Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

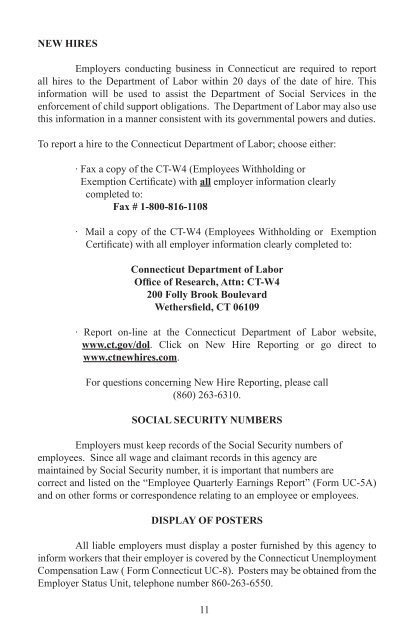

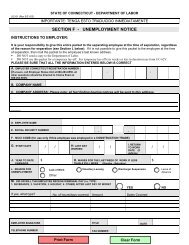

NEW HIRES<br />

Employers conducting business in <strong>Connecticut</strong> are required <strong>to</strong> report<br />

all hires <strong>to</strong> the Department of Labor within 20 days of the date of hire. This<br />

information will be used <strong>to</strong> assist the Department of Social Services in the<br />

enforcement of child support obligations. The Department of Labor may also use<br />

this information in a manner consistent with its governmental powers and duties.<br />

To report a hire <strong>to</strong> the <strong>Connecticut</strong> Department of Labor; choose either:<br />

· Fax a copy of the CT-W4 (Employees Withholding or<br />

Exemption Certificate) with all employer information clearly<br />

completed <strong>to</strong>:<br />

Fax # 1-800-816-1108<br />

· Mail a copy of the CT-W4 (Employees Withholding or Exemption<br />

Certificate) with all employer information clearly completed <strong>to</strong>:<br />

<strong>Connecticut</strong> Department of Labor<br />

Office of Research, Attn: CT-W4<br />

200 Folly Brook Boulevard<br />

Wethersfield, CT 06109<br />

· Report on-line at the <strong>Connecticut</strong> Department of Labor website,<br />

www.ct.gov/dol. Click on New Hire Reporting or go direct <strong>to</strong><br />

www.ctnewhires.com.<br />

For questions concerning New Hire Reporting, please call<br />

(860) 263-6310.<br />

SOCIAL SECURITY NUMBERS<br />

Employers must keep records of the Social Security numbers of<br />

employees. Since all wage and claimant records in this agency are<br />

maintained by Social Security number, it is important that numbers are<br />

correct and listed on the “Employee Quarterly Earnings Report” (Form UC-5A)<br />

and on other forms or correspondence relating <strong>to</strong> an employee or employees.<br />

DISPLAY OF POSTERS<br />

All liable employers must display a poster furnished by this agency <strong>to</strong><br />

inform workers that their employer is covered by the <strong>Connecticut</strong> <strong>Unemployment</strong><br />

<strong>Compensation</strong> Law ( Form <strong>Connecticut</strong> UC-8). Posters may be obtained from the<br />

Employer Status Unit, telephone number 860-263-6550.<br />

11