Download Form - Fidelity

Download Form - Fidelity

Download Form - Fidelity

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

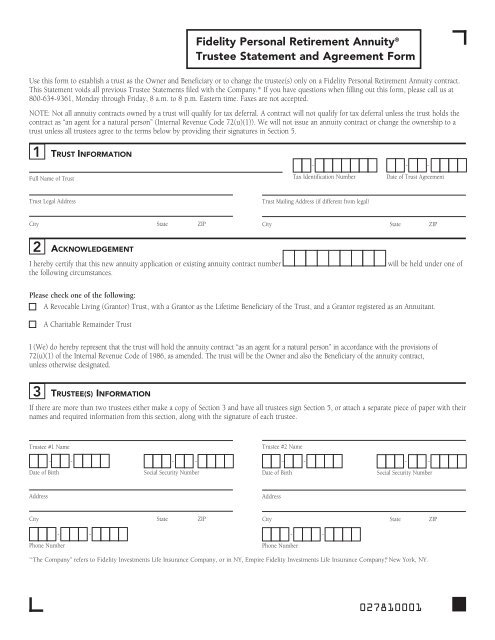

<strong>Fidelity</strong> Personal Retirement Annuity ®<br />

Trustee Statement and Agreement <strong>Form</strong><br />

Use this form to establish a trust as the Owner and Beneficiary or to change the trustee(s) only on a <strong>Fidelity</strong> Personal Retirement Annuity contract.<br />

This Statement voids all previous Trustee Statements filed with the Company.* If you have questions when filling out this form, please call us at<br />

800-634-9361, Monday through Friday, 8 a.m. to 8 p.m. Eastern time. Faxes are not accepted.<br />

NOTE: Not all annuity contracts owned by a trust will qualify for tax deferral. A contract will not qualify for tax deferral unless the trust holds the<br />

contract as “an agent for a natural person” (Internal Revenue Code 72(u)(1)). We will not issue an annuity contract or change the ownership to a<br />

trust unless all trustees agree to the terms below by providing their signatures in Section 5.<br />

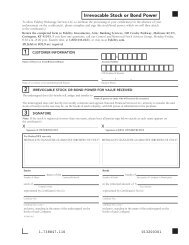

1 TRuST InFoRmATIon<br />

Full Name of Trust<br />

Trust Legal Address<br />

City State ZIP<br />

2 AcknowledgemenT<br />

-<br />

Tax Identification Number<br />

Trust Mailing Address (if different from legal)<br />

- -<br />

Date of Trust Agreement<br />

City State ZIP<br />

I hereby certify that this new annuity application or existing annuity contract number will be held under one of<br />

the following circumstances.<br />

Please check one of the following:<br />

A Revocable Living (Grantor) Trust, with a Grantor as the Lifetime Beneficiary of the Trust, and a Grantor registered as an Annuitant.<br />

A Charitable Remainder Trust<br />

I (We) do hereby represent that the trust will hold the annuity contract “as an agent for a natural person” in accordance with the provisions of<br />

72(u)(1) of the Internal Revenue Code of 1986, as amended. The trust will be the Owner and also the Beneficiary of the annuity contract,<br />

unless otherwise designated.<br />

3 TRuSTee(S) InFoRmATIon<br />

If there are more than two trustees either make a copy of Section 3 and have all trustees sign Section 5, or attach a separate piece of paper with their<br />

names and required information from this section, along with the signature of each trustee.<br />

Trustee #1 Name Trustee #2 Name<br />

- -<br />

- -<br />

- -<br />

Date of Birth<br />

Social Security Number<br />

Date of Birth<br />

Address<br />

City State ZIP<br />

- -<br />

Phone Number<br />

Address<br />

Phone Number<br />

- -<br />

- -<br />

Social Security Number<br />

City State ZIP<br />

* “The Company” refers to <strong>Fidelity</strong> Investments Life Insurance Company, or in NY, Empire <strong>Fidelity</strong> Investments Life Insurance Company, ® New York, NY.<br />

027810001

4 Add oR Remove A TRuSTee (Complete this section only if adding or removing a trustee from an existing trust.)<br />

X<br />

Adding a co-trustee<br />

I (We), (name of co-trustee), certify that I am<br />

(we are) the co-trustee of the above-named trust in accordance with the terms of the trust instrument.<br />

Removing a trustee<br />

Death of trustee. (name of deceased trustee)<br />

Resignation of trustee. I (name of resigning trustee),<br />

certify that I am resigning as trustee of the above-named trust.<br />

SIGNATURE OF RESIGNING TRUSTEE DATE<br />

5 TRuSTee(S) SIgnATuRe(S)<br />

The undersigned trustee(s) certify(ies) that it/he/she is a trustee of the named trust in Section 1 of this form and that it/he/she is authorized to<br />

exercise ownership rights under the contract in accordance with the terms of the trust. The trustee(s) agrees that all transactions made in reliance<br />

upon the statements in Section 2 of this form shall be solely the responsibility of the trustee. The Company has not and will not provide tax advice<br />

with respect to the contract or the trust. The Company intends to report taxes in the same manner as for a contract held by an individual, and<br />

the trustee will be fully responsible for the trust’s tax reporting and payment of any federal, state, or local taxes, penalties, and fees relating to the<br />

contract. The trustee releases the Company and its parent company, affiliates, and subsidiaries from any and all liability regarding the tax reporting<br />

for the contract. The undersigned trustee(s) accepts all responsibility for any taxes that may arise from the ownership of this annuity, including the<br />

10% early withdrawal penalty tax.<br />

X X<br />

SIGNATURE OF TRUSTEE #1 DATE SIGNATURE OF TRUSTEE #2 DATE<br />

NAME AND TITLE OF OFFICER, IF TRUSTEE IS AN INSTITUTION<br />

Please mail this form to: <strong>Fidelity</strong> Investments Life Insurance Company, P.O. Box 770001, Cincinnati, OH 45277-0050<br />

Or in New York: Empire <strong>Fidelity</strong> Investments Life Insurance Company, P.O. Box 770001, Cincinnati, OH 45277-0051<br />

Overnight Mail: <strong>Fidelity</strong> Investments, 100 Crosby Parkway, KC2Q, Covington, KY 41015<br />

<strong>Fidelity</strong> Investments Life Insurance Company is licensed in all states except New York. In New York, insurance products are issued by<br />

Empire <strong>Fidelity</strong> Investments Life Insurance Company, ® New York, NY. Products may not be available in all states. The contract’s financial<br />

guarantees are solely the responsibility of the issuing insurance company.<br />

405339.8.0<br />

1.817266.108<br />

X<br />

SIGNATURE GUARANTEE FOR RESIGNING TRUSTEE<br />

<strong>Fidelity</strong> Brokerage Services LLC, Member NYSE, SIPC