Stuart L. Gillan, Jay C. Hartzell, Andrew Koch, and ... - Pitt Business

Stuart L. Gillan, Jay C. Hartzell, Andrew Koch, and ... - Pitt Business

Stuart L. Gillan, Jay C. Hartzell, Andrew Koch, and ... - Pitt Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

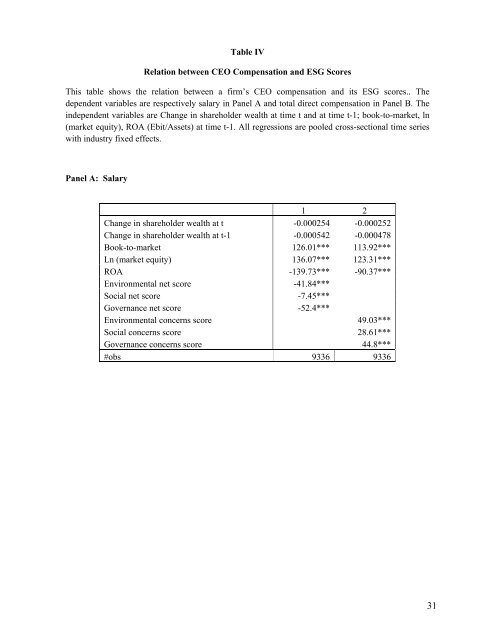

Table IV<br />

Relation between CEO Compensation <strong>and</strong> ESG Scores<br />

This table shows the relation between a firm’s CEO compensation <strong>and</strong> its ESG scores.. The<br />

dependent variables are respectively salary in Panel A <strong>and</strong> total direct compensation in Panel B. The<br />

independent variables are Change in shareholder wealth at time t <strong>and</strong> at time t-1; book-to-market, ln<br />

(market equity), ROA (Ebit/Assets) at time t-1. All regressions are pooled cross-sectional time series<br />

with industry fixed effects.<br />

Panel A: Salary<br />

1 2<br />

Change in shareholder wealth at t -0.000254 -0.000252<br />

Change in shareholder wealth at t-1 -0.000542 -0.000478<br />

Book-to-market 126.01*** 113.92***<br />

Ln (market equity) 136.07*** 123.31***<br />

ROA -139.73*** -90.37***<br />

Environmental net score -41.84***<br />

Social net score -7.45***<br />

Governance net score -52.4***<br />

Environmental concerns score 49.03***<br />

Social concerns score 28.61***<br />

Governance concerns score 44.8***<br />

#obs 9336 9336<br />

31