SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Interest income increased by 10.8% or PHP 1.3 million from PHP 12.5 million in <strong>20</strong>10 to PHP 13.9 million in<br />

<strong>20</strong>11. Interest income in <strong>20</strong>11 and <strong>20</strong>10 are 1.8% and 1.6% of the <strong>20</strong>11 and <strong>20</strong>10 revenue, respectively.<br />

These are mainly due to higher deposits resulting from higher volume of transactions in <strong>20</strong>11.<br />

Interest expense increased by 31.2% or PHP 9.1 million from PHP 29.2 million in <strong>20</strong>10 to PHP 38.3 million<br />

<strong>20</strong>11. Interest expense in <strong>20</strong>11 and <strong>20</strong>10 are -4.9% and -3.8% of the <strong>20</strong>11 and <strong>20</strong>10 revenue, respectively.<br />

These are mainly due to higher availment of loans from bank partners during <strong>20</strong>11 and higher annual interest<br />

rates on the Parent Company’s unsecured, short-term interest-bearing peso-denominated bank loans ranging<br />

from 5.00% to 7.00% in <strong>20</strong>11 and 5.50% to 6.00% in <strong>20</strong>10.<br />

In February <strong>20</strong>10, IREMIT <strong>Remittance</strong> Consulting GmbH (formerly IREMIT EUROPE <strong>Remittance</strong> Consulting<br />

AG) started its remittance business in Italy. On April 28, <strong>20</strong>11, IREMIT <strong>Remittance</strong> Consulting GmbH<br />

(IRCGmbH) stopped its money remittance operations in Rome and Milan in Italy in accordance with Article 75<br />

of the Transitional and Final Provisions of Austrian Payment Services Act, which stipulated that credit<br />

institutions that have held authorizations pursuant to Article 1 paragraph 1 no 23 BWG, as amended by the<br />

Federal Act Federal Law Gazette No. 35/<strong>20</strong>03, prior to December 25, <strong>20</strong>09, have only until April 30, <strong>20</strong>11 to<br />

carry out their money remittance operations.<br />

In December <strong>20</strong>11, IRCGmbH sold assets relating to its operations in Italy to a third party. These assets, with<br />

an aggregate carrying amount of PHP 7.29 million, were sold for a consideration of PHP 72.43 million thereby<br />

resulting to a gain on sale of PHP 65.14 million.<br />

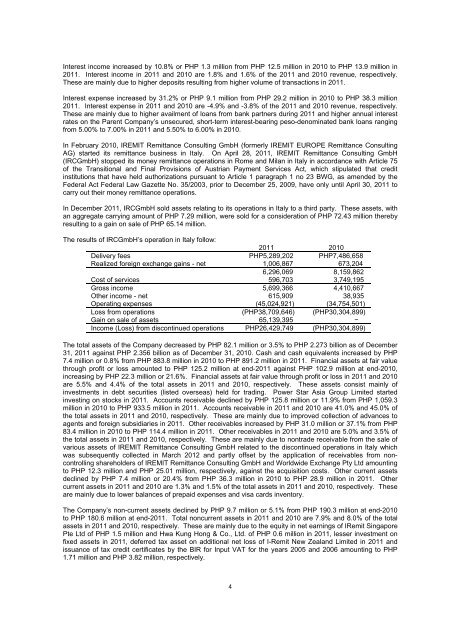

The results of IRCGmbH’s operation in Italy follow:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Delivery fees PHP5,289,<strong>20</strong>2 PHP7,486,658<br />

Realized foreign exchange gains - net 1,006,867 673,<strong>20</strong>4<br />

6,296,069 8,159,862<br />

Cost of services 596,703 3,749,195<br />

Gross income 5,699,366 4,410,667<br />

Other income - net 615,909 38,935<br />

Operating expenses (45,024,921) (34,754,501)<br />

Loss from operations (PHP38,709,646) (PHP30,304,899)<br />

Gain on sale of assets 65,139,395 −<br />

Income (Loss) from discontinued operations PHP26,429,749 (PHP30,304,899)<br />

The total assets of the Company decreased by PHP 82.1 million or 3.5% to PHP 2.273 billion as of December<br />

31, <strong>20</strong>11 against PHP 2.356 billion as of December 31, <strong>20</strong>10. Cash and cash equivalents increased by PHP<br />

7.4 million or 0.8% from PHP 883.8 million in <strong>20</strong>10 to PHP 891.2 million in <strong>20</strong>11. Financial assets at fair value<br />

through profit or loss amounted to PHP 125.2 million at end-<strong>20</strong>11 against PHP 102.9 million at end-<strong>20</strong>10,<br />

increasing by PHP 22.3 million or 21.6%. Financial assets at fair value through profit or loss in <strong>20</strong>11 and <strong>20</strong>10<br />

are 5.5% and 4.4% of the total assets in <strong>20</strong>11 and <strong>20</strong>10, respectively. These assets consist mainly of<br />

investments in debt securities (listed overseas) held for trading. Power Star Asia Group Limited started<br />

investing on stocks in <strong>20</strong>11. Accounts receivable declined by PHP 125.8 million or 11.9% from PHP 1,059.3<br />

million in <strong>20</strong>10 to PHP 933.5 million in <strong>20</strong>11. Accounts receivable in <strong>20</strong>11 and <strong>20</strong>10 are 41.0% and 45.0% of<br />

the total assets in <strong>20</strong>11 and <strong>20</strong>10, respectively. These are mainly due to improved collection of advances to<br />

agents and foreign subsidiaries in <strong>20</strong>11. Other receivables increased by PHP 31.0 million or 37.1% from PHP<br />

83.4 million in <strong>20</strong>10 to PHP 114.4 million in <strong>20</strong>11. Other receivables in <strong>20</strong>11 and <strong>20</strong>10 are 5.0% and 3.5% of<br />

the total assets in <strong>20</strong>11 and <strong>20</strong>10, respectively. These are mainly due to nontrade receivable from the sale of<br />

various assets of IREMIT <strong>Remittance</strong> Consulting GmbH related to the discontinued operations in Italy which<br />

was subsequently collected in March <strong>20</strong>12 and partly offset by the application of receivables from noncontrolling<br />

shareholders of IREMIT <strong>Remittance</strong> Consulting GmbH and Worldwide Exchange Pty Ltd amounting<br />

to PHP 12.3 million and PHP 25.01 million, respectively, against the acquisition costs. Other current assets<br />

declined by PHP 7.4 million or <strong>20</strong>.4% from PHP 36.3 million in <strong>20</strong>10 to PHP 28.9 million in <strong>20</strong>11. Other<br />

current assets in <strong>20</strong>11 and <strong>20</strong>10 are 1.3% and 1.5% of the total assets in <strong>20</strong>11 and <strong>20</strong>10, respectively. These<br />

are mainly due to lower balances of prepaid expenses and visa cards inventory.<br />

The Company’s non-current assets declined by PHP 9.7 million or 5.1% from PHP 190.3 million at end-<strong>20</strong>10<br />

to PHP 180.6 million at end-<strong>20</strong>11. Total noncurrent assets in <strong>20</strong>11 and <strong>20</strong>10 are 7.9% and 8.0% of the total<br />

assets in <strong>20</strong>11 and <strong>20</strong>10, respectively. These are mainly due to the equity in net earnings of IRemit Singapore<br />

Pte Ltd of PHP 1.5 million and Hwa Kung Hong & Co., Ltd. of PHP 0.6 million in <strong>20</strong>11, lesser investment on<br />

fixed assets in <strong>20</strong>11, deferred tax asset on additional net loss of I-Remit New Zealand Limited in <strong>20</strong>11 and<br />

issuance of tax credit certificates by the BIR for Input VAT for the years <strong>20</strong>05 and <strong>20</strong>06 amounting to PHP<br />

1.71 million and PHP 3.82 million, respectively.<br />

4