Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

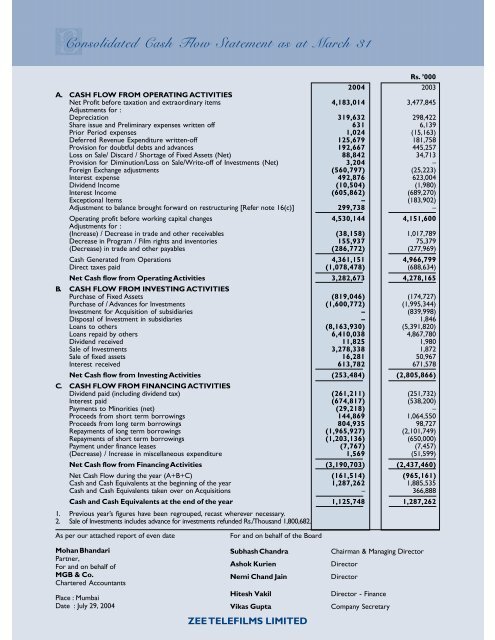

BConsolidated Cash low Statement as at March 31<br />

2004<br />

Rs. ’000<br />

2003<br />

A. CASH LOW ROM OPERATING ACTIVITIES<br />

Net Profit before taxation and extraordinary items<br />

Adjustments for :<br />

4,183,014 3,477,845<br />

Depreciation 319,632 298,422<br />

Share issue and Preliminary expenses written off 631 6,139<br />

Prior Period expenses 1,024 (15,163)<br />

Deferred Revenue Expenditure written-off 125,679 181,758<br />

Provision for doubtful debts and advances 192,667 445,257<br />

Loss on Sale/ Discard / Shortage of ixed Assets (Net) 88,842 34,713<br />

Provision for Diminution/Loss on Sale/Write-off of Investments (Net) 3,204 –<br />

oreign Exchange adjustments (560,797) (25,223)<br />

Interest expense 492,876 623,004<br />

Dividend Income (10,504) (1,980)<br />

Interest Income (605,862) (689,270)<br />

Exceptional Items – (183,902)<br />

Adjustment to balance brought forward on restructuring [Refer note 16(c)] 299,738 –<br />

Operating profit before working capital changes<br />

Adjustments for :<br />

4,530,144 4,151,600<br />

(Increase) / Decrease in trade and other receivables (38,158) 1,017,789<br />

Decrease in Program / ilm rights and inventories 155,937 75,379<br />

(Decrease) in trade and other payables (286,772) (277,969)<br />

Cash Generated from Operations 4,361,151 4,966,799<br />

Direct taxes paid (1,078,478) (688,634)<br />

Net Cash flow from Operating Activities 3,282,673 4,278,165<br />

B. CASH LOW ROM INVESTING ACTIVITIES<br />

Purchase of ixed Assets (819,046) (174,727)<br />

Purchase of / Advances for Investments (1,600,772) (1,995,344)<br />

Investment for Acquisition of subsidiaries – (839,998)<br />

Disposal of Investment in subsidiaries – 1,846<br />

Loans to others (8,163,930) (5,391,820)<br />

Loans repaid by others 6,410,038 4,867,780<br />

Dividend received 11,825 1,980<br />

Sale of Investments 3,278,338 1,872<br />

Sale of fixed assets 16,281 50,967<br />

Interest received 613,782 671,578<br />

Net Cash flow from Investing Activities (253,484) (2,805,866)<br />

C. CASH LOW ROM INANCING ACTIVITIES<br />

Dividend paid (including dividend tax) (261,211) (251,732)<br />

Interest paid (674,817) (538,200)<br />

Payments to Minorities (net) (29,218) –<br />

Proceeds from short term borrowings 144,869 1,064,550<br />

Proceeds from long term borrowings 804,935 98,727<br />

Repayments of long term borrowings (1,965,927) (2,101,749)<br />

Repayments of short term borrowings (1,203,136) (650,000)<br />

Payment under finance leases (7,767) (7,457)<br />

(Decrease) / Increase in miscellaneous expenditure 1,569 (51,599)<br />

Net Cash flow from inancing Activities (3,190,703) (2,437,460)<br />

Net Cash low during the year (A+B+C) (161,514) (965,161)<br />

Cash and Cash Equivalents at the beginning of the year 1,287,262 1,885,535<br />

Cash and Cash Equivalents taken over on Acquisitions – 366,888<br />

Cash and Cash Equivalents at the end of the year 1,125,748 1,287,262<br />

1. Previous year’s figures have been regrouped, recast wherever necessary.<br />

2. Sale of Investments includes advance for investments refunded Rs./Thousand 1,800,682.<br />

As per our attached report of even date<br />

Mohan Bhandari<br />

Partner,<br />

or and on behalf of<br />

MGB & Co.<br />

Chartered Accountants<br />

Place : Mumbai<br />

Date : July 29, 2004<br />

or and on behalf of the Board<br />

Subhash Chandra Chairman & Managing Director<br />

Ashok Kurien Director<br />

Nemi Chand Jain Director<br />

Hitesh Vakil Director - inance<br />

Vikas Gupta Company Secretary<br />

ZEE TELEILMS LIMITED