Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Employer's Guide to Unemployment Compensation - Connecticut ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Rate for Newly Liable Employers<br />

If an employer’s exposure <strong>to</strong> benefit charges commences on or before<br />

July 1st of a given year, the employer does not qualify for an experience rate for<br />

that calendar year or the year which follows. If chargeability begins after July<br />

1st, the employer will not qualify for that calendar year and the two years which<br />

follow.<br />

If the employer’s account has not been chargeable with benefits for a<br />

sufficient period of time <strong>to</strong> be experience rated, his rate is the higher of 1% or<br />

the state’s five-year benefit cost rate. That rate is computed annually by dividing<br />

the <strong>to</strong>tal benefits paid <strong>to</strong> claimants during the five consecutive calendar years<br />

preceding the computation date by the <strong>to</strong>tal amount of taxable wages for the same<br />

period.<br />

Contribution Rate Statements (Form UC-54A) are issued <strong>to</strong> all employers<br />

during the first quarter of each year, including those with insufficient experience<br />

<strong>to</strong> be experience rated.<br />

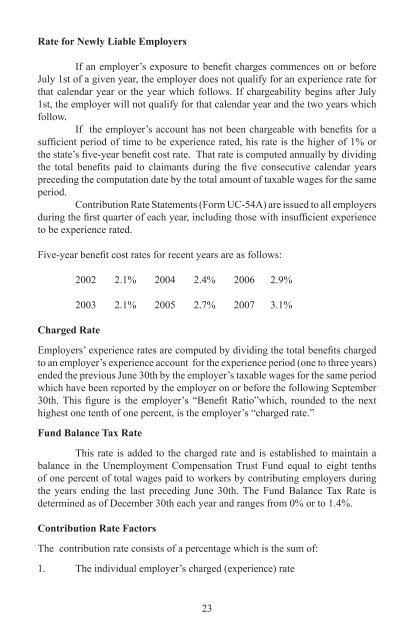

Five-year benefit cost rates for recent years are as follows:<br />

Charged Rate<br />

2002 2.1% 2004 2.4% 2006 2.9%<br />

2003 2.1% 2005 2.7% 2007 3.1%<br />

Employers’ experience rates are computed by dividing the <strong>to</strong>tal benefits charged<br />

<strong>to</strong> an employer’s experience account for the experience period (one <strong>to</strong> three years)<br />

ended the previous June 30th by the employer’s taxable wages for the same period<br />

which have been reported by the employer on or before the following September<br />

30th. This figure is the employer’s “Benefit Ratio”which, rounded <strong>to</strong> the next<br />

highest one tenth of one percent, is the employer’s “charged rate.”<br />

Fund Balance Tax Rate<br />

This rate is added <strong>to</strong> the charged rate and is established <strong>to</strong> maintain a<br />

balance in the <strong>Unemployment</strong> <strong>Compensation</strong> Trust Fund equal <strong>to</strong> eight tenths<br />

of one percent of <strong>to</strong>tal wages paid <strong>to</strong> workers by contributing employers during<br />

the years ending the last preceding June 30th. The Fund Balance Tax Rate is<br />

determined as of December 30th each year and ranges from 0% or <strong>to</strong> 1.4%.<br />

Contribution Rate Fac<strong>to</strong>rs<br />

The contribution rate consists of a percentage which is the sum of:<br />

1. The individual employer’s charged (experience) rate<br />

23