Burnham Holdings, Inc.

Burnham Holdings, Inc.

Burnham Holdings, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

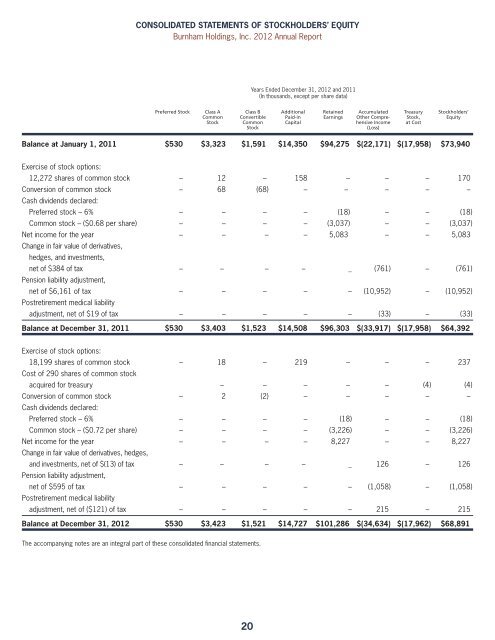

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY<br />

<strong>Burnham</strong> <strong>Holdings</strong>, <strong>Inc</strong>. 2012 Annual Report<br />

Preferred Stock Class A<br />

Common<br />

Stock<br />

Years Ended December 31, 2012 and 2011<br />

(In thousands, except per share data)<br />

Class B<br />

Convertible<br />

Common<br />

Stock<br />

Balance at January 1, 2011 $530 $3,323 $1,591) $14,350 $94,275) $(22,171) $(17,958) $73,940)<br />

Exercise of stock options:<br />

12,272 shares of common stock – 12 –) 158 –) –) –) 170)<br />

Conversion of common stock<br />

Cash dividends declared:<br />

– 68 (68) – –)) –) –) –)<br />

Preferred stock – 6% – – –) – (18)) –) –) (18)<br />

Common stock – ($0.68 per share) – – –) – (3,037)) –) –) (3,037)<br />

Net income for the year<br />

Change in fair value of derivatives,<br />

hedges, and investments,<br />

– – – – 5,083)) –) –) 5,083)<br />

net of $384 of tax<br />

Pension liability adjustment,<br />

– –) – –) _ (761) –) (761)<br />

net of $6,161 of tax<br />

Postretirement medical liability<br />

– – –) – – (10,952) –) (10,952)<br />

adjustment, net of $19 of tax – – –) – – (33) –) (33)<br />

Balance at December 31, 2011 $530 $3,403 $1,523) $14,508 $96,303) )$(33,917) $(17,958) $64,392)<br />

Exercise of stock options:<br />

18,199 shares of common stock<br />

Cost of 290 shares of common stock<br />

– 18 –) 219 –) –) –) 237)<br />

acquired for treasury –) –) – –) –) (4) (4)<br />

Conversion of common stock<br />

Cash dividends declared:<br />

– 2 (2) – –) –) –) –)<br />

Preferred stock – 6% – – –) – (18) –) –) (18)<br />

Common stock – ($0.72 per share) – – –) – (3,226) –) –) (3,226)<br />

Net income for the year<br />

Change in fair value of derivatives, hedges,<br />

– – – – 8,227) –) –) 8,227)<br />

and investments, net of $(13) of tax<br />

Pension liability adjustment,<br />

– –) – –) _ 126) –) 126)<br />

net of $595 of tax<br />

Postretirement medical liability<br />

– – –) – – (1,058) –) (1,058)<br />

adjustment, net of ($121) of tax – – –) – – 215) –) 215)<br />

Balance at December 31, 2012 $530 $3,423 $1,521) $14,727 $101,286) )$(34,634) $(17,962) $68,891)<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

20<br />

Additional<br />

Paid-in<br />

Capital<br />

Retained<br />

Earnings<br />

Accumulated<br />

Other Comprehensive<br />

<strong>Inc</strong>ome<br />

(Loss)<br />

Treasury<br />

Stock,<br />

at Cost<br />

Stockholders’<br />

Equity