FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

FAQ's – Life Insurance – Qualifying Policies - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

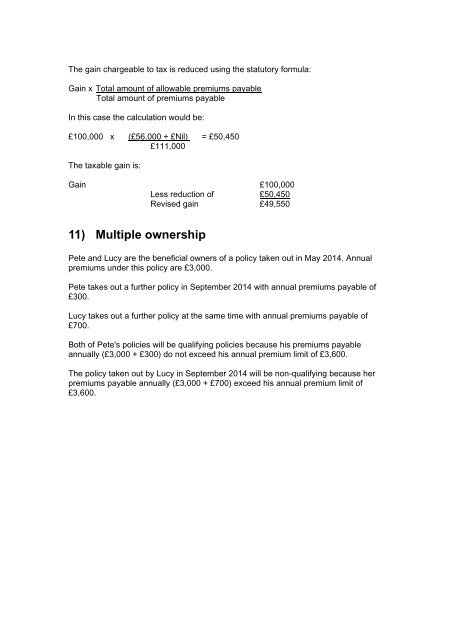

The gain chargeable to tax is reduced using the statutory formula:<br />

Gain x Total amount of allowable premiums payable<br />

Total amount of premiums payable<br />

In this case the calculation would be:<br />

£100,000 x (£56,000 + £Nil) = £50,450<br />

£111,000<br />

The taxable gain is:<br />

Gain £100,000<br />

Less reduction of £50,450<br />

Revised gain £49,550<br />

11) Multiple ownership<br />

Pete and Lucy are the beneficial owners of a policy taken out in May 2014. Annual<br />

premiums under this policy are £3,000.<br />

Pete takes out a further policy in September 2014 with annual premiums payable of<br />

£300.<br />

Lucy takes out a further policy at the same time with annual premiums payable of<br />

£700.<br />

Both of Pete's policies will be qualifying policies because his premiums payable<br />

annually (£3,000 + £300) do not exceed his annual premium limit of £3,600.<br />

The policy taken out by Lucy in September 2014 will be non-qualifying because her<br />

premiums payable annually (£3,000 + £700) exceed his annual premium limit of<br />

£3,600.