Valuing Central Park's Contributions to New York City's ... - Appleseed

Valuing Central Park's Contributions to New York City's ... - Appleseed

Valuing Central Park's Contributions to New York City's ... - Appleseed

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

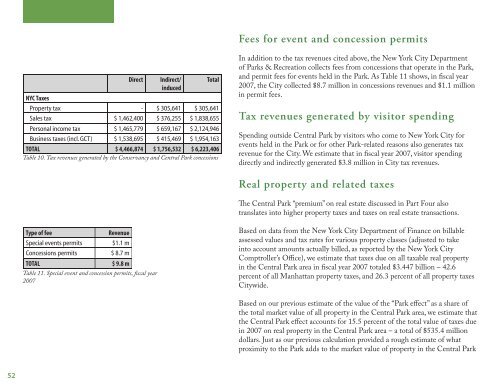

Direct Indirect/<br />

induced<br />

Total<br />

NYC Taxes<br />

Property tax - $ 305,641 $ 305,641<br />

Sales tax $ 1,462,400 $ 376,255 $ 1,838,655<br />

Personal income tax $ 1,465,779 $ 659,167 $ 2,124,946<br />

Business taxes (incl. GCT) $ 1,538,695 $ 415,469 $ 1,954,163<br />

TOTAL $ 4,466,874 $ 1,756,532 $ 6,223,406<br />

Table 10. Tax revenues generated by the Conservancy and <strong>Central</strong> Park concessions<br />

Type of fee Revenue<br />

Special events permits $1.1 m<br />

Concessions permits $ 8.7 m<br />

TOTAL $ 9.8 m<br />

Table 11. Special event and concession permits, fiscal year<br />

2007<br />

Fees for event and concession permits<br />

In addition <strong>to</strong> the tax revenues cited above, the <strong>New</strong> <strong>York</strong> City Department<br />

of Parks & Recreation collects fees from concessions that operate in the Park,<br />

and permit fees for events held in the Park. As Table 11 shows, in fiscal year<br />

2007, the City collected $8.7 million in concessions revenues and $1.1 million<br />

in permit fees.<br />

Tax revenues generated by visi<strong>to</strong>r spending<br />

Spending outside <strong>Central</strong> Park by visi<strong>to</strong>rs who come <strong>to</strong> <strong>New</strong> <strong>York</strong> City for<br />

events held in the Park or for other Park-related reasons also generates tax<br />

revenue for the City. We estimate that in fiscal year 2007, visi<strong>to</strong>r spending<br />

directly and indirectly generated $3.8 million in City tax revenues.<br />

Real property and related taxes<br />

The <strong>Central</strong> Park “premium” on real estate discussed in Part Four also<br />

translates in<strong>to</strong> higher property taxes and taxes on real estate transactions.<br />

Based on data from the <strong>New</strong> <strong>York</strong> City Department of Finance on billable<br />

assessed values and tax rates for various property classes (adjusted <strong>to</strong> take<br />

in<strong>to</strong> account amounts actually billed, as reported by the <strong>New</strong> <strong>York</strong> City<br />

Comptroller’s Office), we estimate that taxes due on all taxable real property<br />

in the <strong>Central</strong> Park area in fiscal year 2007 <strong>to</strong>taled $3.447 billion – 42.6<br />

percent of all Manhattan property taxes, and 26.3 percent of all property taxes<br />

Citywide.<br />

Based on our previous estimate of the value of the “Park effect” as a share of<br />

the <strong>to</strong>tal market value of all property in the <strong>Central</strong> Park area, we estimate that<br />

the <strong>Central</strong> Park effect accounts for 15.5 percent of the <strong>to</strong>tal value of taxes due<br />

in 2007 on real property in the <strong>Central</strong> Park area – a <strong>to</strong>tal of $535.4 million<br />

dollars. Just as our previous calculation provided a rough estimate of what<br />

proximity <strong>to</strong> the Park adds <strong>to</strong> the market value of property in the <strong>Central</strong> Park