Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

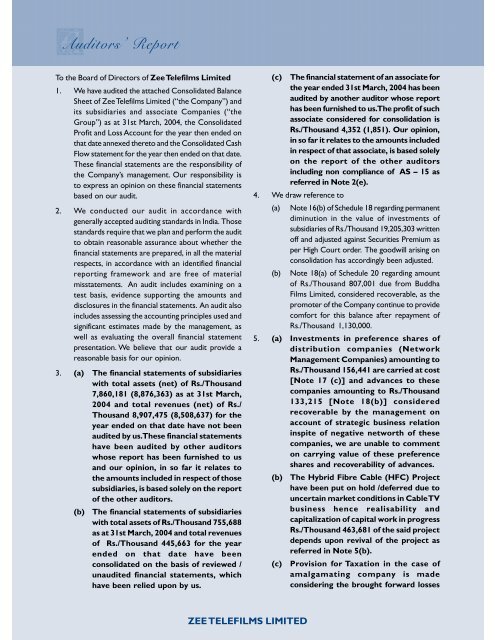

Auditors’ Report<br />

To the Board of Directors of Zee Telefilms Limited<br />

1. We have audited the attached Consolidated Balance<br />

Sheet of Zee Telefilms Limited (“the Company”) and<br />

its subsidiaries and associate Companies (“the<br />

Group”) as at 31st March, 2004, the Consolidated<br />

Profit and Loss Account for the year then ended on<br />

that date annexed thereto and the Consolidated Cash<br />

low statement for the year then ended on that date.<br />

These financial statements are the responsibility of<br />

the Company’s management. Our responsibility is<br />

to express an opinion on these financial statements<br />

based on our audit.<br />

2. We conducted our audit in accordance with<br />

generally accepted auditing standards in India. Those<br />

standards require that we plan and perform the audit<br />

to obtain reasonable assurance about whether the<br />

financial statements are prepared, in all the material<br />

respects, in accordance with an identified financial<br />

reporting framework and are free of material<br />

misstatements. An audit includes examining on a<br />

test basis, evidence supporting the amounts and<br />

disclosures in the financial statements. An audit also<br />

includes assessing the accounting principles used and<br />

significant estimates made by the management, as<br />

well as evaluating the overall financial statement<br />

presentation. We believe that our audit provide a<br />

reasonable basis for our opinion.<br />

3. (a) The financial statements of subsidiaries<br />

with total assets (net) of Rs./Thousand<br />

7,860,181 (8,876,363) as at 31st March,<br />

2004 and total revenues (net) of Rs./<br />

Thousand 8,907,475 (8,508,637) for the<br />

year ended on that date have not been<br />

audited by us. These financial statements<br />

have been audited by other auditors<br />

whose report has been furnished to us<br />

and our opinion, in so far it relates to<br />

the amounts included in respect of those<br />

subsidiaries, is based solely on the report<br />

of the other auditors.<br />

(b) The financial statements of subsidiaries<br />

with total assets of Rs./Thousand 755,688<br />

as at 31st March, 2004 and total revenues<br />

of Rs./Thousand 445,663 for the year<br />

ended on that date have been<br />

consolidated on the basis of reviewed /<br />

unaudited financial statements, which<br />

have been relied upon by us.<br />

ZEE TELEILMS LIMITED<br />

(c) The financial statement of an associate for<br />

the year ended 31st March, 2004 has been<br />

audited by another auditor whose report<br />

has been furnished to us. The profit of such<br />

associate considered for consolidation is<br />

Rs./Thousand 4,352 (1,851). Our opinion,<br />

in so far it relates to the amounts included<br />

in respect of that associate, is based solely<br />

on the report of the other auditors<br />

including non compliance of AS – 15 as<br />

referred in Note 2(e).<br />

4. We draw reference to<br />

(a) Note 16(b) of Schedule 18 regarding permanent<br />

diminution in the value of investments of<br />

subsidiaries of Rs./Thousand 19,205,303 written<br />

off and adjusted against Securities Premium as<br />

per High Court order. The goodwill arising on<br />

consolidation has accordingly been adjusted.<br />

(b) Note 18(a) of Schedule 20 regarding amount<br />

of Rs./Thousand 807,001 due from Buddha<br />

ilms Limited, considered recoverable, as the<br />

promoter of the Company continue to provide<br />

comfort for this balance after repayment of<br />

Rs./Thousand 1,130,000.<br />

5. (a) Investments in preference shares of<br />

distribution companies (Network<br />

Management Companies) amounting to<br />

Rs./Thousand 156,441 are carried at cost<br />

[Note 17 (c)] and advances to these<br />

companies amounting to Rs./Thousand<br />

133,215 [Note 18(b)] considered<br />

recoverable by the management on<br />

account of strategic business relation<br />

inspite of negative networth of these<br />

companies, we are unable to comment<br />

on carrying value of these preference<br />

shares and recoverability of advances.<br />

(b) The Hybrid ibre Cable (HC) Project<br />

have been put on hold /deferred due to<br />

uncertain market conditions in Cable TV<br />

business hence realisability and<br />

capitalization of capital work in progress<br />

Rs./Thousand 463,681 of the said project<br />

depends upon revival of the project as<br />

referred in Note 5(b).<br />

(c) Provision for Taxation in the case of<br />

amalgamating company is made<br />

considering the brought forward losses