Burnham Holdings, Inc.

Burnham Holdings, Inc.

Burnham Holdings, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

occur from time to time and the seasonal nature of our business. The<br />

Revolver and LOC have various financial covenants but no scheduled<br />

payments prior to maturity. As of December 31, 2012 and 2011, the<br />

Company was in compliance with all covenants as shown below:<br />

December December<br />

Dollars in thousands 2011 2012<br />

Funded Debt (1) Stockholders’ Equity on<br />

$ 10,929 $ 1,476<br />

FIFO basis (2) 117,747 123,065 Minimum level:<br />

$102,000 for 2012 and<br />

$100,000 for 2011<br />

Debt Coverage Ratio (1) 5.00 6.02 Minimum Ratio: 1.35<br />

Funded Debt to EBITDA (1) 0.90 0.09 Maximum Ratio: 5.00<br />

(1) As defined by Revolver and LOC Agreement.<br />

(2) Stockholders’ Equity excluding AOCI (shown below) plus LIFO inventory reserve<br />

(which can be found in “Inventories” Note 2 on page 23).<br />

Key Liquidity Data and Other Measures:<br />

December December December<br />

Dollars in thousands 2010 2011 2012<br />

Cash $ 3,965) $ 4,489) $ 4,740)<br />

Working Capital 40,515) 43,555) 40,741)<br />

Total Debt 14,143) 16,320) 7,692)<br />

Financed Debt (1) 12,382) 13,713) 5,265)<br />

Financed Debt (1) to Capital (2) 11.4%) 12.2%) 4.8%)<br />

Stockholders’ Equity 73,940) 64,392) 68,891)<br />

AOCI (22,171) (33,917) (34,634)<br />

Stockholders’ Equity (excluding AOCI) 96,111) 98,309) 103,525)<br />

Common Stock Price $ 15.13) $ 13.50) $ 14.46)<br />

Book Value per share as reported 16.52) 14.34) 15.29)<br />

Book Value per share (excluding AOCI) 21.50) 21.93) 23.01)<br />

(1) Financed Debt is defined as Total Debt less mark-to-market non-cash liability<br />

related to interest rate swap instruments.<br />

(2) Capital is defined as Stockholders’ Equity (excluding AOCI) plus Financed Debt.<br />

REVIEW OF OPERATIONS, (CONTINUED)<br />

<strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>. 2012 Annual Report<br />

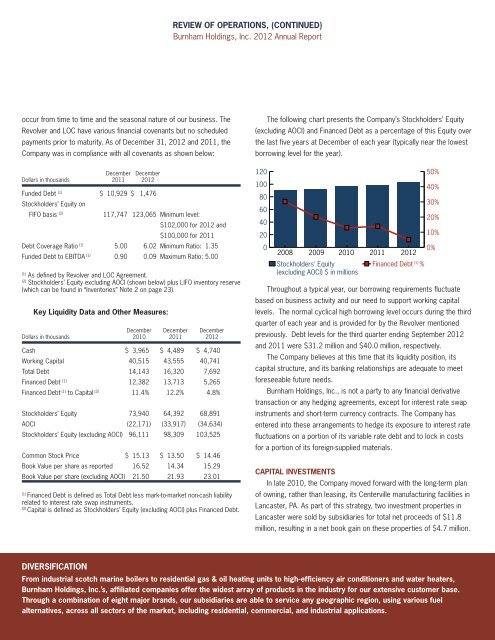

The following chart presents the Company’s Stockholders’ Equity<br />

(excluding AOCI) and Financed Debt as a percentage of this Equity over<br />

the last five years at December of each year (typically near the lowest<br />

borrowing level for the year).<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

2008 2009 2010 2011 2012<br />

Financed Debt (1) 0%<br />

Stockholders' Equity<br />

(excluding AOCI) $ in millions<br />

%<br />

Throughout a typical year, our borrowing requirements fluctuate<br />

based on business activity and our need to support working capital<br />

levels. The normal cyclical high borrowing level occurs during the third<br />

quarter of each year and is provided for by the Revolver mentioned<br />

previously. Debt levels for the third quarter ending September 2012<br />

and 2011 were $31.2 million and $40.0 million, respectively.<br />

The Company believes at this time that its liquidity position, its<br />

capital structure, and its banking relationships are adequate to meet<br />

foreseeable future needs.<br />

<strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>., is not a party to any financial derivative<br />

transaction or any hedging agreements, except for interest rate swap<br />

instruments and short-term currency contracts. The Company has<br />

entered into these arrangements to hedge its exposure to interest rate<br />

fluctuations on a portion of its variable rate debt and to lock in costs<br />

for a portion of its foreign-supplied materials.<br />

CAPITAL INVESTMENTS<br />

In late 2010, the Company moved forward with the long-term plan<br />

of owning, rather than leasing, its Centerville manufacturing facilities in<br />

Lancaster, PA. As part of this strategy, two investment properties in<br />

Lancaster were sold by subsidiaries for total net proceeds of $11.8<br />

million, resulting in a net book gain on these properties of $4.7 million.<br />

DIVERSIFICATION<br />

From industrial scotch marine boilers to residential gas & oil heating units to high-efficiency air conditioners and water heaters,<br />

<strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>.’s, affiliated companies offer the widest array of products in the industry for our extensive customer base.<br />

Through a combination of eight major brands, our subsidiaries are able to service any geographic region, using various fuel<br />

alternatives, across all sectors of the market, including residential, commercial, and industrial applications.