Revenues - Deutsche Bahn AG

Revenues - Deutsche Bahn AG

Revenues - Deutsche Bahn AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

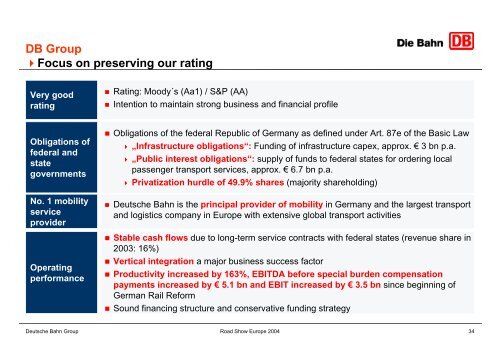

DB Group<br />

Focus on preserving our rating<br />

Very good<br />

rating<br />

Obligations of<br />

federal and<br />

state<br />

governments<br />

No. 1 mobility<br />

service<br />

provider<br />

Operating<br />

performance<br />

Rating: Moody´s (Aa1) / S&P (AA)<br />

Intention to maintain strong business and financial profile<br />

Obligations of the federal Republic of Germany as defined under Art. 87e of the Basic Law<br />

„Infrastructure obligations“: Funding of infrastructure capex, approx. € 3 bn p.a.<br />

„Public interest obligations“: supply of funds to federal states for ordering local<br />

passenger transport services, approx. € 6.7 bn p.a.<br />

Privatization hurdle of 49.9% shares (majority shareholding)<br />

<strong>Deutsche</strong> <strong>Bahn</strong> is the principal provider of mobility in Germany and the largest transport<br />

and logistics company in Europe with extensive global transport activities<br />

Stable cash flows due to long-term service contracts with federal states (revenue share in<br />

2003: 16%)<br />

Vertical integration a major business success factor<br />

Productivity increased by 163%, EBITDA before special burden compensation<br />

payments increased by € 5.1 bn and EBIT increased by € 3.5 bn since beginning of<br />

German Rail Reform<br />

Sound financing structure and conservative funding strategy<br />

<strong>Deutsche</strong> <strong>Bahn</strong> Group Road Show Europe 2004<br />

34