SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

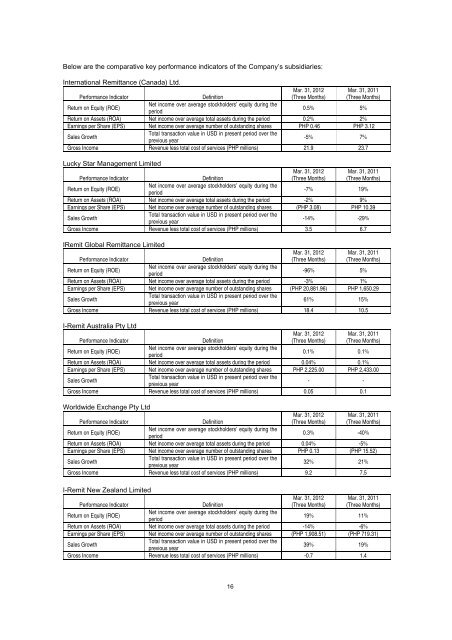

Below are the comparative key performance indicators of the Company’s subsidiaries:<br />

International <strong>Remittance</strong> (Canada) Ltd.<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

0.5% 5%<br />

Return on Assets (ROA) Net income over average total assets during the period 0.2% 2%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares PHP 0.46 PHP 3.12<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

-5% 7%<br />

Gross Income Revenue less total cost of services (PHP millions) 21.9 23.7<br />

Lucky Star Management Limited<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

-7% 19%<br />

Return on Assets (ROA) Net income over average total assets during the period -2% 9%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares (PHP 3.08) PHP 10.39<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

-14% -29%<br />

Gross Income Revenue less total cost of services (PHP millions) 3.5 6.7<br />

IRemit <strong>Global</strong> <strong>Remittance</strong> Limited<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

-96% 5%<br />

Return on Assets (ROA) Net income over average total assets during the period -3% 1%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares (PHP <strong>20</strong>,881.96) PHP 1,650.29<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

61% 15%<br />

Gross Income Revenue less total cost of services (PHP millions) 18.4 10.5<br />

I-Remit Australia Pty Ltd<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

0.1% 0.1%<br />

Return on Assets (ROA) Net income over average total assets during the period 0.04% 0.1%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares PHP 2,225.00 PHP 2,433.00<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

- -<br />

Gross Income Revenue less total cost of services (PHP millions) 0.05 0.1<br />

Worldwide Exchange Pty Ltd<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

0.3% -40%<br />

Return on Assets (ROA) Net income over average total assets during the period 0.04% -5%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares PHP 0.13 (PHP 15.52)<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

32% 21%<br />

Gross Income Revenue less total cost of services (PHP millions) 9.2 7.5<br />

I-Remit New Zealand Limited<br />

Mar. 31, <strong>20</strong>12 Mar. 31, <strong>20</strong>11<br />

Performance Indicator Definition<br />

(Three Months) (Three Months)<br />

Return on Equity (ROE)<br />

Net income over average stockholders’ equity during the<br />

period<br />

19% 11%<br />

Return on Assets (ROA) Net income over average total assets during the period -14% -6%<br />

Earnings per Share (EPS) Net income over average number of outstanding shares (PHP 1,908.51) (PHP 719.31)<br />

Sales Growth<br />

Total transaction value in USD in present period over the<br />

previous year<br />

39% 19%<br />

Gross Income Revenue less total cost of services (PHP millions) -0.7 1.4<br />

16