Download - Universiteit Gent

Download - Universiteit Gent

Download - Universiteit Gent

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

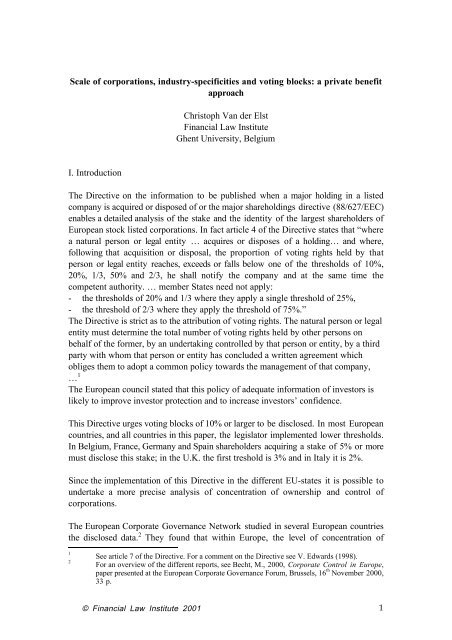

Scale of corporations, industry-specificities and voting blocks: a private benefit<br />

approach<br />

I. Introduction<br />

Christoph Van der Elst<br />

Financial Law Institute<br />

Ghent University, Belgium<br />

The Directive on the information to be published when a major holding in a listed<br />

company is acquired or disposed of or the major shareholdings directive (88/627/EEC)<br />

enables a detailed analysis of the stake and the identity of the largest shareholders of<br />

European stock listed corporations. In fact article 4 of the Directive states that Òwhere<br />

a natural person or legal entity É acquires or disposes of a holdingÉ and where,<br />

following that acquisition or disposal, the proportion of voting rights held by that<br />

person or legal entity reaches, exceeds or falls below one of the thresholds of 10%,<br />

20%, 1/3, 50% and 2/3, he shall notify the company and at the same time the<br />

competent authority. É member States need not apply:<br />

- the thresholds of 20% and 1/3 where they apply a single threshold of 25%,<br />

- the threshold of 2/3 where they apply the threshold of 75%.Ó<br />

The Directive is strict as to the attribution of voting rights. The natural person or legal<br />

entity must determine the total number of voting rights held by other persons on<br />

behalf of the former, by an undertaking controlled by that person or entity, by a third<br />

party with whom that person or entity has concluded a written agreement which<br />

obliges them to adopt a common policy towards the management of that company,<br />

É 1<br />

The European council stated that this policy of adequate information of investors is<br />

likely to improve investor protection and to increase investorsÕ confidence.<br />

This Directive urges voting blocks of 10% or larger to be disclosed. In most European<br />

countries, and all countries in this paper, the legislator implemented lower thresholds.<br />

In Belgium, France, Germany and Spain shareholders acquiring a stake of 5% or more<br />

must disclose this stake; in the U.K. the first treshold is 3% and in Italy it is 2%.<br />

Since the implementation of this Directive in the different EU-states it is possible to<br />

undertake a more precise analysis of concentration of ownership and control of<br />

corporations.<br />

The European Corporate Governance Network studied in several European countries<br />

the disclosed data. 2 They found that within Europe, the level of concentration of<br />

1 See article 7 of the Directive. For a comment on the Directive see V. Edwards (1998).<br />

2 For an overview of the different reports, see Becht, M., 2000, Corporate Control in Europe,<br />

paper presented at the European Corporate Governance Forum, Brussels, 16 th November 2000,<br />

33 p.<br />

© Financial Law Institute 2001 1