Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

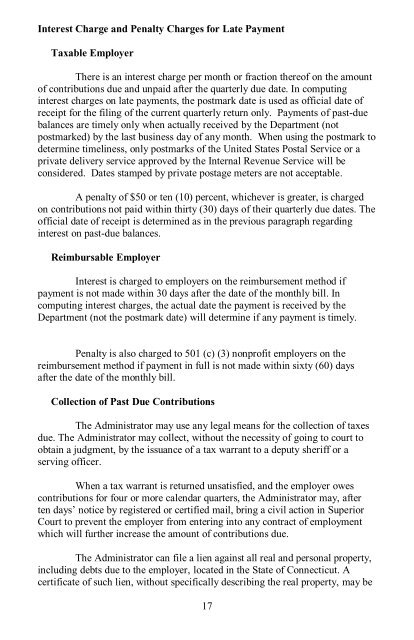

Interest Charge and Penalty Charges for Late Payment<br />

Taxable Employer<br />

There is an interest charge per month or fraction thereof on the amount<br />

of contributions due and unpaid after the quarterly due date. In computing<br />

interest charges on late payments, the postmark date is used as official date of<br />

receipt for the filing of the current quarterly return only. Payments of past-due<br />

balances are timely only when actually received by the Department (not<br />

postmarked) by the last business day of any month. When using the postmark <strong>to</strong><br />

determine timeliness, only postmarks of the United States Postal Service or a<br />

private delivery service approved by the Internal Revenue Service will be<br />

considered. Dates stamped by private postage meters are not acceptable.<br />

A penalty of $50 or ten (10) percent, whichever is greater, is charged<br />

on contributions not paid within thirty (30) days of their quarterly due dates. The<br />

official date of receipt is determined as in the previous paragraph regarding<br />

interest on past-due balances.<br />

Reimbursable Employer<br />

Interest is charged <strong>to</strong> employers on the reimbursement method if<br />

payment is not made within 30 days after the date of the monthly bill. In<br />

computing interest charges, the actual date the payment is received by the<br />

Department (not the postmark date) will determine if any payment is timely.<br />

Penalty is also charged <strong>to</strong> 501 (c) (3) nonprofit employers on the<br />

reimbursement method if payment in full is not made within sixty (60) days<br />

after the date of the monthly bill.<br />

Collection of Past Due Contributions<br />

The Administra<strong>to</strong>r may use any legal means for the collection of taxes<br />

due. The Administra<strong>to</strong>r may collect, without the necessity of going <strong>to</strong> court <strong>to</strong><br />

obtain a judgment, by the issuance of a tax warrant <strong>to</strong> a deputy sheriff or a<br />

serving officer.<br />

When a tax warrant is returned unsatisfied, and the employer owes<br />

contributions for four or more calendar quarters, the Administra<strong>to</strong>r may, after<br />

ten days’ notice by registered or certified mail, bring a civil action in Superior<br />

Court <strong>to</strong> prevent the employer from entering in<strong>to</strong> any contract of employment<br />

which will further increase the amount of contributions due.<br />

The Administra<strong>to</strong>r can file a lien against all real and personal property,<br />

including debts due <strong>to</strong> the employer, located in the State of <strong>Connecticut</strong>. A<br />

certificate of such lien, without specifically describing the real property, may be<br />

17