Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

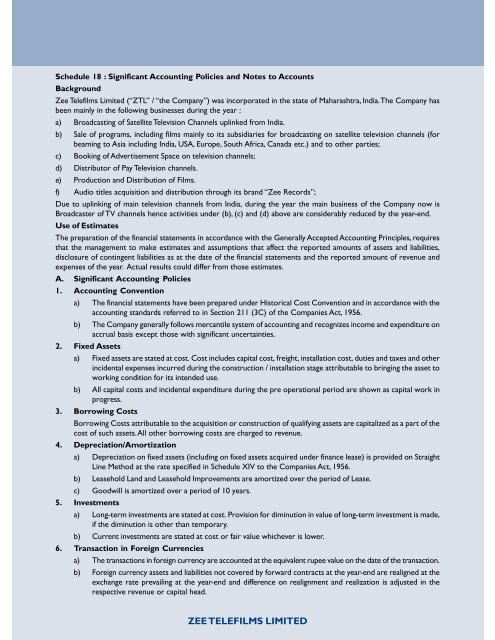

Schedule 18 : Significant Accounting Policies and Notes to Accounts<br />

Background<br />

Zee Telefilms Limited (“ZTL” / “the Company”) was incorporated in the state of Maharashtra, India. The Company has<br />

been mainly in the following businesses during the year :<br />

a) Broadcasting of Satellite Television Channels uplinked from India.<br />

b) Sale of programs, including films mainly to its subsidiaries for broadcasting on satellite television channels (for<br />

beaming to Asia including India, USA, Europe, South Africa, Canada etc.) and to other parties;<br />

c) Booking of Advertisement Space on television channels;<br />

d) Distributor of Pay Television channels.<br />

e) Production and Distribution of ilms.<br />

f) Audio titles acquisition and distribution through its brand “Zee Records”;<br />

Due to uplinking of main television channels from India, during the year the main business of the Company now is<br />

Broadcaster of TV channels hence activities under (b), (c) and (d) above are considerably reduced by the year-end.<br />

Use of Estimates<br />

The preparation of the financial statements in accordance with the Generally Accepted Accounting Principles, requires<br />

that the management to make estimates and assumptions that affect the reported amounts of assets and liabilities,<br />

disclosure of contingent liabilities as at the date of the financial statements and the reported amount of revenue and<br />

expenses of the year. Actual results could differ from those estimates.<br />

A. Significant Accounting Policies<br />

1. Accounting Convention<br />

a) The financial statements have been prepared under Historical Cost Convention and in accordance with the<br />

accounting standards referred to in Section 211 (3C) of the Companies Act, 1956.<br />

b) The Company generally follows mercantile system of accounting and recognizes income and expenditure on<br />

accrual basis except those with significant uncertainties.<br />

2. ixed Assets<br />

a) ixed assets are stated at cost. Cost includes capital cost, freight, installation cost, duties and taxes and other<br />

incidental expenses incurred during the construction / installation stage attributable to bringing the asset to<br />

working condition for its intended use.<br />

b) All capital costs and incidental expenditure during the pre operational period are shown as capital work in<br />

progress.<br />

3. Borrowing Costs<br />

Borrowing Costs attributable to the acquisition or construction of qualifying assets are capitalized as a part of the<br />

cost of such assets. All other borrowing costs are charged to revenue.<br />

4. Depreciation/Amortization<br />

a) Depreciation on fixed assets (including on fixed assets acquired under finance lease) is provided on Straight<br />

Line Method at the rate specified in Schedule XIV to the Companies Act, 1956.<br />

b) Leasehold Land and Leasehold Improvements are amortized over the period of Lease.<br />

c) Goodwill is amortized over a period of 10 years.<br />

5. Investments<br />

a) Long-term investments are stated at cost. Provision for diminution in value of long-term investment is made,<br />

if the diminution is other than temporary.<br />

b) Current investments are stated at cost or fair value whichever is lower.<br />

6. Transaction in oreign Currencies<br />

a) The transactions in foreign currency are accounted at the equivalent rupee value on the date of the transaction.<br />

b) oreign currency assets and liabilities not covered by forward contracts at the year-end are realigned at the<br />

exchange rate prevailing at the year-end and difference on realignment and realization is adjusted in the<br />

respective revenue or capital head.<br />

ZEE TELEILMS LIMITED