RICS Annual Review 2012

RICS Annual Review 2012

RICS Annual Review 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

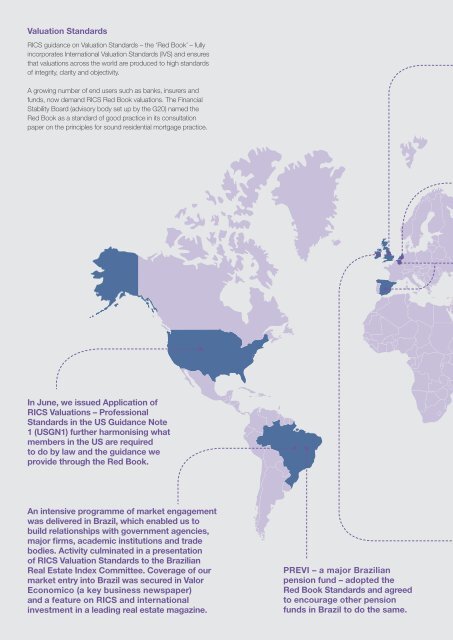

Valuation Standards<br />

<br />

<br />

that valuations across the world are produced to high standards<br />

of integrity, clarity and objectivity.<br />

A growing number of end users such as banks, insurers and<br />

funds, now demand <strong>RICS</strong> Red Book valuations. The Financial<br />

Stability Board (advisory body set up by the G20) named the<br />

Red Book as a standard of good practice in its consultation<br />

paper on the principles for sound residential mortgage practice.<br />

In June, we issued Application of<br />

<strong>RICS</strong> Valuations – Professional<br />

Standards in the US Guidance Note<br />

1 (USGN1) further harmonising what<br />

members in the US are required<br />

to do by law and the guidance we<br />

provide through the Red Book.<br />

An intensive programme of market engagement<br />

was delivered in Brazil, which enabled us to<br />

build relationships with government agencies,<br />

major firms, academic institutions and trade<br />

bodies. Activity culminated in a presentation<br />

of <strong>RICS</strong> Valuation Standards to the Brazilian<br />

Real Estate Index Committee. Coverage of our<br />

market entry into Brazil was secured in Valor<br />

Economico (a key business newspaper)<br />

and a feature on <strong>RICS</strong> and international<br />

investment in a leading real estate magazine.<br />

PREVI – a major Brazilian<br />

pension fund – adopted the<br />

Red Book Standards and agreed<br />

to encourage other pension<br />

funds in Brazil to do the same.