Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Magnetic Media Wage Reporting<br />

Each employer and each person or organization which, as an agent,<br />

is required <strong>to</strong> report wages for a <strong>to</strong>tal of two hundred fifty (250) or more<br />

<strong>Connecticut</strong> employees <strong>to</strong> the <strong>Connecticut</strong> Department of Labor for the purposes<br />

of <strong>Unemployment</strong> <strong>Compensation</strong>, is required <strong>to</strong> submit such information<br />

via magnetic media or FTP using a format and procedures identified by the<br />

Administra<strong>to</strong>r. Such employers are required <strong>to</strong> contact the Tax Au<strong>to</strong>mation and<br />

Wage Processing Unit for instructions. A detailed edit, format and procedures<br />

booklet is available free of charge. Assistance is available at (860) 263-6370. The<br />

booklet can also be found on our website located at:<br />

www.ctdol.state.ct.us/uitax/magnetic.htm<br />

All employers on the magnetic media tax method of payment are mailed a<br />

quarterly pre-addressed Employment Contribution Voucher (Form UC-2MAG).<br />

“None” Returns by Telephone or via the Internet<br />

Employers who have had no employees or paid no wages during any<br />

calendar quarter are able <strong>to</strong> file their “None” returns by telephone, or via the<br />

Internet, eliminating the need <strong>to</strong> fill out and mail a “None” Employer<br />

Contribution quarterly tax return.<br />

To file ”None” Employer Contribution quarterly tax returns by telephone,<br />

call (860) 566-1018 or (203) 248-4270 and use option #3. A recorded menu will<br />

guide you through the necessary steps required <strong>to</strong> file your return. An employer<br />

may file up <strong>to</strong> four (4) quarters with a single telephone call.<br />

To file “None Employer Contributions” return via the internet, see page<br />

13 “Internet filing of UI Tax and Wage Report”.<br />

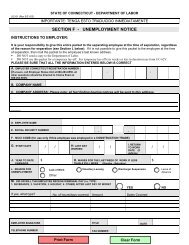

Paper Wage Reporting<br />

• Taxable Employer<br />

Employers who file their contribution returns on paper are mailed a<br />

quarterly pre-addressed Employer Contribution Return and Employee<br />

Quarterly Earnings Report. The Employer Contribution Return (Form<br />

UC-2) is used <strong>to</strong> compute the amount of contributions due, based on<br />

reported taxable wages. The Employee Quarterly Earnings Report (Form<br />

UC-5A) is used <strong>to</strong> show, in detail, the employee’s Social Security<br />

number, name and <strong>to</strong>tal earnings in the quarter. The Employee<br />

Quarterly Earnings Report and the Employer Contribution Return must<br />

be completed and forwarded, with a check for contributions due, <strong>to</strong> the<br />

“Administra<strong>to</strong>r, <strong>Unemployment</strong> <strong>Compensation</strong>,” on or before the last day<br />

of the month following the close of the calendar quarter. When the due<br />

15