional operating expenses over the prior fiscal year to fully operate the new system. The system required the addition<br />

of 16 new personnel in FY<strong>2004</strong> and a significant increase in power consumption. Overall, the new system, of which several phases came<br />

on-line in FY2003, requires 39 personnel at a cost of $2.4 million and approximately $1 million in electricity to operate annually. This project<br />

is discussed in more detail in the “Capital Improvement Program” section of this MD&A. Other increases in operating expenses in the Terminal,<br />

Airside and Commercial Landside cost centers during FY<strong>2004</strong> reflect the continuation of the Authority to return to a normal level of customer<br />

service expected by the community and traveling public. Personnel expenses increased over the prior year due to the funding of additional<br />

positions, the cost of living adjustment in January <strong>2004</strong> and related benefit expenses. Increases in contractual maintenance, which include<br />

janitorial services, shuttle, elevator and escalator maintenance were $884,800 over the prior year. Due to a rate increase, the Authority<br />

incurred approximately $380,000 in additional electricity expenses for the year. Decreases in expenses occurred with the actual property<br />

and liability insurance for FY<strong>2004</strong> coming in $820,100 less than FY2003, and the elimination of inspection requirements at the short term<br />

parking garage entrance, which resulted in a decrease of $286,000.<br />

Other noted decreases in expenses occurred with the elimination of contractual law enforcement services provided by Hillsborough<br />

County, saving $412,200, the elimination of an outside towing service, saving $93,400, and reductions in the use of outside legal and<br />

engineering services, decreasing these expenses $163,800. These services and operational requirements are now provided by the Authority’s<br />

in-house personnel. It is important to note the Authority actively continues with cost containment efforts in controlling expenditures in all<br />

areas possible, including contracted services, contracted maintenance and other operating expenditures. This is evident by the cost per<br />

enplanement for the year of $4.21, compared to the budgeted amount of $4.70.<br />

FY2003 Discussion of Operating Expenses<br />

Significant changes during FY2003 resulted in considerable additional costs for the Authority. In mid-October 2002, new Airside E opened<br />

and Delta, United and Air Canada were relocated to this facility. Due to the requirements of the airlines, this airside was over 108,303<br />

square feet larger than Airside C, which was closed when the new airside commenced operations. The increased costs associated with<br />

operating the new Airside E and its passenger transfer system impacted FY2003 by approximately $1,195,600. The Authority incurred<br />

large increases in insurance costs and just the rise in property insurance premiums accounted for $1,624,400 in increased expenses. Also<br />

included in FY2003 were increases in operating expenditures due to additional security measures that were required by the TSA.<br />

After the events of September 11, 2001, the Authority adopted a FY2002 amended budget that significantly curtailed expenses. The cost<br />

containment measures in FY2002 reduced expenses by over $4 million over the original budget by reducing or cutting costs in all areas<br />

except those related to safety or security. As expected, this cost-cutting program, while certainly successful in controlling expenses,<br />

reduced the level of customer service and FY2003 marked the first step toward returning to a normal level of operations.<br />

With awareness of the foregoing, the following discusses specific variances within the operating expense area in FY2003 compared to<br />

FY2002. Salaries and wages increases of $2,625,900, along with associated increases in FICA and pension expenses were related to additional<br />

security requirements and the elimination of the hiring freeze. Overtime for FY2003 was reduced $351,700 over FY2002 with the<br />

implementation of twelve-hour shifts in the police and traffic departments and as new permanent positions fulfilled certain requirements<br />

that mandated the use of overtime in the prior fiscal year. Group health and workers’ compensation insurance increased $919,700 over<br />

the prior year as a result of increases in personnel and the rise in premiums. Janitorial costs, at $5,523,600 for FY2003, were $642,100 (a<br />

significant portion of this increase related to worker compensation insurance increases) over FY2002. Electricity expenses were $964,600<br />

over FY2002 with the additional energy requirements of Airside E, resumption of normal operating schedules for elevators, escalators and<br />

shuttle cars and the return of the terminal building to normal temperatures. As experienced in the past fiscal year, insurance costs continued<br />

to rise for the Authority, with FY2003 increasing $1,624,400 over the prior year. Even with the increases in expenses in FY2003, the<br />

Authority remained committed to providing quality services while maintaining a competitive cost structure for the airlines serving the airport.<br />

21

Summary of Changes in Net Assets<br />

The following is a summary of the statements of revenues, expenses and changes in net assets:<br />

Fiscal Year Fiscal Year Fiscal Year Change 2003 Change 2002<br />

<strong>2004</strong> 2003 2002 to <strong>2004</strong> to 2003<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Operating Revenues<br />

Operating Grants and<br />

$137,385,122 $126,358,490 $116,876,030 $ 11,026,632 $ 9,482,460<br />

Reimbursements 1,430,182 3,787,348 1,989,150 (2,357,166) 1,798,198<br />

Operating Expenses<br />

Distribution of Airline<br />

65,664,033 62,038,539 53,944,315 3,625,494 8,094,224<br />

Revenue Sharing 6,906,692<br />

___________________<br />

5,254,849<br />

___________________<br />

5,388,897<br />

___________________<br />

1,651,843<br />

___________________<br />

(134,048)<br />

___________________<br />

Operating Income before<br />

Depreciation and<br />

Amortization<br />

Depreciation and<br />

66,244,579 62,852,450 59,531,968 3,392,129 3,320,482<br />

Amortization 59,996,075<br />

___________________<br />

41,617,751<br />

___________________<br />

45,974,034<br />

___________________<br />

18,378,324<br />

___________________<br />

(4,356,283)<br />

___________________<br />

Income from Operations<br />

Net Non-Operating<br />

6,248,504 21,234,699 13,557,934 (14,986,195) 7,676,765<br />

Expense 18,816,564 21,725,964 21,013,341 (2,909,400) 712,623<br />

Capital Contributions 54,581,033<br />

___________________<br />

57,552,837<br />

___________________<br />

44,536,925<br />

___________________<br />

(2,971,804)<br />

___________________<br />

13,015,912<br />

___________________<br />

Increase in Net Assets $ 42,012,973 $ 57,061,572 $ 37,081,518 $(15,048,599) $19,980,054<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Operating income before depreciation and amortization at $66,244,600 for FY<strong>2004</strong> is $3,392,100 higher than the previous year.<br />

Contributing to this positive variance is an increase in operating revenues of $11,026,600, offset by an increase in operating expenses of<br />

$3,625,500. In FY2003, operating income before depreciation and amortization was $3,320,500 over FY2002. Details of the operating<br />

revenues and expenses are more fully discussed in the previous section “<strong>Financial</strong> Highlights” of this MD&A.<br />

Depreciation and amortization expense, at $59,996,100 for the current year, was $18,378,300 higher than the FY2003 due to the<br />

impact of a full year of depreciation for assets that were capitalized at the end of FY2003. Another factor contributing to the additional<br />

depreciation relates to the completion of the new baggage handling system and the disposal of old system, which became obsolete for<br />

current requirements and needs. Depreciation and amortization expense of $41,617,800 in FY2003 was $4,356,300 lower than FY2002<br />

due to the accelerated depreciation of the Airside C building in FY2002. This airside was closed October 15, 2002, and the airlines were<br />

relocated to new Airside E. The Airside C Building has been demolished and reconstruction efforts are underway.<br />

Capital Contributions consists of Federal and State Grants and Passenger Facility Charges (PFCs), which are being received to fund various<br />

construction projects and the land acquisition program at the <strong>Airport</strong>. PFCs are collected at a $4.50 per passenger level by the airlines, of<br />

which $4.39 is remitted to the Authority. Due to the increase in enplaned passengers for FY<strong>2004</strong>, the collection of PFCs during FY<strong>2004</strong><br />

increased $3,583,000 (11.5%) over the prior year. This increase was offset by a decrease in state grants received in FY<strong>2004</strong> for the new<br />

outbound baggage system and federal and state grants that were received for the reconstruction of Airside C in FY2003. Capital contributions<br />

in FY2003 reflect a full year of receipt of PFCs at the $4.50 level (effective June 1, 2002, previously $3.00) with a total increase of<br />

$7,752,900 over FY2002. The balance of the variance for FY2003 is primarily due to the grants received for the new outbound baggage<br />

system and for the reconstruction of Airside C mentioned above.<br />

22<br />

Summary of Statements of Net Assets<br />

A summarized comparison of the Authority’s total assets, total liabilities and net assets at September 30, <strong>2004</strong>, 2003 and 2002 is as follows:<br />

Change 2003 Change 2002<br />

<strong>2004</strong> 2003 2002 to <strong>2004</strong> to 2003<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Assets<br />

Current assets<br />

Current unrestricted<br />

assets<br />

Current restricted<br />

$ 25,907,831 $ 18,386,421 $ 52,326,592 $ 7,521,410 $ (33,940,171)<br />

assets<br />

Non-current assets<br />

165,188,124 256,249,616 104,637,671 (91,061,492) 151,611,945<br />

Capital assets, net<br />

Other non-current<br />

1,001,570,672 893,572,412 776,712,459 107,998,260 116,859,953<br />

assets 7,578,211<br />

___________________<br />

8,928,863<br />

___________________<br />

5,476,224<br />

___________________<br />

(1,350,652)<br />

___________________<br />

3,452,639<br />

___________________<br />

Total Assets $1,200,244,838 $1,177,137,312 $939,152,946 $ 23,107,526 $237,984,366<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Liabilities<br />

Current liabilities $ 64,722,642 $ 61,663,664 $ 63,592,428 $ 3,058,978 $ (1,928,764)<br />

Non-current liabilities 672,431,045<br />

___________________<br />

694,395,470<br />

___________________<br />

511,543,912<br />

___________________<br />

(21,964,425)<br />

___________________<br />

182,851,558<br />

___________________<br />

Total Liabilities 737,153,687 756,059,134 575,136,340 (18,905,447) 180,922,794<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Net Assets<br />

Invested in capital<br />

assets, net of debt 369,044,731 339,523,551 306,240,304 29,521,180 33,283,247<br />

Restricted 70,632,151 63,633,500 16,686,541 6,998,651 46,946,959<br />

Unrestricted 23,414,269<br />

___________________<br />

17,921,127<br />

___________________<br />

41,089,761<br />

___________________<br />

5,493,142<br />

___________________<br />

(23,168,634)<br />

___________________<br />

Total Net Assets $ 463,091,151 $ 421,078,178 $364,016,606 $ 42,012,973 $ 57,061,572<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

___________________ ___________________ ___________________ ___________________ ___________________<br />

Current restricted assets decreased $91,061,500 in FY<strong>2004</strong>, primarily as a result of the use of construction bond funds in FY<strong>2004</strong> for the<br />

capital improvement program; the bonds were issued in FY2003. In FY2003, current assets increased $117,671,800 over FY2002, due to<br />

the bond funding received for the capital improvement program, offset by expenditures of construction funds in FY2003. Net capital assets<br />

increased $107,998,300 in FY<strong>2004</strong> over FY2003 and $116,860,000 in FY2003 over FY2002. Both years’ variances reflect the completion<br />

of major projects and the commencement of new capital spending under the capital improvement program.<br />

Current liabilities, with a balance of $64,722,600 at September 30, <strong>2004</strong>, were $3,059,000 higher than the balance at September 30,<br />

2003. The balance at September 30, 2003 of $61,633,664 was $1,928,000 less than the balance at September 30, 2002. The variances<br />

for each year are primarily due to the changes in the construction accounts payable. Non-current liabilities decreased $21,964,400 in<br />

FY<strong>2004</strong> over FY2003, primarily due to the principal payment of $19,395,000 on the revenue bonds and a $5,000,000 principal payment<br />

on the outstanding commercial paper program. Non-current liabilities in FY2003 increased $182,851,600 over FY2002, due to the issuance<br />

of new bond financing for the on-going capital program and refinancing of a portion of the commercial paper program, offset by a<br />

reduction of $18,440,000 of revenue bonds payable due to bond maturities.<br />

23

Total net assets in FY<strong>2004</strong> increased $42,013,000 over FY2003 reflecting grant and PFC contributions for capital projects totaling<br />

$54,581,0300, offset by a higher depreciation in the current year. In FY2003, total net assets increased $57,061,600 over the prior year<br />

reflecting capital contributions for capital projects totaling $57,552,800, offset by a net loss of $491,200 in FY2003.<br />

The FY2003 bond financing and the associated impact upon the capital program is discussed in more detail in subsequent sections of this<br />

MD&A (see “Capital Improvement Program”, “Capital Planning and Financing” and “Debt Management”).<br />

Capital Improvement Program<br />

The Authority’s approved FY<strong>2004</strong> Capital Budget, in the total amount of $72,010,000, continues an aggressive program to develop the<br />

necessary facilities and improvements to meet the demands of the aviation system for the <strong>Airport</strong>’s market area. Current year capital spending<br />

includes projects approved in prior years that are still under construction. During FY<strong>2004</strong>, the Authority expended $152,533,923 in its<br />

on-going capital improvement program.<br />

In early FY2003, Delta Airlines relocated from Airside C where they had operated for over 30 years, to a new Airside E facility with additional<br />

gates and operational space. The FY2003 Capital Budget included funds for the demolition and replacement of the Airside C building<br />

with a 12-gate facility ($119,731,800) to meet the growing needs of Southwest Airlines. The FY<strong>2004</strong> Capital Budget added funding of<br />

$15,072,200 to the Airside C project to increase the capacity of the planned facility to a 16-gate structure. The Authority will relocate airline<br />

tenants at Airside D to the space that will be vacated by Southwest Airlines at Airside A and to the additional gates in Airside C. Airside<br />

D, a 34-year-old structure, is the last of the original airsides at the <strong>Airport</strong> and will be closed upon the opening of new Airside C. The<br />

reconstruction of Airside C is scheduled for completion in the spring of 2005. Sources of funding for this project include grants, PFCs and<br />

revenue bonds.<br />

The outbound baggage system, a project originally approved in FY2003 at a cost of $107,235,000 was allocated additional funding of<br />

$19,587,900 in the FY<strong>2004</strong> Capital Budget. The outbound baggage system integrates in-line screening and eliminates the need for the<br />

passenger to transfer baggage from the airline ticket counter to the TSA screening point after checking in. The screening units on the<br />

ticket level were removed, increasing queuing and circulation space within the ticket level of the terminal. The new system, fully operational<br />

in FY<strong>2004</strong>, also converts the former manual load and transportation of baggage to a fully automated high-speed network with<br />

approximately four miles of conveyors, providing baggage tracking and sorting features. The Airside C related portion of this system will<br />

be brought on-line with the opening of the new airside. Major funding for the outbound baggage system is provided from state grants,<br />

PFCs and PFC backed revenue bonds. In addition, the Authority has requested a Letter of Intent from the TSA to assist in offsetting a portion<br />

of the costs of the new system.<br />

PFC Application #6, authorizing PFC collections in the amount of $298,115,400 was approved by the Federal Aviation Administration<br />

during FY2003, bringing the total collection authority for all PFC applications to $593,121,200. Through September 30, <strong>2004</strong>, $233,648,700<br />

revenue has been collected under these approved applications. Expenditures under the PFC applications through September 30, <strong>2004</strong><br />

total $440,029,000. Expenditures in excess of collections are funded from the issuance of PFC backed revenue bonds, commercial paper,<br />

or from Authority funds that will be reimbursed from PFCs.<br />

Capital Planning and Financing<br />

Typically, airports in the United States develop master plans that define the airports’ ultimate configuration at full development during<br />

20-year time spans, thereby establishing airport complex requirements. An update to the Authority’s last Master Plan is currently underway,<br />

with completion scheduled for late 2005. Master plans do not normally provide detailed information to determine funding strategies. The<br />

Authority periodically prepares (or updates) a Strategic Business Plan to provide a 10-year detailed funding analysis of operating expenses,<br />

revenues, and projected airline charges and establish development and financial goals along with measurement criteria. The plan’s overriding<br />

objective is to place the Authority in a healthy financial position without overburdening the air carriers, while maintaining competitive<br />

airline rates and charges. Funding strategies and recommendations will ensure airport facilities and improvements are brought on line<br />