FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

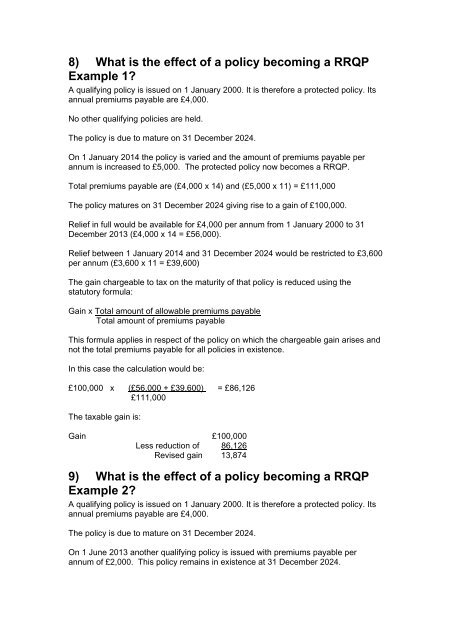

8) What is the effect of a policy becoming a RRQP<br />

Example 1?<br />

A qualifying policy is issued on 1 January 2000. It is therefore a protected policy. Its<br />

annual premiums payable are £4,000.<br />

No other qualifying policies are held.<br />

The policy is due to mature on 31 December 2024.<br />

On 1 January 2014 the policy is varied and the amount of premiums payable per<br />

annum is increased to £5,000. The protected policy now becomes a RRQP.<br />

Total premiums payable are (£4,000 x 14) and (£5,000 x 11) = £111,000<br />

The policy matures on 31 December 2024 giving rise to a gain of £100,000.<br />

Relief in full would be available for £4,000 per annum from 1 January 2000 to 31<br />

December 2013 (£4,000 x 14 = £56,000).<br />

Relief between 1 January 2014 and 31 December 2024 would be restricted to £3,600<br />

per annum (£3,600 x 11 = £39,600)<br />

The gain chargeable to tax on the maturity of that policy is reduced using the<br />

statutory formula:<br />

Gain x Total amount of allowable premiums payable<br />

Total amount of premiums payable<br />

This formula applies in respect of the policy on which the chargeable gain arises and<br />

not the total premiums payable for all policies in existence.<br />

In this case the calculation would be:<br />

£100,000 x (£56,000 + £39,600) = £86,126<br />

£111,000<br />

The taxable gain is:<br />

Gain £100,000<br />

Less reduction of 86,126<br />

Revised gain 13,874<br />

9) What is the effect of a policy becoming a RRQP<br />

Example 2?<br />

A qualifying policy is issued on 1 January 2000. It is therefore a protected policy. Its<br />

annual premiums payable are £4,000.<br />

The policy is due to mature on 31 December 2024.<br />

On 1 June 2013 another qualifying policy is issued with premiums payable per<br />

annum of £2,000. This policy remains in existence at 31 December 2024.