Volume I. Part I - California Public Utilities Commission

Volume I. Part I - California Public Utilities Commission

Volume I. Part I - California Public Utilities Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

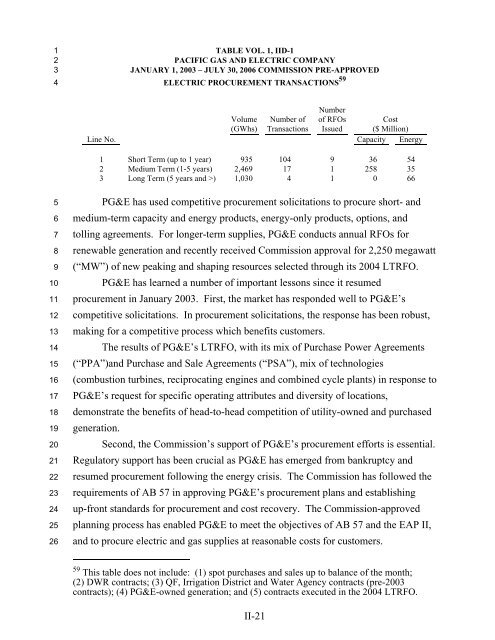

TABLE VOL. 1, IID-1<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

JANUARY 1, 2003 – JULY 30, 2006 COMMISSION PRE-APPROVED<br />

ELECTRIC PROCUREMENT TRANSACTIONS 59<br />

<strong>Volume</strong> Number of<br />

Number<br />

of RFOs Cost<br />

(GWhs) Transactions Issued ($ Million)<br />

Line No. Capacity Energy<br />

1 Short Term (up to 1 year) 935 104 9 36 54<br />

2 Medium Term (1-5 years) 2,469 17 1 258 35<br />

3 Long Term (5 years and >) 1,030 4 1 0 66<br />

PG&E has used competitive procurement solicitations to procure short- and<br />

medium-term capacity and energy products, energy-only products, options, and<br />

tolling agreements. For longer-term supplies, PG&E conducts annual RFOs for<br />

renewable generation and recently received <strong>Commission</strong> approval for 2,250 megawatt<br />

(“MW”) of new peaking and shaping resources selected through its 2004 LTRFO.<br />

PG&E has learned a number of important lessons since it resumed<br />

procurement in January 2003. First, the market has responded well to PG&E’s<br />

competitive solicitations. In procurement solicitations, the response has been robust,<br />

making for a competitive process which benefits customers.<br />

The results of PG&E’s LTRFO, with its mix of Purchase Power Agreements<br />

(“PPA”)and Purchase and Sale Agreements (“PSA”), mix of technologies<br />

(combustion turbines, reciprocating engines and combined cycle plants) in response to<br />

PG&E’s request for specific operating attributes and diversity of locations,<br />

demonstrate the benefits of head-to-head competition of utility-owned and purchased<br />

generation.<br />

Second, the <strong>Commission</strong>’s support of PG&E’s procurement efforts is essential.<br />

Regulatory support has been crucial as PG&E has emerged from bankruptcy and<br />

resumed procurement following the energy crisis. The <strong>Commission</strong> has followed the<br />

requirements of AB 57 in approving PG&E’s procurement plans and establishing<br />

up-front standards for procurement and cost recovery. The <strong>Commission</strong>-approved<br />

planning process has enabled PG&E to meet the objectives of AB 57 and the EAP II,<br />

and to procure electric and gas supplies at reasonable costs for customers.<br />

59 This table does not include: (1) spot purchases and sales up to balance of the month;<br />

(2) DWR contracts; (3) QF, Irrigation District and Water Agency contracts (pre-2003<br />

contracts); (4) PG&E-owned generation; and (5) contracts executed in the 2004 LTRFO.<br />

II-21