FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

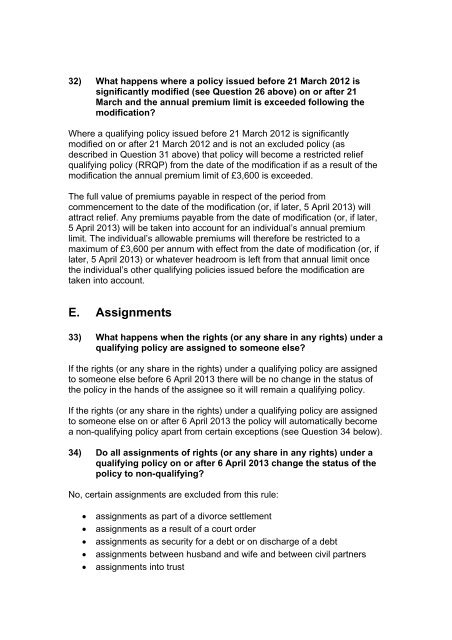

32) What happens where a policy issued before 21 March 2012 is<br />

significantly modified (see Question 26 above) on or after 21<br />

March and the annual premium limit is exceeded following the<br />

modification?<br />

Where a qualifying policy issued before 21 March 2012 is significantly<br />

modified on or after 21 March 2012 and is not an excluded policy (as<br />

described in Question 31 above) that policy will become a restricted relief<br />

qualifying policy (RRQP) from the date of the modification if as a result of the<br />

modification the annual premium limit of £3,600 is exceeded.<br />

The full value of premiums payable in respect of the period from<br />

commencement to the date of the modification (or, if later, 5 April 2013) will<br />

attract relief. Any premiums payable from the date of modification (or, if later,<br />

5 April 2013) will be taken into account for an individual’s annual premium<br />

limit. The individual’s allowable premiums will therefore be restricted to a<br />

maximum of £3,600 per annum with effect from the date of modification (or, if<br />

later, 5 April 2013) or whatever headroom is left from that annual limit once<br />

the individual’s other qualifying policies issued before the modification are<br />

taken into account.<br />

E. Assignments<br />

33) What happens when the rights (or any share in any rights) under a<br />

qualifying policy are assigned to someone else?<br />

If the rights (or any share in the rights) under a qualifying policy are assigned<br />

to someone else before 6 April 2013 there will be no change in the status of<br />

the policy in the hands of the assignee so it will remain a qualifying policy.<br />

If the rights (or any share in the rights) under a qualifying policy are assigned<br />

to someone else on or after 6 April 2013 the policy will automatically become<br />

a non-qualifying policy apart from certain exceptions (see Question 34 below).<br />

34) Do all assignments of rights (or any share in any rights) under a<br />

qualifying policy on or after 6 April 2013 change the status of the<br />

policy to non-qualifying?<br />

No, certain assignments are excluded from this rule:<br />

assignments as part of a divorce settlement<br />

assignments as a result of a court order<br />

assignments as security for a debt or on discharge of a debt<br />

assignments between husband and wife and between civil partners<br />

assignments into trust