Valuing Central Park's Contributions to New York City's ... - Appleseed

Valuing Central Park's Contributions to New York City's ... - Appleseed

Valuing Central Park's Contributions to New York City's ... - Appleseed

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

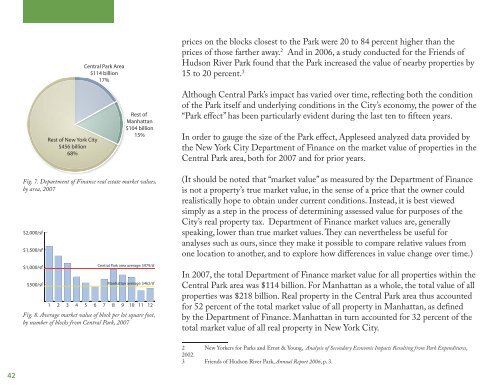

Rest of <strong>New</strong> <strong>York</strong> City<br />

$456 billion<br />

68%<br />

<strong>Central</strong> Park Area<br />

$114 billion<br />

17%<br />

Rest of<br />

Manhattan<br />

$104 billion<br />

15%<br />

Fig. 7. Department of Finance real estate market values,<br />

by area, 2007<br />

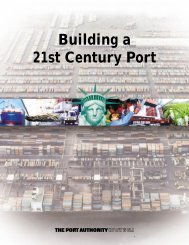

$2,000/sf<br />

$1,500/sf<br />

$1,000/sf<br />

$500/sf<br />

<strong>Central</strong> Park area average: $979/sf<br />

Manhattan average: $462/sf<br />

1 2 3 4 5 6 7 8 9 10 11 12<br />

Fig. 8. Average market value of block per lot square foot,<br />

by number of blocks from <strong>Central</strong> Park, 2007<br />

prices on the blocks closest <strong>to</strong> the Park were 20 <strong>to</strong> 84 percent higher than the<br />

prices of those farther away. 2 And in 2006, a study conducted for the Friends of<br />

Hudson River Park found that the Park increased the value of nearby properties by<br />

15 <strong>to</strong> 20 percent. 3<br />

Although <strong>Central</strong> Park’s impact has varied over time, reflecting both the condition<br />

of the Park itself and underlying conditions in the City’s economy, the power of the<br />

“Park effect” has been particularly evident during the last ten <strong>to</strong> fifteen years.<br />

In order <strong>to</strong> gauge the size of the Park effect, <strong>Appleseed</strong> analyzed data provided by<br />

the <strong>New</strong> <strong>York</strong> City Department of Finance on the market value of properties in the<br />

<strong>Central</strong> Park area, both for 2007 and for prior years.<br />

(It should be noted that “market value” as measured by the Department of Finance<br />

is not a property’s true market value, in the sense of a price that the owner could<br />

realistically hope <strong>to</strong> obtain under current conditions. Instead, it is best viewed<br />

simply as a step in the process of determining assessed value for purposes of the<br />

City’s real property tax. Department of Finance market values are, generally<br />

speaking, lower than true market values. They can nevertheless be useful for<br />

analyses such as ours, since they make it possible <strong>to</strong> compare relative values from<br />

one location <strong>to</strong> another, and <strong>to</strong> explore how differences in value change over time.)<br />

In 2007, the <strong>to</strong>tal Department of Finance market value for all properties within the<br />

<strong>Central</strong> Park area was $114 billion. For Manhattan as a whole, the <strong>to</strong>tal value of all<br />

properties was $218 billion. Real property in the <strong>Central</strong> Park area thus accounted<br />

for 52 percent of the <strong>to</strong>tal market value of all property in Manhattan, as defined<br />

by the Department of Finance. Manhattan in turn accounted for 32 percent of the<br />

<strong>to</strong>tal market value of all real property in <strong>New</strong> <strong>York</strong> City.<br />

2 <strong>New</strong> <strong>York</strong>ers for Parks and Ernst & Young, Analysis of Secondary Economic Impacts Resulting from Park Expenditures,<br />

2002.<br />

3 Friends of Hudson River Park, Annual Report 2006, p. 3.