Notes to the combined and consolidated financial statements - Mondi

Notes to the combined and consolidated financial statements - Mondi

Notes to the combined and consolidated financial statements - Mondi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>combined</strong> <strong>and</strong><br />

<strong>consolidated</strong> <strong>financial</strong> <strong>statements</strong> continued<br />

for <strong>the</strong> year ended 31 December 2009<br />

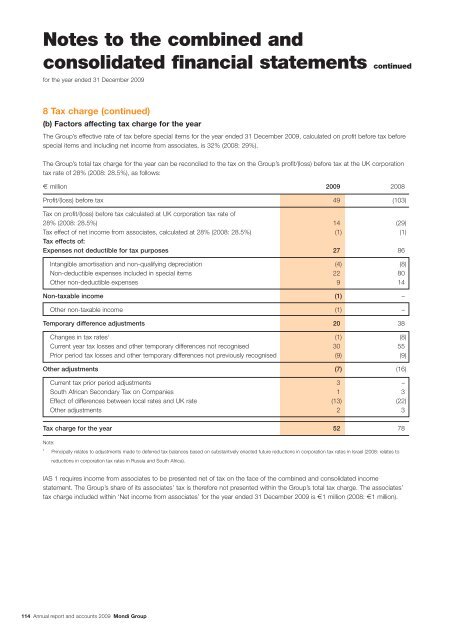

8 Tax charge (continued)<br />

(b) Fac<strong>to</strong>rs affecting tax charge for <strong>the</strong> year<br />

The Group’s effective rate of tax before special items for <strong>the</strong> year ended 31 December 2009, calculated on profit before tax before<br />

special items <strong>and</strong> including net income from associates, is 32% (2008: 29%).<br />

The Group’s <strong>to</strong>tal tax charge for <strong>the</strong> year can be reconciled <strong>to</strong> <strong>the</strong> tax on <strong>the</strong> Group’s profit/(loss) before tax at <strong>the</strong> UK corporation<br />

tax rate of 28% (2008: 28.5%), as follows:<br />

E million 2009 2008<br />

Profit/(loss) before tax 49 (103)<br />

Tax on profit/(loss) before tax calculated at UK corporation tax rate of<br />

28% (2008: 28.5%) 14 (29)<br />

Tax effect of net income from associates, calculated at 28% (2008: 28.5%) (1) (1)<br />

Tax effects of:<br />

Expenses not deductible for tax purposes 27 86<br />

Intangible amortisation <strong>and</strong> non-qualifying depreciation (4) (8)<br />

Non-deductible expenses included in special items 22 80<br />

O<strong>the</strong>r non-deductible expenses 9 14<br />

Non-taxable income (1) –<br />

O<strong>the</strong>r non-taxable income (1) –<br />

Temporary difference adjustments 20 38<br />

Changes in tax rates 1 (1) (8)<br />

Current year tax losses <strong>and</strong> o<strong>the</strong>r temporary differences not recognised 30 55<br />

Prior period tax losses <strong>and</strong> o<strong>the</strong>r temporary differences not previously recognised (9) (9)<br />

O<strong>the</strong>r adjustments (7) (16)<br />

Current tax prior period adjustments 3 –<br />

South African Secondary Tax on Companies 1 3<br />

Effect of differences between local rates <strong>and</strong> UK rate (13) (22)<br />

O<strong>the</strong>r adjustments 2 3<br />

Tax charge for <strong>the</strong> year 52 78<br />

Note:<br />

1<br />

Principally relates <strong>to</strong> adjustments made <strong>to</strong> deferred tax balances based on substantively enacted future reductions in corporation tax rates in Israel (2008: relates <strong>to</strong><br />

reductions in corporation tax rates in Russia <strong>and</strong> South Africa).<br />

IAS 1 requires income from associates <strong>to</strong> be presented net of tax on <strong>the</strong> face of <strong>the</strong> <strong>combined</strong> <strong>and</strong> <strong>consolidated</strong> income<br />

statement. The Group’s share of its associates’ tax is <strong>the</strong>refore not presented within <strong>the</strong> Group’s <strong>to</strong>tal tax charge. The associates’<br />

tax charge included within ‘Net income from associates’ for <strong>the</strong> year ended 31 December 2009 is E1 million (2008: E1 million).<br />

114 Annual report <strong>and</strong> accounts 2009 <strong>Mondi</strong> Group