IHT400 Notes : Guide to completing your Inheritance Tax account

IHT400 Notes : Guide to completing your Inheritance Tax account

IHT400 Notes : Guide to completing your Inheritance Tax account

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>IHT400</strong> <strong>Notes</strong><br />

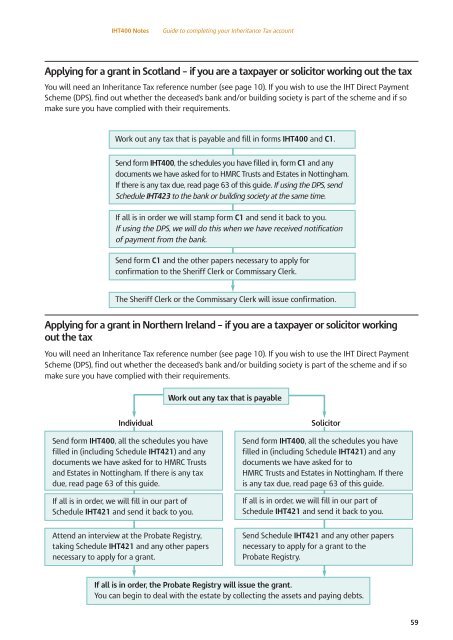

Applying for a grant in Scotland – if you are a taxpayer or solici<strong>to</strong>r working out the tax<br />

You will need an <strong>Inheritance</strong> <strong>Tax</strong> reference number (see page 10). If you wish <strong>to</strong> use the IHT Direct Payment<br />

Scheme (DPS), find out whether the deceased's bank and/or building society is part of the scheme and if so<br />

make sure you have complied with their requirements.<br />

Work out any tax that is payable and fill in forms <strong>IHT400</strong> and C1.<br />

Send form <strong>IHT400</strong>, the schedules you have filled in, form C1 and any<br />

documents we have asked for <strong>to</strong> HMRC Trusts and Estates in Nottingham.<br />

If there is any tax due, read page 63 of this guide. If using the DPS, send<br />

Schedule IHT423 <strong>to</strong> the bank or building society at the same time.<br />

If all is in order we will stamp form C1 and send it back <strong>to</strong> you.<br />

If using the DPS, we will do this when we have received notification<br />

of payment from the bank.<br />

Send form C1 and the other papers necessary <strong>to</strong> apply for<br />

confirmation <strong>to</strong> the Sheriff Clerk or Commissary Clerk.<br />

The Sheriff Clerk or the Commissary Clerk will issue confirmation.<br />

Applying for a grant in Northern Ireland – if you are a taxpayer or solici<strong>to</strong>r working<br />

out the tax<br />

You will need an <strong>Inheritance</strong> <strong>Tax</strong> reference number (see page 10). If you wish <strong>to</strong> use the IHT Direct Payment<br />

Scheme (DPS), find out whether the deceased's bank and/or building society is part of the scheme and if so<br />

make sure you have complied with their requirements.<br />

Send form <strong>IHT400</strong>, all the schedules you have<br />

filled in (including Schedule IHT421) and any<br />

documents we have asked for <strong>to</strong> HMRC Trusts<br />

and Estates in Nottingham. If there is any tax<br />

due, read page 63 of this guide.<br />

If all is in order, we will fill in our part of<br />

Schedule IHT421 and send it back <strong>to</strong> you.<br />

Attend an interview at the Probate Registry,<br />

taking Schedule IHT421 and any other papers<br />

necessary <strong>to</strong> apply for a grant.<br />

<strong>Guide</strong> <strong>to</strong> <strong>completing</strong> <strong>your</strong> <strong>Inheritance</strong> <strong>Tax</strong> <strong>account</strong><br />

Work out any tax that is payable<br />

Individual Solici<strong>to</strong>r<br />

Send form <strong>IHT400</strong>, all the schedules you have<br />

filled in (including Schedule IHT421) and any<br />

documents we have asked for <strong>to</strong><br />

HMRC Trusts and Estates in Nottingham. If there<br />

is any tax due, read page 63 of this guide.<br />

If all is in order, we will fill in our part of<br />

Schedule IHT421 and send it back <strong>to</strong> you.<br />

Send Schedule IHT421 and any other papers<br />

necessary <strong>to</strong> apply for a grant <strong>to</strong> the<br />

Probate Registry.<br />

If all is in order, the Probate Registry will issue the grant.<br />

You can begin <strong>to</strong> deal with the estate by collecting the assets and paying debts.<br />

59