Download - Universiteit Gent

Download - Universiteit Gent

Download - Universiteit Gent

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

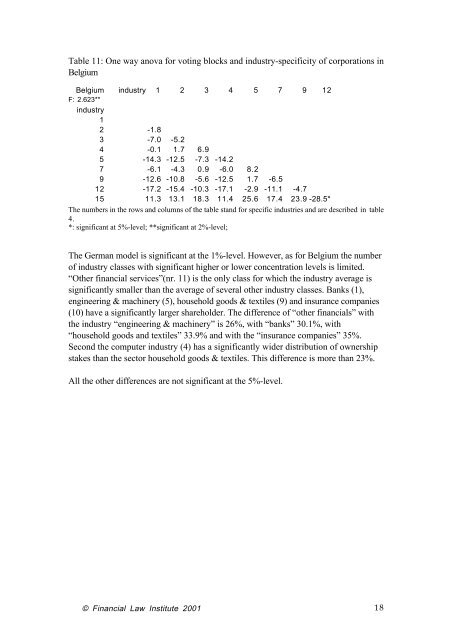

Table 11: One way anova for voting blocks and industry-specificity of corporations in<br />

Belgium<br />

Belgium industry 1 2 3 4 5 7 9 12<br />

F: 2.623**<br />

industry<br />

1<br />

2 -1.8<br />

3 -7.0 -5.2<br />

4 -0.1 1.7 6.9<br />

5 -14.3 -12.5 -7.3 -14.2<br />

7 -6.1 -4.3 0.9 -6.0 8.2<br />

9 -12.6 -10.8 -5.6 -12.5 1.7 -6.5<br />

12 -17.2 -15.4 -10.3 -17.1 -2.9 -11.1 -4.7<br />

15 11.3 13.1 18.3 11.4 25.6 17.4 23.9 -28.5*<br />

The numbers in the rows and columns of the table stand for specific industries and are described in table<br />

4.<br />

*: significant at 5%-level; **significant at 2%-level;<br />

The German model is significant at the 1%-level. However, as for Belgium the number<br />

of industry classes with significant higher or lower concentration levels is limited.<br />

ÒOther financial servicesÓ(nr. 11) is the only class for which the industry average is<br />

significantly smaller than the average of several other industry classes. Banks (1),<br />

engineering & machinery (5), household goods & textiles (9) and insurance companies<br />

(10) have a significantly larger shareholder. The difference of Òother financialsÓ with<br />

the industry Òengineering & machineryÓ is 26%, with ÒbanksÓ 30.1%, with<br />

Òhousehold goods and textilesÓ 33.9% and with the Òinsurance companiesÓ 35%.<br />

Second the computer industry (4) has a significantly wider distribution of ownership<br />

stakes than the sector household goods & textiles. This difference is more than 23%.<br />

All the other differences are not significant at the 5%-level.<br />

© Financial Law Institute 2001 18