2002 Annual Report - SBM Offshore

2002 Annual Report - SBM Offshore

2002 Annual Report - SBM Offshore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The monocolumn for the Matterhorn TLP, under tow<br />

in Singapore.<br />

The LPG and LNG markets<br />

With its success in obtaining an eight-year lease and<br />

operate contract for the Sanha LPG FPSO, the Group has<br />

reinforced its position as one of the leading companies in<br />

the supply of gas exploitation facilities. This contract<br />

creates a benchmark in the LPG segment, where it is<br />

expected that demand will grow considerably in the<br />

coming years.<br />

It is clear that global demand for LNG is going to<br />

increase, and export/import infrastructures are already<br />

being planned in the USA, Europe and South East Asia.<br />

In this segment, the two offshore developments which<br />

were expected to start in <strong>2002</strong> did not materialise. The<br />

project for Kudu in Namibia was suspended due to<br />

insufficient reserves, while the Sunrise project in<br />

Australia was postponed for political reasons.<br />

Nonetheless, a global demand for LNG infrastructures is<br />

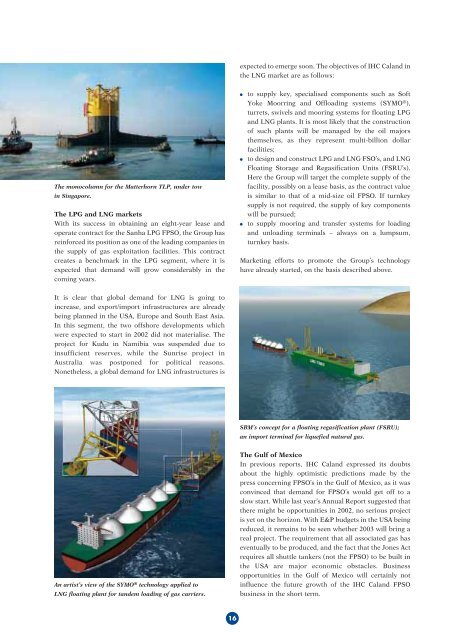

An artist’s view of the SYMO ® technology applied to<br />

LNG floating plant for tandem loading of gas carriers.<br />

16<br />

expected to emerge soon. The objectives of IHC Caland in<br />

the LNG market are as follows:<br />

x to supply key, specialised components such as Soft<br />

Yoke Moorring and Offloading systems (SYMO ® ),<br />

turrets, swivels and mooring systems for floating LPG<br />

and LNG plants. It is most likely that the construction<br />

of such plants will be managed by the oil majors<br />

themselves, as they represent multi-billion dollar<br />

facilities;<br />

x to design and construct LPG and LNG FSO’s, and LNG<br />

Floating Storage and Regasification Units (FSRU’s).<br />

Here the Group will target the complete supply of the<br />

facility, possibly on a lease basis, as the contract value<br />

is similar to that of a mid-size oil FPSO. If turnkey<br />

supply is not required, the supply of key components<br />

will be pursued;<br />

x to supply mooring and transfer systems for loading<br />

and unloading terminals – always on a lumpsum,<br />

turnkey basis.<br />

Marketing efforts to promote the Group’s technology<br />

have already started, on the basis described above.<br />

<strong>SBM</strong>’s concept for a floating regasification plant (FSRU);<br />

an import terminal for liquefied natural gas.<br />

The Gulf of Mexico<br />

In previous reports, IHC Caland expressed its doubts<br />

about the highly optimistic predictions made by the<br />

press concerning FPSO’s in the Gulf of Mexico, as it was<br />

convinced that demand for FPSO’s would get off to a<br />

slow start. While last year’s <strong>Annual</strong> <strong>Report</strong> suggested that<br />

there might be opportunities in <strong>2002</strong>, no serious project<br />

is yet on the horizon. With E&P budgets in the USA being<br />

reduced, it remains to be seen whether 2003 will bring a<br />

real project. The requirement that all associated gas has<br />

eventually to be produced, and the fact that the Jones Act<br />

requires all shuttle tankers (not the FPSO) to be built in<br />

the USA are major economic obstacles. Business<br />

opportunities in the Gulf of Mexico will certainly not<br />

influence the future growth of the IHC Caland FPSO<br />

business in the short term.