Average versus incremental costs

Average versus incremental costs

Average versus incremental costs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

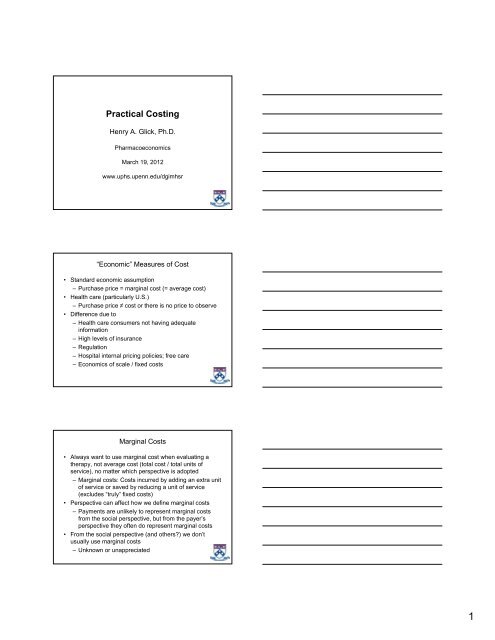

Practical Costing<br />

Henry A. Glick, Ph.D.<br />

Pharmacoeconomics<br />

March 19, 2012<br />

www.uphs.upenn.edu/dgimhsr<br />

“Economic” Measures of Cost<br />

• Standard economic assumption<br />

– Purchase price = marginal cost (= average cost)<br />

• Health care (particularly U.S.)<br />

– Purchase price ≠ cost or there is no price to observe<br />

• Difference due to<br />

– Health care consumers not having adequate<br />

information<br />

– High levels of insurance<br />

– Regulation<br />

– Hospital internal pricing policies; free care<br />

– Economics of scale / fixed <strong>costs</strong><br />

Marginal Costs<br />

• Always want to use marginal cost when evaluating a<br />

therapy, not average cost (total cost / total units of<br />

service), no matter which perspective is adopted<br />

– Marginal <strong>costs</strong>: Costs incurred by adding an extra unit<br />

of service or saved by reducing a unit of service<br />

(excludes “truly” fixed <strong>costs</strong>)<br />

• Perspective can affect how we define marginal <strong>costs</strong><br />

– Payments are unlikely to represent marginal <strong>costs</strong><br />

from the social perspective, but from the payer’s<br />

perspective they often do represent marginal <strong>costs</strong><br />

• From the social perspective (and others?) we don’t<br />

usually use marginal <strong>costs</strong><br />

– Unknown or unappreciated<br />

1

Marginal Costs (2)<br />

• In health care, marginal <strong>costs</strong> generally differ from<br />

average <strong>costs</strong><br />

• What is counted as a marginal cost may vary depending<br />

on how we define the program we are evaluating<br />

– Creation of a new program <strong>versus</strong> expansion of an<br />

existing program<br />

– Temporary program or permanent<br />

– Small program or large<br />

Variable vs Fixed Costs<br />

• Economics textbook assumption: In the short run, labor<br />

is a variable input while capital is a fixed input<br />

• Increasing output from its current level in the “short run”<br />

implies the addition of labor but no addition of capital<br />

(which is assumed to be fixed in the short run)<br />

• Given enough time, capital can be varied<br />

• Implication: short run marginal cost will usually be higher<br />

than long run marginal cost because there is more<br />

freedom to adjust to the ideal level of labor and capital in<br />

the long run<br />

“Discretionary” Fixed Costs<br />

• The fact that some <strong>costs</strong> aren’t observed to change<br />

doesn’t mean they are fixed<br />

• Technically, fixed <strong>costs</strong> are those that are impossible or<br />

foolish to change<br />

– e.g., we might elect to maintain a constant staffing<br />

level independent of number of patients on a ward,<br />

but that’s a choice we make<br />

– We could rent buildings and add or subtract rented<br />

space as volume changes<br />

• Cost of discretionary “fixed” <strong>costs</strong> equals their net benefit<br />

in their next best use<br />

– Often 0, but not always<br />

2

Transactions ≠ Social Costs<br />

• Not all transactions represents social opportunity <strong>costs</strong><br />

– Pure profits (monopoly or fortuitous)<br />

– Fixed <strong>costs</strong><br />

– External benefits<br />

– Transfers<br />

• Social security<br />

• Disability payments<br />

• Unemployment benefits<br />

Translating Service Use to Cost<br />

• If we have collected information about medical service<br />

use, need to translate it into a cost that can be compared<br />

with the measure of study effectiveness<br />

• Common to<br />

– Identify medical service use<br />

– Identify price weights (unit <strong>costs</strong>) and multiply service<br />

use times price weights<br />

– Sum the products<br />

• Alternatively, administrative data -- such as billing<br />

records -- may provide measures of both medical service<br />

use and cost (or expenditure)<br />

Costing Specific Services<br />

3

Outline, Costing Specific Services<br />

• Readily available U.S. data<br />

–Hospital <strong>costs</strong><br />

• Charges and cost-to-charge ratios<br />

• DRGs<br />

• National Inpatient File (HCUP)<br />

– Physician fees<br />

• Medicare Fee schedule<br />

• Hospital outpatient bills<br />

– Other federal fee schedules<br />

– Drug prices<br />

Hospital Costs<br />

• Readily available U.S. hospital cost data<br />

– Charges and Cost to Charge Ratios (Medicare Cost<br />

Report)<br />

– Diagnosis Related Groups (DRGs)<br />

– National Inpatient File<br />

• Hospital accounting data<br />

Cost-To-Charge Ratios<br />

(Medicare Cost Report)<br />

• In US, total charges represent amounts hospitals "bill"<br />

for services, but not how much hospital services actually<br />

cost nor the specific amounts that hospitals receive in<br />

payment<br />

• CMS cost-to-charge ratios represent the quotient of CMS<br />

recognized <strong>costs</strong> divided by hospital charges<br />

(operating+capital CCR)<br />

• Web resource: FY 2011 Impact File<br />

http://www.cms.gov/AcuteInpatientPPS/FFD/itemdetail.asp?filterType=<br />

none&filterByDID=0&sortByDID=1&sortOrder=descending&itemID=<br />

CMS1255464&intNumPerPage=10<br />

4

Cost-To-Charge Ratios<br />

(Medicare Cost Report) (Cont.)<br />

• Advantages<br />

– Readily available from all hospitals<br />

– Uniform methodology<br />

• Disadvantages<br />

– Works on averages (how bad is that?)<br />

– Includes fixed <strong>costs</strong><br />

– Not easy to estimate <strong>costs</strong> of intermediate products<br />

(i.e., bundles of services such as a procedure)<br />

New<br />

England<br />

Mid<br />

Atlantic<br />

South<br />

Atlantic<br />

E.N.<br />

Central<br />

E.S.<br />

Central<br />

2011 Operating Cost-To-Charge Ratios *<br />

Large<br />

Urban<br />

.468<br />

.433<br />

.300<br />

.276<br />

.352<br />

.335<br />

.363<br />

.328<br />

.328<br />

.286<br />

Urban Classification<br />

Other<br />

Urban<br />

.479<br />

.437<br />

.347<br />

.315<br />

.334<br />

.327<br />

.376<br />

.357<br />

.300<br />

.286<br />

Rural<br />

.524<br />

.481<br />

.486<br />

.451<br />

.392<br />

.380<br />

.452<br />

.440<br />

.376<br />

.345<br />

* Row 1, Simple average; Row 2, Weighted by # of beds<br />

W.N.<br />

Central<br />

W.S.<br />

Central<br />

Mountain<br />

Pacific<br />

Puerto<br />

Rico<br />

Total<br />

2011 Operating Cost-To-Charge Ratios<br />

.349<br />

.321<br />

.294<br />

.263<br />

.243<br />

.229<br />

.250<br />

.239<br />

.475<br />

.467<br />

.321<br />

.297<br />

.381<br />

.349<br />

.328<br />

.278<br />

.375<br />

.348<br />

.317<br />

.295<br />

.561<br />

.549<br />

.354<br />

.329<br />

Source: FY_2011_FR_Impact_File.zip<br />

.438<br />

.405<br />

.394<br />

.344<br />

.475<br />

.440<br />

.412<br />

.401<br />

-<br />

-<br />

.419<br />

.391<br />

Total<br />

.482<br />

.439<br />

.344<br />

.297<br />

.355<br />

.337<br />

.388<br />

.352<br />

.345<br />

.304<br />

.394<br />

.349<br />

.343<br />

.283<br />

.373<br />

.310<br />

.284<br />

.259<br />

.506<br />

.492<br />

.359<br />

.320<br />

5

Diagnosis Related Groups (DRGs)<br />

• Are used by Medicare and a large number of insurers to<br />

reimburse hospital services<br />

• DRGs are a set of relative weights for hospitalizations<br />

(identified by ICD-9-CM code and level of concomitant<br />

conditions)<br />

– i.e., the cost of other hospitalizations is reported in<br />

relative terms compared to the cost of an average<br />

hospitalization<br />

– e.g., a hospitalization with a DRG weight of 2.0 is<br />

considered to be twice as costly as a hospitalization<br />

with a DRG weight of 1.0<br />

Initial Development<br />

• DRG weights initially based on relative average charge<br />

for different types of hospitalization<br />

– Hospitalizations assigned to DRGs<br />

– <strong>Average</strong> hospital charge per DRG estimated<br />

– Relative weight derived by dividing DRG-specific<br />

average hospital charge by average charge for all<br />

hospitalizations<br />

• Charges for hospitalizations in individual DRGs were not<br />

very homogeneous<br />

– Use of the DRG weights explained only about 10% of<br />

the variation in charges<br />

Changes, October 2007<br />

• Changed relative weights to reflect <strong>costs</strong> rather than<br />

charges<br />

– Unweighted mean of weights relatively unchanged,<br />

although medical weights on average increased ~1%<br />

while surgical weights on average decreased ~1%<br />

• Expanded concomitant condition coding<br />

– Without; With; With major<br />

• Eliminated age coding<br />

• Changed outlier threshold<br />

• Renumbered DRGs<br />

6

Advantages / Disadvantages<br />

• Advantages<br />

– Readily available<br />

– Uniform methodology<br />

• Disadvantages<br />

– Different conditions in a DRG may have widely<br />

varying <strong>costs</strong><br />

– Cannot (without adjustment) distinguish different<br />

levels of intensity of care within a DRG<br />

– Based originally on charges; did not explain a large<br />

amount of variation<br />

– Do not include physician fees<br />

DRG Web Resource<br />

http://www.cms.gov/acuteinpatientpps/downloads/FY_2011<br />

_FR_Table_5.zip<br />

Surg/<br />

DRG<br />

MDC Med<br />

001<br />

002<br />

263<br />

264<br />

280<br />

281<br />

282<br />

283<br />

284<br />

285<br />

PRE<br />

PRE<br />

05<br />

05<br />

05<br />

05<br />

05<br />

05<br />

05<br />

05<br />

SELECTED DRG DATA (Table 5, 2011)<br />

Surg<br />

Surg<br />

Surg<br />

Surg<br />

Med<br />

Med<br />

Med<br />

Med<br />

Med<br />

Med<br />

Description<br />

Heart transplan or implant w/MCC<br />

Heart transplant or implanc w/o MCC<br />

Vein ligation & stripping<br />

Other circulatory system O.R. proc<br />

Acute MI, discharged alive w/MCC<br />

Acute MI, discharged alive w/CC<br />

Acute MI, discharged alive w/o<br />

CC/MCC<br />

Acute MI, Expired w/MCC<br />

Acute MI, Expired w/CC<br />

Acute MI, expired w/o CC/MCC<br />

Rel<br />

Wght<br />

26.3441 31.6 31.9<br />

13.6127 17.6 22.6<br />

1.7565<br />

2.5305<br />

1.8503<br />

1.1912<br />

0.8064<br />

1.7151<br />

0.8888<br />

0.5712<br />

Geo<br />

LOS<br />

3.5<br />

5.5<br />

5.2<br />

3.6<br />

2.2<br />

3.2<br />

2.1<br />

1.4<br />

Arith<br />

LOS<br />

5.6<br />

8.2<br />

6.6<br />

4.4<br />

2.8<br />

5.1<br />

2.0<br />

1.8<br />

7

DRG Reimbursement<br />

• Relative weights aren't payments<br />

– Payment rates set by Congress annually<br />

• Payment includes base payment, divided into laborrelated<br />

and nonlabor<br />

– Labor-related adjusted by wage index<br />

– Nonlabor adjusted by cost of living adjustment<br />

• Additional percentage add-ons are made if hospital:<br />

– Treats a high-percentage of low income patients<br />

(disproportionate share)<br />

– Is a teaching hospital (indirect medical education)<br />

–Has outlier cases<br />

National Inpatient sample (NIS / HCUP)<br />

• Largest all-payer inpatient care database in the US<br />

• Contains clinical and resource use information included<br />

in a typical discharge abstract<br />

– Only national hospital database containing charge<br />

(cost) information on all patients, regardless of payer<br />

• Has data from approximately 8 million hospital stays<br />

each year<br />

– In 2008, represents 20% stratified sample of U.S.<br />

community hospitals<br />

National Inpatient sample (NIS / HCUP)<br />

• Allows for hospital <strong>costs</strong> by subgroup<br />

– Diagnosis Related Group (DRG) in use on discharge<br />

date<br />

– Diagnoses and procedures<br />

• Hospital, county, and state identifiers for links to other<br />

datasets<br />

• Severity and patient level controls<br />

– Age, gender, race, expected primary and secondary<br />

payer, Median household income for patient's ZIP<br />

Code<br />

8

Other HCUP Databases<br />

• National Kids Inpatient Database (KID)<br />

• Nationwide Emergency Department Sample (NEDS) &<br />

Statewide Emergency Department Databases (SEDD)<br />

• State Ambulatory Surgery Databases (SASD)<br />

HCUP Calculator<br />

http://hcupnet.ahrq.gov/HCUPnet.jsp?Id=BCA3534C7A0C1<br />

C28&Form=SelLAY&JS=Y&Action=%3E%3ENext%3E%<br />

3E&_LAY=Researcher<br />

“National Statistics on All Stays” Create your own<br />

statistics…<br />

All Hosp, 2009<br />

LOS<br />

4.6<br />

(0.0)<br />

Charge<br />

$30,655<br />

(758)<br />

Cost<br />

$9173<br />

(126)<br />

U.S. Physician Data: The Medicare Fee Schedule<br />

• Used by Medicare to reimburse physician services<br />

• Fee schedule is a set of relative value units (RVUs) for<br />

medical services (identified by CPT code)<br />

• RVUs report relative cost of providing a service<br />

– i.e., some service designated as the baseline level of<br />

work (RVU = 1.0); the work for all other services are<br />

reported in relative terms compared to this baseline<br />

– e.g., a service with an RVU of 2.0 represents twice<br />

the work of a service with an RVU of 1.0<br />

9

U.S. Physician Data: The Medicare Fee Schedule (2)<br />

• Separate RVUs were estimated for the work involved in<br />

a procedure (physician work RVUs), malpractice, and for<br />

practice expenses (facility fees)<br />

• Payment = RVU * $/RVU (set annually by Congress)<br />

Initial Development<br />

• RVUs were developed in an extensive study conducted<br />

by clinicians, economists, statisticians, measurement<br />

psychologists, and experts in survey research<br />

• Expert panels of physicians within each specialty<br />

enumerated their different tasks and assigned RVUs to<br />

these tasks within their specialty<br />

• Expert panels of physicians from multiple specialties<br />

developed cross walks between RVUs in each of the<br />

specialties (e.g., an RVU of 1.0 in specialty A might have<br />

been determined to be equivalent to an RVU of 0.95 in<br />

speciality B)<br />

Advantages and Disadvantages<br />

• Advantages<br />

– Readily available<br />

•Files<br />

www.cms.hhs.gov/PhysicianFeeSched/PFSRVF/list.asp<br />

• Look up calculator<br />

https://www.cms.gov/apps/physician-feeschedule/overview.aspx<br />

– Uniform methodology<br />

• Disadvantages<br />

– May be difficult to identify services provided in<br />

individual physician / patient encounters<br />

10

CPT/<br />

HCPCS<br />

99201<br />

99203<br />

99205<br />

Selected 2011 Medicare Fee Schedule RVUs<br />

Description<br />

Office/op visit, new: problem<br />

focused hist & exam; straight<br />

forward med decis making; ~10 min<br />

Office/op visit, new: detailed hist &<br />

exam; med decis making of low<br />

complexity; ~30 min face-to-face<br />

Office/op visit, new: comprehensive<br />

hist & exam; med decis making of<br />

high complexity, ~60 min<br />

* $33.9764 / RVU<br />

Work Tot NF Tot Fac<br />

RVU RVU RVU<br />

0.48<br />

1.42<br />

3.17<br />

1.25<br />

3.13<br />

5.95<br />

0.78<br />

2.28<br />

4.93<br />

“Bundled” Office Visit Costs<br />

• Medical Expenditure Panel Survey Stat Brief #166<br />

Expenses for Office-Based Physician Visits by Specialty,<br />

2004*<br />

– Dentistry: 155<br />

–GP: 101<br />

– Pediatrics: 98<br />

– Ob/Gyn: 153<br />

– Opthalmology 206<br />

– Orthopedics 210<br />

– Psychiatry: 95<br />

– Dermatology: 142<br />

– Other: 235<br />

* Also see #157, Regional Differences in Total and Out-of-Pocket<br />

Expenditures for Selected Types of Office-Based Visits, 2004<br />

Medical Expenditure Panel Survey Statistical Briefs<br />

• #111: Expenses for a Hospital Emergency Room Visit,<br />

2003<br />

– <strong>Average</strong> expenditure*: $560<br />

– <strong>Average</strong> if surgical procedure performed: $904<br />

– <strong>Average</strong> if 1+ nonsurgical services † provided: $637<br />

– <strong>Average</strong> if no special service provided: $302<br />

* Direct payments from individuals, private insurance, Medicare, Medicaid,<br />

Workers’ Compensation, and miscellaneous other sources. Expenditures<br />

include those for both facility and separately billed physicians’ services<br />

† Laboratory test, sonogram or ultrasound, X-ray, mammogram, MRI, CAT<br />

scan EKG, ECG, EEG, vaccination, anesthesia, and other miscellaneous<br />

diagnostic tests<br />

11

2011 Clinical Diagnostic Laboratory Fee Schedule<br />

HCPC<br />

85520<br />

85525<br />

85530<br />

85536<br />

85540<br />

85547<br />

85576<br />

85597<br />

85610<br />

85612<br />

Heparin neutralization<br />

Heparine-protamine tolerance<br />

Iron stain peripheral blood<br />

WBC alkaline phosphatase<br />

RBC mechanical fragility<br />

Blood platelet aggregation<br />

Phospholipid platelet neutralization<br />

Prothrombin time<br />

Viper venom prothrombin time<br />

16.67<br />

19.95<br />

9.11<br />

12.11<br />

12.11<br />

30.23<br />

25.30<br />

5.53<br />

13.47<br />

http://www.cms.hhs.gov/ClinicalLabFeeSched/02_clinlab.asp#TopOfPage<br />

HCPC<br />

A5500<br />

A5501<br />

A5503<br />

A6010<br />

A6023<br />

V2475<br />

V2750<br />

Short Description<br />

Heparin assay<br />

Nat Limit<br />

18.43<br />

2011 Medicare Durable Good Fee Schedule<br />

Short Description<br />

Diab shoe for density insert<br />

Diabetic custom molded shoe<br />

Diabetic shoe w/roller rockr<br />

Collagen based wound filler<br />

Collagen dressing>48 sq in<br />

Tint, any color/solid/grad<br />

Anti-reflective coating<br />

Ceiling<br />

80.03<br />

240.06<br />

39.12<br />

32.48<br />

199.62<br />

12.34<br />

22.93<br />

Mid point<br />

24.90<br />

22.53<br />

26.96<br />

12.31<br />

16.36<br />

16.36<br />

40.85<br />

34.19<br />

7.47<br />

18.2<br />

Floor<br />

60.02<br />

180.05<br />

29.34<br />

27.61<br />

169.68<br />

9.25<br />

17.20<br />

http://www.cms.hhs.gov/DMEPOSFeeSched/LSDMEPOSFEE/<br />

HOME HEALTH VISIT COSTS *<br />

N, Mean<br />

Visit Type Agen. Cost S.D. Min Max<br />

Skilled nurse 4609 87.68 35.10 12.65 756.89<br />

Physical therapist 4287 104.40 43.37 12.29 663.63<br />

Occupat therapist 3492 107.78 52.31 10.20 773.86<br />

Speech therapist 3292 110.50 58.60 10.84 724<br />

Med/Soc services 3661 139.77 82.01 10.20 883.8<br />

Home health aid 4603 40.30 20.97 5.67 848.7<br />

* Cost data used in establishing the Home Health Agency(HHA) Per-Visit Cost Limits for<br />

fiscal periods beginning after October 1, 1999. The cost and statistical data were<br />

obtained from Free Standing Medicare HHA cost reports (Form 1728-94) for full cost<br />

reporting periods beginning on or after October 1, 1994 and settled by March 1998.<br />

Data may no longer be maintained by CMS<br />

12

Medicare Fee Schedules Home Pages<br />

• http://www.cms.hhs.gov/FeeScheduleGenInfo/<br />

• http://www.cms.hhs.gov/ProspMedicareFeeSvcPmtGen/<br />

Drug Prices<br />

• <strong>Average</strong> wholesale price (AWP) has been commonly<br />

used in the literature as an estimate of drug prices<br />

• AWP is an unregulated number that has been found by<br />

courts to be a fairly artificial construct that has been<br />

gamed by the pharmaceutical industry<br />

• Historically, AWP was the average price charged by<br />

wholesalers to providers, like doctors and pharmacies,<br />

derived from an industry-wide formulaic 20%-%25<br />

markup between actual acquisition cost and AWP<br />

• Over time, actual margins have fallen to 2%-3%, and the<br />

20%-25% markups no longer reflect actual wholesaler<br />

margins<br />

ASP<br />

• For non-Part D drugs, Medicare has moved to<br />

reimbursing drugs by use of a small mark-up of average<br />

sales price (ASP)<br />

– ASP represents the sales price including volume<br />

discounts, prompt pay discounts, cash discounts, free<br />

goods that are contingent on any purchase<br />

requirement, chargebacks, and rebates<br />

– Applies to physician-administered drugs (e.g.,<br />

chemotherapy infused in physicians’ offices)<br />

13

AWP / ASP Comparison<br />

• The US Inspector General's office* has reported:<br />

– The median difference between ASP and AWP is<br />

49%<br />

– For generic drugs, ASP is 68% less than AWP at the<br />

median<br />

– For single source brand drugs, ASP is 26% less than<br />

AWP<br />

– For multisource branded drugs, ASP is 30% less<br />

* Medicaid Drug Price Comparison: <strong>Average</strong> Sales Price To <strong>Average</strong><br />

Wholesale Price, Office of the Inspector General, DHHS, June 2005<br />

HCPCS<br />

90658<br />

90716<br />

90647<br />

J0130<br />

J9260<br />

J1438<br />

J3370<br />

J2020<br />

J9182<br />

J3480<br />

J7330<br />

Description<br />

Selected 2009 ASP Prices<br />

Flu vaccine, 3+ years, im<br />

Chicken pox vaccine, sc<br />

HIB, PRP-OMP, im<br />

Abciximab injection<br />

Methotrexate sodium inj<br />

Etanercept injection<br />

Vancomycin hcl injection<br />

Linezolid injection<br />

Etoposide injection<br />

Inj potassium chloride<br />

Cultured chondrocytes, impnt<br />

0.5 ML<br />

10 MG<br />

50 MG<br />

25 MG<br />

500 MG<br />

200 MG<br />

10 MG<br />

2 MEQ<br />

https://www.cms.gov/McrPartBDrugAvgSalesPrice/01_overview.asp#TopOfP<br />

age<br />

AMP<br />

Dosage<br />

0.5 ML<br />

0.5 ML<br />

1<br />

Payment limit<br />

$13.218<br />

$77.651<br />

$23.34<br />

$438.872<br />

$2.201<br />

$180.782<br />

$3.017<br />

$30.23<br />

$0.463<br />

$0.015<br />

$23,102<br />

• Alternatively, Medicaid upper limits are based on<br />

average manufacturers price (AMP) plus a dispensing<br />

fee for pharmaceuticals<br />

– AMP represents the average price paid to the<br />

manufacturer by wholesalers for drugs distributed to<br />

the retail pharmacy class of trade including discounts<br />

and other price concessions provided by the<br />

manufacturer, but without regard to customary prompt<br />

pay discounts extended to wholesalers<br />

14

AWP / AMP Comparison<br />

• The US Inspector General's office* has reported:<br />

– For generic drugs, AMP on average is between 65%<br />

(simple average) and 74% (sales-weighted average)<br />

less than AWP<br />

– For single-branded drugs AMP on average is 25%<br />

less than AWP<br />

– For multisource branded drugs, AMP on average is<br />

between 35% and 40% less than AWP<br />

* Medicaid Drug Price Comparisons: <strong>Average</strong> Manufacturer Price to<br />

Published Prices, Office of the Inspector General, DHHS, June 2005<br />

Thomson Reuters Redbook<br />

• Provides<br />

–AWP<br />

– Wholesale Acquisition Cost (WAC)<br />

– Direct Price (DP)<br />

– Suggested Retail Price (SRP)<br />

– Federal Upper Limit (FUL)<br />

VA Federal Supply Schedule (FSS)<br />

• Some of the most complete / accessable pharmaceutical<br />

price lists<br />

– FSS Big 4 prices (for VA, DoD, PHS, and Coast<br />

Guard) based on vendor’s most favored commercial<br />

customer pricing or statutorily-required pricing<br />

calculations<br />

– FSS Dual prices -- for Other Government Agencies<br />

authorized to use the FSS program -- based on most<br />

favored commercial customer pricing negotiations<br />

• Web address:<br />

http://www.pbm.va.gov/DrugPharmaceuticalPrices.aspx<br />

15