2002 Annual Report - SBM Offshore

2002 Annual Report - SBM Offshore

2002 Annual Report - SBM Offshore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

of <strong>2002</strong> / Overview of 2003<br />

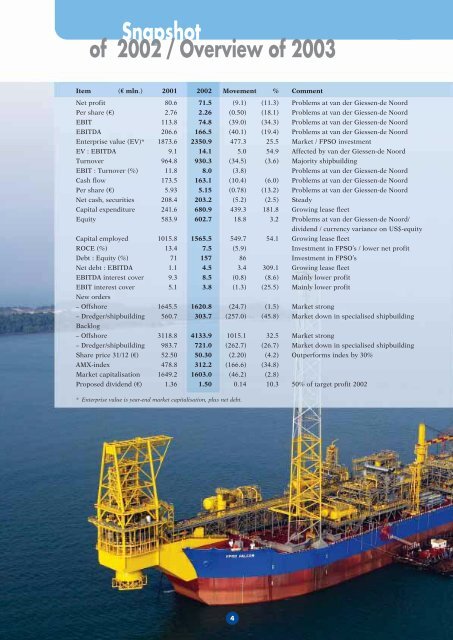

Item (€ mln.) 2001 <strong>2002</strong> Movement % Comment<br />

Net profit 80.6 71.5 (9.1) (11.3) Problems at van der Giessen-de Noord<br />

Per share (€) 2.76 2.26 (0.50) (18.1) Problems at van der Giessen-de Noord<br />

EBIT 113.8 74.8 (39.0) (34.3) Problems at van der Giessen-de Noord<br />

EBITDA 206.6 166.5 (40.1) (19.4) Problems at van der Giessen-de Noord<br />

Enterprise value (EV)* 1873.6 2350.9 477.3 25.5 Market / FPSO investment<br />

EV : EBITDA 9.1 14.1 5.0 54.9 Affected by van der Giessen-de Noord<br />

Turnover 964.8 930.3 (34.5) (3.6) Majority shipbuilding<br />

EBIT : Turnover (%) 11.8 8.0 (3.8) Problems at van der Giessen-de Noord<br />

Cash flow 173.5 163.1 (10.4) (6.0) Problems at van der Giessen-de Noord<br />

Per share (€) 5.93 5.15 (0.78) (13.2) Problems at van der Giessen-de Noord<br />

Net cash, securities 208.4 203.2 (5.2) (2.5) Steady<br />

Capital expenditure 241.6 680.9 439.3 181.8 Growing lease fleet<br />

Equity 583.9 602.7 18.8 3.2 Problems at van der Giessen-de Noord/<br />

dividend / currency variance on US$-equity<br />

Capital employed 1015.8 1565.5 549.7 54.1 Growing lease fleet<br />

ROCE (%) 13.4 7.5 (5.9) Investment in FPSO’s / lower net profit<br />

Debt : Equity (%) 71 157 86 Investment in FPSO’s<br />

Net debt : EBITDA 1.1 4.5 3.4 309.1 Growing lease fleet<br />

EBITDA interest cover 9.3 8.5 (0.8) (8.6) Mainly lower profit<br />

EBIT interest cover<br />

New orders<br />

5.1 3.8 (1.3) (25.5) Mainly lower profit<br />

– <strong>Offshore</strong> 1645.5 1620.8 (24.7) (1.5) Market strong<br />

– Dredger/shipbuilding<br />

Backlog<br />

560.7 303.7 (257.0) (45.8) Market down in specialised shipbuilding<br />

– <strong>Offshore</strong> 3118.8 4133.9 1015.1 32.5 Market strong<br />

– Dredger/shipbuilding 983.7 721.0 (262.7) (26.7) Market down in specialised shipbuilding<br />

Share price 31/12 (€) 52.50 50.30 (2.20) (4.2) Outperforms index by 30%<br />

AMX-index 478.8 312.2 (166.6) (34.8)<br />

Market capitalisation 1649.2 1603.0 (46.2) (2.8)<br />

Proposed dividend (€) 1.36 1.50 0.14 10.3 50% of target profit <strong>2002</strong><br />

* Enterprise value is year-end market capitalisation, plus net debt.<br />

4