Burnham Holdings, Inc.

Burnham Holdings, Inc.

Burnham Holdings, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

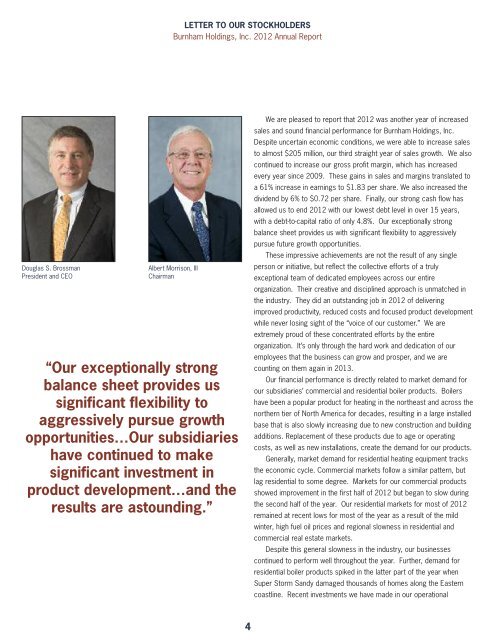

Douglas S. Brossman<br />

President and CEO<br />

LETTER TO OUR STOCKHOLDERS<br />

<strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>. 2012 Annual Report<br />

Albert Morrison, III<br />

Chairman<br />

“Our exceptionally strong<br />

balance sheet provides us<br />

significant flexibility to<br />

aggressively pursue growth<br />

opportunities…Our subsidiaries<br />

have continued to make<br />

significant investment in<br />

product development…and the<br />

results are astounding.”<br />

4<br />

We are pleased to report that 2012 was another year of increased<br />

sales and sound financial performance for <strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>.<br />

Despite uncertain economic conditions, we were able to increase sales<br />

to almost $205 million, our third straight year of sales growth. We also<br />

continued to increase our gross profit margin, which has increased<br />

every year since 2009. These gains in sales and margins translated to<br />

a 61% increase in earnings to $1.83 per share. We also increased the<br />

dividend by 6% to $0.72 per share. Finally, our strong cash flow has<br />

allowed us to end 2012 with our lowest debt level in over 15 years,<br />

with a debt-to-capital ratio of only 4.8%. Our exceptionally strong<br />

balance sheet provides us with significant flexibility to aggressively<br />

pursue future growth opportunities.<br />

These impressive achievements are not the result of any single<br />

person or initiative, but reflect the collective efforts of a truly<br />

exceptional team of dedicated employees across our entire<br />

organization. Their creative and disciplined approach is unmatched in<br />

the industry. They did an outstanding job in 2012 of delivering<br />

improved productivity, reduced costs and focused product development<br />

while never losing sight of the “voice of our customer.” We are<br />

extremely proud of these concentrated efforts by the entire<br />

organization. It’s only through the hard work and dedication of our<br />

employees that the business can grow and prosper, and we are<br />

counting on them again in 2013.<br />

Our financial performance is directly related to market demand for<br />

our subsidiaries’ commercial and residential boiler products. Boilers<br />

have been a popular product for heating in the northeast and across the<br />

northern tier of North America for decades, resulting in a large installed<br />

base that is also slowly increasing due to new construction and building<br />

additions. Replacement of these products due to age or operating<br />

costs, as well as new installations, create the demand for our products.<br />

Generally, market demand for residential heating equipment tracks<br />

the economic cycle. Commercial markets follow a similar pattern, but<br />

lag residential to some degree. Markets for our commercial products<br />

showed improvement in the first half of 2012 but began to slow during<br />

the second half of the year. Our residential markets for most of 2012<br />

remained at recent lows for most of the year as a result of the mild<br />

winter, high fuel oil prices and regional slowness in residential and<br />

commercial real estate markets.<br />

Despite this general slowness in the industry, our businesses<br />

continued to perform well throughout the year. Further, demand for<br />

residential boiler products spiked in the latter part of the year when<br />

Super Storm Sandy damaged thousands of homes along the Eastern<br />

coastline. Recent investments we have made in our operational