IHT400 Notes : Guide to completing your Inheritance Tax account

IHT400 Notes : Guide to completing your Inheritance Tax account

IHT400 Notes : Guide to completing your Inheritance Tax account

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

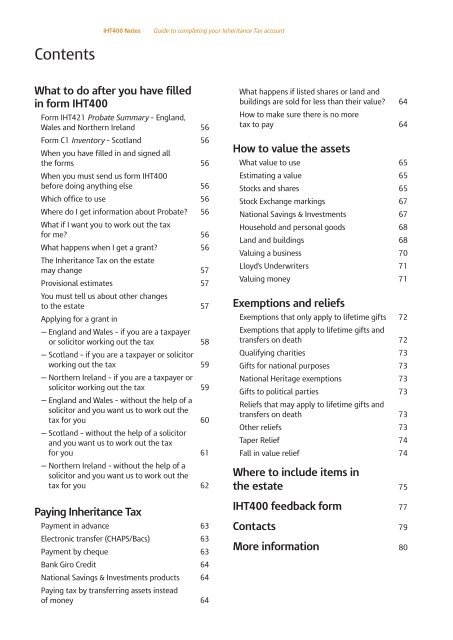

Contents<br />

<strong>IHT400</strong> <strong>Notes</strong><br />

What <strong>to</strong> do after you have filled<br />

in form <strong>IHT400</strong><br />

Form IHT421 Probate Summary – England,<br />

Wales and Northern Ireland 56<br />

Form C1 Inven<strong>to</strong>ry – Scotland 56<br />

When you have filled in and signed all<br />

the forms 56<br />

When you must send us form <strong>IHT400</strong><br />

before doing anything else 56<br />

Which office <strong>to</strong> use 56<br />

Where do I get information about Probate? 56<br />

What if I want you <strong>to</strong> work out the tax<br />

for me? 56<br />

What happens when I get a grant? 56<br />

The <strong>Inheritance</strong> <strong>Tax</strong> on the estate<br />

may change 57<br />

Provisional estimates 57<br />

You must tell us about other changes<br />

<strong>to</strong> the estate 57<br />

Applying for a grant in<br />

— England and Wales – if you are a taxpayer<br />

or solici<strong>to</strong>r working out the tax 58<br />

— Scotland – if you are a taxpayer or solici<strong>to</strong>r<br />

working out the tax 59<br />

— Northern Ireland – if you are a taxpayer or<br />

solici<strong>to</strong>r working out the tax 59<br />

— England and Wales – without the help of a<br />

solici<strong>to</strong>r and you want us <strong>to</strong> work out the<br />

tax for you 60<br />

— Scotland – without the help of a solici<strong>to</strong>r<br />

and you want us <strong>to</strong> work out the tax<br />

for you 61<br />

— Northern Ireland – without the help of a<br />

solici<strong>to</strong>r and you want us <strong>to</strong> work out the<br />

tax for you 62<br />

Paying <strong>Inheritance</strong> <strong>Tax</strong><br />

Payment in advance 63<br />

Electronic transfer (CHAPS/Bacs) 63<br />

Payment by cheque 63<br />

Bank Giro Credit 64<br />

National Savings & Investments products<br />

Paying tax by transferring assets instead<br />

64<br />

of money 64<br />

<strong>Guide</strong> <strong>to</strong> <strong>completing</strong> <strong>your</strong> <strong>Inheritance</strong> <strong>Tax</strong> <strong>account</strong><br />

What happens if listed shares or land and<br />

buildings are sold for less than their value? 64<br />

How <strong>to</strong> make sure there is no more<br />

tax <strong>to</strong> pay 64<br />

How <strong>to</strong> value the assets<br />

What value <strong>to</strong> use 65<br />

Estimating a value 65<br />

S<strong>to</strong>cks and shares 65<br />

S<strong>to</strong>ck Exchange markings 67<br />

National Savings & Investments 67<br />

Household and personal goods 68<br />

Land and buildings 68<br />

Valuing a business 70<br />

Lloyd's Underwriters 71<br />

Valuing money 71<br />

Exemptions and reliefs<br />

Exemptions that only apply <strong>to</strong> lifetime gifts<br />

Exemptions that apply <strong>to</strong> lifetime gifts and<br />

72<br />

transfers on death 72<br />

Qualifying charities 73<br />

Gifts for national purposes 73<br />

National Heritage exemptions 73<br />

Gifts <strong>to</strong> political parties<br />

Reliefs that may apply <strong>to</strong> lifetime gifts and<br />

73<br />

transfers on death 73<br />

Other reliefs 73<br />

Taper Relief 74<br />

Fall in value relief 74<br />

Where <strong>to</strong> include items in<br />

the estate 75<br />

<strong>IHT400</strong> feedback form 77<br />

Contacts 79<br />

More information 80