Optimum coal value

Optimum coal value

Optimum coal value

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SA Mining November 2009 48<br />

<strong>Optimum</strong> <strong>coal</strong> <strong>value</strong><br />

The fourth largest SA <strong>coal</strong> exporter, 56% black-owned <strong>Optimum</strong> Coal, is in the process<br />

of transforming. Its <strong>coal</strong> portfolio is rapidly expanding and its strategy to diversify is far<br />

beyond conception. Laura Cornish spoke to CEO, Mike Teke and COO, Henry White<br />

about <strong>Optimum</strong> Coal’s current status and forward-looking growth.<br />

Having acquired the massive <strong>Optimum</strong> Collieries from<br />

BHP Billiton Energy Coal SA (BECSA) in June last year, it<br />

took <strong>Optimum</strong> less than a year to pay off the debt.<br />

For a privately owned large-scale mine developer, it continues<br />

to classify itself as a cash generator, on the lookout<br />

for new assets and ready to develop new and upgraded<br />

projects, or to acquire additional assets.<br />

As evidence of this, it recently increased its stake in the<br />

<strong>Optimum</strong> Collieries contiguous property, Koornfontein,<br />

from 5% to 19.2%. The Koornfontein operation owns<br />

1.5mtpa of Richards Bay Coal Terminal (RBCT) entitlement.<br />

An underground operation, it mines the 2 seam currently<br />

but is looking to mine 4 seam to increase its resource by<br />

55mt.<br />

It has good infrastructure, including washing plants and<br />

a rapid load-out facility.<br />

Additionally, <strong>Optimum</strong> Coal also bought a 9% stake in<br />

diversified mid-tier miner, Metorex and a 26% stake in junior<br />

platinum player, Afarak Platinum – all these transactions<br />

were completed this year.<br />

<strong>Optimum</strong> Coal’s total RBCT <strong>coal</strong> export entitlement is<br />

6.5mtpa.<br />

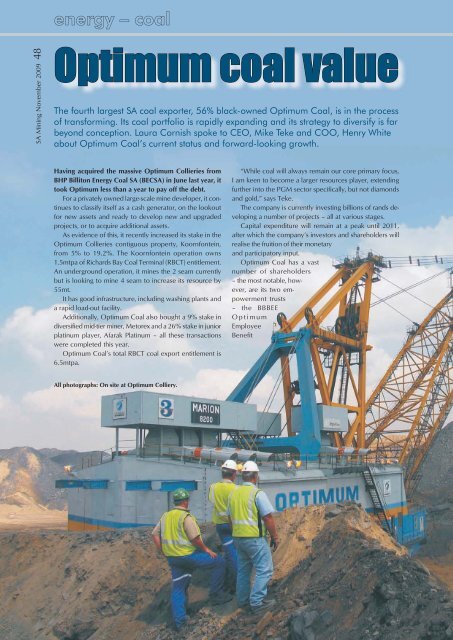

All photographs: On site at <strong>Optimum</strong> Colliery.<br />

“While <strong>coal</strong> will always remain our core primary focus,<br />

I am keen to become a larger resources player, extending<br />

further into the PGM sector specifically, but not diamonds<br />

and gold,” says Teke.<br />

The company is currently investing billions of rands developing<br />

a number of projects – all at various stages.<br />

Capital expenditure will remain at a peak until 2011,<br />

after which the company’s investors and shareholders will<br />

realise the fruition of their monetary<br />

and participatory input.<br />

<strong>Optimum</strong> Coal has a vast<br />

number of shareholders<br />

– the most notable, however,<br />

are its two empowerment<br />

trusts<br />

– the BBBEE<br />

<strong>Optimum</strong><br />

Employee<br />

Benefit

Trust (holding 12.5%) and the BBBEE<br />

<strong>Optimum</strong> Community Trust (also a<br />

12.5% shareholder).<br />

Despite the heavy investment in<br />

its project portfolio, the company<br />

declared an R120m dividend, with<br />

the key aim of capitalising the trusts<br />

to the benefit of the surrounding communities<br />

and <strong>Optimum</strong> Coal’s loyal<br />

employees. “When our capital expenditure<br />

programme comes down,<br />

the full intention will then be to see<br />

greater cash flow to our employees<br />

and shareholders,” Teke points out.<br />

The CEO, who previously worked<br />

for Impala Platinum, says its opera-<br />

Mike Teke.<br />

tional success lies behind its model of<br />

three foundation principles – safety; tonnes; and costs.<br />

The first cornerstone of the business – safety – is every<br />

bit as important as tonnes produced and cash generated.<br />

Asiphephe or ‘let’s be safe’ is a training programme started<br />

this year which all employees and contractors now have<br />

to undergo.<br />

Training is an essential part of any successful mining<br />

company, Teke notes.<br />

<strong>Optimum</strong> Coal’s total RBCT <strong>coal</strong> export entitlement is<br />

6.5mtpa.<br />

THE OPERATIONS<br />

<strong>Optimum</strong> Collieries – located in Mpumalanga near the Hendrina<br />

power station – is a large-scale, three-seam open-cast,<br />

and, more recently, underground operation.<br />

The 15mtpa run of mine (ROM) complex is underway<br />

with two expansion projects, and possibly a third in the<br />

near future.<br />

With nine draglines on site – ‘complex’ defines its large<br />

scale size – to the extent that it also uses two major mining<br />

contractors – Moolmans and Sentula’s MegaCube, as well<br />

as a local contractor to undertake some ancillary<br />

open-cast mining activities.<br />

Henry White.<br />

OPTIMUM STATISTICS<br />

Screen feed 15.15mtpa<br />

Eskom supply 5.5mtpa<br />

Export & inland supply 6mtpa<br />

BOSHMANSPOORT<br />

The first of two major expansions at <strong>Optimum</strong> Collieries is<br />

the Boshmanspoort underground project.<br />

With a capital expenditure budget of R600m (excluding<br />

mining equipment) – the mine will access the 2 seam to<br />

provide 4mtpa (ROM).<br />

49 SA Mining November 2009

SA Mining November 2009 50<br />

While all of the necessary infrastructure<br />

required to operate underground<br />

will be completed and commissioned<br />

in January next year, first <strong>coal</strong> was<br />

extracted just six months after initially<br />

preparing the area.<br />

“Mining and building concurrently<br />

is challenging, but successful in terms<br />

of funding the project,” says White.<br />

The project will have a 12 to14<br />

year lifespan as a board and pillar operation,<br />

and range in depth anywhere<br />

between 35m and 100m.<br />

Because of the waste to <strong>coal</strong> ratio<br />

and the Klein Olifants River running<br />

through the area, the decision to go<br />

underground was necessary.<br />

The company’s policy is to outsource<br />

all physical underground<br />

mining activity, and local contractor<br />

CoalCor was appointed to handle all<br />

physical mining activity.<br />

KWAGGA NORTH<br />

“This open-cast project is a ROM tonnage<br />

replacement project – which<br />

will only require the transfer of mining<br />

equipment to operate,” White<br />

explains.<br />

What will initially be a one-dragline,<br />

two-seam operation will ultimately be<br />

a four-dragline operation mining about<br />

8mpta (ROM). Life of mine (LOM) is<br />

expected to be between 14 and 15<br />

years.<br />

The project will be developed in<br />

three phases – of which the first is<br />

already complete, including box cut<br />

and related infrastructure.<br />

Phase 2 – currently in progress until<br />

June next year - includes the acquisition<br />

of additional surrounding farms,<br />

as well as the relocation of a small<br />

community and graveyard.<br />

Phase 3, which will commence in<br />

July/August next year, will extend the<br />

entire necessary logistics infrastructure,<br />

including conveyors, tipping<br />

points, etc.<br />

Valued at R720m, the Kwagga<br />

North section will be ‘ready to run’<br />

in June 2011.<br />

OPTIMUM COAL’S WATER<br />

TREATMENT PLANT<br />

Typical with large open-cast mines<br />

(10 000ha of disturbed land to date at<br />

<strong>Optimum</strong> Colliery), is the accumulation<br />

of affected water.<br />

“A decision was made about two<br />

years ago to construct a water treatment<br />

plant to re-process our water,<br />

and the final evidence will be next<br />

April when the plant is wet-commissioned,”<br />

says White.<br />

A test period will follow, taking anywhere<br />

between three and six months<br />

to complete to verify that the water is<br />

clean enough for consumption.<br />

The objective is to sell all the<br />

re-processed water to the local municipality.<br />

Costing R600m, the 15Mℓ/day<br />

plant will look after <strong>Optimum</strong> Coal’s<br />

water needs for the next 20 years.<br />

White does, however, mention that<br />

evaluations are already underway to<br />

determine if one plant will be sufficient<br />

going beyond 20 years.<br />

“Unlike most other <strong>coal</strong> operations,<br />

our water is not acidic, but contains<br />

dissolved salts (sulphates), which are<br />

easier to treat,” White adds.<br />

BROWNFIELD DEVELOPMENTS<br />

VLAKFONTEIN<br />

Situated in the Ermelo <strong>coal</strong> fields, Vlakfontein<br />

is a 55mt (in-situ) open-cast<br />

thermal <strong>coal</strong> deposit with the potential<br />

to be a 3mtpa (ROM) colliery.<br />

Two thirds of the <strong>coal</strong> produced will<br />

be for export, and the remainder for<br />

local power generation.<br />

Exploration drilling has now been<br />

completed, and geological model updating<br />

will run until June next year.<br />

The intention is to commission the<br />

project towards the end of 2011, or<br />

beginning of 2012, says White.<br />

As a truck and shovel operation, the

mine will span between 12 and 15 years, its construction<br />

through to commissioning is expected to cost R700m.<br />

51 SA Mining November 2009<br />

OVERVAAL<br />

Next to Coal of Africa’s Mooiplaats Colliery and the Camden<br />

power station in Mpumalanga, the 203mt (in-situ) thermal<br />

deposit has the potential to produce 3mtpa (ROM) as<br />

an underground (100m – 180m depth) operation.<br />

It has relatively thin seams when compared with conventional<br />

<strong>coal</strong> mines, but will be mined using the common<br />

board and pillar mining method. The final phase of exploration<br />

is nearing completion.<br />

MPEFU AND NEKEL (LIMPOPO)<br />

Far down the pipeline, these two Limpopo-based projects<br />

are still early-stage prospects. The speed at which they will<br />

be developed is largely dependent on how the infrastructure<br />

in the area is built up.<br />

White already confirms that each prospect is a ten-yearplus<br />

mining project.<br />

The 160mt Mpefu thermal <strong>coal</strong> project, or 66mt coking<br />

<strong>coal</strong> deposit, will be an open-cast and underground<br />

operation: 13 holes of a 40-hole drilling programme have<br />

been completed.<br />

<strong>Optimum</strong> has a 51% stake in Nekel, a deep <strong>coal</strong> deposit<br />

with coking <strong>coal</strong> potential.<br />

An exploration drilling programme is currently being<br />

prepared, and information gathering is in progress with the<br />

Council of Geoscience.