Sharing deal insight - pwc

Sharing deal insight - pwc

Sharing deal insight - pwc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

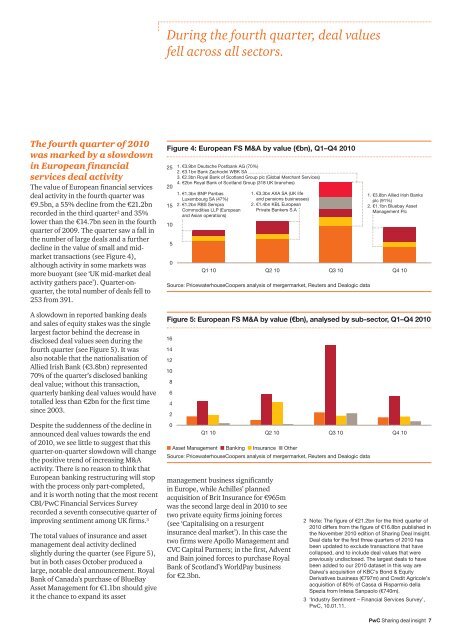

The fourth quarter of 2010<br />

was marked by a slowdown<br />

in European financial<br />

services <strong>deal</strong> activity<br />

The value of European financial services<br />

<strong>deal</strong> activity in the fourth quarter was<br />

€9.5bn, a 55% decline from the €21.2bn<br />

recorded in the third quarter 2 and 35%<br />

lower than the €14.7bn seen in the fourth<br />

quarter of 2009. The quarter saw a fall in<br />

the number of large <strong>deal</strong>s and a further<br />

decline in the value of small and midmarket<br />

transactions (see Figure 4),<br />

although activity in some markets was<br />

more buoyant (see ‘UK mid-market <strong>deal</strong><br />

activity gathers pace’). Quarter-onquarter,<br />

the total number of <strong>deal</strong>s fell to<br />

253 from 391.<br />

A slowdown in reported banking <strong>deal</strong>s<br />

and sales of equity stakes was the single<br />

largest factor behind the decrease in<br />

disclosed <strong>deal</strong> values seen during the<br />

fourth quarter (see Figure 5). It was<br />

also notable that the nationalisation of<br />

Allied Irish Bank (€3.8bn) represented<br />

70% of the quarter’s disclosed banking<br />

<strong>deal</strong> value; without this transaction,<br />

quarterly banking <strong>deal</strong> values would have<br />

totalled less than €2bn for the first time<br />

since 2003.<br />

Despite the suddenness of the decline in<br />

announced <strong>deal</strong> values towards the end<br />

of 2010, we see little to suggest that this<br />

quarter-on-quarter slowdown will change<br />

the positive trend of increasing M&A<br />

activity. There is no reason to think that<br />

European banking restructuring will stop<br />

with the process only part-completed,<br />

and it is worth noting that the most recent<br />

CBI/PwC Financial Services Survey<br />

recorded a seventh consecutive quarter of<br />

improving sentiment among UK firms. 3<br />

The total values of insurance and asset<br />

management <strong>deal</strong> activity declined<br />

slightly during the quarter (see Figure 5),<br />

but in both cases October produced a<br />

large, notable <strong>deal</strong> announcement. Royal<br />

Bank of Canada’s purchase of BlueBay<br />

Asset Management for €1.1bn should give<br />

it the chance to expand its asset<br />

During the fourth quarter, <strong>deal</strong> values<br />

fell across all sectors.<br />

Figure 4: European FS M&A by value (€bn), Q1–Q4 2010<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Source: PricewaterhouseCoopers analysis of mergermarket, Reuters and Dealogic data<br />

Figure 5: European FS M&A by value (€bn), analysed by sub-sector, Q1–Q4 2010<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1. €3.9bn Deutsche Postbank AG (70%)<br />

2. €3.1bn Bank Zachodni WBK SA<br />

3. €2.3bn Royal Bank of Scotland Group plc (Global Merchant Services)<br />

4. €2bn Royal Bank of Scotland Group (318 UK branches)<br />

1. €1.3bn BNP Paribas<br />

Luxembourg SA (47%)<br />

2. €1.2bn RBS Sempra<br />

Commodities LLP (European<br />

and Asian operations)<br />

1. €3.3bn AXA SA (UK life<br />

and pensions businesses)<br />

2. €1.4bn KBL European<br />

Private Bankers S.A<br />

Q1 10 Q2 10 Q3 10 Q4 10<br />

Q1 10 Q2 10 Q3 10 Q4 10<br />

n Asset Management n Banking n Insurance n Other<br />

Source: PricewaterhouseCoopers analysis of mergermarket, Reuters and Dealogic data<br />

management business significantly<br />

in Europe, while Achilles’ planned<br />

acquisition of Brit Insurance for €965m<br />

was the second large <strong>deal</strong> in 2010 to see<br />

two private equity firms joining forces<br />

(see ‘Capitalising on a resurgent<br />

insurance <strong>deal</strong> market’). In this case the<br />

two firms were Apollo Management and<br />

CVC Capital Partners; in the first, Advent<br />

and Bain joined forces to purchase Royal<br />

Bank of Scotland’s WorldPay business<br />

for €2.3bn.<br />

1. €3.8bn Allied Irish Banks<br />

plc (91%)<br />

2. €1.1bn Bluebay Asset<br />

Management Plc<br />

2 Note: The figure of €21.2bn for the third quarter of<br />

2010 differs from the figure of €16.8bn published in<br />

the November 2010 edition of <strong>Sharing</strong> Deal Insight.<br />

Deal data for the first three quarters of 2010 has<br />

been updated to exclude transactions that have<br />

collapsed, and to include <strong>deal</strong> values that were<br />

previously undisclosed. The largest <strong>deal</strong>s to have<br />

been added to our 2010 dataset in this way are<br />

Daiwa’s acquisition of KBC’s Bond & Equity<br />

Derivatives business (€797m) and Credit Agricole’s<br />

acquisition of 80% of Cassa di Risparmio della<br />

Spezia from Intesa Sanpaolo (€740m).<br />

3 ‘Industry Sentiment – Financial Services Survey’,<br />

PwC, 10.01.11.<br />

PwC <strong>Sharing</strong> <strong>deal</strong> <strong>insight</strong> 7