FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

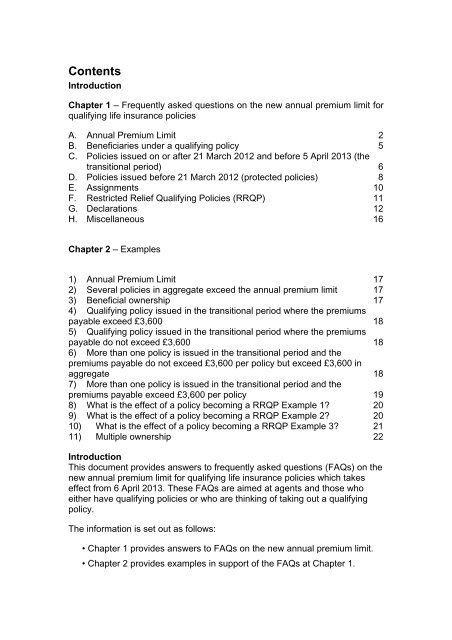

Contents<br />

Introduction<br />

Chapter 1 <strong>–</strong> Frequently asked questions on the new annual premium limit for<br />

qualifying life insurance policies<br />

A. Annual Premium Limit 2<br />

B. Beneficiaries under a qualifying policy 5<br />

C. <strong>Policies</strong> issued on or after 21 March 2012 and before 5 April 2013 (the<br />

transitional period) 6<br />

D. <strong>Policies</strong> issued before 21 March 2012 (protected policies) 8<br />

E. Assignments 10<br />

F. Restricted Relief <strong>Qualifying</strong> <strong>Policies</strong> (RRQP) 11<br />

G. Declarations 12<br />

H. Miscellaneous 16<br />

Chapter 2 <strong>–</strong> Examples<br />

1) Annual Premium Limit 17<br />

2) Several policies in aggregate exceed the annual premium limit 17<br />

3) Beneficial ownership 17<br />

4) <strong>Qualifying</strong> policy issued in the transitional period where the premiums<br />

payable exceed £3,600 18<br />

5) <strong>Qualifying</strong> policy issued in the transitional period where the premiums<br />

payable do not exceed £3,600 18<br />

6) More than one policy is issued in the transitional period and the<br />

premiums payable do not exceed £3,600 per policy but exceed £3,600 in<br />

aggregate 18<br />

7) More than one policy is issued in the transitional period and the<br />

premiums payable exceed £3,600 per policy 19<br />

8) What is the effect of a policy becoming a RRQP Example 1? 20<br />

9) What is the effect of a policy becoming a RRQP Example 2? 20<br />

10) What is the effect of a policy becoming a RRQP Example 3? 21<br />

11) Multiple ownership 22<br />

Introduction<br />

This document provides answers to frequently asked questions (FAQs) on the<br />

new annual premium limit for qualifying life insurance policies which takes<br />

effect from 6 April 2013. These FAQs are aimed at agents and those who<br />

either have qualifying policies or who are thinking of taking out a qualifying<br />

policy.<br />

The information is set out as follows:<br />

• Chapter 1 provides answers to FAQs on the new annual premium limit.<br />

• Chapter 2 provides examples in support of the FAQs at Chapter 1.

Chapter 1<br />

A. Annual Premium Limit<br />

1) What is a qualifying policy?<br />

A qualifying policy is a life insurance policy with a special tax status.<br />

When a qualifying policy comes to an end, or is treated as coming to an end,<br />

it is usually not subject to income tax or capital gains tax.<br />

The conditions that a policy should fulfill if it is to be a qualifying policy are set<br />

out in the <strong>Insurance</strong> Policyholder Taxation Manual<br />

IPTM2020 - <strong>Qualifying</strong> policies and life assurance premium relief: outline of<br />

qualifying policy rules<br />

If you are in any doubt as to whether your policy was issued as a qualifying or<br />

non-qualifying policy, your insurance provider or your financial or tax adviser<br />

will be able to advise you<br />

2) What is the annual limit for a qualifying policy?<br />

From 6 April 2013, the annual limit for premiums payable under qualifying<br />

policies is £3,600 in a 12 month period.<br />

3) Is the annual limit applied as a limit per policy or as an overall<br />

limit?<br />

The annual limit is an aggregate amount that generally applies to all qualifying<br />

policies held by an individual at any one time including transitional period<br />

policies but see also questions 7 (rules applying to protected policies) and 8<br />

(certain exclusions).<br />

Link to Example 1<br />

4) When does the annual premium limit apply?<br />

The annual premium limit applies from 6 April 2013.<br />

5) Can policies be backdated under the annual premium limit rules?<br />

The qualifying policy rules permit the backdating of a policy by three months<br />

(i.e. the policy can be treated as made on an earlier date).<br />

<strong>Policies</strong> made in the 3 month period 21 March 2012 to 21 June 2012 cannot<br />

be backdated to a date before 21 March 2012 for the purposes of the annual<br />

premium limit.

<strong>Policies</strong> made in the period 6 April 2013 to 6 July 2013 cannot be backdated<br />

to a date before 6 April 2013 for the purposes of the annual premium limit.<br />

6) To whom does the annual premium limit apply?<br />

The annual premium limit applies to beneficiaries under a qualifying policy<br />

(see Section B).<br />

7) Does the annual premium limit apply to all qualifying policies held<br />

from 6 April 2013?<br />

The annual premium limit will apply as follows:<br />

(a) All policies issued on or after 6 April 2013<br />

(b) All policies issued in the transitional period (i.e. on or after 21 March<br />

2012 and before 6 April 2013)<br />

(c) <strong>Policies</strong> issued before 21 March 2012 which become restricted relief<br />

qualifying policies after that date (see section F).<br />

8) Are any policies excluded from counting towards in the annual<br />

premium limit?<br />

Yes, the following policies are excluded from the annual premium limit:<br />

Existing protected policies as at 5 April 2013 which secure a capital sum<br />

payable either<br />

on survival for a specified term or on earlier death or<br />

on earlier death or disability and<br />

which have been issued and are maintained for the sole purpose of<br />

ensuring that the borrower under an interest-only mortgage will have<br />

sufficient funds to repay the capital lent under the mortgage<br />

<strong>Policies</strong> (referred to as “pure protection” policies in the legislation) which<br />

have no surrender value and are not capable of acquiring a surrender<br />

value or<br />

under which the benefits payable cannot exceed the amount of the<br />

premiums paid except on death or disability<br />

9) Is a single policy with premiums exceeding £3,600 treated as nonqualifying,<br />

or is relief available up to the threshold?<br />

If the policy is issued on or after 6 April 2013, the whole policy will be nonqualifying<br />

if premiums exceed £3,600 in any 12 month period.<br />

<strong>Policies</strong> issued before this date may be restricted relief qualifying policies<br />

(“RRQPs”) <strong>–</strong> see section F.

10) Where a policy with annual premiums payable of less than £3,600<br />

is treated as non-qualifying because the annual premium limit is<br />

exhausted by existing policies, can that non-qualifying policy<br />

become a qualifying policy if one of the existing qualifying<br />

policies matures or becomes non-qualifying?<br />

No, once the policy is designated a non-qualifying policy because the annual<br />

premium limit has been exceeded, that policy will always remain a nonqualifying<br />

policy.<br />

11) If several policies in aggregate exceed the annual premium limit<br />

can the beneficiary under the policy (see section B below) choose<br />

which policy is the qualifying policy?<br />

If the total annual premiums payable under the combined policies exceed the<br />

annual premium limit, the policy or policies whose premiums cause the limit to<br />

be breached will not be a qualifying policy.<br />

Where the limit has been exceeded, a “last in, first out” approach applies so<br />

that the most recently issued policy or policies will not be a qualifying policy.<br />

Where an earlier policy is modified and, as a result, the annual premium limit<br />

of £3,600 is breached, the “last in, first out” approach still applies but the date<br />

of the modification is substituted for the original issue date. This may cause<br />

the modified policy to become either non-qualifying or a restricted relief<br />

qualifying policy (“RRQP”) <strong>–</strong> see section F, even though its issue date is<br />

earlier.<br />

Link to Example 2<br />

12) What is a cluster policy?<br />

This is where the sum invested by a customer is divided up equally between a<br />

number of identical life insurance policies. These will be separate policies<br />

provided that the policies are genuinely distinct and self-contained and the<br />

documentation supports this. There can be one policy document for all the<br />

clustered policies but it should be clear that the policies are separate and<br />

each policy must be uniquely designated by appropriate sub-numbering.<br />

Ideally, each policy will have a separate policy schedule showing the details of<br />

that policy but a composite schedule may be accepted as evidence of a<br />

cluster policy provided it is clear that it relates to separate policies.<br />

See also the <strong>Insurance</strong> Policyholder Taxation Manual for additional<br />

information on cluster policies.<br />

IPTM7330 - Surrenders and part surrenders: cluster policies

13) How are the non-qualifying policies identified if more than one<br />

policy is issued on the same day or where a cluster policy (see<br />

question 12) is issued and the annual premium limit is exceeded?<br />

Where two or more policies are issued at the same time, the policy whose<br />

unique identifier is lower in either number or letter will be treated as issued<br />

first.<br />

14) What if a cluster policy (see Question 12) has no identifier and the<br />

annual premium limit is exceeded in respect of the cluster as a<br />

whole?<br />

If a cluster policy has no identifier and the annual premium limit is exceeded in<br />

respect of the cluster as a whole then the entire cluster will be treated as nonqualifying.<br />

15) Can the annual premium limit be applied to segments of a single<br />

policy?<br />

The legislation applies to the single policy rather than to each of the segments<br />

within that single policy. The annual premium limit therefore applies to the<br />

single policy.<br />

16) How does the annual premium limit apply to “low start”<br />

endowment policies?<br />

The annual premium limit will apply to premiums payable throughout the life of<br />

the policy. Variable premium policies will be non-qualifying from the outset if<br />

premiums payable will exceed £3,600 in any 12 month period.<br />

B. Beneficiaries under a qualifying policy<br />

17) When is an individual a beneficiary under a qualifying policy?<br />

An individual is a beneficiary under a qualifying policy if he/she is the<br />

beneficial owner of any rights under the policy or any share in rights under the<br />

policy.<br />

18) What is beneficial ownership?<br />

There are two types of ownership, legal and beneficial, that co-exist in any<br />

property:<br />

The legal owner is the person(s) in whose name the property is held or<br />

registered. ‘Legal owner’ includes a trustee or nominee.<br />

The beneficial owner is the person for whose benefit the property is<br />

held.

The same person may be both legal owner and beneficial owner of the life<br />

insurance policy. This will be the case where an owner of the policy holds it<br />

for his own benefit and not as a trustee or nominee for some other person.<br />

There can be a separation of legal and beneficial ownership. In this case the<br />

beneficial owner will be the person who enjoys the benefits of the policy even<br />

though another person is the legal owner.<br />

You are likely to be the beneficial owner if you paid the premium(s) and you<br />

(or your estate after your death) are entitled to any benefits under the policy.<br />

Link to Example 3<br />

19) What about policies held in a bare trust?<br />

A bare trust (sometimes called an ‘absolute’ trust) is where the beneficiary or<br />

beneficiaries has/have immediate and absolute entitlement to trust capital and<br />

income. The ‘beneficiary under the policy’ is the beneficiary of the bare trust.<br />

20) What about policies held under other types of trusts?<br />

Where there is no individual who is the beneficial owner of the rights or any<br />

share in the rights under the qualifying policy (i.e. where there is no absolute<br />

unfettered or unrestricted right to the policy held in trust) the beneficiary for<br />

the purposes of this legislation is the individual who created the trust, known<br />

as the settlor.<br />

C. <strong>Policies</strong> issued on or after 21 March 2012 and<br />

before 6 April 2013 (the transitional period)<br />

21) How are policies issued in the transitional period treated if the<br />

premiums payable exceed £3,600?<br />

If a qualifying policy is issued in the transitional period and the premiums<br />

payable under that policy exceed the annual premium limit of £3,600 which<br />

applies from 6 April 2013, that policy will be a restricted relief qualifying policy<br />

(RRQP) - see section F below.<br />

For RRQPs, this means the full value of the premiums payable in respect of<br />

the period from commencement of the policy up to and including 5 April 2013<br />

will be relieved. Any premiums payable from 6 April onwards will be taken<br />

into account for an individual’s annual premium limit.<br />

The individual’s allowable premiums in respect of that policy will therefore be<br />

restricted to a maximum of £3,600 per annum with effect from 6 April 2013 or<br />

whatever headroom is left from that limit once the individual’s other qualifying<br />

policies (which existed at the time the policy became a RRQP) are taken into<br />

account.

Link to Example 4<br />

22) How are policies issued in the transitional period treated if the<br />

annual premiums payable do not exceed £3,600?<br />

If a qualifying policy is issued in the transitional period and the premiums<br />

payable under that policy do not exceed the annual premium limit of £3,600<br />

which applies from 6 April 2013, the policy will count towards the individual’s<br />

annual premium limit in the period from 6 April 2013.<br />

Link to Example 5<br />

23) How are policies issued in the transitional period treated if more<br />

than one policy is issued and the annual premiums payable do<br />

not exceed £3,600 per policy but exceed £3,600 in aggregate?<br />

If more than one qualifying policy is issued in the transitional period and the<br />

premiums payable under each policy do not exceed the annual premium limit<br />

of £3,600 which applies from 6 April 2013, each of the policies will attract full<br />

relief for premiums payable in respect of the period from which they are taken<br />

out to 5 April 2013.<br />

Each policy will count towards the individual’s annual premium limit in the<br />

period from 6 April 2013.<br />

The later policy that, when aggregated with earlier policies issued in the<br />

transitional period, first results in the annual premium limit of £3,600 being<br />

breached will be a restricted relief qualifying policy (RRQP) as will any<br />

subsequent policies issued in the transitional period <strong>–</strong> see section F.<br />

Link to Example 6<br />

24) How are policies issued in the transitional period treated if more<br />

than one policy is issued and each policy exceeds the annual<br />

premium limit of £3,600?<br />

If more than one qualifying policy is issued in the transitional period and the<br />

premiums payable under each policy exceed the annual premium limit of<br />

£3,600 which applies from 6 April 2013, each of the policies will attract full<br />

relief for premiums payable in respect of the period from which they are taken<br />

out to 5 April 2013.<br />

Each policy will count towards the individual’s annual premium limit in the<br />

period from 6 April 2013 and will be considered by reference to the date they<br />

were taken out commencing with the earliest.<br />

Each policy will be a restricted relief qualifying policy (RRQP) <strong>–</strong> see section F.<br />

Link to Example 7

25) What happens if a policy is issued in the transitional period with<br />

annual premiums payable not exceeding £3,600 and<br />

is subject to significant modification after issue but<br />

before 6 April 2013<br />

and which results in the annual premiums payable under that<br />

policy exceeding £3,600?<br />

If a qualifying policy is issued in the transitional period and the premiums<br />

payable under that policy do not exceed the annual premium limit of £3,600<br />

but that policy is then subject to significant modification (see Question 30<br />

below) after issue but before 6 April 2013 and, as a result of the modification,<br />

the annual premium limit is exceeded, that policy will be a restricted relief<br />

qualifying policy (RRQP) (see section F).<br />

26) Are any policies excluded from inclusion in the annual premium<br />

limit?<br />

Yes, the following transitional period policies are excluded from the annual<br />

premium limit:<br />

Existing protected policies as at 5 April 2013 which secure a capital sum<br />

payable either<br />

on survival for a specified term or on earlier death or<br />

on earlier death or disability and<br />

which have been issued and are maintained for the sole purpose of<br />

ensuring that the borrower under an interest-only mortgage will have<br />

sufficient funds to repay the capital lent under the mortgage<br />

<strong>Policies</strong> (referred to as “pure protection” policies in the legislation) which<br />

have no surrender value and are not capable of acquiring a surrender<br />

value or<br />

under which the benefits payable cannot exceed the amount of the<br />

premiums paid except on death or disability<br />

D. <strong>Policies</strong> issued before 21 March 2012 (protected<br />

policies)<br />

27) What is a protected policy?<br />

A protected policy is a qualifying policy issued before 21 March 2012.<br />

28) Will qualifying policies issued before 21 March 2012 be affected<br />

by the annual premium limit?<br />

<strong>Qualifying</strong> policies issued before 21 March 2012 will not be affected by the<br />

annual premium limit unless:

they are subjected to significant modification (see Question 29 below )<br />

on or after 21 March 2012 or<br />

are assigned (see section E below) on or after 6 April 2013.<br />

29) What is significant modification?<br />

We define “significant modification” of a protected policy as significantly<br />

varying (see Question 30) the terms of the existing policy or substituting a<br />

new policy in place of the existing policy where substituting results in a<br />

significant variation of the existing policy’s terms.<br />

A significant modification does not occur where the only change is in the life<br />

assured under the policy.<br />

A significant modification does not occur where the premiums payable under<br />

a policy are increased or the term of the policy is extended and those<br />

alteration arise from provisions within the contract which have been a feature<br />

of the policy prior to 21 March 2012 which apply automatically. This means<br />

that they are not applied at the instigation of the policyholder or beneficial<br />

owner, or by the exercise of an option.<br />

30) What is significant variation?<br />

By “significant variation” we mean where the policy is amended to extend the<br />

period over which premiums are payable or to increase the total amount of<br />

premiums payable under the policy or both.<br />

31) Are any policies excluded from inclusion in the annual premium<br />

limit?<br />

Yes, the following protected policies are excluded from the annual premium<br />

limit:<br />

Existing protected policies as at 5 April 2013 which secure a capital sum<br />

payable either<br />

on survival for a specified term or on earlier death or<br />

on earlier death or disability and<br />

which have been issued and are maintained for the sole purpose of<br />

ensuring that the borrower under an interest-only mortgage will have<br />

sufficient funds to repay the capital lent under the mortgage<br />

<strong>Policies</strong> (referred to as “pure protection” policies in the legislation) which<br />

have no surrender value and are not capable of acquiring a surrender<br />

value or<br />

under which the benefits payable cannot exceed the amount of the<br />

premiums paid except on death or disability

32) What happens where a policy issued before 21 March 2012 is<br />

significantly modified (see Question 26 above) on or after 21<br />

March and the annual premium limit is exceeded following the<br />

modification?<br />

Where a qualifying policy issued before 21 March 2012 is significantly<br />

modified on or after 21 March 2012 and is not an excluded policy (as<br />

described in Question 31 above) that policy will become a restricted relief<br />

qualifying policy (RRQP) from the date of the modification if as a result of the<br />

modification the annual premium limit of £3,600 is exceeded.<br />

The full value of premiums payable in respect of the period from<br />

commencement to the date of the modification (or, if later, 5 April 2013) will<br />

attract relief. Any premiums payable from the date of modification (or, if later,<br />

5 April 2013) will be taken into account for an individual’s annual premium<br />

limit. The individual’s allowable premiums will therefore be restricted to a<br />

maximum of £3,600 per annum with effect from the date of modification (or, if<br />

later, 5 April 2013) or whatever headroom is left from that annual limit once<br />

the individual’s other qualifying policies issued before the modification are<br />

taken into account.<br />

E. Assignments<br />

33) What happens when the rights (or any share in any rights) under a<br />

qualifying policy are assigned to someone else?<br />

If the rights (or any share in the rights) under a qualifying policy are assigned<br />

to someone else before 6 April 2013 there will be no change in the status of<br />

the policy in the hands of the assignee so it will remain a qualifying policy.<br />

If the rights (or any share in the rights) under a qualifying policy are assigned<br />

to someone else on or after 6 April 2013 the policy will automatically become<br />

a non-qualifying policy apart from certain exceptions (see Question 34 below).<br />

34) Do all assignments of rights (or any share in any rights) under a<br />

qualifying policy on or after 6 April 2013 change the status of the<br />

policy to non-qualifying?<br />

No, certain assignments are excluded from this rule:<br />

assignments as part of a divorce settlement<br />

assignments as a result of a court order<br />

assignments as security for a debt or on discharge of a debt<br />

assignments between husband and wife and between civil partners<br />

assignments into trust

35) What happens when an assignment of rights (or any share in any<br />

rights) under a qualifying policy on or after 6 April 2013 takes<br />

place and one of the exceptions in Question 34 above applies?<br />

For the purposes of the annual premium limit, the assignee must consider the<br />

assigned policy together with all his/her other qualifying policies already<br />

subject to the annual premium limit rules.<br />

This means that he/she must aggregate the total annual premiums payable in<br />

respect of existing qualifying policies issued on or after 6 April 2013 and any<br />

restricted relief qualifying policies (RRQPs) (see section F. below).<br />

If the premiums payable under the assigned policy, when aggregated with the<br />

assignee's other qualifying policies, do not lead the assignee to breach the<br />

annual premium limit of £3,600 the assigned policy will remain a qualifying<br />

policy in the hands of the assignee.<br />

If the premiums payable under the assigned policy, when aggregated with the<br />

assignee's other qualifying policies lead the assignee to breach the annual<br />

premium limit of £3,600 the status of the assigned policy will be as follows:<br />

a qualifying policy issued on or after 6 April 2013 will become nonqualifying<br />

a qualifying policy issued on or after 21 March 2012 and before 6 April<br />

2013 will become an RRQP or remain a RRQP if it already was one.<br />

a qualifying policy issued before 21 March 2012 will become a RRQP<br />

F. Restricted Relief <strong>Qualifying</strong> <strong>Policies</strong> (RRQP)<br />

36) What is a Restricted Relief <strong>Qualifying</strong> Policy (RRQP)?<br />

A RRQP is a qualifying policy that will not have full tax relief when a<br />

chargeable event occurs.<br />

37) When does a qualifying policy become a RRQP?<br />

A qualifying policy becomes a RRQP where:<br />

a qualifying policy is issued on or after 21 March 2012 and before 6<br />

April 2013 where the beneficiary is in breach of the annual premium<br />

limit as a result of the issue of that policy.<br />

an excluded assignment (see Question 34 above) takes place on or<br />

after 6 April 2013 of a qualifying policy issued before 21 March 2012<br />

where the assignment results in the assignee being in breach of their<br />

annual premium limit in respect of that policy.<br />

a qualifying policy issued on or after 21 March 2012 and significantly<br />

modified (see Question 29 above) before 6 April 2013 where the<br />

modification results in the beneficiary being in breach of the annual<br />

premium limit.

the significant modification (see Question 29 above) on or after 21<br />

March 2012 of a qualifying policy issued before 21 March 2012 where<br />

that modification results in the beneficiary being in breach of the annual<br />

premium limit.<br />

38) What is the effect of a policy becoming a RRQP?<br />

The policy attracts full relief for the period up to the date that it becomes a<br />

RRQP. From that date relief is restricted to the balance of the annual premium<br />

limit not used up by other qualifying policies.<br />

Link to Examples 8 -10<br />

G. Declarations<br />

39) When is a declaration required?<br />

A declaration is required where:<br />

a qualifying policy is issued on or after 6 April 2013<br />

where a significant modification (see Question 29 above) is made on or<br />

after 6 April 2013 to an existing qualifying policy<br />

where a qualifying policy is assigned to someone else on or after 6<br />

April and the assignment is an excluded assignment listed in Question<br />

34.<br />

40) Who should make a declaration?<br />

Declarations are to be made by each person who is a beneficiary under the<br />

policy (see section B).<br />

41) Who should make the declaration in the case of a minor?<br />

Minors will usually be represented by a person who has parental responsibility<br />

over them and such a person may make the declaration on behalf of the<br />

minor.<br />

42) To whom must the declaration be made?<br />

The declaration must be made to the insurance company that provided or is<br />

providing the qualifying policy (see Question 44 below)<br />

43) When must the declaration be made?<br />

The declaration must be made within 3 months of the event in Question 39<br />

having taken place.

44) What happens if the 3 month time limit has expired and I have not<br />

made a declaration?<br />

If the time limit for making a declaration has expired the policy will<br />

automatically become a non-qualifying policy and will be treated as being a<br />

non-qualifying policy from the date of its issue, or if relevant a significant<br />

modification or assignment.<br />

<strong>HM</strong>RC will accept late declarations by the beneficial owner where there is a<br />

reasonable excuse for that individual failing to make the declaration. The<br />

declaration must be made without unreasonable delay after the situation<br />

covered by that reasonable excuse ceases to apply.<br />

In such cases late declarations together with an explanation of why the<br />

declaration was made late should be sent to:<br />

<strong>HM</strong> <strong>Revenue</strong> & <strong>Customs</strong>,<br />

CTIAA (Technical) <strong>Insurance</strong> Group,<br />

3c/06, 3rd Floor,<br />

100 Parliament Street<br />

London<br />

SW1A 2BQ<br />

45) What does <strong>HM</strong>RC consider to be a reasonable excuse?<br />

Generally, a 'reasonable excuse' is when some unforeseeable or unusual<br />

event beyond your control has prevented you from making your declaration on<br />

time. A combination of unexpected and foreseeable events may when viewed<br />

together be a reasonable excuse.<br />

It is necessary to consider the actions of the person from the perspective of a<br />

prudent person exercising reasonable foresight and due diligence, having<br />

proper regard for their responsibilities under the Taxes Acts.<br />

If the individual could reasonably have foreseen the event, whether or not it is<br />

within their control, we expect the person to take reasonable steps to be able<br />

meet their obligations.<br />

It is not possible to give a comprehensive list of what might be a reasonable<br />

excuse. It will depend upon the particular circumstances in which the failure to<br />

make a declaration occurred and the particular circumstances and abilities of<br />

the individual who has failed to make the declaration. What is a reasonable<br />

excuse for one person’s circumstances may not be a reasonable excuse for<br />

another person, or the same person in different circumstances.<br />

If there is a reasonable excuse it must exist throughout the affected period.

<strong>HM</strong>RC would normally consider the onset of a serious illness, disability or<br />

serious mental health condition at the same time the declaration was due that<br />

made the individual incapable of making that declaration a reasonable<br />

excuse.<br />

We will not accept an excuse where an individual has not made a reasonable<br />

effort to meet the deadline such as for example, forgetting about the deadline.<br />

The following reasons are also unlikely to be accepted by <strong>HM</strong>RC as a<br />

reasonable excuse:<br />

Pressure of work<br />

Lack of information<br />

<strong>HM</strong>RC/<strong>Insurance</strong> company did not remind me<br />

Ignorance of the law<br />

46) What is meant by unreasonable delay?<br />

The following examples should assist in determining what is meant by<br />

unreasonable delay:<br />

(a) No unreasonable delay<br />

Kate was unable to make a declaration on time due to the death of a family<br />

member and, from the information available, <strong>HM</strong>RC accepted that the<br />

bereavement was a reasonable excuse.<br />

Kate made a declaration two weeks after the funeral.<br />

As Kate had a reasonable excuse for not making the declaration on time,<br />

<strong>HM</strong>RC judged that, based on the facts of this case, the delay in correcting it<br />

was reasonable. The reasonable excuse provision applies so that the policy is<br />

reinstated as a qualifying policy or restricted relief qualifying policy from the<br />

date that it was issued or if relevant the significant modification (see Question<br />

29 above) or assignment was made as appropriate.<br />

(b) Unreasonable delay<br />

Lisa was unable to make a declaration on time due to the death of a family<br />

member and, from the information available, <strong>HM</strong>RC accepted that the<br />

bereavement was a reasonable excuse.<br />

However, Lisa had still not made a declaration for a few months after the<br />

bereavement and did not notify her policy provider (or <strong>HM</strong>RC) of any other<br />

changes to her circumstances.

Although Lisa had a reasonable excuse for not making a declaration on time<br />

due to the death of a family member, based on the facts of this case, by<br />

waiting so long to correct that failure meant that she had failed to take<br />

reasonable care and so the delay became unreasonable. Lisa cannot take<br />

advantage of this provision, so the policy is treated as non-qualifying from the<br />

date of issue or if relevant the date of the significant modification (see<br />

Question 29 above) or assignment as appropriate.<br />

47) Does <strong>HM</strong>RC provide a form on which a declaration may be made?<br />

No, insurance providers may provide the necessary forms for a declaration.<br />

48) What information is required on the declaration?<br />

The following information will be required:<br />

Full name<br />

Address<br />

National insurance number (NINO)<br />

Date of birth<br />

Whether the individual is a beneficiary under another qualifying policy<br />

A statement that the individual has not exceeded the annual premium<br />

limit of £3,600<br />

The policy identification number of the policy<br />

The date the policy was issued<br />

Where the policy is one issued before 6 April 2013 and is significantly<br />

modified on or after 6 April 2013, confirmation of whether the policy<br />

was issued and is being maintained for the sole purpose of ensuring<br />

that the borrower under an interest-only mortgage will have sufficient<br />

funds to repay the capital lent under the mortgage.<br />

Details of a significant variation (see Question 30 above), including the<br />

date from which it applies, of a policy.<br />

The date of assignment and the full name and address of the person to<br />

whom the policy was assigned if the assignment is one of those listed<br />

in Question 34.<br />

The full name and address of the previous beneficiary if the<br />

assignment is one of those listed in Question 34.<br />

Date of declaration.<br />

49) What happens if I make an incorrect/false declaration?<br />

If you make a false/incorrect declaration your policy will be incorrectly treated<br />

as a qualifying policy when a chargeable event gain arises. If you make an<br />

inaccurate self-assessment return or fail to make a self-assessment return as<br />

a consequence of this incorrect treatment when you are liable to tax you will<br />

be required to pay the full amount of tax due together with interest and<br />

penalties for that inaccuracy or failure.

H. Miscellaneous<br />

50) Can the decision to significantly modify (see Question 29) a policy<br />

be reversed?<br />

A significant modification will be ignored if the effect of that modification is<br />

cancelled within 3 months of the day the modification occurred. This<br />

nullification of the modification will not in itself constitute a modification but is<br />

treated as if this change never took place. The policy reverts back to its<br />

original state prior to this change.<br />

If instead of a cancellation described above, an individual decides to modify<br />

the policy again so that for example their premium limit is not breached but is<br />

reduced to the balance of £3,600 relief available, this is treated as another<br />

modification. The loss of qualifying status cannot be reversed in these<br />

circumstances (see Question 10) and so the rectification provisions will not<br />

apply.<br />

51) How are premiums paid under multiple ownership policies treated<br />

for the purposes of each beneficial owner’s annual premium limit?<br />

Where there is more than one beneficial owner of a qualifying policy the<br />

premiums payable under the policy will count in full towards each beneficial<br />

owner’s premium limit of £3,600.<br />

Link to Example 11

Chapter 2<br />

Examples in support of frequently asked questions<br />

1) Annual Premium Limit<br />

Bob takes out a policy that meets all the requirements for a qualifying policy issued<br />

on 7 April 2013 with premiums of £2,500 payable annually. This policy is a qualifying<br />

policy because the premiums payable are under the £3,600 limit.<br />

In May 2014, Bob takes out another policy of which he is the sole beneficial owner<br />

and that meets all the current requirements for a qualifying policy. Annual premiums<br />

are £500. The aggregate of his premiums is £2,500 + £500 = £3,000. This policy is<br />

also a qualifying policy because the aggregate premiums payable do not exceed the<br />

£3,600 limit.<br />

In August 2014, Bob takes out a further policy of which he is the sole beneficial<br />

owner and that meets all the current requirements for a qualifying policy. Annual<br />

premiums are £1,000. Bob must consider his existing premiums in addition to the<br />

new policy to establish whether this is a qualifying policy. In total his premiums are<br />

now £2,500 + £500 + £1,000 = £4,000. His premiums now exceed the annual limit.<br />

As such, the policy issued in August 2014 cannot be a qualifying policy as the £3,600<br />

limit has been exceeded.<br />

2) Several policies in aggregate exceed the annual<br />

premium limit<br />

Jim takes out a policy in May 2013 with annual premiums payable of £3,000.<br />

He is the beneficial owner of a further policy with premiums of £2,000 issued in<br />

February 2014. This additional policy means his total annual premiums now total<br />

£5,000. This takes him over the £3,600 threshold.<br />

Jim cannot choose which policy is qualifying and which is non-qualifying.<br />

Under the last in first out rules, the policy issued in February 2014 will be nonqualifying,<br />

whilst the May 2013 policy will be a qualifying policy.<br />

3) Beneficial ownership<br />

Sally takes out a life policy under her name making herself and Brian, her husband,<br />

the joint beneficiaries under the policy. Sally is the legal owner but both her and her<br />

husband are entitled to the gains that might arise under the policy. They are therefore<br />

joint beneficial owners and jointly liable to income tax on any chargeable event gain.

4) <strong>Qualifying</strong> policy issued in the transitional period<br />

where the premiums payable exceed £3,600<br />

Maria takes out a qualifying policy on 30 March 2012 with annual premiums payable<br />

of £4,000.<br />

The premiums payable exceed the £3,600 annual premium limit.<br />

Relief in full would be available for £4,000 per annum from 30 March 2012 until 5<br />

April 2013.<br />

From 6 April 2013 relief up to £3,600 is available but Maria cannot take out any more<br />

qualifying policies because her annual premium limit is exhausted by the policy she<br />

took out on 30 March 2012.<br />

5) <strong>Qualifying</strong> policy issued in the transitional period<br />

where the premiums payable do not exceed £3,600<br />

Helen takes out a qualifying policy on 30 March 2012 with annual premiums payable<br />

of £2,500.<br />

In May 2014, Helen takes out another policy of which she is the sole beneficial owner<br />

and that meets all the current requirements for a qualifying policy. Annual premiums<br />

are £500. The aggregate of her premiums is £2,500 + £500 = £3,000. This policy is<br />

also a qualifying policy because the aggregate premiums payable do not exceed the<br />

£3,600 limit.<br />

In August 2014, Helen takes out a further policy of which she is the sole beneficial<br />

owner and that meets all the current requirements for a qualifying policy. Annual<br />

premiums are £1,000. Helen must consider her existing premiums in addition to the<br />

new policy to establish whether this is a qualifying policy. In total her premiums are<br />

now £2,500 + £500 + £1,000 = £4,000. Helen's premiums now exceed the annual<br />

limit. As such, the policy issued in August 2014 cannot be a qualifying policy as the<br />

£3,600 limit has been exceeded.<br />

If Helen had taken out a policy with annual premiums payable of £600 instead this<br />

would have used the available balance of her annual premium limit and so would<br />

have been a qualifying policy.<br />

6) More than one policy is issued in the transitional<br />

period and the premiums payable do not exceed<br />

£3,600 per policy but exceed £3,600 in aggregate<br />

Eddie takes out 5 qualifying policies as follows:<br />

30 March 2012<br />

31 March 2012<br />

1 April 2012<br />

2 April 2012<br />

3 April 2012

Each policy has annual premiums payable of £1,000<br />

Relief in full is available for each of the policies for the period from which they are<br />

taken out until 5 April 2013.<br />

From 6 April 2013 relief will be available as follows:<br />

30 March 2012 policy £1,000<br />

31 March 2012 policy £1,000<br />

1 April 2012 policy £1,000<br />

2 April 2012 policy £600<br />

3 April 2012 policy £Nil<br />

7) More than one policy is issued in the transitional<br />

period and the premiums payable exceed £3,600 per<br />

policy<br />

Pamela takes out 5 qualifying policies as follows:<br />

30 March 2012<br />

31 March 2012<br />

1 April 2012<br />

2 April 2012<br />

3 April 2012<br />

Each policy has annual premiums payable of £3,600<br />

Relief in full is available for each of the policies for the period from which they are<br />

taken out until 5 April 2013.<br />

From 6 April 2013 relief will be available as follows:<br />

30 March 2012 policy £3,600<br />

31 March 2012 policy £Nil<br />

1 April 2012 policy £Nil<br />

2 April 2012 policy £Nil<br />

3 April 2012 policy £Nil<br />

While the 4 policies taken out on or after 31 March 2012 will be restricted relief<br />

qualifying policies (“RRQPs”), because Pamela has used up all of her annual<br />

premium limit of £3,600 on the policy issued on 30 March 2012, the available balance<br />

is nil. When the earliest policy matures (assuming that Pamela is not the beneficial<br />

owner of any other policies) the 31 March 2012 policy will attract relief of £3,600 from<br />

the date of the first policy’s maturity.

8) What is the effect of a policy becoming a RRQP<br />

Example 1?<br />

A qualifying policy is issued on 1 January 2000. It is therefore a protected policy. Its<br />

annual premiums payable are £4,000.<br />

No other qualifying policies are held.<br />

The policy is due to mature on 31 December 2024.<br />

On 1 January 2014 the policy is varied and the amount of premiums payable per<br />

annum is increased to £5,000. The protected policy now becomes a RRQP.<br />

Total premiums payable are (£4,000 x 14) and (£5,000 x 11) = £111,000<br />

The policy matures on 31 December 2024 giving rise to a gain of £100,000.<br />

Relief in full would be available for £4,000 per annum from 1 January 2000 to 31<br />

December 2013 (£4,000 x 14 = £56,000).<br />

Relief between 1 January 2014 and 31 December 2024 would be restricted to £3,600<br />

per annum (£3,600 x 11 = £39,600)<br />

The gain chargeable to tax on the maturity of that policy is reduced using the<br />

statutory formula:<br />

Gain x Total amount of allowable premiums payable<br />

Total amount of premiums payable<br />

This formula applies in respect of the policy on which the chargeable gain arises and<br />

not the total premiums payable for all policies in existence.<br />

In this case the calculation would be:<br />

£100,000 x (£56,000 + £39,600) = £86,126<br />

£111,000<br />

The taxable gain is:<br />

Gain £100,000<br />

Less reduction of 86,126<br />

Revised gain 13,874<br />

9) What is the effect of a policy becoming a RRQP<br />

Example 2?<br />

A qualifying policy is issued on 1 January 2000. It is therefore a protected policy. Its<br />

annual premiums payable are £4,000.<br />

The policy is due to mature on 31 December 2024.<br />

On 1 June 2013 another qualifying policy is issued with premiums payable per<br />

annum of £2,000. This policy remains in existence at 31 December 2024.

No other qualifying policies are held.<br />

On 1 January 2014 the first policy is varied and the amount of premiums payable per<br />

annum is increased to £5,000. The protected policy now becomes a RRQP.<br />

Total premiums payable are (£4,000 x 14) and (£5,000 x 11) = £111,000<br />

The policy matures on 31 December 2024 giving rise to a gain of £100,000.<br />

In this case relief for the original policy between 1 January 2014 and 31 December<br />

2024 would be restricted to £1,600 per annum (£1,600 x 11 = £17,600) as a result of<br />

its variation. £2,000 of the annual premium limit is already taken up by the later<br />

qualifying policy issued on 1 June 2013.<br />

The gain chargeable to tax is reduced using the statutory formula:<br />

Gain x Total amount of allowable premiums payable<br />

Total amount of premiums payable<br />

In this case the calculation would be:<br />

£100,000 x (£56,000 + £17,600) = £66,306<br />

£111,000<br />

The taxable gain is:<br />

Gain £100,000<br />

Less reduction of £66,306<br />

Revised gain £33,694<br />

10) What is the effect of a policy becoming a RRQP<br />

Example 3?<br />

A qualifying policy is issued on 1 January 2000. It is therefore a protected policy. Its<br />

annual premiums payable are £4,000.<br />

The policy is due to mature on 31 December 2024.<br />

On 1 June 2013 another qualifying policy is issued with premiums payable per<br />

annum of £3,600. This policy remains in existence at 31 December 2024.<br />

No other qualifying policies are held.<br />

On 1 January 2014 the first policy is varied and the amount of premiums payable per<br />

annum is increased to £5,000. The protected policy now becomes a RRQP.<br />

Total premiums payable are (£4,000 x 14) and (£5,000 x 11) = £111,000<br />

The policy matures on 31 December 2024 giving rise to a gain of £100,000.<br />

In this case relief for the original policy between 1 January 2014 and 31 December<br />

2024 would be restricted to £Nil as a result of its variation. The annual premium limit<br />

is fully used by the later qualifying policy issued on 1 June 2013.

The gain chargeable to tax is reduced using the statutory formula:<br />

Gain x Total amount of allowable premiums payable<br />

Total amount of premiums payable<br />

In this case the calculation would be:<br />

£100,000 x (£56,000 + £Nil) = £50,450<br />

£111,000<br />

The taxable gain is:<br />

Gain £100,000<br />

Less reduction of £50,450<br />

Revised gain £49,550<br />

11) Multiple ownership<br />

Pete and Lucy are the beneficial owners of a policy taken out in May 2014. Annual<br />

premiums under this policy are £3,000.<br />

Pete takes out a further policy in September 2014 with annual premiums payable of<br />

£300.<br />

Lucy takes out a further policy at the same time with annual premiums payable of<br />

£700.<br />

Both of Pete's policies will be qualifying policies because his premiums payable<br />

annually (£3,000 + £300) do not exceed his annual premium limit of £3,600.<br />

The policy taken out by Lucy in September 2014 will be non-qualifying because her<br />

premiums payable annually (£3,000 + £700) exceed his annual premium limit of<br />

£3,600.