RICS Annual Review 2012

RICS Annual Review 2012

RICS Annual Review 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ics.org

Advancing standards<br />

and professionalism<br />

in land, property and<br />

construction<br />

<strong>RICS</strong> is the world’s leading professional qualification when it comes to land,<br />

property and construction.<br />

Wherever you are in the world, the designation ‘<strong>RICS</strong>’ stands for professional<br />

excellence, expertise and integrity. This is why over 100 000 professionals have<br />

recognised the importance of securing <strong>RICS</strong> status by becoming members.<br />

Given the close link between property markets and economic performance,<br />

people, governments, banks, commercial organisations and employers are<br />

looking for more certainty around standards and ethics.<br />

As one of the few professions to have established arm’s length self regulation<br />

of our members and firms, <strong>RICS</strong> is able to set and maintain the highest standards,<br />

whilst operating as an independent organisation in the public interest.<br />

Our overarching body, <strong>RICS</strong> Governing Council, has a clear vision for the<br />

organisation – to be recognised in key worldwide markets as the body that<br />

sets and enforces professional standards and offers access to the most<br />

sought after professional status.<br />

To achieve Governing Council’s vision we established four corporate goals<br />

for 2011/<strong>2012</strong>:<br />

achieve recognition of <strong>RICS</strong> standards by markets and governments<br />

provide professionals with leading edge products, services and information<br />

be recognised as a leader in ‘responsible business’ practices<br />

make <strong>RICS</strong> more agile to take advantage of new opportunities.<br />

In this annual review, which covers August 2011 to July <strong>2012</strong>, we provide a<br />

snapshot of the year’s achievements in meeting our goals and in realising<br />

Governing Council’s vision. We also report on financial performance and look<br />

ahead to some of the key issues on our agenda for the forthcoming year.

Achieve recognition<br />

of <strong>RICS</strong> standards by<br />

markets and governments<br />

(See pages 10–17)<br />

Provide professionals<br />

with leading edge<br />

products, services<br />

and information<br />

(See pages 18–21)<br />

Be recognised as a<br />

leader in ‘responsible<br />

business’ practices<br />

(See pages 22–23)<br />

Make <strong>RICS</strong> more agile<br />

to take advantage of<br />

new opportunities<br />

(See pages 24–25)<br />

Contents<br />

Introduction<br />

Foreword from the President 04<br />

Message from the Chief Executive 06<br />

Highlights of the year 08<br />

The Economist’s view 09<br />

Corporate performance<br />

Goal one – recognition of standards 10<br />

Goal two – equipping leading edge professionals 18<br />

Goal three – responsible business 22<br />

Goal four – agile approach to new opportunities 24<br />

<strong>RICS</strong> membership 26<br />

Membership growth 28<br />

Group financial statements 30<br />

Group income statement 31<br />

Group balance sheet 32<br />

Group cashflow statement 33<br />

Notes to the summary financial statement 34<br />

Independent auditors’ statement 35<br />

<strong>RICS</strong> governance structure 36<br />

<strong>RICS</strong> management structure 38

Foreword

Foreword from<br />

the President<br />

As markets worldwide continue to seek pathways out of the global financial crisis,<br />

professionalism is emerging as a core component of the solution. Professionalism<br />

creates trust and leads to confidence in the market.<br />

Surveying is at the heart of the market. It touches every part of our lives: the spaces<br />

where we work, live and play; the infrastructure that underpins and connects them, and<br />

the legal and financial aspects governing and enabling their use and ownership. <strong>RICS</strong><br />

members are active in sectors as diverse as sustainable urban development; affordable<br />

housing; capital markets; urban and rural infrastructure; project management and<br />

business valuation.<br />

Over the past year <strong>RICS</strong> has gone from strength to strength in both new and established<br />

markets. Today we have some 114 000 members and trainees in over 140 countries<br />

– a genuinely global network of professionals.<br />

With growing demand for professionalism, <strong>RICS</strong> has become the leading proponent of<br />

internationally recognised standards that provide reassurance to developers, investors,<br />

lenders and consumers. Standards enable meaningful comparisons, leading to wellinformed<br />

decisions. They provide for certainty, transparency and the most efficient use<br />

of scarce resources.<br />

Our international presence helps us to achieve international standards. I therefore pay<br />

tribute to my immediate predecessor, See Lian Ong, who did so much to forge new<br />

partnerships for <strong>RICS</strong> in China, Japan and throughout Asia.<br />

Just a few of our most significant achievements during the last year include:<br />

<br />

of Business and Intangible Assets was introduced as a chartered discipline<br />

<br />

New Rules of Measurement (NRM) in April<br />

<br />

<br />

<br />

<br />

<strong>RICS</strong>’ leading position today is testament to the strong and highly effective partnership<br />

between our staff and members. Over 1 000 members give their time freely to sit on <strong>RICS</strong><br />

boards and committees, or to act as assessors and mentors. This partnership and shared<br />

commitment to the highest standards is perhaps our greatest strength; it gives life to the<br />

profession and enables us to deliver the many achievements featured in this review.<br />

Alan Collett F<strong>RICS</strong><br />

<strong>RICS</strong> President <strong>2012</strong>/2013<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 05

Message<br />

from the Chief<br />

Executive<br />

Against a background of continuing challenge in some of our key<br />

markets, I’m delighted to be able to report significant progress<br />

during the year towards realising our Governing Council’s vision<br />

‘to be recognised in key worldwide markets as the body that sets<br />

and enforces professional standards and offers access to the most<br />

sought after professional status’.<br />

Recent world events have demonstrated beyond doubt the vital<br />

role of land, property and the built environment in underpinning<br />

vibrant and sustainable economies. As I talk to employers,<br />

industry leaders, government ministers and those who use our<br />

members’ services around our markets, I am constantly struck<br />

by the clear and increasing demand for professional standards<br />

and ethical practice. In a word, we are being asked to provide<br />

confidence, in both the competence and the integrity of our<br />

profession as a vital component in the success of developed<br />

and emerging markets.<br />

Achieving recognition by markets and governments<br />

Building market and stakeholder trust and recognition is therefore<br />

our core purpose. We do this very specifically by targeting<br />

employers, end users, governments and opinion formers, seeking<br />

formal adoption and endorsement of <strong>RICS</strong> qualifications and<br />

standards. The year has seen some outstanding examples<br />

of recognition for <strong>RICS</strong> members and standards around the<br />

<br />

<br />

<br />

on Construction Standards and the New Rules of Measurement,<br />

launched in April <strong>2012</strong>. There are many more examples of how<br />

we are raising the status of the profession in this review.<br />

Establishing <strong>RICS</strong> in Brazil<br />

<br />

relationships with key government agencies, major firms, academic<br />

<br />

about building the profile of the profession, partnering with senior<br />

real estate professionals to identify and promote best practice<br />

through <strong>RICS</strong> standards and guidance. We recruited a full-time<br />

Regional Manager to build recognition of <strong>RICS</strong> and manage the<br />

<br />

Board and Membership Development Committee were established<br />

to help guide various initiatives and align us with the market.<br />

<br />

areas of particular success.<br />

Promoting the profession<br />

<br />

showcased by London Olympics <strong>2012</strong>, as they build capacity<br />

for vital infrastructure, commercial and residential developments.<br />

<br />

four years, is one of those countries. In September <strong>2012</strong> I was<br />

<br />

<br />

Along with the Prime Minister I met many leading figures including<br />

<br />

professional body to be represented in the influential delegation<br />

of 30 business leaders, demonstrating that we are really achieving<br />

our vision to gain market recognition for our standards – a huge win<br />

for <strong>RICS</strong> and the profession, and a personal honour. I look forward<br />

to maximising the opportunity we have earned by showcasing the<br />

advances being made by the profession worldwide.<br />

Strengthening confidence in valuation<br />

<br />

<br />

<br />

<br />

<br />

<br />

always been to ensure that these standards, which underpin so<br />

much economic activity around the world, are being maintained<br />

and correctly applied. The new intake of members brings the total<br />

<br />

<br />

about the quality and consistency of valuation advice following<br />

<br />

demonstrates the value that professional regulation provides to<br />

underpin high standards and support markets globally. Monitoring<br />

activity has continued to take place for registered valuers operating<br />

<br />

very successful and has demonstrated that the model works<br />

<br />

Influence, profile and credibility<br />

Our economic commentary and research programme continued<br />

to earn attention and respect, supported by high quality media<br />

coverage across the world on a wide range of issues including<br />

Public Private Partnerships, future trends in corporate real estate in<br />

global cities as well as our regular surveys on property market trends.<br />

Enhancing continuing professional development<br />

Governing Council approved a new policy for continuing<br />

professional development (CPD) which will be introduced from<br />

1 January 2013. In response to member feedback, we have<br />

outlined a clearer policy, including a 20 hour annual commitment<br />

to CPD and mandatory ethics training at least once every three<br />

years. This policy will make it simpler for <strong>RICS</strong> members to comply<br />

and to demonstrate how they stand apart from their competitors.<br />

We have implemented a new online CPD management system to<br />

make it simpler for members to record their CPD, and therefore for<br />

<strong>RICS</strong> to assess compliance highlighting member competence and<br />

excellence as fundamental to raising standards in the profession.<br />

Sean Tompkins<br />

<strong>RICS</strong> Chief Executive

2011/<strong>2012</strong><br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 07

Highlights<br />

of the year<br />

March <strong>2012</strong><br />

Clear and<br />

simple ethical<br />

standards<br />

launched<br />

April <strong>2012</strong><br />

<strong>RICS</strong> members’<br />

role in London<br />

<strong>2012</strong> celebrated<br />

July <strong>2012</strong><br />

Corporate Twitter<br />

account had over<br />

20 000 followers<br />

at year’s end<br />

July <strong>2012</strong><br />

First firm in<br />

the Americas<br />

became ‘Regulated<br />

by <strong>RICS</strong>’, bringing<br />

regulated firms<br />

worldwide to 10 500<br />

July <strong>2012</strong><br />

Corporate<br />

LinkedIn account<br />

had over 27 000<br />

members by the<br />

end of the year<br />

Across the year<br />

Real Estate Agency<br />

and Brokerage<br />

Standards endorsed<br />

by major firms<br />

across the globe<br />

January <strong>2012</strong><br />

New route to<br />

membership<br />

launched<br />

– professional<br />

experience route<br />

(PER)<br />

July <strong>2012</strong><br />

Nearly 14 000<br />

Registered<br />

Valuers<br />

worldwide by<br />

end of year<br />

February <strong>2012</strong><br />

Valuation of<br />

business and<br />

intangible assets<br />

pathway launched<br />

– the first new one<br />

in almost 10 years

July <strong>2012</strong><br />

Our dispute<br />

resolution service<br />

now operates in<br />

every state and<br />

territory in Australia<br />

March <strong>2012</strong><br />

Won a AUD<br />

$650 000<br />

government tender<br />

to produce help<br />

for SME tenants<br />

on energy saving<br />

July <strong>2012</strong><br />

Nearly 13 000<br />

registered web<br />

class users on our<br />

Online Academy<br />

The<br />

Economist’s<br />

view<br />

There was understandable optimism that <strong>2012</strong> would be the year<br />

when the world economy finally began to shrug off the legacy of<br />

the credit crunch and the subsequent recession. However growth<br />

expectations have been progressively downgraded as the year has<br />

advanced and this trend has not just been a feature of the so-<br />

<br />

significant slowing in the pace of activity while the Chinese economy<br />

has seen growth moderate from in excess of 9% to something<br />

<br />

In response to the more sluggish business climate central banks,<br />

and in some cases governments, have been taking steps to try<br />

<br />

meant more in the way of unorthodox monetary policy, in<br />

<br />

interest rates have been lowered, reserve requirements relaxed<br />

and in some cases, a fiscal stimulus provided. It is too early to<br />

say how successful this set of measures will prove given the<br />

significant headwinds that will continue to emerge from the<br />

<br />

<br />

Meanwhile, the real estate sector has continued to display a<br />

measure of resilience away from the more mature economies.<br />

So slower, but still positive, growth in the B<strong>RICS</strong> has, for example,<br />

largely underpinned both the commercial and residential property<br />

sectors in these countries. The construction sector, meanwhile, has<br />

continued to be a source of growth in much of the emerging world<br />

albeit a less dynamic one than was previously the case.<br />

In the more mature parts of the world, finance remains a very real<br />

issue for real estate. This has contributed to a very real divergence<br />

in interest between ‘hot’ properties where purchases have often<br />

been funded by equity and the rest. The latter have more typically<br />

struggled against the backdrop of weak economic activity,<br />

oversupply (in some cases) and a shortfall of debt funding. However<br />

<br />

(the epicentre of the original crisis) may finally be beginning to turn<br />

around after experiencing the most dramatic of falls in both sales<br />

and prices.<br />

Looking forward, there are good reasons for believing that 2013<br />

will be a better year from a macro perspective than <strong>2012</strong> with<br />

policymakers now beginning to recognise the scale of the actions<br />

needed to deal with a credit induced recession. However, it<br />

would be foolish to assume that growth will be significantly higher,<br />

particularly in the west. Fiscal programmes will continue to be<br />

geared towards public sector debt reduction and indeed, the scale<br />

of the tightening in policy could in some countries accelerate.<br />

At the same time, the emerging world may re-emerge as a more<br />

vigorous driver of global growth. This may be particularly so if<br />

the measures currently being taken to rebalance some of these<br />

economies towards domestic consumption and away from<br />

reliance on exports to the west are successful.<br />

Simon Rubinsohn<br />

<strong>RICS</strong> Chief Economist<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 09

Achieve<br />

recognition of<br />

<strong>RICS</strong> standards<br />

by markets and<br />

governments<br />

The major focus of much of our activity during the year was to<br />

establish the importance of our standards and the role of <strong>RICS</strong><br />

and its members in global economies. During our reporting year<br />

we achieved some notable successes in gaining recognition in<br />

markets and with governments around the world.<br />

Real Estate Agency and Brokerage Standards<br />

<br />

gained major traction globally with governments and key<br />

employers. Several international firms formally recognised and<br />

<br />

<br />

to endorse and recognise their commitment to adopt the<br />

<br />

<br />

for China as well.

REABS was translated into<br />

a number of languages<br />

including Chinese, Dutch,<br />

French, German and Italian<br />

From the Baltics to Spain and from France to Sweden<br />

<br />

by multinational firms such as BNP Paribas, Aguirre<br />

Newman, Colliers, Axis Property and Catella, to name<br />

but a few.<br />

It wasn’t only <strong>RICS</strong> members and their firms who<br />

<br />

<br />

Practice Checklist. At its official launch <strong>RICS</strong> was<br />

acknowledged as a major contributor.<br />

<br />

into a number of languages including Chinese, Dutch,<br />

French, German and Italian.<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 11

Valuation Standards<br />

<br />

<br />

that valuations across the world are produced to high standards<br />

of integrity, clarity and objectivity.<br />

A growing number of end users such as banks, insurers and<br />

funds, now demand <strong>RICS</strong> Red Book valuations. The Financial<br />

Stability Board (advisory body set up by the G20) named the<br />

Red Book as a standard of good practice in its consultation<br />

paper on the principles for sound residential mortgage practice.<br />

In June, we issued Application of<br />

<strong>RICS</strong> Valuations – Professional<br />

Standards in the US Guidance Note<br />

1 (USGN1) further harmonising what<br />

members in the US are required<br />

to do by law and the guidance we<br />

provide through the Red Book.<br />

An intensive programme of market engagement<br />

was delivered in Brazil, which enabled us to<br />

build relationships with government agencies,<br />

major firms, academic institutions and trade<br />

bodies. Activity culminated in a presentation<br />

of <strong>RICS</strong> Valuation Standards to the Brazilian<br />

Real Estate Index Committee. Coverage of our<br />

market entry into Brazil was secured in Valor<br />

Economico (a key business newspaper)<br />

and a feature on <strong>RICS</strong> and international<br />

investment in a leading real estate magazine.<br />

PREVI – a major Brazilian<br />

pension fund – adopted the<br />

Red Book Standards and agreed<br />

to encourage other pension<br />

funds in Brazil to do the same.

In the UK, Baroness Hanham, Communities<br />

and Local Government Minister in the House<br />

of Lords, recognised the value of our<br />

Valuation Standards during a debate on the<br />

Local Government Finance Bill. While Baroness<br />

Hayter highlighted the professional standards<br />

of surveyors as a model for the financial<br />

services sector to follow in a debate on the<br />

Financial Services Bill in the House of Lords.<br />

Following a consultation period<br />

with our kindred body, the<br />

Society of Chartered Surveyors<br />

in Ireland (SCSI), a new chapter<br />

on residential mortgage valuations<br />

in Ireland has been developed as<br />

part of the Red Book. Approved<br />

and endorsed by <strong>RICS</strong>, this was<br />

officially launched in June.<br />

The Association of Banks in the Netherlands<br />

agreed to prescribe the Red Book and <strong>RICS</strong><br />

accreditation to their members, for larger<br />

portfolios and buildings of considerable value.<br />

PricewaterhouseCoopers<br />

in Benelux agreed to obtain<br />

Red Book valuations for<br />

all their audited real estate<br />

portfolios. In Spain Knight<br />

Frank and Spanish valuation<br />

body Tasadora Thirsa signed<br />

an agreement to carry out<br />

valuation assignments<br />

according to <strong>RICS</strong> Standards.<br />

<strong>RICS</strong>’ recommendations on the Land<br />

Acquisition Bill in India were heeded by<br />

the Indian Government. We opposed an<br />

irrational approach to land valuation in<br />

the draft legislation and recommended<br />

adoption of market valuer as per IVS and<br />

the Red Book. The Bill was withdrawn as<br />

a result to give time for further consultation.<br />

<strong>RICS</strong>, as a professional body, and our<br />

qualifications were formally recognised in<br />

India by The Indian National Housing Bank<br />

and Indian Banks Association. Additionally,<br />

the Indian housing minister praised <strong>RICS</strong> for<br />

our ongoing efforts to bring professionalism<br />

to the Indian property industry.<br />

<strong>RICS</strong> valuation surveyors in Australia are<br />

now recognised by all major banks, following<br />

recognition by National Australia Bank. We<br />

were also accepted by the Tax Practitioners<br />

Board in Australia for the purposes of quantity<br />

surveyors being registered with the Board.<br />

<strong>RICS</strong> was invited to sit on two Australian<br />

national standards setting bodies to provide<br />

advice on new sustainability standards.<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 13

Measurement Standards<br />

<br />

and New Rules of Measurement (NRM) marked one of the most<br />

significant advances by <strong>RICS</strong> in the past 30 years. The Standards<br />

provide the tools for the construction industry to work collaboratively,<br />

efficiently and consistently. With the rise of Building Information<br />

Modelling (BIM) and the twin imperatives of cutting costs and<br />

carbon out of construction projects, there has never been a more<br />

pressing time to introduce new standards for cost estimating and<br />

<br />

Paul Morrell was a keynote speaker at the launch of the Standards<br />

<br />

an audience of over 100 industry leaders.<br />

The NRM have been adopted in other markets too. The Japanese<br />

Government’s Research Institute on Building Cost (RIBC) will be<br />

including translations of certain parts of NRM 1 in their annual report,<br />

<br />

Surveyors as a standard which summarises the way of thinking<br />

of the cost control in the lifecycle of construction project”.<br />

“Extremely useful for Japanese<br />

Quantity Surveyors as a standard<br />

which summarises the way of<br />

thinking of the cost control in the<br />

lifecycle of construction projects”<br />

<br />

included <strong>RICS</strong> designated members in its list of approved providers<br />

of cost estimating services for a project.<br />

Regulated by <strong>RICS</strong><br />

<strong>RICS</strong> continued to bring assurance to firms and their clients by<br />

regulating firms in new world regions. By the end of the year we<br />

had registered the first regulated firms in the Americas, the Middle<br />

<br />

demonstrated their commitment to following the highest standards<br />

of client protection, service and ethics as well as professional<br />

<br />

<strong>RICS</strong>’ worldwide.<br />

<br />

became the first in the western hemisphere to become an <strong>RICS</strong><br />

regulated firm. This is a milestone in the growing market in the<br />

<br />

regulated, we are beginning to see demand from governments<br />

and banks in the region for the proactive regulation that our<br />

valuer registration initiative offers.<br />

Collaborating internationally to set standards<br />

Working with other leaders in the profession we will together<br />

ensure high level principle-based international standards are<br />

created and sustained. While in the public interest, they will also<br />

open international markets for <strong>RICS</strong> membership, knowledge<br />

products and regulation in all Professional Groups. We are initially<br />

<br />

while ensuring they fit together and enable each other.<br />

10 500<br />

firms ‘Regulated by <strong>RICS</strong>’ worldwide

New opportunities<br />

Americas<br />

<br />

<br />

<br />

to address the issue. The event, hosted by the Appraisal<br />

Foundation and supported by <strong>RICS</strong>, took place in April and<br />

proved a further milestone in achieving recognition of our<br />

<br />

<br />

Summit in October.<br />

<br />

we were accepted as a member of both the High Performance<br />

Buildings Congressional Caucus Coalition and the Consultative<br />

Council of the National Institute of Building Sciences.<br />

South Africa<br />

<br />

number of organisations in South Africa which will help enhance<br />

<br />

collaboration with the following bodies:<br />

<br />

<br />

(South African member association for quantity surveyors)<br />

<br />

<br />

<br />

representative body of property companies in South Africa).<br />

Japan<br />

<br />

<br />

<br />

<br />

<br />

being signed between our two organisations and has opened a<br />

<br />

Russia<br />

<br />

(overarching body of all Russian professional self-regulated<br />

<br />

Moscow) will lead to closer collaboration with these bodies as<br />

well as having significant symbolic value in the Russian market.<br />

Sweden<br />

We met with Handlesbanken (one of the four big Swedish banks)<br />

to encourage leading Swedish banks to recognise the Red Book.<br />

Lead, influence and<br />

provoke discussions<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 15

Thought leadership<br />

With the wealth of knowledge, research capabilities and<br />

market insight at our disposal we are in a strong position<br />

to lead, influence and provoke discussions on key industry<br />

issues across the world.<br />

The <strong>2012</strong> Games: The Regeneration Legacy<br />

<br />

Westminster, compares the planning and delivery of the <strong>2012</strong><br />

Games in London with the approach of other host cities in delivering<br />

regeneration associated with six previous major sporting events.<br />

<br />

Cup in France and the 2006 Commonwealth Games in Melbourne.<br />

It highlights London’s focus on legacy from the outset as a key<br />

factor in planning for lasting benefit and how the Games provided<br />

a unique opportunity to stimulate the regeneration of the heart of<br />

<br />

on and around the site.<br />

The report was launched by Olympics Minister Hugh Robertson<br />

<br />

and Sport (DCMS) website. As well as being used as part of <strong>RICS</strong><br />

<br />

to support <strong>RICS</strong> engagement and promotion in different countries<br />

<br />

Real estate and construction professionals in India by 2020<br />

This study, carried out by Jones Lang LaSalle, indicates a likely<br />

shortage of around 44 million core professionals in India by 2020.<br />

The research analyses the future contribution of built environment<br />

in India’s economic growth, population trends and corresponding<br />

potential demand for real estate space and infrastructure. It then<br />

analyses the professions and skills that will be required, in terms<br />

of demand and supply of core professions of civil engineering,<br />

architecture and planning; non-core professions; and new<br />

specialised professions that are emerging in the fast-paced<br />

and increasingly complex built environment.<br />

The research has been the basis for a range of government<br />

engagement by <strong>RICS</strong> India which has established <strong>RICS</strong> as an<br />

influential body when it comes to the skills needs of India as<br />

the country’s economy expands.<br />

Commercial real estate climate change model<br />

<br />

from over 60 000 buildings to build a picture of how climate<br />

change affects operating costs and investment decisions in the<br />

<br />

constant, overall energy demand and operating costs would<br />

decrease, as increased electricity costs would be more than<br />

compensated for by reduced heating costs. For office buildings,<br />

<br />

<br />

This report has attracted interest from property owners and<br />

occupiers in both the public and private sectors. <strong>RICS</strong>, along<br />

with the research authors Sturgis Profiling, is in the process of<br />

<br />

into a software tool to be used by property investors.<br />

Tax Increment Financing: An opportunity for the UK<br />

The report critically examines the TIF models that are operational<br />

<br />

<br />

introduction of pilot TIF schemes in Scotland and the possible<br />

use of TIF at Battersea in London.<br />

The report was used to respond to the<br />

<br />

issued in 2011 on the localisation<br />

and retention of business rates.<br />

The Future of Private Finance Initiative<br />

and Public Private Partnerships<br />

This groundbreaking research looked<br />

at the impact of the global financial<br />

crisis on Public Private<br />

Partnerships in Australia,<br />

<br />

<br />

It highlighted both<br />

the benefits of PPPs<br />

and the problems that<br />

affect the system.<br />

A series of <strong>RICS</strong> launch<br />

events were held in<br />

different countries culminating in a<br />

major conference in New Delhi in August 2011. The findings<br />

<br />

<br />

<br />

<br />

Our UK members recognised<br />

<strong>RICS</strong> members played a vital role in delivering the London <strong>2012</strong><br />

Olympic and Paralympic Games, from before the bid, through land<br />

assembly, planning and construction to the crucial regeneration<br />

legacy. In a film documentary and specially extended issue of<br />

Modus, we showcased some of the hundreds of <strong>RICS</strong> members<br />

behind the success of the Games. Baroness Ford, Chair of the<br />

Olympic Park Legacy Company, hosted a reception for MPs,<br />

peers and members at the House of Lords in recognition of <strong>RICS</strong><br />

members’ achievements.<br />

<br />

<br />

– and our members’ lead role in it – received extensive media<br />

<br />

<br />

new Industry Framework for pub companies will specify that all rent<br />

review assessments must comply with <strong>RICS</strong> guidance and that rent<br />

assessments for new Full Repairing and Insuring leases must be<br />

signed off by an <strong>RICS</strong> qualified individual.<br />

<strong>RICS</strong> was invited to join the Scottish Government’s Regeneration<br />

Strategy Implementation Group which is led by Alex Neil, Cabinet<br />

Secretary for Infrastructure and Capital Investment. The group will<br />

be responsible for delivering the Government’s regeneration strategy.<br />

Consumer group Which? recommended in its Which Money?<br />

<br />

structural surveys.

Our presence in Brazil enhanced<br />

<strong>2012</strong> Legacy<br />

The wealth of knowledge and expertise<br />

<strong>RICS</strong> members have in the delivery of major<br />

construction and infrastructure projects made<br />

the London <strong>2012</strong> Olympic and Paralympic<br />

Games the resounding success it was. With Rio<br />

de Janeiro set to host the Olympic Games in<br />

<br />

to export the experience and knowledge acquired<br />

during the preparation for London <strong>2012</strong> and its<br />

subsequent regeneration legacy.<br />

Mission to Brazil<br />

<br />

accompanied Prime Minister David Cameron<br />

<br />

<br />

<br />

<br />

influential delegation of 30 business leaders<br />

and <strong>RICS</strong> was the only professional body to be<br />

represented, further demonstrating recognition<br />

of our standards on a global platform. He<br />

used the trip to champion British property and<br />

<br />

Government has made significant long-term<br />

commitment to infrastructure spending across<br />

road, rail, air and sea projects. Sean attended<br />

<br />

<br />

on public private partnerships (PPP) and<br />

infrastructure where he presented a copy<br />

of <strong>RICS</strong>’ global PPP research.<br />

Training the profession<br />

Our training offering to our members went<br />

from strength to strength this year and saw<br />

an increase in the demand for our services by<br />

<br />

face to face and distance learning courses for<br />

<br />

market has real demand for professional training<br />

programmes and our training products enable<br />

practitioners to learn about global best practices.<br />

The world’s largest real estate firms, Cushman<br />

<br />

to provide in-house technical training for their<br />

<br />

<br />

to include a range of professional disciplines.<br />

Establishing regional capabilities<br />

We are supporting the global expansion of<br />

<br />

and skills to the local talent by embedding<br />

our standards and skills in the region through<br />

education, training, academia, research and<br />

business development. The establishment of<br />

our standards, in line with international best<br />

<br />

opportunities for inward investment from the<br />

<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 17

Provide<br />

professionals<br />

with leading<br />

edge products,<br />

services and<br />

information<br />

To underpin the growth of the profession and the establishment<br />

of <strong>RICS</strong> in the major economic and political centres, we invest<br />

in the development of professional guidance, training and<br />

information, equipping our members to grow their technical<br />

and professional knowledge and skills.<br />

42<br />

technical<br />

guides<br />

produced in 2011/<strong>2012</strong>

Focus on ethics<br />

The global financial and economic crisis has revived demand for<br />

ethical practice. We constantly meet governments and end users<br />

who are looking for confidence, certainty and integrity. <strong>RICS</strong> ethical<br />

standards form the basis of all of <strong>RICS</strong> professional guidance and<br />

practice statements. This year we have focused on simplifying<br />

and promoting our ethical principles, making them relevant and<br />

applicable across markets. Our five ethical standards are:<br />

<br />

<br />

<br />

<br />

<br />

We have developed a toolkit to help members apply these<br />

standards in their day to day work. The principles and<br />

supporting material will be available in eight different languages.<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 19

Professional standards and guidance<br />

During the year we produced 42 practice statements, guidance<br />

notes and information papers to provide our members with relevant<br />

technical material to enable them to carry out their work.<br />

Practice standards<br />

Real estate agency and brokerage standards, 1st edition (Italian)<br />

Real estate agency and brokerage standards, 1st edition (Dutch)<br />

Real estate agency and brokerage standards, 1st edition (French)<br />

Real estate agency and brokerage standards, 1st edition (Chinese)<br />

Real estate agency and brokerage standards, 1st edition (German)<br />

Commercial real estate agency standards<br />

Red Book 8th edition<br />

Application of the Red Book in the US<br />

Red Book translation (Chinese)<br />

Red Book translation (Italian)<br />

Red Book translation (German)<br />

Valuation for secured lending in Italy – Italian Red Book chapter<br />

Residential Markets Rents (RB UKVS)<br />

Methodology to calculate embodied carbon<br />

Guidance notes<br />

Negotiating terms for options and leases<br />

Cost analysis and benchmarking (Black Book)<br />

Damages for delays to completion (Black Book)<br />

Conflict avoidance and dispute resolution in<br />

construction (Black Book)<br />

Retention (Black Book)<br />

Subsidence in relation to insurance claims<br />

Party walls<br />

Commercial property management<br />

Blue Book<br />

Asbestos 3rd edition<br />

Surveyors acting as expert witnesses (addendum)<br />

French Valuation of OPCIs<br />

Forced Sale GN – Netherlands<br />

Conflicts of interest<br />

Managing the design delivery, 1st edition<br />

NRM 1 – Order of cost estimating and cost planning for<br />

capital building works 2nd editon<br />

NRM 2 – Detailed measurement for building works<br />

Dilapidations<br />

Residential Property Valuation Ireland<br />

Valuation of individual new build homes<br />

Sports ground certification<br />

Information paper<br />

Sustainability in residential property valuation<br />

Rare earth metals<br />

Flat roof covering<br />

Facilities management information and<br />

data management<br />

Comparable evidence<br />

Japanese Knotweed and residential property,<br />

1st edition<br />

Valuations of hotels<br />

Valuation of renewable energy installations<br />

Valuation of independent healthcare properties<br />

in the UK<br />

Equality, inclusion and the built environment:<br />

A glossary of terms<br />

Public sector property asset management<br />

guidelines, 2nd edition<br />

User guides<br />

Valuation certainty<br />

Residential markets rents

New ways to join the profession<br />

First pathway in 10 years launched<br />

<strong>RICS</strong> launched its first new pathway in almost 10 years in January<br />

<strong>2012</strong>. Developed in response to market feedback and member<br />

<br />

pathway available across all chartered routes to membership.<br />

<br />

<br />

Assoc<strong>RICS</strong><br />

<strong>RICS</strong>’ newest qualification provides an opportunity for those without<br />

a degree who have relevant work experience to become an <strong>RICS</strong><br />

Associate – Assoc<strong>RICS</strong>. We launched a new pathway for Land<br />

for Associate membership in June. The pathway is for candidates<br />

working in the environmental, minerals and waste management,<br />

planning and development, and rural sectors. A new real estate<br />

agency pathway was also launched, covering commercial,<br />

residential and mixed use properties, for countries where there are<br />

currently no established qualifications in this area of the property<br />

profession. The Associate grade of membership launched in<br />

Oceania and the Americas in October 2011.<br />

Professional Experience Route<br />

The new professional experience route to membership launched<br />

globally in October 2011 following a six month pilot with firms<br />

<br />

offers experienced property professionals the opportunity to gain<br />

recognition and enhanced status with a world class professional<br />

qualification. By the end of the year professional experience route<br />

<br />

rate – 12% higher than the average for other routes to membership.<br />

Promotional and development work for the route is underway<br />

<br />

Malaysia and Thailand with assessor training in these countries<br />

in the pipeline.<br />

<strong>RICS</strong> Fellowship<br />

The new fellowship scheme was launched at the beginning of April.<br />

The new, simplified system sets out 17 characteristics that <strong>RICS</strong><br />

expects to see from someone aiming to become a Fellow of <strong>RICS</strong>.<br />

Information products<br />

<br />

provides the latest international and regional news and views, expert<br />

advice an in-depth features tailored specifically for the Americas<br />

<br />

read publication for members and stakeholders across the western<br />

hemisphere, and following a successful publication of the first<br />

Modus, the quarterly pan-American edition will now be published<br />

<br />

Developing BCIS<br />

<br />

<br />

tender from the Australian Federal Government to host, maintain<br />

and commercialise Cost Analysis Model for the Building the<br />

<br />

The tender enables us to establish our Building Cost Information<br />

Service (BCIS) in the region and through data collected over the<br />

lifetime of the project we will be able to develop services and<br />

commercial offerings across Oceania.<br />

Evolving DRS<br />

Our dispute resolution services (DRS) gained success in Oceania.<br />

DRS now operate in every state and territory in Australia after<br />

the Deputy Premier of South Australia approved our application<br />

to appoint adjudicators under the South Australia security of<br />

payment legislation. <strong>RICS</strong> is the only alternative dispute resolution<br />

(ADR) provider to have national authority to appoint adjudicators.<br />

Meanwhile in Dubai and South Africa an ADR initiative (including<br />

mediator training) is successfully underway.<br />

First new pathway in<br />

10 years launched<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 21

Wholly devoted to<br />

corporate responsibility<br />

Be recognised<br />

as a leader in<br />

‘responsible<br />

business’<br />

practices<br />

Responsible action is at the heart of everything we do at<br />

<strong>RICS</strong>. As a global professional body governed by a Royal<br />

Charter requiring us to promote the public interest, <strong>RICS</strong><br />

is – by definition – wholly devoted to corporate responsibility.<br />

UN Global Compact<br />

<br />

principles has provided us with an ideal framework for<br />

understanding challenges and opportunities on the way to<br />

demonstrable leadership as a responsible business. We<br />

<br />

the Children consultation on Children’s Rights and Business<br />

Principles in March and as a signatory to the Internships<br />

Code of Best Practice we stressed the importance of young<br />

workers’ rights in our sector.<br />

We were commissioned by the Food and Agriculture<br />

<br />

on how to mainstream leading academic institutions in<br />

the implementation of the voluntary guidelines on the<br />

responsible governance of tenure of land, forests and<br />

fisheries in the context of food security.<br />

<br />

<br />

<br />

<br />

<br />

<br />

Sustainable Buildings Climate Initiative) forming the basis<br />

for closer collaboration in the future.<br />

Embedding sustainability in land, real estate<br />

and the built environment<br />

<br />

<br />

Initiative) announced alignment of goals in order to<br />

integrate sustainability principles into valuations and<br />

decisions about investment.

a series of well-attended conference sessions on energy<br />

efficiency. At the event we launched our draft information<br />

paper on measuring embodied carbon and new research<br />

<br />

<br />

the commercial value in building the sustainability lifecycle.<br />

We presented a paper on sustainability at the British Council/<br />

<br />

<br />

<br />

<br />

project which sees <strong>RICS</strong> develop training material advising<br />

<br />

the energy efficiency of their buildings.<br />

Sustainability in Australia<br />

<br />

government tender to produce a guide for small and medium<br />

enterprise tenants to assist them to understand the potential<br />

energy savings in their leased premises.<br />

<br />

Property (Australia) course notes. The notes (an Australian first)<br />

set a benchmark for valuers in Australia looking to value the<br />

sustainability of existing buildings.<br />

<br />

<br />

recognises <strong>RICS</strong>’ contribution to property research and to the<br />

property profession through the region.<br />

Community activity<br />

Disaster Management Commission (DMC)<br />

Created in the aftermath of the 2004 Asian tsunami, the<br />

<br />

built environment volunteers. Bringing the skills and technical<br />

knowledge of <strong>RICS</strong> members to strengthen capacity of<br />

communities threatened by natural and manmade disasters<br />

remains at the heart of the DMC’s work.<br />

The Malawi Government approved DMC’s project proposals<br />

to review and revise newly drafted guidelines for safer house<br />

construction in the country.<br />

<br />

the need for greater involvement of land and construction<br />

professionals in post-disaster reconstruction. The event<br />

<br />

<br />

and International Red Cross officials as well as key players<br />

working with the governments of Pakistan, Malawi and Haiti.<br />

Charity Property Help<br />

Charity Property Help provides free support and guidance on<br />

<br />

through a one hour free consultation session with an <strong>RICS</strong><br />

regulated firm. During 2011/<strong>2012</strong> Charity Property Help assisted<br />

<br />

their services to the scheme, taking the total number of registered<br />

<br />

Chartered Surveyors Voluntary Service<br />

<br />

<br />

<br />

surveyors provide advisory services on a range of issues through<br />

<br />

Professions for Good<br />

We hosted the launch of Professions for Good (P4G) Social<br />

Mobility Toolkit in February which equips employers, professional<br />

bodies and regulators to measure and promote greater social<br />

mobility. <strong>RICS</strong> is a founder member of P4G, a group of leading<br />

<br />

<br />

<br />

Employee engagement<br />

£3 500 raised for<br />

corporate charity<br />

Giving something back<br />

We recognise that working with local communities can drive<br />

employee engagement. All <strong>RICS</strong> employees continue to be eligible<br />

for one paid day off per year to take part in volunteering activities<br />

<br />

arrange to support a charity or community group of their choice,<br />

<br />

doubled in the year with 100 days being taken by employees.<br />

Corporate affiliation with an international charity<br />

In March we signed a partnership with WaterAid to be our<br />

corporate charity. The start of the three year relationship<br />

saw May designated as <strong>RICS</strong> volunteering month where<br />

employees from across the world participated in local events<br />

for fundraising activities for WaterAid and other charities close<br />

to employees’ hearts. By the end of August we had raised<br />

<br />

A great place to work and a highly engaged workforce<br />

<strong>RICS</strong> retained One to Watch status in the annual Best Companies<br />

employee survey. Best Companies, the independent firm that<br />

conducts the employee survey, found that even though the global<br />

economic climate had affected all firms’ results, <strong>RICS</strong> managed to<br />

buck the trend, as overall it did not see a drop in its scores across<br />

the eight factors that are measured.<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 23

Make <strong>RICS</strong> more<br />

agile to take<br />

advantage of new<br />

opportunities<br />

To underpin the growth of the profession and the establishment of <strong>RICS</strong> in<br />

our target markets we are investing in our business development capabilities.<br />

Digitally advanced<br />

A clearer, smarter and faster website was launched following a major<br />

programme of investment in our digital capability. The new rics.org allows<br />

easier navigation, better networking and simple access to news, knowledge<br />

and standards. Above all it provides our members with a platform to help<br />

them at each stage of their professional life. Members are able to register<br />

and build their online profile, promote their expertise, appear in searches,<br />

manage their topics of interest and communication preferences, record<br />

their CPD and find out what is happening in their area.<br />

<strong>RICS</strong> Recruit moved to a new upgraded platform on schedule in March and<br />

now has ecommerce capabilities, is compatible for use on mobile phones,<br />

provides users with more control of their profiles and has recruiter services.

Online self-management of CPD<br />

<strong>RICS</strong> members constantly seek knowledge and told us that they want it to be<br />

easier to complete and manage their continuing professional development (CPD)<br />

– and for it to be simpler to demonstrate compliance. Having listened to this<br />

feedback, a new policy and set of rules have been approved by Governing<br />

Council to take effect from 1 January 2013 to demonstrate members’ professional<br />

and ethical competence and compliance with <strong>RICS</strong> standards.<br />

The new CPD rules<br />

From 1 January 2013 all members must:<br />

<br />

<br />

<br />

of ethical practice during a rolling three year period.<br />

We will be making sure all members understand these new provisions<br />

through extensive communications during <strong>2012</strong>/2013.<br />

Connecting locally and globally<br />

By the end of the year our corporate Twitter account had over 20 000 followers.<br />

The account, which attracts on average seven new followers per tweet, is a<br />

heavyweight in the property and construction industry’s social media community,<br />

out-ranking trade media titles. We are now tracking 600 chartered surveyors and<br />

surveying firms on Twitter, enabling users to see in an instant what chartered<br />

surveyors across the world are tweeting.<br />

<strong>RICS</strong>’ corporate LinkedIn account had over 27 000 members by the end of the<br />

year. The group is open to all property professionals and provides a platform for<br />

intelligent debate and knowledge sharing amongst peers.<br />

Online Academy<br />

At the end of July we had nearly 13 000 registered web class users (low cost<br />

online live training sessions) from more than 90 countries that had enrolled on<br />

more than 2 200 courses as part of our Online Academy offering.<br />

20 000<br />

Twitter followers<br />

27 000<br />

LinkedIn followers<br />

13 000<br />

registered on our Online Academy<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 25

<strong>RICS</strong><br />

membership<br />

Building the status and recognition of the profession depends<br />

on growing our membership to achieve critical mass. In this way<br />

we embed standards, trust and confidence in our markets.<br />

Total number of <strong>RICS</strong> members by world region<br />

2 704<br />

9 668<br />

7 114<br />

Americas Asia Europe<br />

Members Members Members<br />

5% 10.5% 10%<br />

Increase Increase Increase<br />

As at end 31 July <strong>2012</strong>

617<br />

Total membership<br />

3 601<br />

F<strong>RICS</strong> 20 050<br />

M<strong>RICS</strong> 73 729<br />

Assoc<strong>RICS</strong> 2 772<br />

Trainees 17 909<br />

2 651<br />

88 105<br />

India MEA Oceania UK (including Ireland)<br />

Members Members Members Members<br />

19.6% 7% 12% 0.6%<br />

Increase Increase Increase Increase<br />

Total number of <strong>RICS</strong> members by world region<br />

F<strong>RICS</strong> M<strong>RICS</strong> Assoc<strong>RICS</strong> Trainees<br />

Americas 815 1 676 29 1 842<br />

Asia 763 6 855 185 1 865<br />

Europe 761 4 787 17 1 549<br />

India 72 496 1 48<br />

Ireland 415 1 679 224 31<br />

MEA 404 2 305 104 788<br />

Oceania 438 1 717 27 469<br />

UK 16 382 54 214 2 185 12 975<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 27

Membership<br />

growth<br />

<strong>RICS</strong> designations<br />

F<strong>RICS</strong> – Fellow of <strong>RICS</strong><br />

A prestigious award – only members who are high achievers in<br />

their careers may apply to become a fellow. They will be leaders;<br />

active people who have completed unique projects or contributed<br />

to the profession.<br />

M<strong>RICS</strong> – Member of <strong>RICS</strong><br />

For members who have undergone a period of rigorous<br />

study and training. <strong>RICS</strong> membership is only awarded to<br />

those who are prepared to maintain exemplary standards<br />

– for the public advantage.<br />

Assoc<strong>RICS</strong> – Associate of <strong>RICS</strong><br />

Assoc<strong>RICS</strong> is a non-chartered grade for technical and support<br />

staff working in the land, property and construction sectors.<br />

The entry-level grade offers members a progressive,<br />

non-graduate route to chartered status.<br />

Five year trend in membership growth<br />

Year end F<strong>RICS</strong> M<strong>RICS</strong> Assoc<strong>RICS</strong> Trainees Total<br />

July <strong>2012</strong> 20 050 73 729 2 772 17 909 114 460<br />

July 2011 20 214 72 027 2 420 16 950 111 611<br />

July 2010 20 622 69 846 2 185 16 469 109 122<br />

July 2009 21 043 67 789 2 182 16 760 107 774<br />

July 2008 21 415 65 351 2 252 15 971 104 989<br />

12 10<br />

11

09<br />

08<br />

F<strong>RICS</strong><br />

12<br />

12<br />

11<br />

11<br />

10<br />

09<br />

08<br />

10<br />

08<br />

12<br />

10<br />

09<br />

09<br />

11<br />

08<br />

M<strong>RICS</strong><br />

Assoc<strong>RICS</strong><br />

Trainees<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 29

Group Financial Statements<br />

as at 31 July <strong>2012</strong><br />

Principal activities<br />

The principal activities of the Group include setting professional standards, including those for admission to membership,<br />

the maintenance of members’ professional competence, the regulation and standards of practice, providing information<br />

and the promotion of the profession.<br />

The Group funds its activities through an annual professional membership subscription, regulatory fees and income<br />

from commercial services such as learning events and software applications.<br />

Overall financial performance<br />

The Group has undergone a period of prudent investment aimed at accelerating its long-term vision. As such it is<br />

prepared for a period of controlled financial deficits over the next few years before it expects to see a return on these<br />

investments and return to operating at close to break-even. The operating result for the year was a deficit of £1,814,000<br />

(£2,622,000 in 2010/2011). Additionally, the Group crystallised a gain of £2,500,000 on the disposal and reinvestment<br />

of the Group’s investment portfolio following the transfer of its management.<br />

Outside the UK, membership subscriptions grew by almost £1,000,000, this increase was primarily generated by a growth<br />

in membership of nearly 2 000 with the strongest growth coming from North Asia and Europe. Total subscription income<br />

for the Group grew from £36,580,000 in 2010/2011 to £38,050,000 in 2011/<strong>2012</strong>.<br />

In accordance with the Group’s adopted accounting policies, Red Book revaluations were undertaken of the properties<br />

in London and Edinburgh. As a result there has been an uplift in the carrying values of these assets at the end of the<br />

financial year.<br />

<strong>RICS</strong> reserve levels continue to be maintained at a level in accordance with the reserves policy agreed by<br />

<strong>RICS</strong> Finance Committee.<br />

Despite the challenges of the economic environment the Group has delivered favourably against its business plan.<br />

The Group remains hopeful that this momentum may be carried forward whilst at the same time leveraging the investment<br />

in technology to produce continued operational efficiencies.<br />

The following pages show the Group Income Statement, Group Balance Sheet, Group Cashflow Statement, Notes to the<br />

Summary Financial Statements and a report from the Group Auditors. The pages have been extracted from the audited<br />

financial statements for the year ended 31 July <strong>2012</strong>. The full accounts can be found in the <strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> and<br />

Financial Statements <strong>2012</strong>.<br />

Total Income<br />

2011 =<br />

43 136M<br />

<strong>2012</strong> =<br />

48 177M

Group Income Statement<br />

for the year ended 31 July <strong>2012</strong><br />

31 July <strong>2012</strong> 31 July 2011<br />

Note Income Expenditure Total Total<br />

£’000 £’000 £’000 £’000<br />

Income and direct costs<br />

Professional subscription and entry fees 41,722 (991) 40,731 39,188<br />

Learning, professional development & other member services 20,079 (14,621) 5,458 3,948<br />

Total income and direct costs before exceptional item 61,801 (15,612) 46,189 43,136<br />

Exceptional item 2 1,988 - 1,988 -<br />

Total income and direct costs after exceptional item 63,789 (15,612) 48,177 43,136<br />

Key activities and services<br />

Creating and enforcing professional standards - (9,003) (9,003) (7,297)<br />

Gaining influence and building brand profile - (7,610) (7,610) (7,917)<br />

Regional and local service provision - (14,522) (14,522) (13,457)<br />

Technology development - (400) (400) (1,071)<br />

Legal and governance - (3,235) (3,235) (2,694)<br />

Technology operations - (4,459) (4,459) (4,673)<br />

Property operations and lifecycle maintenance - (2,070) (2,070) (2,174)<br />

Finance operations and ongoing compliance - (2,586) (2,586) (2,558)<br />

Depreciation and amortisation - (1,893) (1,893) (2,032)<br />

Central activities - (4,058) (4,058) (1,419)<br />

Total expenditure on key activities and services - (49,836) (49,836) (45,292)<br />

Other costs<br />

Charitable trusts and donations - (134) (134) (123)<br />

Refurbishment of property at Parliament Square, London - (3) (3) (329)<br />

Deficit on foreign exchange - (18) (18) (14)<br />

Total other costs - (155) (155) (466)<br />

Operating result 63,789 (65,603) (1,814) (2,622)<br />

Surplus/(deficit) on sale of fixed assets 326 - 326 (176)<br />

Result before interest and taxation 64,115 (65,603) (1,488) (2,798)<br />

Investment income 520 - 520 551<br />

Other interest receivable and similar income 540 - 540 414<br />

Result before taxation (428) (1,833)<br />

Taxation (charge)/credit (1,213) 970<br />

Net deficit for year after taxation 3 (1,641) (863)<br />

Consolidated Note of Historical Cost Surpluses and Deficits 31 July <strong>2012</strong> 31 July 2011<br />

for the year ended 31 July <strong>2012</strong> Note Total Total<br />

£’000 £’000<br />

Reported deficit for the year before taxation (428) (1,833)<br />

Realisation of investment revaluation 2,190 -<br />

Historical cost surplus for the year before taxation 1,762 (1,833)<br />

Historical cost surplus/(deficit) for the year after taxation 3 549 (863)<br />

All activities have arisen from continuing operations.<br />

These summary financial statements were approved by the Management Board on 22 November <strong>2012</strong> and were signed<br />

on its behalf by James Carter, Chairman of Management Board and Sean Tompkins, Chief Executive Officer.<br />

These summary financial statements are only a summary of the information, relating to the income statement, note of historical<br />

cost surpluses and deficits, balance sheet and cashflow statement contained in the consolidated <strong>Annual</strong> <strong>Review</strong> and Financial<br />

Statements and are not statutory accounts. A copy of the full annual report and financial statements can be viewed online at<br />

http://www.rics.org/aboutus<br />

The full <strong>Annual</strong> <strong>Review</strong> and Financial Statements for the year ended 31 July <strong>2012</strong> was subject to audit and the Auditors’ report<br />

was unqualified. The full financial statements were approved by the Management Board on 22 November <strong>2012</strong> and were signed<br />

on its behalf by James Carter, Chairman of Management Board and Sean Tompkins, Chief Executive Officer.<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 31

Group Balance Sheet<br />

as at 31 July <strong>2012</strong><br />

31 July <strong>2012</strong> 31 July 2011<br />

Note Total Total<br />

£’000 £’000<br />

Fixed assets<br />

Intangible assets 54 62<br />

Tangible assets 29,193 26,940<br />

Listed and unlisted investments 24,020 24,613<br />

Current assets<br />

53,267 51,615<br />

Stocks 454 391<br />

Debtors 6,171 7,679<br />

Short term investments 492 3,309<br />

Cash at bank and in hand 143 2,937<br />

7,260 14,316<br />

Creditors:<br />

Amounts falling due within one year (30,362) (31,118)<br />

Net current liabilities (23,102) (16,802)<br />

Total assets less current liabilities 30,165 34,813<br />

Creditors:<br />

Amounts falling due after one year (87) (1,171)<br />

Provisions for liabilities (19) (10)<br />

Net assets before pension (liability)/asset 30,059 33,632<br />

Pension (liability)/asset (4,004) 3,047<br />

Pension (liability)/asset 26,055 36,679<br />

Reserves<br />

General reserves 3 24,307 34,912<br />

Restricted reserves 3 1,748 1,767<br />

Net assets 26,055 36,679<br />

There is no share capital since the constitution of <strong>RICS</strong> is that of a body corporate under Royal Charter.<br />

Fixed assets<br />

<strong>2012</strong><br />

54<br />

£’000<br />

£’000<br />

Intangible assets<br />

29,193 24,020<br />

£’000<br />

£’000<br />

Tangible assets<br />

£’000<br />

2011 62 26,940 24,613<br />

£’000<br />

Listed and unlisted<br />

investments<br />

=<br />

3.2%<br />

increase

Group Cashflow Statement<br />

as at 31 July <strong>2012</strong><br />

31 July <strong>2012</strong> 31 July 2011<br />

Total Total<br />

£’000 £’000<br />

Net cash outflow from operating activities (3,033) (1,582)<br />

Returns on investments and servicing of finance 1,060 965<br />

Taxation - (118)<br />

Capital expenditure and financial investment (3,638) (803)<br />

Net cash outflow before use of liquid resources and financing (5,611) (1,538)<br />

Management of liquid resources 2,817 1,884<br />

(Decrease)/increase in cash in the year (2,794) 346<br />

Reconciliation of net cash flow to movement in net funds<br />

(Decrease)/increase in cash in the year (2,794) 346<br />

Cash outflow from decrease in liquid resources (2,817) (1,884)<br />

Changes in net funds resulting from cash flows (5,611) (1,538)<br />

Effect of foreign exchange rate changes - 33<br />

Movement in net funds in the year (5,611) (1,505)<br />

Net funds at 1 August 6,246 7,751<br />

Net funds at 31 July 635 6,246<br />

Returns on investments and servicing of finance<br />

2011 =<br />

965,000<br />

<strong>2012</strong> =<br />

1,060,000<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 33

Notes to the Summary<br />

Financial Statements<br />

as at 31 July <strong>2012</strong><br />

1. Basis of preparation<br />

The financial statements have been prepared in accordance with United Kingdom Generally Accepted Accounting Practice<br />

under the historical cost convention, as modified by the revaluation of fixed asset investments and freehold land and buildings<br />

to market value at the balance sheet date. The presentational requirements of the Companies Act 2006 have been applied<br />

where applicable on a voluntary basis, as this is not a statutory requirement due to the Royal Charter status of <strong>RICS</strong>.<br />

2. Exceptional item<br />

The Exceptional item relates to a review of the recognition of Assessment of Professional Competence (APC) revenue.<br />

Following review, the Group considers APC revenue to be more appropriately recognised in the period of invoice as although<br />

not all obligations are fulfilled at this point, any remaining unfulfilled obligations are immaterial from a Group perspective.<br />

In the prior year an element of APC income was recognised in the period of invoice, with the remaining income being deferred<br />

until specific services were provided. The deferred income was recorded in the balance sheet within creditors.<br />

As a result of this change in treatment, the Group result before taxation has been increased by £1,187,000 relating to the<br />

release of deferred income brought forward from the previous accounting period and revenues of £801,000 relating to new<br />

APC registrants that would have been deferred under the old estimation approach. Both of these amounts have been<br />

included in the current year as an Exceptional item.<br />

3. Reserves<br />

Revenue reserves £’000 £’000<br />

At 1 August 2011 5,775<br />

Deficit on activities after taxation for the year (1,641)<br />

Transferred from other reserves - crystallised investment revaluation surplus 2,190<br />

Recognised surplus for the year 549<br />

Transferred to other reserves (35)<br />

Other recognised gain - reversal of deferred tax 1,070<br />

Other recognised deficit - pensions (9,634)<br />

At 31 July <strong>2012</strong> (2,275)<br />

Other general reserves<br />

Revaluation<br />

reserve<br />

£’000<br />

Premises<br />

reserve<br />

£’000<br />

Clients Money<br />

reserve<br />

£’000<br />

Translation<br />

reserve<br />

£’000<br />

Investment<br />

revaluation<br />

reserve<br />

£’000<br />

At 1 August 2011 16,522 6,019 1,609 671 4,316 29,137<br />

Revaluation surplus/(deficit)<br />

Transferred to other reserves -<br />

400 - - - (880) (480)<br />

crystallised revaluation surplus - - - - (2,190) (2,190)<br />

Retranslation - - - 61 - 61<br />

Transferred from other reserves - (3) 57 - - 54<br />

At 31 July <strong>2012</strong> 16,922 6,016 1,666 732 1,246 26,582<br />

Total general reserves 24,307<br />

Restricted reserves<br />

Member<br />

Support<br />

Service Other Total<br />

£’000 £’000 £’000<br />

At 1 August 2011 1,096 671 1,767<br />

Transferred from other reserves (19) - (19)<br />

At 31 July <strong>2012</strong> 1,077 671 1,748<br />

Total<br />

£’000

Independent Auditors’<br />

Statement to the Governing<br />

Council of the Royal Institution<br />

of Chartered Surveyors<br />

To the Members of the Royal Institution of Chartered Surveyors (‘<strong>RICS</strong>’)<br />

We have examined the summary financial statements for the year ended<br />

31 July <strong>2012</strong> set out on pages 31-34.<br />

Respective responsibilities of the Management Board and auditor<br />

The Management Board is responsible for preparing the summary consolidated<br />

income statement, summary consolidated balance sheet and summary consolidated<br />

cashflow in accordance with applicable United Kingdom law.<br />

Our responsibility is to report to you our opinion on the consistency of the summary<br />

financial statements within the annual review with the full annual financial statements.<br />

We also read the other information contained in the annual review and consider<br />

the implications for our report if we become aware of any apparent misstatements<br />

of material inconsistencies with the summary financial statements.<br />

Our report has been prepared pursuant to the requirements of the Royal Charter and<br />

for no other purpose. No person is entitled to rely on this statement unless such a person<br />

is a person entitled to rely upon this statement by virtue of and for the purpose of the<br />

Royal Charter or has been expressly authorised to do so by our prior written consent.<br />

Save as above, we do not accept responsibility for this statement to any other person<br />

or for any other purpose and we hereby expressly disclaim any and all such liability.<br />

Basis of opinion<br />

We conducted our work in accordance with Bulletin 2008/3 ‘The Auditors’ Statement<br />

on summary financial statements in the United Kingdom’ issued by the Auditing<br />

Practices Board. Our report on <strong>RICS</strong>’ full annual financial statements describes<br />

the basis of our opinion on those financial statements and on the annual review.<br />

Opinion<br />

In our opinion the summary financial statements are consistent with the full annual<br />

financial statements and the annual review of the Royal Institution of Chartered Surveyors<br />

for the year ended 31 July <strong>2012</strong>.<br />

We have not considered the effects of any events between the date on which we signed<br />

our report on the full annual financial statements on 30 November <strong>2012</strong> and the date<br />

of this statement. statement.<br />

Andrew Stickland<br />

For and on behalf of BDO LLP, statutory auditor<br />

Gatwick<br />

United Kingdom<br />

04 December <strong>2012</strong><br />

BDO LLP is a limited liability partnership registered in England and Wales<br />

(with registered number OC305127).<br />

<strong>RICS</strong> <strong>Annual</strong> <strong>Review</strong> 2011/<strong>2012</strong> 35

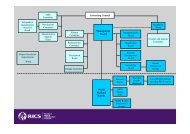

<strong>RICS</strong><br />

governance<br />

structure<br />

<strong>RICS</strong>’ strategic direction is set by Governing Council incorporating<br />

the leadership team and member representatives from across<br />

the world.<br />

The Council, chaired by <strong>RICS</strong>’ President, is supported by a<br />

number of groups and boards, populated by around 1 000<br />

active members, <strong>RICS</strong> staff and ‘lay’ (non) members. These<br />

include world regional boards, national councils, 17 specialist<br />

professional group boards, policy committees and boards,<br />

covering membership, communications, knowledge and the<br />

arm’s length Regulatory Board.<br />

Knowledge<br />

Board<br />

World<br />

Boards<br />

Communications<br />

Board<br />

Regulatory<br />

Board<br />

The arm’s length Regulatory<br />

Board reports solely to Governing<br />

Council on its activities<br />

Membership<br />

Board

Privy<br />

Council<br />

Grants and awards<br />

Royal Charter<br />

Governing<br />

Council<br />

Management of Royal Charter<br />

obligations, setting direction<br />

and strategy<br />

Audit<br />

Committee<br />

Finance<br />